Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 28 Oct, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

The Chinese financial technology firm Ant Group Co. is set to raise roughly $34.4 billion on the Shanghai STAR Board and Hong Kong Stock Exchange. The IPO will surpass the $29.4 billion that Saudi Arabian Oil Co. raised last year, and the dual sale in two of the most biggest global markets for securities could help boost the share’s premium price.

“Considering its exposure and market position in fintech, and the fact it is a dual [Shanghai and Hong Kong] listing, it could create a scarcity premium against peers," Billy Leung, Hong Kong-based director of Equity Research at Haitong International Securities, told S&P Global Market Intelligence.

With a one-third stake owned by billionare Jack Ma’s e-commerce giant Alibaba, Ant’s debut outside of the U.S. equities market is is the latest in a series of companies to take their firms public in China. From January through September, 180 global companies made their public offering in Shanghai, according to a recent Ernst & Young report, and in the third quarter alone Shanghai generated the most listing proceeds of any market, totaling 25% of the global share.

Twenty three firms headquartered in mainland China—totalling half of the U.S.’s cross-border listings for January-September—debuted in the U.S., according to EY. When Mr. Ma took Alibaba public in 2014, he listed the company on the New York Stock Exchange for $25 billion.

The unprecedented offering reinforces the power of payments platforms in China. Beyond the 730 million users of Ant, users of the omnipresent Alipay, which is also owned by Alibaba, and WeChat Pay platforms must also be banked in mainland China or Hong Kong. Ant and Tencent Holdings Ltd. hold a 95% adoption rate with Chinese consumers, according to an Asia Consumer Insights survey conducted in September by Kagan, part of S&P Global Market Intelligence, due in part to the payment providers’ support of e-commerce, ride-hailing, and food-delivery platforms.

Ant said in a filing in Shanghai that institutional investors applied for 76.04 billion A-shares in the initial price consultation, or 284.45 times the offline offering portion, priced on Shanghai's STAR Board at 68.80 yuan apiece.

There's been a tremendous amount of appetite for this IPO, from both retail investors and institutional investors," Zennon Kapron, director of Singapore-based consultancy KapronAsia, told S&P Global Market Intelligence. "There was never going to be a perfect size for the IPO. But certainly, given the numbers that we've seen come out, it will certainly be fully subscribed, if not tremendously oversubscribed."

Today is Wednesday, October 28, 2020, and here is today’s essential intelligence.

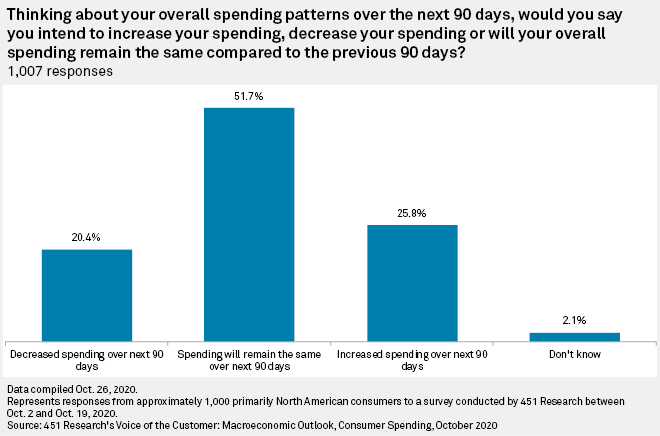

Most Consumers Expect Spending to Remain the Same in Coming Months – 451 Survey

Most consumers expect their spending to remain the same in the coming months even as concerns about the coronavirus crisis, the economy and job market persist, according to a new survey by 451 Research, an offering of S&P Global Market Intelligence. Nearly 52% of survey respondents said their spending will remain the same over the next 90 days compared to the previous 90 days, while 20.4% said they would spend less over the next three months, according to the latest edition of the Voice of the Customer: Macroeconomic Outlook, Consumer Spending survey.

—Read the full article from S&P Global Market Intelligence

Consumer Companies Paid Lower Tax Rates Under Trump, Could See Hikes with Biden

Corporate taxes dropped for consumer companies, among others, following the passage of the 2017 tax reforms championed by President Donald Trump. A Joe Biden presidency, meanwhile, promises to roll back many of the Trump tax cuts while keeping rates below where they sat under previous administrations. Part of Biden's tax plan includes increasing the statutory corporate rate to 28% from the 21% enacted by President Donald Trump in late 2017. Prior to Trump's tax reform plan, the corporate tax rate sat at 35%.

—Read the full article from S&P Global Market Intelligence

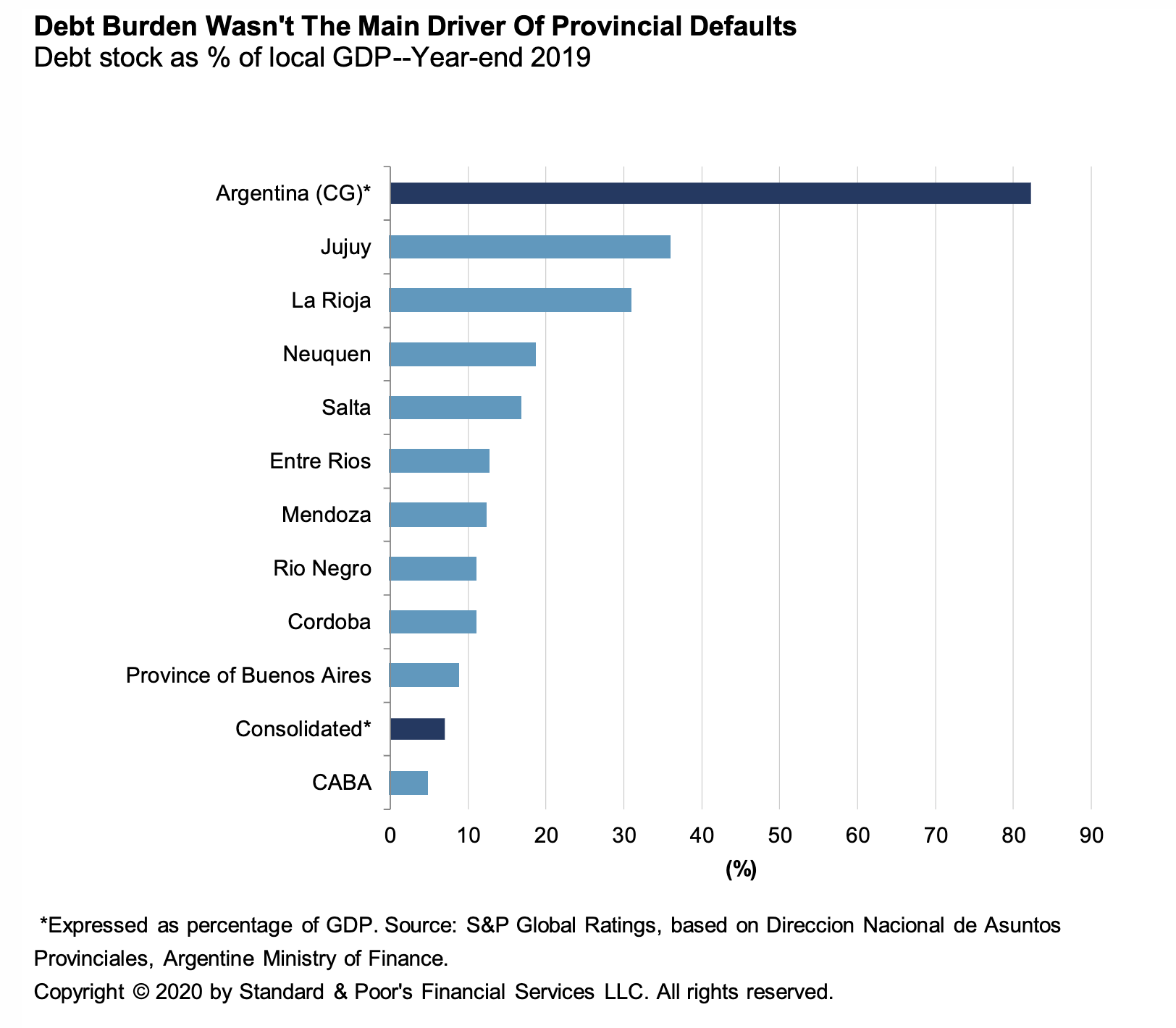

Credit FAQ: Challenges and Opportunities Await Argentine Provinces After Their Debt Restructuring

The conclusion of Argentina's US$100 billion sovereign international and local law debt restructuring has created space for subnational governments to move ahead with their own restructuring deals. 12 of the 24 Argentine provinces plan to restructure about $13 billion in international law bonds. All of the 10 local government entities rated by S&P Global Ratings, except the city of Buenos Aires, have indicated they intend to seek debt relief amid the severe recession due to the COVID-19 pandemic that has heightened fiscal pressures, and following the sovereign's debt restructuring.

—Read the full report from S&P Global Ratings

U.S. Public Finance Report Card: What a Difference a Decade Makes: Housing Finance Agency Rating Stability in Uncertain Times

State HFA issuer credit ratings remained strong and stable from 2019 through the first 10 months of 2020. Of the 23 state HFAs S&P Global Ratings rates, 21 are rated 'AA-' or higher. Ratios in 2019 show mixed performance, but mostly positive trends with equity and assets at decade-long highs. Ratings expects 2020 financial ratios to deteriorate somewhat due to the COVID-19 pandemic, with higher delinquencies overall and stressed liquidity for some.

—Read the full report from S&P Global Ratings

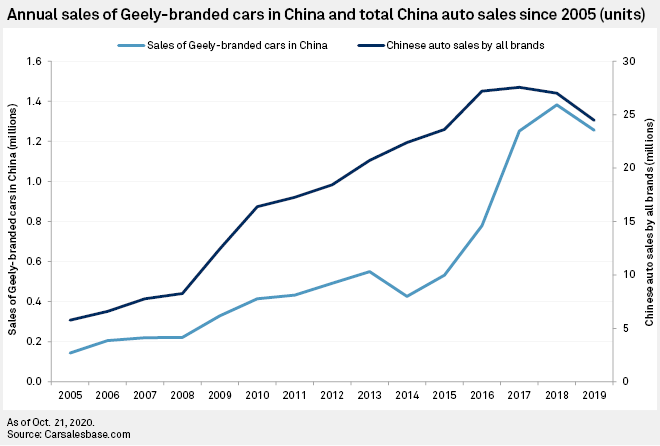

Geely Seeks to Woo China's Tech Investors with Cars' Digital, Electric Future

Chinese automaker Geely Automobile Holdings Ltd. is set to become the first car company to join Shanghai's technology-focused STAR stock exchange with a $3 billion secondary listing, underscoring the sector's transition from heavy industry to one with digitalization at its core. It's also a landmark moment for Geely and founder Shu Fu Li. The son of a farmer from eastern China and a trained engineer, Li tried his hand at photography, manufacturing refrigerators and making mopeds before establishing Geely two decades ago, just in time to capitalize on the boom in China's auto industry.

—Read the full article from S&P Global Market Intelligence

More Than Three-Quarters of Southeast Asia's Broadband Households Still on Speeds Below 100 Mbps

Kagan estimates about 34.5 million broadband households receive below 100 Mbps speeds among six surveyed countries in Southeast Asia, translating to 77.1% of the total 44.8 million broadband households as of year-end 2019. This is a complete 360-degree turn from Asia-Pacific’s overall regional penetration, with 74.6% of its total broadband subscribers having access to download speeds of 100 Mbps and above as of 2019.

—Read the full article from S&P Global Market Intelligence

U.S. Big Tech CEOs to Testify About Content Moderation Practices

Top executives from Alphabet Inc.'s Google LLC, Facebook Inc. and Twitter Inc. will testify before Congress this week about their content moderation practices amid allegations of censorship from Republican lawmakers and increasing calls to modify big tech's legal liability shield. The hearing, which is set for Oct. 28, will be titled, "Does Section 230's Sweeping Immunity Enable Big Tech Bad Behavior?"

—Read the full article from S&P Global Market Intelligence

Listen: Welcome to the Platts Future Energy Podcast: Energy Transition in the Time of COVID-19

In this first Platts Future Energy podcast (in video form too this time!), representatives from Analytics, News and Pricing discuss the impact of COVID-19 on the Energy Transition, with a focus on: energy demand and carbon emissions, now and in the years ahead; recovery programs, whether supportive, regressive or ineffective; and finally, the technology pathways set to emerge strongest from the pandemic.

—Listen and subscribe to Platts Future Energy, a podcast from S&P Global Platts

Emerging Markets Ripe for Climate Deals, but Come with Social Costs, Risks

There is huge need for financing climate-related projects in emerging markets, but the social costs and the lack of return are acting as deterrents to global lenders. Developing countries will play a crucial role if the world is going to meet climate goals like the Paris Agreement on climate change, which aims to limit global temperature rises to less than 2 degrees C. Investors and policymakers in developing countries are caught between a rock and a hard place, however, as the social and financial cost of a rapid green transition could be huge, something that has been compounded by the coronavirus pandemic, market participants say.

—Read the full article from S&P Global Market Intelligence

EU Green Deal will Drive Clean Growth and Virus Recovery: EC's Timmermans

The EU's Green Deal is an opportunity to drive Europe's strategy for long-term clean economic growth at the same time as powering a recovery from the coronavirus pandemic, the European Commission's executive vice-president Frans Timmermans said Oct. 26. Achieving both goals simultaneously lies at the heart of Europe's strategy on energy and climate as the bloc attempts to boost employment now and achieve growth in clean industries over the long term.

—Read the full article from S&P Global Platts

About Half of the U.S. Gulf of Mexico's Oil and Gas Volumes Offline Ahead of Zeta

Roughly half of all the oil and gas production from the US Gulf of Mexico was shut in Oct. 27 ahead of Tropical Storm Zeta, which is expected to again strengthen into a hurricane before making a projected landfall in southeastern Louisiana. An estimated 914,811 b/d of crude production and 1,500 MMcf/d of natural gas production was shut in, reflecting 49.45% and 55.35% of US Gulf output, respectively, according to the US Bureau of Safety and Environmental Enforcement.

—Read the full article from S&P Global Platts

Watch: Market Movers Europe, Oct 26-30: Oil, Metals Markets Eye Q3 Corporate Results

In this week's highlights: It's corporate results season for oil majors; Glencore is due to release its third-quarter production report; global steel overcapacity is on the agenda; and a possible lack of capacity is exercising the UK power market.

—Watch and share this Market Movers video from S&P Global Platts

Jet Blue Sees Higher Q4 Demand for Air Travel Despite Rising Coronavirus Cases

Jet Blue expects a pick-up in air travel demand in the fourth quarter, helped by an uptick in bookings for end-year holiday travel despite the rise in coronavirus cases, a trend which bodes well for increasing jet fuel demand and refinery utilization. "For the fourth quarter, our current planning assumption is for capacity to decline 45% year-over-year given our current expectations for improved bookings," said Joanna Geraghty, Jet Blue's chief operating officer on the company's Oct. 27 third-quarter results call.

—Read the full article from S&P Global Platts

Peak Oil is Coming, It’s Just a Question of When: Fuel for Thought

Peak demand for oil is certainly approaching, but opinion is divided about the timing of its arrival. BP foresees in one of its scenarios a dramatic decline in consumption on the horizon and has warned “peak oil” is already upon us. Its most aggressive forecast expects global demand to halve to 55 million b/d by 2050 if governments and consumers adopt uncompromising energy transition policies to address climate change.

—Read the full article from S&P Global Platts

S&P Podcast: 2020 Election's Implications for Fracking, FERC and Utilities

While Democratic nominee Joseph Biden and Republican President Donald Trump have different stances on fossil fuels, much of the demand for clean energy is being driven at the state and individual consumer level, where it may be difficult to reverse the momentum of a transition toward more renewables. But there are several ways that transition could be slowed or accelerated by the outcome of the election.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language