Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 25 Mar, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

A 400-meter-long (1,300 feet) cargo ship has blocked one of the world’s most active and important trade routes—creating a catastrophic maritime traffic jam that’s adding physical disruption to the already discombobulated supply chains connecting the global economy.

Ever Given, a 224,000-ton mega container ship sailing under the Panama flag, was lodged sideways and ran aground in Egypt’s Suez Canal on March 24 after being swept up in a 40-knot sandstorm that caused a blackout which diminished visibility and navigation. The transportation chokepoint blocked by one of the shipping world’s most monumental vessels connects the Red Sea with the Mediterranean and serves as a primary waterway in the international trade of consumer goods and petroleum products between Asia, Europe, the Middle East, and the U.S. The ship departed from China and was destined for Rotterdam, and has thwarted dozens of other ships at the north and south ends of the canal from passing through the 120-mile-long artery.

"This is coming at a time when container trade is already disrupted and there are significant delays at port, so it really is the icing on the cake for some liners,” a freight forwarder told S&P Global Platts.

Although S&P Global Platts Analytics anticipates the situation is unlikely to affect shipping rates in the long-term, the incident rippled through many commodities markets and delayed a plethora of shipments in a trade environment already strained by the coronavirus crisis’ disruptions. Both steel and liquified natural gas trading markets appeared to be minimally affected.

Market observers had largely hoped the Ever Given, which is roughly as long as the Empire State Building and Eiffel Tower are high, would be refloated, towed, and moved from the canal by this morning, but the ship remains stuck and the backlog of vessels could take between seven to 14 days to clear. S&P Global Platts Analytics doesn't expect the blockage to last more than a few days, but said that a longer closure could add volatility in freight rates and oil and gas prices.

"The blockage of the Suez Canal comes at a very bad time. Bunker prices and some relevant freight rates have been increasing steadily since the end of 2020. And although upward pressure have eased-off in recent weeks, they remain high enough to encourage the use of shorter shipping routes," David Martinez, senior direct of commodity solutions for crude oil and refined products at S&P Global Platts, told the Daily Update. "How this disruption reflects on the prices for commodities, including freight rates, remain to be seen and will depend on the duration of the blockage. We have not seen a significant impact in short-term price yet. But it is clear that the longer it last, the more its effects will propagate and be felt up and down the supply chain of commodities and finished products."

The megaship’s owner, Japan's Shoei Kisen Kaisha, said today that it is considering what needs to be done to alleviate the situation. A power shovel was deployed yesterday to the Suez Canal in efforts of moving the Ever Given, but whether the container ship can be removed from the shallows and out of the waterway completely in the immediate term is yet to be seen.

"The more [grounded] the ship is, the longer an operation will take. It can take days to weeks" and "consider[ing] bringing in all the equipment we need, that's not around the corner" for the Ever Given, Peter Berdowski, CEO of the dredging and heavy lift company Royal Boskalis Westminster tasked with rescuing the giant container ship, said today on a Dutch television program, according to S&P Global Platts. He compared the giant ship to a "heavy whale."

If the Ever Given remains entrapped, the calamity will worsen. More than 18,000 ships pass through the canal each year, according to the Suez Canal Authority, and S&P Global Platts data show that approximately 80 ships transporting crude and other oil products, chemical, dry bulk, and other container cargo have been waiting to traverse the canal from both sides.

"Every hour that passes, the backlog at the canal increases, placing further stresses on supply lines that were already deprived of buffers," James Wroe, head of liner operations for the integrated shipping company Maersk in Asia-Pacific, said, according to S&P Global Platts.

In an effort to divert course and maintain trade flows, some container lines expressed plans to reroute their cargoes through the Cape of Good Hope. But doing so could bring additional challenges.

"Going via the Cape [of Good Hope] will be a key option for some of the container liners, but that has additional costs obviously in terms of delayed transit times and significantly higher bunker consumption due to the additional distance steamed," the freight forwarder told S&P Global Platts.

Today is Thursday, March 25, 2021, and here is today’s essential intelligence.

For The U.S... Let The Good Times Roll

S&P Global Economics is optimistic that the recovery is starting to accelerate in the U.S., with the risk of recession over the next 12 months a much lower 10% to 15% (was 20% to 25%). S&P Global Economics raised their real GDP growth forecasts for 2021 and 2022 to 6.5% and 3.1%, respectively, from 4.2% and 3.0% in the December report.

—Read the full report from S&P Global Ratings

PE Firms Target Packaging Companies Supporting Consumer, Pharma In 2020

Global private equity packaging company deals continued apace in the first few months of 2021, with the six transactions recorded as of March 10 on track to become the second-highest quarterly total in the past year, S&P Global Market Intelligence data shows.

—Read the full article from S&P Global Market Intelligence

NYSE 'Very Committed' To Wooing More Asian Companies To List In U.S.

NYSE, the world's biggest exchange by market capitalization of companies listed on it, is also looking to deepen its relationship with Asia-based companies, aiming to bring them to New York to either debut or pursue a secondary listing. It recently had South Korea's e-commerce company Coupang Inc. ring the market bell, which has been the second-largest non-U.S. IPO on the exchange. Chinese software company Tuya Inc. also listed on the NYSE this month.

—Read the full article from S&P Global Market Intelligence

Greek Banks To Take Aim At Bad Loans With More Securitizations In 2021

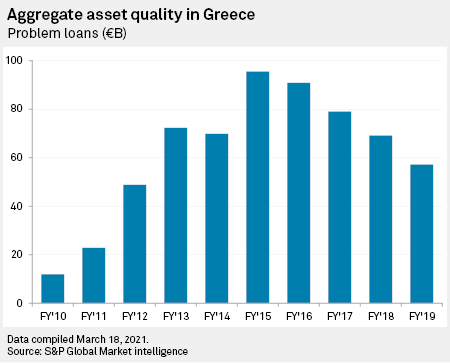

A renewed focus on securitization in 2021 could see Greece's major banks cutting their bad loan ratios down to single digits. Analysts say that this could mark the start of a new era for the country's "big four" banks — Piraeus Financial Holdings SA, National Bank of Greece SA, Alpha Bank AE and Eurobank Ergasias Services and Holdings SA — all of which have grappled with stubbornly high levels of toxic debt in the decade following the global financial crisis.

—Read the full article from S&P Global Market Intelligence

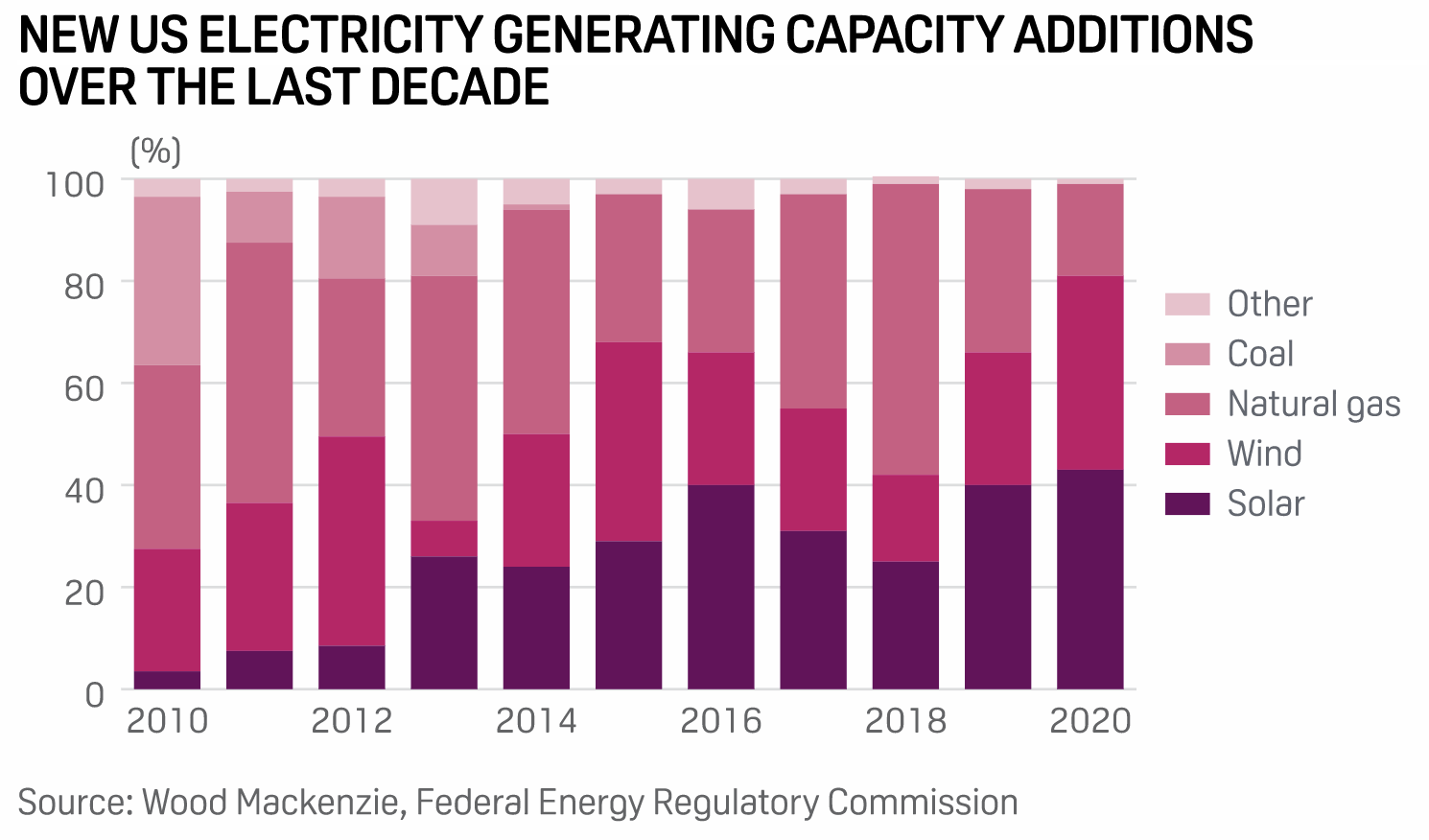

Solar Industry Expected To Keep Setting Records Until 2024 Tax Credit Step-Down

The solar industry installed a record 19.2 GW in 2020, leading all technologies in new electric capacity additions, and is on track to more than quadruple in size during the next decade, officials said March 23 during a Solar Energy Industries Association webinar.

—Read the full article from S&P Global Platts

Iberdrola, EDF Slam Support For Natural Gas In EU's Green Finance Rulebook

Two of Europe's largest power groups have called on the EU to refrain from backtracking on plans to essentially exclude natural gas from its green taxonomy, a guide for investors that is supposed to drive vast amounts of capital into climate-friendly activities over the coming decades.

—Read the full article from S&P Global Market Intelligence

Texas Politicians Vow Fix For Loophole That Kept Natural Gas Facilities Offline

Texas politicians vowed March 24 to fix loopholes that allowed paperwork failures to keep natural gas facilities from being deemed "critical infrastructure" during the historic February freeze that left much of the state without power for days at a time.

—Read the full article from S&P Global Platts

Will Shipping Energy Efficiency Regulations Cause More Headaches For Owners?

The International Maritime Organization has approved amendments to its MARPOL Annex VI regulations, introducing an Energy Efficiency Design Index (EEDI) that is expected to come into force in 2023. Container editor George Griffiths and tankers editor Charlotte Bucchioni look at what these new amendments entail, and how they might impact the world of shipping at a time when freight rates are already volatile and uncertainty has become the new normal.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

Mexico’s Energy Sector Stagnates As AMLO’s Counter-Reform Plays Out

Political instability has always been the Achilles' heel of Latin America. Investments in the region have often been jeopardized by governments who make changes to what came before. The energy sector has been particularly affected, as it has been directed by ideological concepts, rather than economic or technical facts. Mexico is no exception.

—Read the full article from S&P Global Platts

Smaller Uranium Companies Buy Up Material Atop Global Hype For Nuclear Power

Uranium juniors faced with the prospects of a nuclear renaissance and prices below the cost of production are trying to capitalize on their dilemma with a simple strategy: buy, buy, buy.

—Read the full article from S&P Global Market Intelligence

Gold Producers Need To Consolidate To Remain 'Relevant,' Sibanye CEO Says

After floating the idea of a megamerger between three South African gold producers in early March, Sibanye Stillwater Ltd. CEO Neal Froneman told S&P Global Market Intelligence that such a combination is just one approach to growth the company is considering as it seeks to throw more weight around the market.

—Read the full article from S&P Global Platts

Amid Budding Industry Optimism, U.S. Natural Gas Production Hit One-Year High

Domestic gas production surged to a nearly 12-month high this week as rising optimism in the US oil and gas industry continues to fuel an expansion in drilling activity and upstream investment.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language