Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 5 May, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

No longer on the fringe or considered an alternative trend, cryptocurrencies have become so mainstream that they’re now welcome on Wall Street.

S&P Dow Jones Indices launched three new decentralized currency indexes yesterday—the S&P Bitcoin Index, S&P Ethereum Index, and S&P Crypto Mega Cap Index—that will measure the market performance of their respective currencies.

“Enormous value is now being transacted in dozens of exchanges where there are no traditional market makers. But along with opportunities, this asset class comes with a host of new challenges,” Sharon Liebowitz, senior director of innovation and strategy at S&P Dow Jones Indices, said in an article introducing the indices. “As an emerging space, one of the biggest issues is a lack of transparency.”

“Our cryptocurrency indices seek to address some of the challenges the industry is currently facing, including the issue of transparency,” Ms. Liebowitz said. “S&P DJI’s independent, reliable, and accessible indices have a long track record of bringing transparency to a wide range of markets across asset classes and geographies, and we believe they can do the same for this emerging, complex asset class.”

The move follows a flurry of activity in the cryptocurrency space that has ushered these intangible assets into the financial services sector.

On the first day that the cryptocurrency exchange operator Coinbase Global went public in U.S. markets on April 14, shares momentarily surpassed $100 billion in market capitalization before closing at $85.78 billion—more than the Intercontinental Exchange, Nasdaq, and Chicago Board Options Exchange command individually, according to S&P Global Market Intelligence.

Regulated blockchain-infrastructure platform Paxos recently received the first-ever approval from the U.S. Office of the Comptroller of the Currency to establish a de novo national trust bank, paving the path for the creation of U.S. crypto banks.

Investors are enjoying the bull market across cryptocurrencies. Dogecoin, which was created as a cryptocurrency in 2013 on the basis of a viral meme depicting a Shiba Inu dog, soared 30% yesterday to trade a new record high of approximately 54 cents, according to Coin Metrics data. Similarly, many market participants told S&P Global Platts that they’ve flocked to Bitcoin as a comparable store-of-value investment to gold for its abilities to hedge against currency devaluation and market volatility during the coronavirus crisis.

Still, while the excitement surrounding cryptocurrencies is accelerating their adoption, more guardrails may need to be implemented to safeguard the system, according to S&P Global Ratings, which believes cryptocurrencies continue to be speculative instruments. Environmental concerns abound regarding the extreme amount of energy consumed mining decentralized currencies, alongside a perceived need for more regulatory oversight and public confidence.

“Digital currencies like Bitcoin carry significant volatility and regulatory risk in our view, and as a result the reported value will not be netted in our net debt calculation,” S&P Global Ratings said in a report yesterday. “Accessibility and liquidity are the two key factors we use in determining whether digital currencies can be quickly converted to cash to pay down debt; difficulties remain for both of these factors. We may recognize the value of bitcoin, if large enough, in the qualitative areas of our analysis.”

Today is Wednesday, May 5, 2021 and here is today’s essential intelligence.

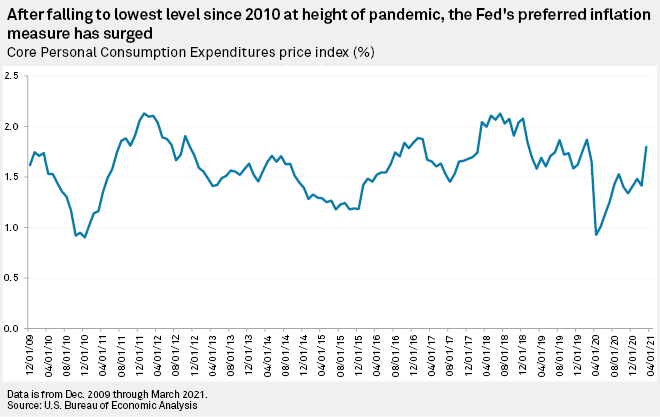

U.S. Recovery Could Be Upended If Fed's Bet On 'Transitory' Inflation Proves Wrong

Inflation is on track to rise to levels not seen in 14 years and the Federal Reserve is betting heavily that the stay at these heights will be brief. But if this substantial jump is not temporary, or "transitory" as Fed Chairman Jerome Powell has frequently said, the consequences could be dire for the domestic economy's post-pandemic rebound, analysts said.

—Read the full article from S&P Global Market Intelligence

EU Eyes Easing Nonessential Air Travel In Boost For Jet Demand

The European Commission is considering allowing nonessential flights from outside its member state territory for travelers vaccinated against COVID-19 amid hope of firming demand in the jet fuel market, as holiday season looms.

—Read the full article from S&P Global Platts

Q1 2021 Global Capital Markets Activity: SPAC IPOs, Issuance in Consumer Discretionary Sector Surge

2020 was thought to be the year of SPACs, yet initial public offerings (IPOs) of SPACs in Q1 2021 overtook all of 2020. During the first three months, SPACs raised a total of $88.5 billion in capital from IPOs, nearly 22x more than the $4 billion raised in 2020. During the this first quarter alone, there were 320 blank-check companies that went public globally which is 10x more than the same quarter prior year.

—Read the full article from S&P Global Market Intelligence

Ferrous Scrap Prices Weaken To Iron Ore As Correlation Breaks Down

Ferrous scrap has decoupled from stronger iron ore prices so far in 2021, as low coking coal costs and strong steel demand in China and elsewhere support iron ore consumption at blast furnaces.

—Read the full article from S&P Global Platts

Wheat Defies Seasonal Norms With Rebound On Corn Price Rally

Global wheat prices are drawing strength from soaring corn prices, which have hit a record high as strong demand and supply concerns stemming from weather woes apply pressure to both sides of an already tight balance sheet, narrowing the feed wheat to corn price ratio to an unprecedented low.

—Read the full article from S&P Global Platts

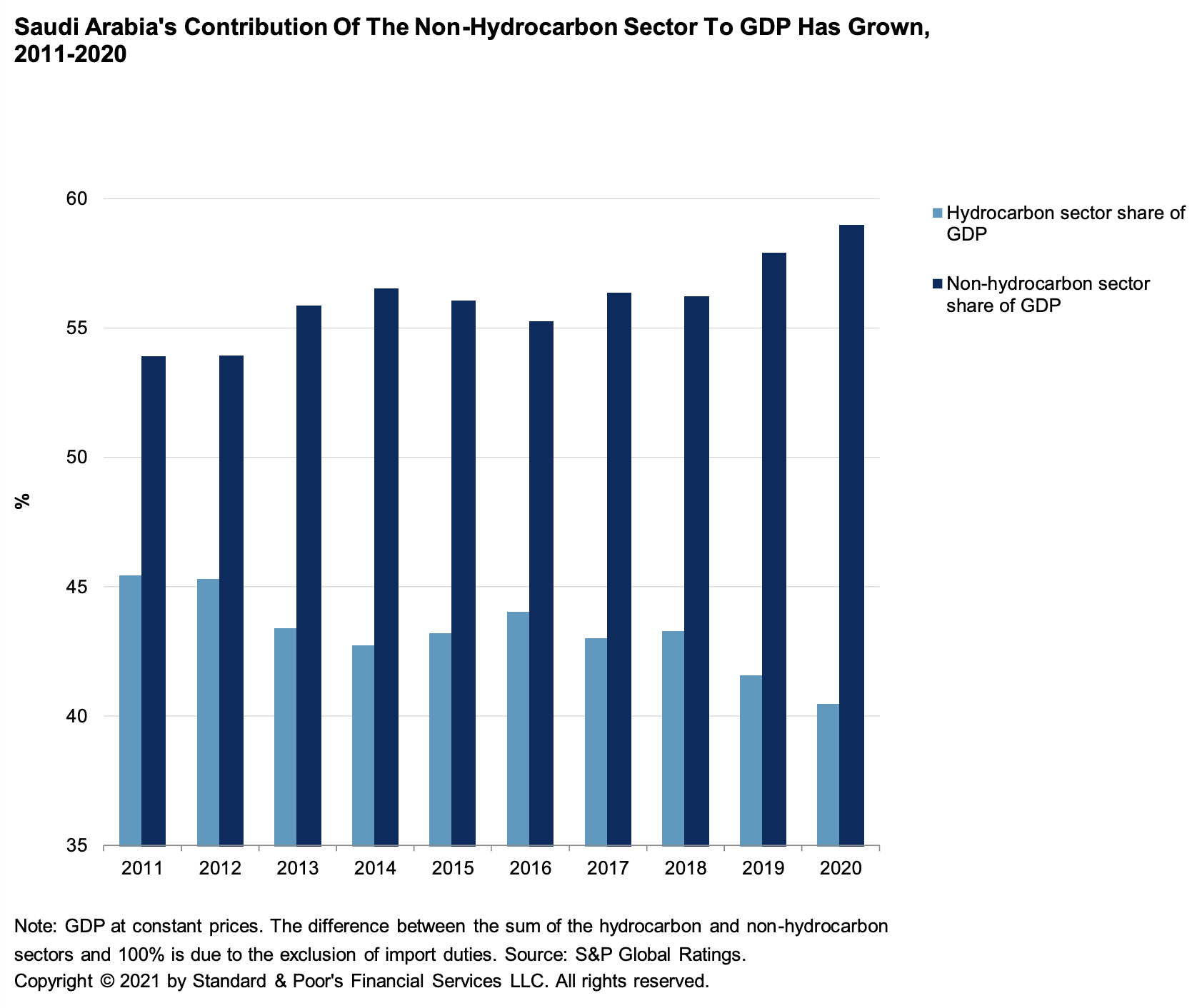

Vision 2030 Will Push Forward Saudi Arabia’s Debt Capital Market

Saudi authorities are continuing to further develop their debt and equity markets and increase foreign direct investment in the country. Driving growth of the country's debt market will be an increase in issuance to help fund the SAR12 trillion ($3.2 trillion) Vision 2030. Also favoring growth of the Saudi debt market are lending limits that Saudi banks will face as borrowing needs grow. The Saudi riyal's peg to the U.S. dollar will continue to provide comfort to foreign investors. S&P Global Ratings views development of Saudi debt markets as broadly supportive of the credit profiles of the country's banks and corporates over the long term.

—Read the full report from S&P Global Ratings

European Corporate Support Schemes: Extending And Amending

The resurgence of COVID-19 in Europe over the winter has led governments to further extend and amend most of their emergency support measures, some as far as to the end of December 2021, to minimize structural damage to economies. Credit support alone will not be sufficient to protect credit quality in sectors most disrupted by the pandemic, as S&P Global Ratings’ liquidity scores for rated companies illustrate.

—Read the full report from S&P Global Ratings

European Office REITs Should Prove Resilient To A Gradual Decline In Tenant Demand

Although office rents and occupancy could soften through 2022 because of subdued demand for office space in most European markets, S&P Global Ratings believes the environment will remain manageable for landlords. The REITs S&P Global Ratings rates are proving resilient so far to the weaker market, with limited rent declines and still rising office property values. Unpaid rents and rent concessions have been modest despite long-lasting inertia on the leasing market. S&P Global Ratings does not yet observe a strong shortening of lease durations or a large subleasing trend, rather some rises in rent incentives for new leases.

—Read the full report from S&P Global Ratings

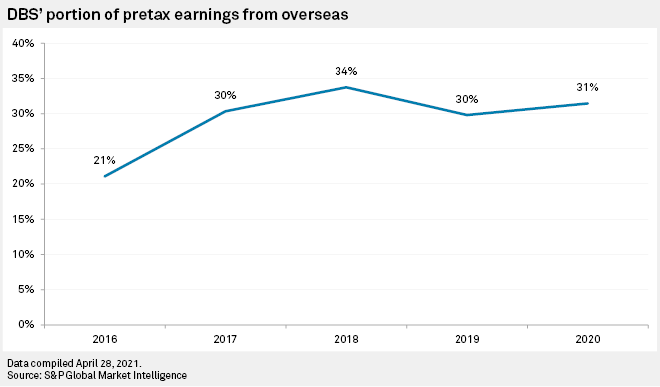

DBS May Stay Hungry For Acquisitions In Quest To Dominate Asia Banking: Analysts

DBS Group Holdings Ltd. may stay on the hunt for more acquisitions to fuel growth as its small, though high-value, home market of Singapore poses limits on its ambitions of becoming a leading Asian bank, analysts say.

—Read the full article from S&P Global Market Intelligence

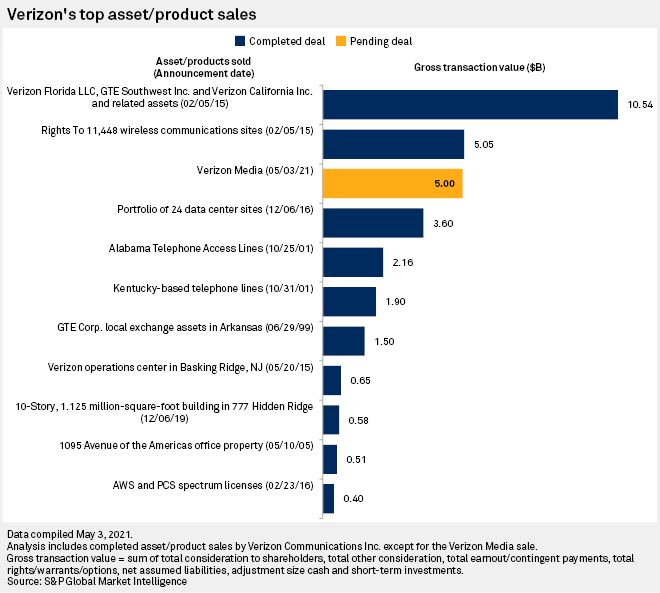

Verizon Set To Unload Yahoo, AOL To Focus On 5G Wireless Competition

After spending years trying to buy and build its way into the digital media market, Verizon Communications Inc. has decided to sell out of it. The company said May 3 that it agreed to sell its Verizon Media business — including brands AOL Inc., Yahoo!, TechCrunch and Engadget — to funds managed by private equity firm Apollo Global Management Inc. for $5 billion. Under the terms of the deal, which is set to close in the second half of the year, Verizon will retain a 10% stake in the media business.

—Read the full article from S&P Global Market Intelligence

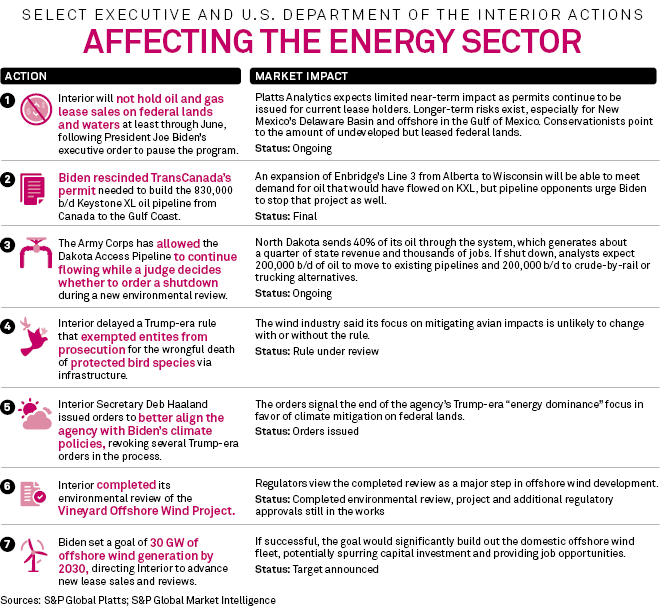

1st 100 Days: Interior Sends 'Clear Signal' Promoting Wind, Targeting Oil, Gas

Just over 100 days into President Joe Biden's term, the U.S. Department of the Interior has already taken several steps to enact his climate and clean energy policies while also taking aim at the fossil fuel sector.

—Read the full article from S&P Global Market Intelligence

California Fracking Ban A Bigger Boon To Crude Imports Than Bust For Production

California's move to stop hydraulic fracturing permits by 2024 will likely do little to speed up the current decline in output, but any crackdown on production would boost the state's dependence on imported crude.

—Read the full article from S&P Global Platts

World's Largest Green Hydrogen Project Eyes Australian Ammonia Exports

The world's largest developer of renewable hydrogen projects, InterContinental Energy, is targeting ammonia exports on a massive scale from its pioneer project in Western Australia, the company's chief strategy officer, Sacha Thacker said May 4.

—Read the full article from S&P Global Platts

Workers' Comp Profitability Steady, Premiums Fall In 2020 Amid Pandemic

Underwriting profitability remained relatively stable in the U.S. workers' compensation market in 2020 as the COVID-19 pandemic raged and premium volumes fell. But while the pandemic may be ebbing in the U.S. in 2021, the workers' comp space cannot yet say it was unscathed.

—Read the full article from S&P Global Market Intelligence

General Strike Ends At Port Of Montreal, But 2020 Earnings Suffer From Labor Issues

Operations resumed at the Port of Montreal on May 1 after an act of Parliament ended a general strike of dockworkers, but labor issues contributed to a drop in decline in volumes and revenue in 2020, the port authority said on May 3.

—Read the full article from S&P Global Platts

Listen: Will Biden’s Review Of Oil, Gas Leasing Turn Into A Drilling Ban?

The U.S. Interior Department has approved more than 500 drilling permits on federal lands and waters since January, despite the Biden administration's halt to new lease sales. The agency has not said when it might resume leasing, other than canceling any sales through June. Producer-state senators contend that this pause will turn into a permanent ban. Senator John Hoeven, Republican-North Dakota, made that case on the Capitol Crude podcast May 3. We took a look at how the leasing review is actually impacting US oil production. Ash Singh, S&P Global Platts manager of supply and production analytics, shares the latest outlook and gives his prediction for how leasing might resume. He also gets into the current economic climate for US drillers and how capital discipline is playing out in the early stages of pandemic recovery.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Platts

India's Jet Fuel Demand Set To Be Hit By Sharp Surge In COVID-19 Infections

India's jet fuel demand is expected to succumb to the latest headwinds -- the mutant COVID-19 variant -- as many states in the country impose lockdowns and countries worldwide ban flights, or restrict movements, to and from the South Asian nation to curb the spread of the variant.

—Read the full article from S&P Global Platts

China's Long March To Consolidate Small Refineries – Recent Measures A Game Changer?

China's has stepped up efforts to reform the refinery sector. New measures include the installation of sales to-tax monitoring systems at retail pumps, the crackdown on oil smuggling and an investigation into refineries' compliance with the terms for receiving crude quotas.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language