Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 6 Nov, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

As the United Kingdom hunkers down for a second lockdown, the country’s central bank announced a stimulus package and the government extended some support schemes to soften the economic pain of a double-dip recession.

Across Europe, a second wave of coronavirus cases have surged by 22% in the seven-day period to Tuesday, Nov. 3, according to the World Health Organization. Over the same period, Britain reported an average of 22,347 new cases per day, according to Johns Hopkins University data. After resisting additional coronavirus containment measures, Prime Minister Boris Johnson said he had “no alternative” than to implement restrictions. Effective Thursday, pubs, restaurants, and non-essential businesses will remain shut through December 2.

In reaction to what Bank of England Governor Andrew Bailey described as the “dramatic impact” of the increasing infections, the U.K.’s central bank expanded its quantitative easing policy by £150 billion ($195 billion) on Nov. 5. The boost will ultimately bring the BoE’s total pandemic stimulus package, used to purchase government bonds and corporate assets, to £895 billion. The Monetary Policy Committee maintained the central bank’s benchmark interest rate at 0.1%.

In coordination with the BoE, U.K. Chancellor Rishi Sunak announced on Nov. 5 the Treasury’s plan to extend its furlough program by five months through March to pay people who are unable to work during the lockdown up to 80% of their lost wages. Self-employed workers are now able to accept the benefits under the plan.

Over the course of the pandemic, the government’s furlough scheme has prevented additional and longer-lasting damage to the U.K. economy, according to S&P Global Ratings.

“I’ve always said I would do whatever it takes to protect jobs and livelihoods across the UK—and that has meant adapting our support as the path of the virus has changed,” Mr. Sunak said in a statement. It’s clear the economic effects are much longer lasting for businesses than the duration of any restrictions, which is why we have decided to go further with our support.”

The increased fiscal and monetary policy comes as the outlook for England’s economy worsens.

“Over the remainder of the forecast period, GDP is projected to recover further as the direct impact of Covid on the economy is assumed to wane,” the central bank said in its Nov. 5 statement. “The recovery takes time, however, and the risks around the GDP projection are judged to be skewed to the downside.”

The BoE projected that the prolonged pandemic will prompt the U.K. economy to contract in the fourth quarter of this year. The European Commission said its autumn forecast on Nov. 5 that Britain will likely experience a 10.3% contraction this year and respective growth of 3.3% and 2.1% for 2021 and 2022. The International Monetary Fund lowered its forecast for the country on Oct. 29, now expecting it to contract by 10.4% this year and expand by 5.7% next year; its previous perspective earlier this month foresaw the U.K.’s output slumping 9.8% in 2020 and growing by 5.9% in 2021. S&P Global Ratings lowered its forecast for the U.K. economy at the start of last month to project a contraction of 9.7% for this year and rebounding growth of 7.9% next year.

“Many hurdles are ahead on the path to recovery, and we now see the economy slightly worse off over the next three years,” S&P Global Ratings said in its forecast.

Today is Friday, November 6, 2020, and here is today’s essential intelligence.

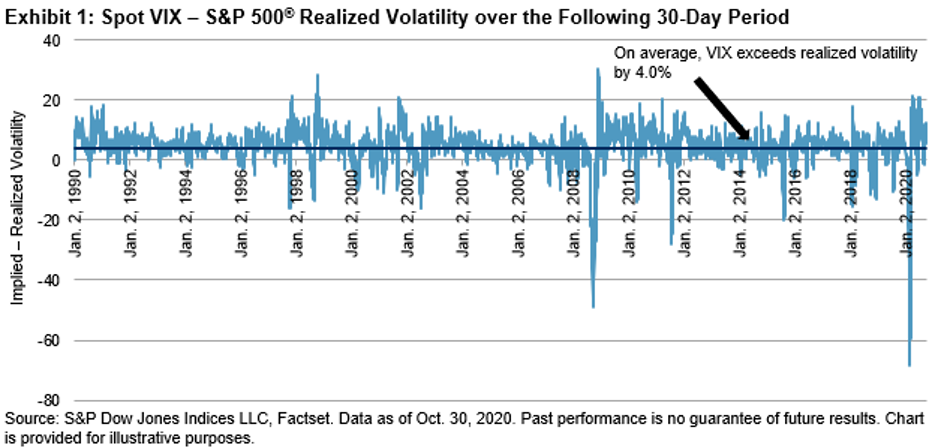

While Fixed Income Yields Remain Low, Theta Gang Generates Income through Covered Calls

S&P Global Ratings Research expects the S&P/LSTA Leveraged Loan Index lagging twelve-month default rate (by number of issuers) to increase to 8% by June 2021 from 4.6% as of September 2020 (see chart 1).

—Read the full article from S&P Dow Jones Indices

How do You Look Out for Potential Financial or Accounting Anomalies?

Detecting fraud in accounting data remains one of the long-standing challenges for auditors, fraud investigators, regulators and investors. Is there any method or any way to help stakeholders discover accounting abnormalities and basic warning signs in the financial statements which may point to hidden risks?

—Read the full article from S&P Global Market Intelligence

Europe is COVID-19 Interruption Claims 'Hotspot'; Court Battles Limited for Now

Denied coronavirus business interruption insurance claims have spurred lawsuits across several European countries, creating uncertainty about the insurance industry's ultimate liability. But disputes are not widespread across the continent, and the effect on the insurance industry overall looks likely to be manageable.

—Read the full article from S&P Global Market Intelligence

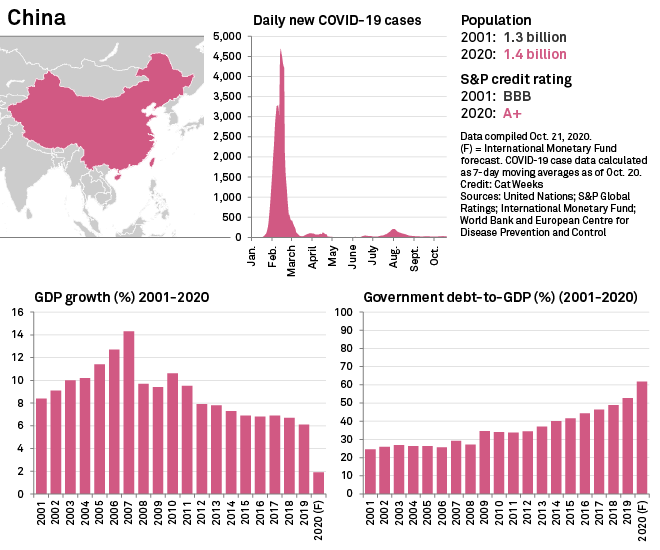

COVID-19 Magnifies BRICS Divergence as China Solidifies Lead

Almost 20 years after the acronym BRICS was coined, the arrival of the coronavirus pandemic has been another opportunity for China to demonstrate why it is in a league of its own when compared with the group's other members, Brazil, Russia, India and South Africa.

—Read the full article from S&P Global Market Intelligence

ING Unveils New Dividend Policy, Capital Target

ING Groep NV announced a new dividend policy and long-term capital target, along with a refocusing of its main businesses, as it reported a year-over-year decline in its third-quarter results.

—Read the full article from S&P Global Market Intelligence

Amid 'Permanent' Low-Rate Environment, Danske Passes on Bill to Retail Customers

Danske Bank A/S's decision to pass on negative interest rates to more retail customers will affect around 10% of the approximate 1.3 million retail account holders it has in Denmark, the bank told S&P Global Market Intelligence.

—Read the full article from S&P Global Market Intelligence

Singapore's Banks Ease Provisioning for Bad Loans as Pandemic Abates

Singapore's banks continued to provide for bad loans in the third quarter, though the pace slowed sharply, indicating that the lenders may have built sufficient buffers against a pandemic-induced increase in nonperforming assets.

—Read the full article from S&P Global Market Intelligence

National Australia Bank Eyes Costs to Fall Below A$7.7B Over Next 5 Years

National Australia Bank Ltd. aims to bring down absolute costs to less than A$7.7 billion over the next three to five years while focusing on growing its corporate lending segment, CEO Ross McEwan said, citing amid revenue headwinds and a low interest rate environment.

—Read the full article from S&P Global Market Intelligence

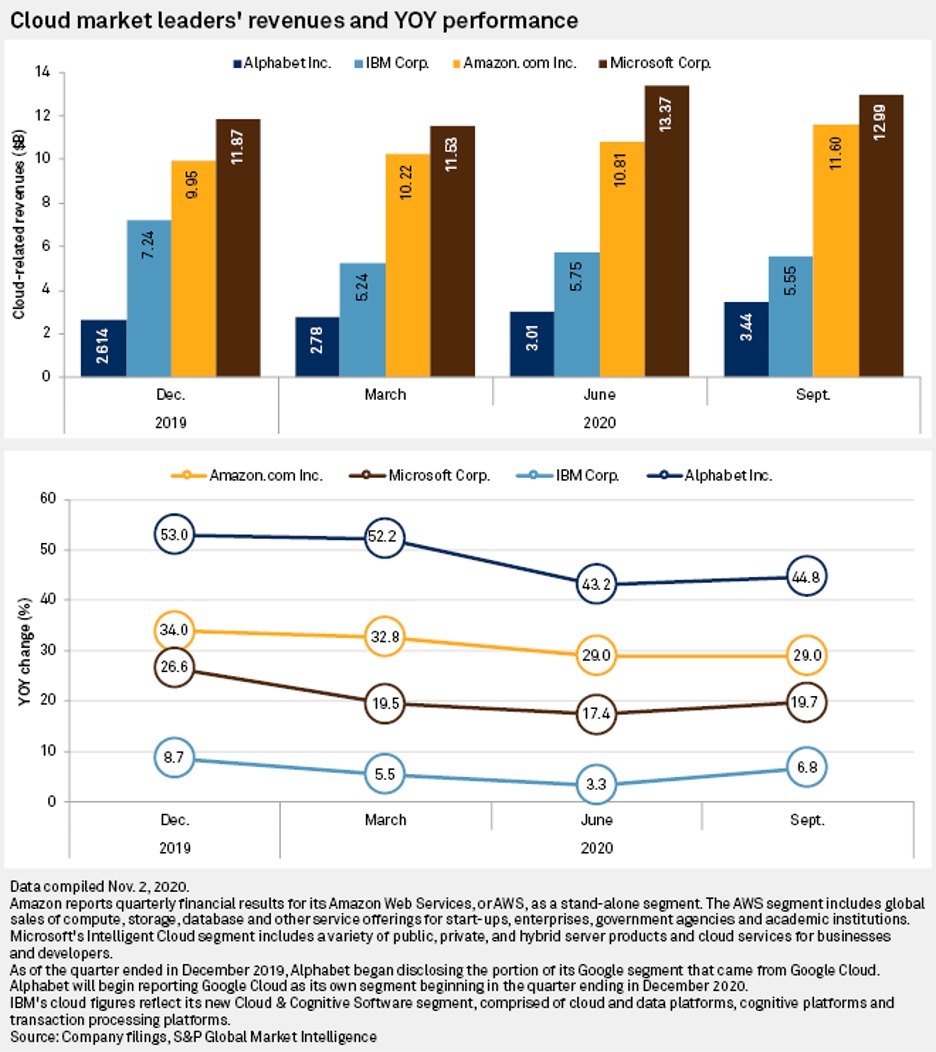

Cloud Growth Skyrockets In Q3 as COVID-19 Continues to Accelerate Demand

The cloud-computing market picked up more momentum in the third quarter as companies continue to migrate their workloads to digital formats during the pandemic.

—Read the full article from S&P Global Market Intelligence

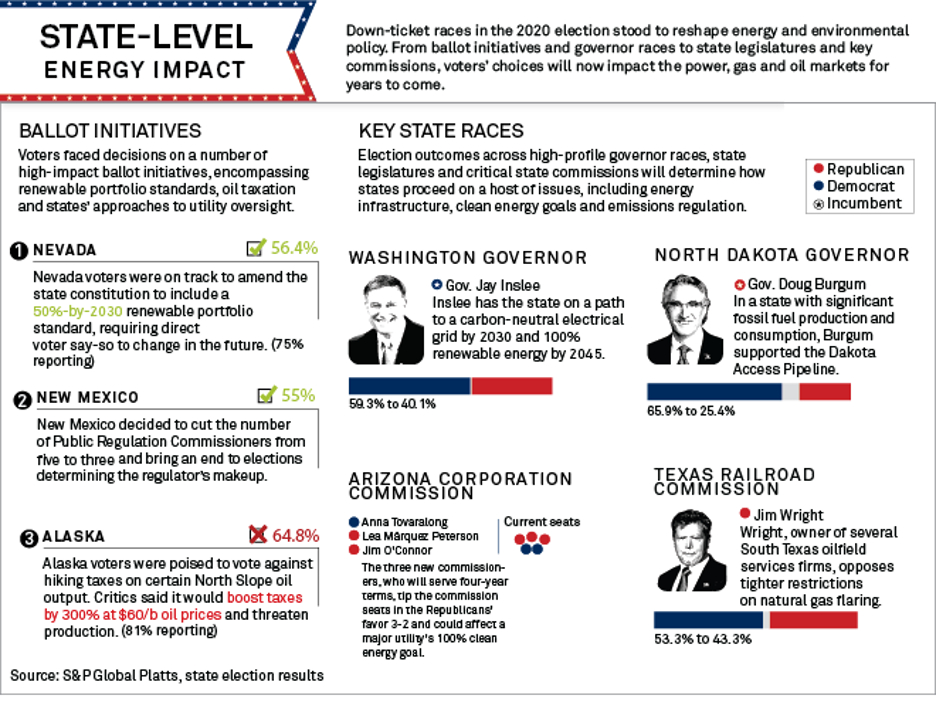

US ELECTIONS: Results show deeper divide on energy issues, tough path for tackling climate

While control of the White House and US Senate waits for ballot counters, a host of implications for energy and commodity markets from the Nov. 3 elections unfolded across the country, revealing a deepening US divide on energy issues that will make it harder to pursue federal policy on decarbonization and mitigating climate change.

—Read the full article from S&P Global Platts

U.S. ELECTIONS: Early Spurt of Energy Actions Possible If White House Flips

In a scenario where Democratic contender Joe Biden takes the White House after the final counts are tallied, energy lawyers Nov. 5 depicted a flurry of activity possible in his first 100 days in office with consequences for energy-sector interests.

—Read the full article from S&P Global Platts

Biofuels In Prime Position to Deliver on Short-Term Climate Goals: Goodfuels CEO

As transport industries look to slash greenhouse gas emissions and examine alternative power options, biofuels are well-placed to meet short-term international emissions goals, Dutch biofuels provider GoodFuels CEO Dirk Kronemijer said Nov. 5.

—Read the full article from S&P Global Platts

Watch: Market Movers Europe, Nov 2-6: OPEC+ Faces New Lockdowns, Europe Talks Clean Energy

In this week's highlights: OPEC+ faces Libya's resurgence and a new wave of lockdowns, the hydrogen market awaits Italy's Snam's third quarter results; the UK government could publish its Energy White Paper; and the West African polymer market hopes for calm in Ivory Coast.

—Watch the full Market Movers video from S&P Global Platts

Analysis: Singapore bunker sales remain resilient despite strong headwinds

Singapore's bunker sales are expected to remain steady to slightly higher throughout 2020 on a year-on-year basis, despite expectations of dwindling global demand for bunker fuels as the coronavirus pandemic continues to dent demand for many commodities, including marine fuel.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language