Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 13 Nov, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

On Feb. 2 of this year, countries around the world began to limit global air travel. As these restrictions grew more common, and business and leisure travel ground to a halt, the global hospitality industry suffered. Hotel occupancy rates in the U.S. fell toward 20% in March and April, and remain well below 50%, with revenue per available room (RevPAR) plunging nationwide to $43.76. In warm-weather destinations such as southern Florida and Hawaii, these numbers are significantly worse as leisure travel has been particularly hard hit.

The announcement this week of successful late-stage trials for a coronavirus vaccine developed by Pfizer Inc. and BioNTech SE buoyed hospitality-industry stocks. Shares of Park Hotels & Resorts Inc. increased 40% on the news. But even that positive development comes too late for many hotels and hospitality companies.

On Nov. 4, Hilton Worldwide reported a loss in the third quarter of 28 cents per share, which the company’s chief financial officer attributed to the continued hit to travel during the pandemic. In October, S&P Global Ratings removed Marriott International Inc.’s ratings from CreditWatch, but affirmed its ‘BBB-‘ issuer credit rating.

"The negative outlook reflects significant risks from the ongoing pandemic and economic recession, and the likelihood we could downgrade the rating if a medical solution to COVID-19 is not achieved in mid-2021 or broadly disseminated by late 2021 in a manner that enables business and group travel and hotel demand to recover sufficiently for Marriott to restore credit measures in 2022," S&P Global Ratings said of its decision.

On the positive side, the retail, leisure, and hospitality industries accounted for 58.8% of the job gains in October’s unexpectedly positive employment report. But economists see danger signs without further federal stimulus.

"Continuing jobless claims fell last month, which is a positive on the face of it, but the worry is the decline could be people have just fallen off and are no longer on benefits because they have been unemployed for so long," Beth Ann Bovino, S&P Global Ratings' U.S. chief economist told S&P Global Market Intelligence. "For the people in leisure and hospitality, the longer this fire lasts, the longer they stay unemployed. They lose access to unemployment benefits, and the vicious cycle continues."

Business-interruption coverage for hospitality companies has become the subject of lawsuits in Europe as insurance companies have tried to deny claims to limit their exposure. Befuddled by a set of ambiguous and inconsistent laws across the Eurozone, the German state of Bavaria's Ministry of Economic Affairs struck a deal with the state's big insurers in April to pay hotels 10%-15% of their losses regardless of policy terms.

As infection rates have increased across Europe and lockdowns have returned, the hospitality industry is certain to suffer a second shock. "Leisure and hospitality are in the crosshairs," Andrew Angeli, European head of real asset research at CBRE Global Investors Ltd told S&P Global Market Intelligence. "They've had the greatest burden placed on them in terms of operating hours lost."

Despite all the grim news for the industry, Airbnb , the vacation-rental company, is proceeding with plans for an initial public offering (IPO) in December. According to reports, they aim to raise roughly $3 billion.

Today is Friday, November 13, 2020, and here is today’s essential intelligence.

Listen: Leveraged Finance & CLOs Uncovered Podcast: Analyzing Altice’s Take Private

Hina and Sandeep are joined by Thibaud Lagache, analyst in the corporate ratings group to discuss Altice, telecom provider of pay television, broadband internet and mobile services.

—Listen and subscribe to Leveraged Finance & CLOs Uncovered, a podcast from S&P Global Ratings

Borrowing Costs Plummet for U.S. High-Yield Companies – Risk Monitor

Investor expectations that the Federal Reserve will have to act to support the economy are resulting in tightening credit spreads, most notably for companies with lower credit ratings.

—Read the full article from S&P Global Market Intelligence

China Property Watch: Issuers Go on a Debt Diet

Government measures to cool China's residential market should result in a 5% drop in home prices in 2021, with sales likely flat on increased volumes.

—Read the full report from S&P Global Ratings

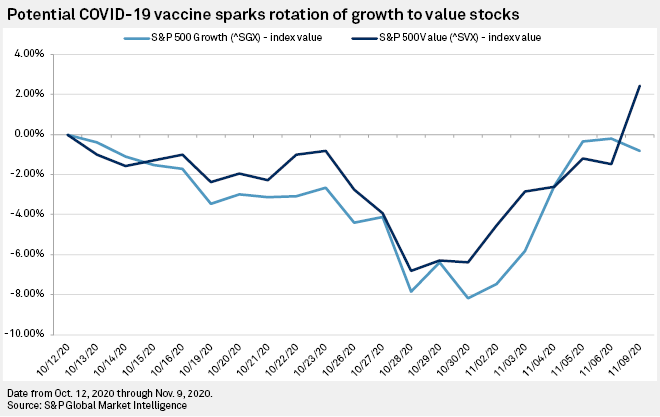

Vaccine Hopes Reverse Pandemic Stock Trends, but Effect May Not Last

Pandemic plays are out and reopening plays are in, but the staying power of the equity market's latest trend will largely depend on the viability of a vaccine.

—Read the full article from S&P Global Market Intelligence

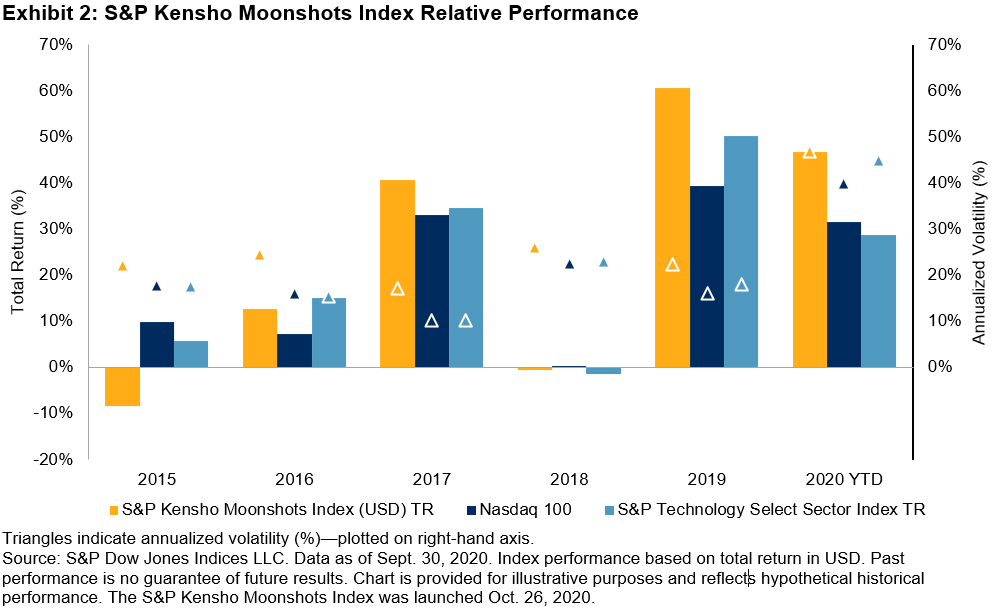

Measuring Innovation: Essential Insights in an Era of Disruption to the Global Economy

It has become more essential than ever for market participants to adopt a quantifiable framework with which to understand and measure innovation.

—Read the full article from S&P Dow Jones Indices

Climate-Focused De Novo Aims to 'Shock and Awe' Global Warming Doubters

Joe Biden's presidential win could be a boon for a bank startup with a climate focus.

—Read the full article from S&P Global Market Intelligence

Insurance Regulators Weigh Ban on Underwriting Factors They Say Harm Minorities

Regulators are putting a renewed focus on how race plays into insurance practices. In summer 2020, National Association of Insurance Commissioners President Commissioner Ray Farmer launched a special committee to examine race and insurance.

—Read the full article from S&P Global Market Intelligence

Biden Transition Team Rolls Out Energy Agency Review Groups

Early energy-related steps began unfolding in the lead-up to a Biden administration, starting with the naming of agency review teams to help ready departments of Energy and Interior and financial and environmental regulators for a handover of power.

—Read the full article from S&P Global Platts

Listen: Tanker Freight Runs Aground in Q4 Amid Demand Destruction

Marieke Alsguth, Catherine Wood, and Nicole Baquerizo of the S&P Global Platts shipping team discuss how 2020 freight patterns have diverted dramatically from the norm in the Americas, and what shipowners have their eyes on as potential strengtheners of the market.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language