Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 19 May, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

As companies and countries align their decarbonization efforts with their net-zero targets, many have turned to carbon offsets to reduce their emissions. But is compensating for continued emissions by reducing emissions elsewhere a meaningful contribution in combating climate change?

Carbon offsets, also referred to as carbon credits, are everywhere. Purchased by companies in either mandatory, compliance, or voluntary markets, the sustainable finance instruments emphasize avoiding nature loss like deforestation; improving nature-based sequestration, including reforestation; avoiding emissions, including methane from cows and landfills; and the direct removal of CO2 from the atmosphere through carbon capture and other means. Many market participants believe a large-scale carbon market will be critical to limiting global warming to 2-degrees Celsius. Detractors of the market believe high-emitting industries have focused too much on offsetting to reach carbon neutrality instead of curbing or transitioning their actual activity. Nonetheless, a multitude of the carbon offsets presently available are outdated, of poor quality, or hard to verify—which creates the risk of increasing global emissions rather than controlling them, according to S&P Global Sustainable1. In response, a number of institutions around the world are working to resolve the disparity and improve the quality of carbon offsets to ensure companies purchasing them are doing good business.

Carbon offsets "can be a powerful tool if they're done right,” Alex Hanafi, the Environmental Defense Fund’s director of Multilateral Climate Strategy, who is working on a project to provide guidance on appropriate carbon credits to buyers, told S&P Global Sustainable1. “If they're not done right, they can actually be detrimental to climate action.”

Many supporters of carbon credits stand by the financial instruments’ moral basis. “Offsets incentivize and stimulate emissions reductions across a broad spectrum of projects that are achievable today and can be used to complement rather than supplement primary emissions reductions. So that's an example of a way to something that's readily available globally right now,” Tyler Baron, the CEO of Minerva Bunkering, a wholly owned subsidiary of Mercuria Energy Group, one of the largest privately owned energy and commodities companies worldwide, told S&P Global Platts.

Ahead of the United Nations’ Climate Change Conference, or COP26, in November, companies from the U.S. to China have committed to aggressive nationally determined contributions under the Paris Agreement to reduce emissions and climate change. The International Emissions Trading Association believes the increased climate commitments on the path to net zero will result in growing interest and demand for carbon offsets. Still, the International Energy Agency said this week that the global economy will need to cease new oil and gas developments—physical polluting activity—in order to reach net zero emissions by 2050.

In the meantime, more work in the market is necessary. "While the current offset market is incredibly fragmented, there is a possibility of a general shift towards offsets from specific types of projects or environmental criteria as companies take on stricter internal standards for their own purchases and those of their counterparties,” Jeff Berman, S&P Global Platts Analytics’ head of emissions and clean energy transition, told S&P Global Platts.

Today is Wednesday, May 19, 2021, and here is today’s essential intelligence.

Watch: Unpacking SPIVA Europe: Did Volatility Provide Opportunity?

How did active managers respond to record volatility and soaring spreads in 2020 as the pandemic brought Europe to a halt? Tim Edwards and Andrew Innes of S&P DJI join Rebecca Chesworth of State Street Global Advisors and Pio Benetti of Kairos Partners SGR to explore the latest results from SPIVA Europe and the active and passive landscape.

—Watch and share this video from S&P Dow Jones Indices

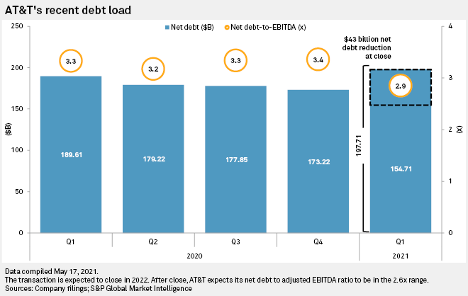

With AT&T's Warnermedia Deal, Another U.S. Wireless Leader Retreats From Content

A grand experiment by U.S. wireless carriers to make and distribute video content appears to be coming to an end, as AT&T Inc. joins Verizon Communications Inc. in preparing to shed its media business.

—Read the full article from S&P Global Market Intelligence

Tech in Banking: An Age of Digital Disruption

The coronavirus pandemic was a shock to the system for many of Europe’s banks, forcing them to pick up the pace of technological change in order to continue serving clients remotely, according to panelists at S&P Global Market Intelligence’s most recent event in its “Tech in Banking” webinar series.

—Read the full article from S&P Global Market Intelligence

ESG Factors are Increasingly Influencing Banks In Russia and Neighboring Countries

Environmental, social, and governance (ESG)-related regulation is set to rapidly evolve over the next few years, and will provide business opportunities, new regulatory requirements, and additional costs for banks in Russia, the Commonwealth of Independent States, Ukraine, and Georgia. Find out more in a report examining the growing influence of ESG factors for banks in this region.

—Read the full report from S&P Global Ratings

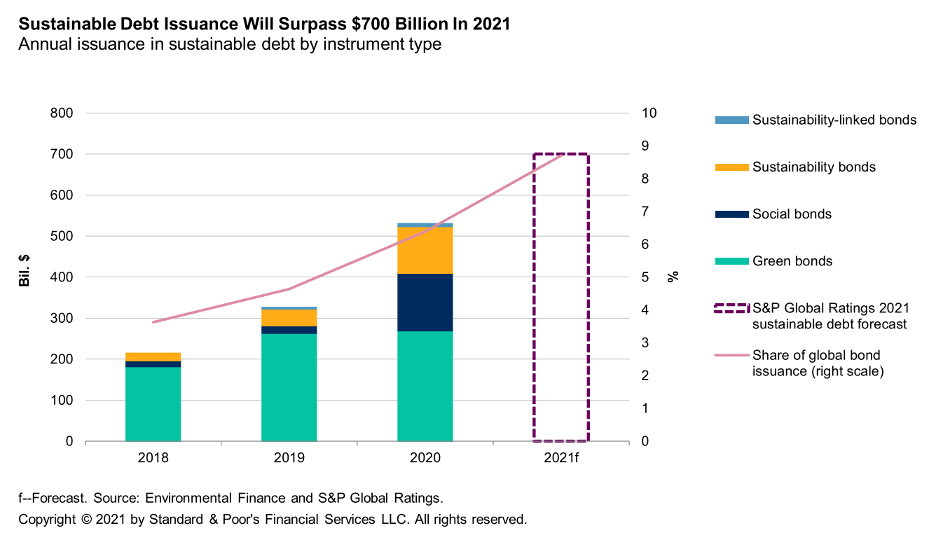

China Q1 Green Bond Issuance Rebounds, May Reach New High This Year

China's green bond issuance in the January-to-March period rose to the highest level in six quarters, leading some analysts to predict this year's volume may beat the 2019 record as the nation pushes ahead with its emission reduction plans.

—Read the full article from S&P Global Market Intelligence

GDP, Jobs, Climate Goals All Aided by Federal Support of Transmission Projects: Report

Federal support of already planned transmission investment and policies to foster timely construction of grid expansions would have significant economic stimulus effects in the short term and aid achievement of longer term decarbonization goals, a new report released May 18 said.

—Read the full article from S&P Global Platts

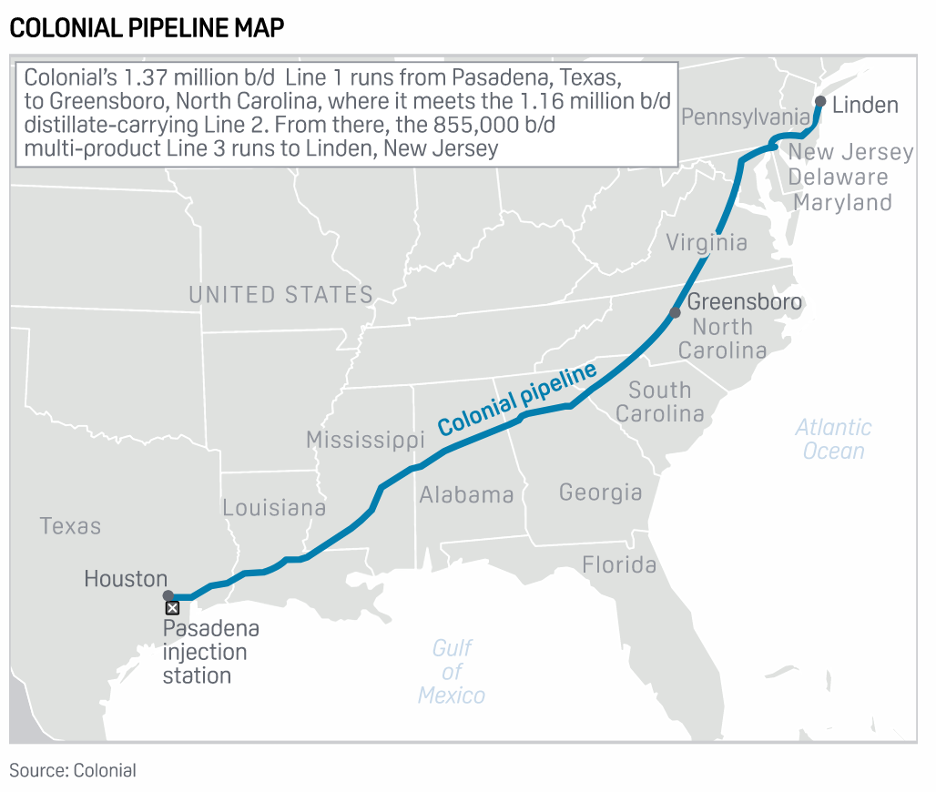

Colonial Pipeline's Customer Communications System Back Online After Experiencing Problems

Colonial Pipeline's communications system for shippers came back online late May 18 after experiencing problems for most of the day, again disrupting operations even though the petroleum products artery is up and running again after being halted for nearly a week following a cyberattack.

—Read the full article from S&P Global Platts

U.S. Natural Gas Storage Deficit Continues to Climb as Power Demand Heats Up

The US gas storage deficit to last year and the five-year average continued to climb, while warmer weather setting in across the US diminished the chances for bulky builds as gas-fired power demand grows.

—Read the full article from S&P Global Platts

New COVID-19 Waves Burst Travel Bubble Hopes, Dimming Aviation Outlook

The recent spike in COVID-19 infections in Asia-Pacific has dimmed the near-term outlook for the regional aviation sector, undermining previous optimism of air travel bubbles as countries beef up border controls and travel restrictions in a bid to curb the spread of the virus.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language