Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 19 May, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Energy Security Vs. Energy Transition

The quest to diversify energy imports and reduce reliance on Russia while also maintaining net-zero ambitions has the potential to create additional geopolitical tensions.

As the war in Ukraine continues to affect energy security, the question of whether advanced economies will be able to prioritize long-term energy transitions with immediate energy needs is yet to be resolved. Against the backdrop of the conflict, the short-term spotlight on energy security could spur greater coal and nuclear generation, but could be followed by a more medium-term net-zero push to reduce fossil fuel dependence, according to IHS Markit, now part of S&P Global.

The war in Ukraine and energy supply disruption "have amplified the discussion around energy security and highlighted the important role our industry plays in meeting today's energy needs," Francois Poirier, the chief executive of the North American energy firm TC Energy, told said during the company’s earnings call last month, according to S&P Global Commodity Insights. "The intersection of energy security and energy transition is not an obstacle to growth. We believe, rather, that it's a catalyst."

This week, the European Union proposed stronger energy efficiency and renewable energy targets for its member countries to achieve by 2030 as part of its REPowerEU legislative package to support the bloc's transition away from Russian gas imports by 2027. The package aims to replace Russian fossil fuel imports by saving energy, diversifying imports, and accelerating the energy transition. The plan will see the EU nearly double its solar power capacity in the next three years from 2020 levels, and solar becoming the bloc’s largest power source by the end of the decade, according to S&P Global Market Intelligence.

Despite establishing direct clean energy initiatives, the EU’s plan to pivot from Russia to the Middle East for necessary supplies of liquified natural gas could be complicated by pressure on Gulf economies, which get the majority of their GDP from hydrocarbon revenues, to accelerate their renewable energy adoption, according to S&P Global Commodity Insights.

“Gulf officials have taken exception to what they see as the cognitive dissonance of western finger-wagging on climate change while asking for more oil and gas supplies to tamp down surging prices and alleviate a supply squeeze exacerbated by U.S. and EU sanctions on key producers, including Russia for its invasion of Ukraine,” Herman Wang, managing editor S&P Global Commodity Insights’ OPEC and Middle East news at S&P Global Commodity Insights, said in a report yesterday. “The battle lines figure to remain entrenched, even as the Middle East prepares to host the next two U.N. climate summits: COP27 in Egypt in 2022 and COP28 in the UAE in 2023 … But for now, the current energy crunch remains a fissure between European consumers and the Middle East producers they rely on.”

Today is Thursday, May 19, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

Regime Shift: Is Higher Inflation Here To Stay?

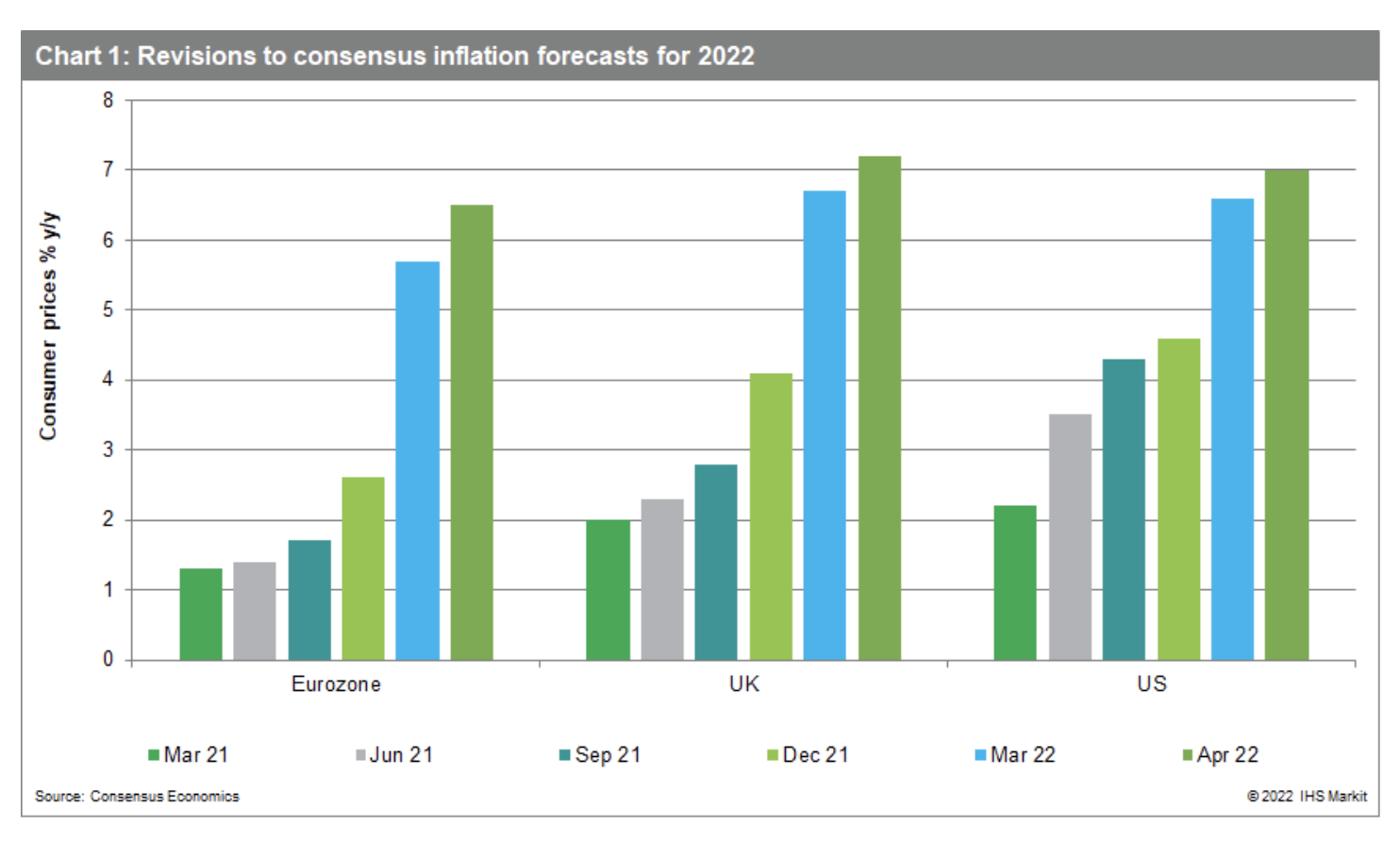

What was initially expected to be a transitory period of moderately higher consumer price inflation across the globe has morphed into a phase of persistent, exceptionally high inflation rates, captured in the evolution of annual forecasts for 2022. Upward pressures stemming initially from a range of primarily COVID-19-related effects are now being aggravated by various spillover effects following Russia's invasion of Ukraine. Focusing on Europe, we assess various arguments for and against such a shift.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Global Credit Conditions Special Update: Inflation, War, And COVID Drag On

Deteriorating global macroeconomic conditions, combined with heightened geopolitical uncertainty and lingering COVID-19 lockdowns in China, fuel persistently high inflation, market volatility, and rising yields, and pose an increasingly challenging outlook for credit.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

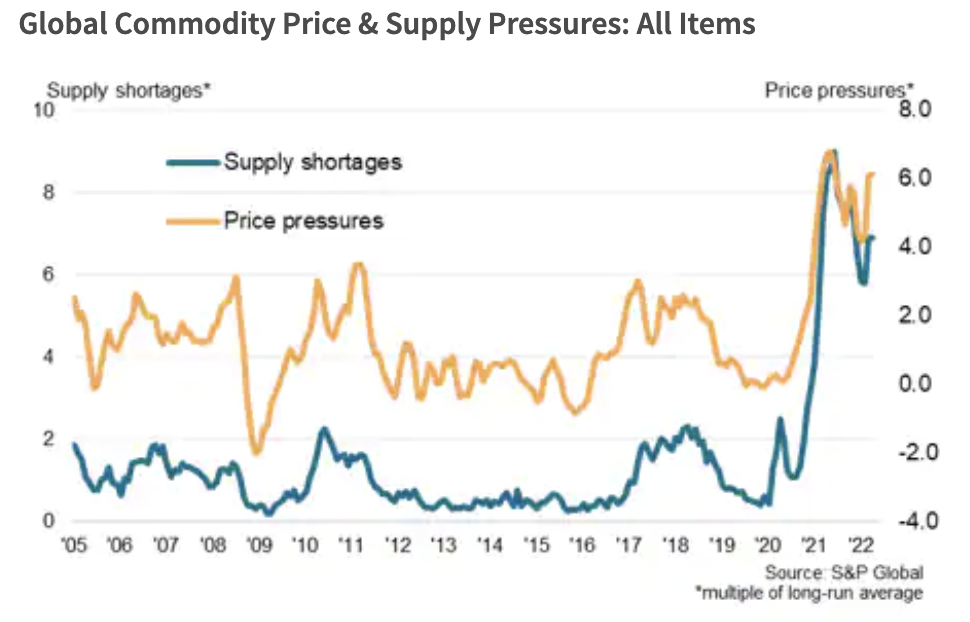

Global Commodity Price And Supply Indicators Signal Semiconductor Shortage Showing Signs Of Peaking

The S&P Global PMI™ Commodity Price and Supply Indicators track the development of price pressures and supply shortages each month for at least 20 items using responses gathered from the S&P Global Manufacturing PMI survey. Amongst which, semiconductors saw the most severe upward price pressure in April. That said, there are hints of supply shortages and price increases peaking for semiconductors, even as the situation remain severe by historical standards.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

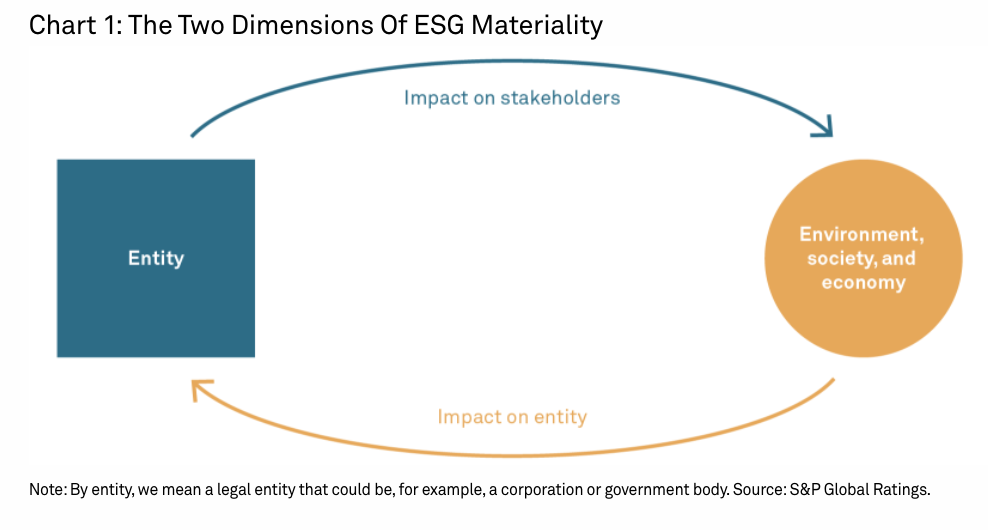

Materiality Mapping: Providing Insights Into The Relative Materiality Of ESG Factors

As environmental, social, and governance (ESG) factors become integral considerations in the marketplace across many types of analysis, investors are seeking more and clearer information about what these mean, including their relevance and materiality. In this context, S&P Global Ratings and S&P Global Sustainable1 have jointly researched two dimensions of ESG materiality: stakeholder materiality and financial materiality.

—Read the report from S&P Global Ratings and S&P Global Sustainable1

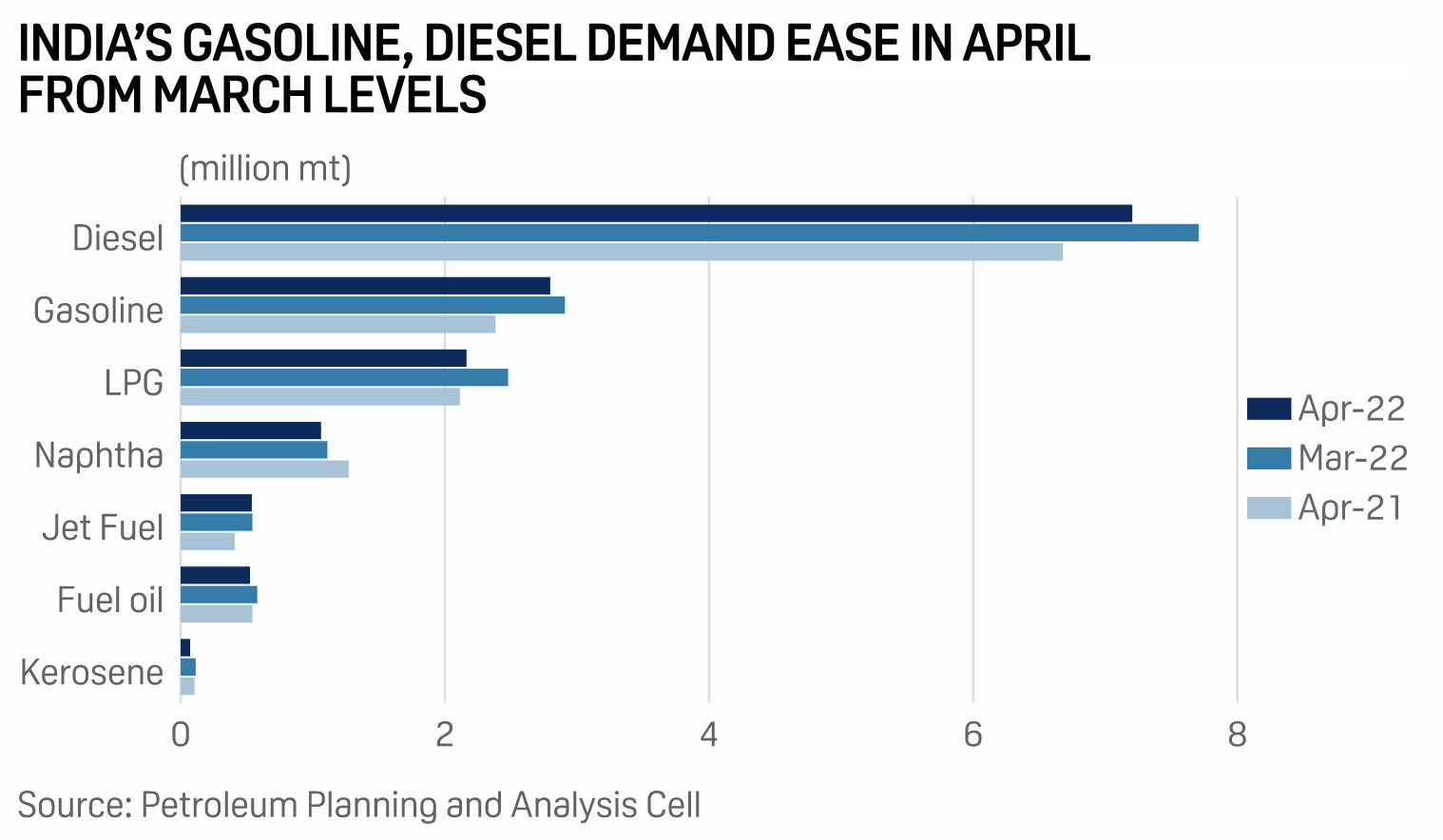

Surging Prices Hold Back India's Oil Demand Growth Momentum, Albeit Temporarily

India's sustained uptrend in oil consumption came to a halt and slipped into the red in April from March levels as rising domestic retail fuel prices on the back of surging crude took a toll on gasoline, diesel, and LPG demand, but analysts said the trend could get reversed in May. They noted that despite the month-on-month slowdown in oil products consumption in April, year-on-year demand posted solid growth and fundamentals for sustained demand revival were intact, with India expected to post robust year-on-year demand growth for the whole of 2022.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 65: The Operations Side Of AI/ML

The use of artificial intelligence and machine learning (AI/ML) is growing rapidly, but there’s not a lot of visibility into the set of supporting capabilities that have to be in place to support it. Nick Patience returns to Next in Tech to discuss the results of the latest AI/ML study and to dig into use cases and operations aspects with host Eric Hanselman. While a lack of data scientists has been a popular concern, there’s a lot more that’s needed to support AI/ML efforts. MLOps can come to the rescue.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence