Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 2 Jun, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Weighing various energy market scenarios to meet the conditions of the Paris Agreement, countries across North America, Europe, and the Middle East are going big for blue hydrogen as one viable clean fuel to drive the transition away from fossil fuels.

Produced by capturing and storing carbon emitted from steam methane reforming of natural gas, blue hydrogen’s global production capacity is likely to grow significantly in the next decade worldwide—to 3.3 million metric tons per year by 2028, from 0.6 million metric tons now, according to S&P Global Platts Analytics' Hydrogen Market Monitor. Blue hydrogen’s growth would outpace planned capacity for its cousin green hydrogen, produced from renewable energy inputs, which S&P Global Platts Analytics expects to expand to approximately 0.6 million metric ton per year, up from roughly 0.2 million. S&P Global Platts Analytics expects 2021 global pure hydrogen demand to increase to 74.1 million metric tons per year, a 4.2% year-on-year increase after the 3.8% slump spurred in 2020 by the COVID-19 crisis.

That hasn’t stopped the United Kingdom from kickstarting a massive hydrogen economy initiative, nor global oil majors and other emitting industries like shipping and mining from centering hydrogen in their net-zero strategies.

The U.K. is expected to launch its hydrogen economy strategy this quarter, and in March committed more than $200 million toward nine clean energy and emissions reductions projects. Integrating hydrogen into the national grid, renewable development, and oil and gas industry are emerging priorities. The U.K. wants its hydrogen future to be colorless, but in the near-term is leaning blue and could ultimately pursue both blue and green pathways. Energy giant BP is building what will be the U.K.’s largest blue hydrogen production plant on the northern coast in Teesside, which will have capacity for its first production by 2027 and will produce an annual 260,000 metric tons of blue hydrogen by 2030.

The U.K.’s hydrogen strategy will take a "twin-track approach", Rita Wadey, the country's deputy director of hydrogen strategy, said May 25 at an IDEA London Accelerating Net Zero: Hydrogen in the Energy Mix webinar, according to S&P Global Platts. "It would not be blue or green, but both. Blue gives us volume as well as investment."

The United Arab Emirates, which is the third-largest oil producer in OPEC, plans to prioritize blue hydrogen to keep pace with the energy transition alongside the country’s oil and gas sectors. Abu Dhabi National Oil Co. said it will build a blue ammonia production plant in order to become a leader in hydrogen and other clean energy products, and has already forged international trade agreements on hydrogen with countries like Japan.

"Realistically, blue hydrogen is cheaper than green hydrogen, and as an oil and gas producer, we are very well-positioned to be very competitive when it comes to blue hydrogen—and it's coming in the next few years, while green hydrogen still needs more time," Yousif al-Ali, the U.A.E. energy ministry's assistant undersecretary for electricity, water, and future energy affairs, told S&P Global Platts in an interview. "It is expected green hydrogen can be competitive in 10 years and blue hydrogen may be competitive before, in five to seven years.”

Not all market participants are as enthused about blue hydrogen. Within the full spectrum of hydrogen sources, many market participants see both blue and green hydrogen as critical to the energy transition, and some view renewable-powered green hydrogen as the better option. Others perceive hydrogen to play a complimentary role in meeting global clean energy and climate goals, rather than the mature or pre-eminent force.

"When it comes to blue, I really don't think from a cost perspective that blue has a chance, to be honest," electrolyzer producer Nel Hydrogen CEO Jon Andre Lokke said about the possibility that blue hydrogen production may not being economical beyond the short-term. "I think it is pushed very much by the big oil companies because they don't have a choice, and they're afraid of losing power and the oligopoly position,” he said during a May 6 virtual event sponsored by the research firm Rystad Energy, according to S&P Global Platts. “But I think with green renewable hydrogen, the cost is going to go down much faster than the analysts think. Look at what happened in wind."

"Of course, not a silver bullet—it's one part of what we need to decarbonize," David Bryson, Uniper's chief operating officer, said in reference to hydrogen generally on April 26 at the Financial Times' Hydrogen Summit, according to S&P Global Platts. "There are inefficiencies, but those are removed over time and improved … They should not allow us to stop from moving forward."

Today is Tuesday, June 2, 2021, and here is today’s essential intelligence.

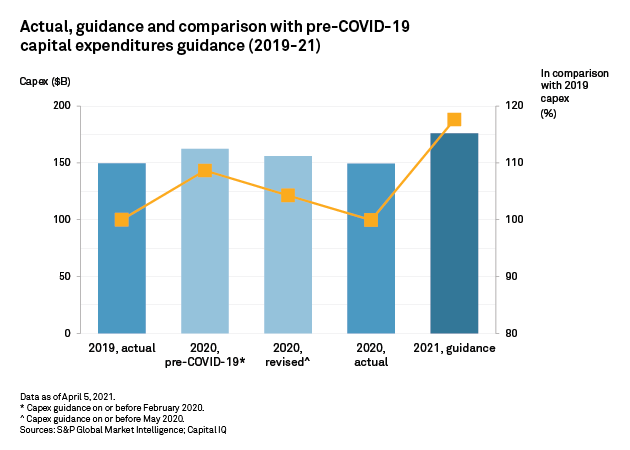

COVID-19 Pushed Capex Down 8% in 2020, but Recovery Expected in 2021

At the beginning of 2020, the mining companies examined by S&P Global Market Intelligence were forecasting capital expenditures of $162 billion, or 9% higher than 2019 spending. As the COVID-19 pandemic set in globally, however, regional lockdowns forced work stoppages and supply chains were in upheaval. This led companies to revise their spending plans 4% lower to $156 billion for the year — though still well above 2019 levels.

—Read the full article from S&P Global Market Intelligence

High Levels of Dispersion across the Commodities Complex in May

At the headline level, it was a rather subdued month for commodities. The S&P GSCI gained 2.5%, taking YTD performance to 26.0%. While the S&P GSCI’s upward momentum attenuated, high dispersion in the performance of single commodities continued, albeit with reversals among the leaders and laggards. Most of the grains sagged to the bottom of the performance table after surging in April, while feeder cattle, silver, and gold switched ends of the table. Coffee offered an exception, with caffeine-boosting double-digit gains in both periods.

—Read the full article from S&P Dow Jones Indices

Managing and Planning through Uncertain Times from an FA Perspective

In March 2021, S&P Dow Jones Indices facilitated a discussion during S&P DJI’s virtual event with two financial advisors from Australia and Canada and an NZX representative who works closely with FAs in New Zealand. S&P Dow Jones Indices asked them to reflect on the past year and how they pivoted with the onset of the Covid-19 pandemic.

—Read the full article from S&P Dow Jones Indices

Performance Analysis of a Carbon-Optimized Passive Index Portfolio

Many of S&P Global Market Intelligence’s Investment Management clients are slowly incorporating ESG as part of their investment process, but the integration, aside from trend-following purpose, has not been trivial since this concept has only recently picked up interest. Given the nature of the investment community, the single question that S&P Global Market Intelligence gets the most is whether there is alpha potential by incorporating ESG into the investment process. Can we really invest and at the same time, save the Earth?

—Read the full article from S&P Global Market Intelligence

SF Credit Brief: Some $54 Billion of U.S. Securitization Issuance In May 2021; $270 Billion YTD, Up Over 60% Year Over Year

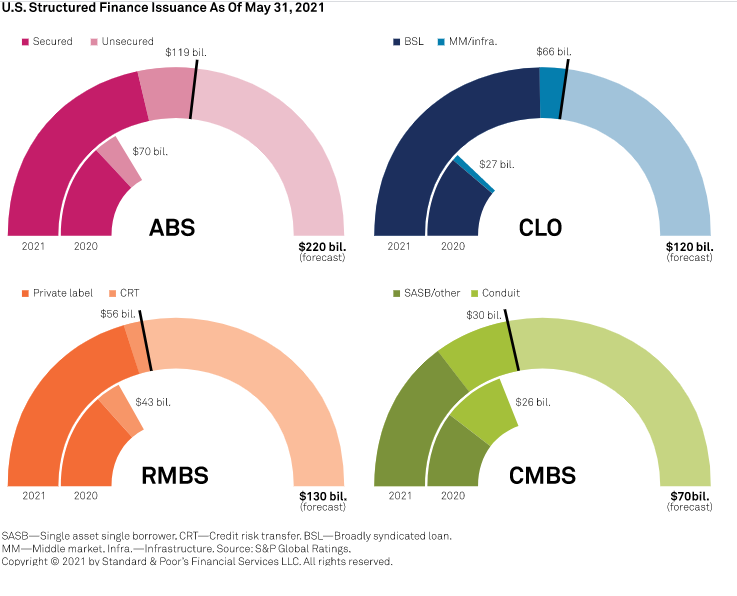

U.S. structured finance new issuance across the four major sectors (asset-backed securities [ABS], commercial mortgage-backed securities [CMBS], collateralized loan obligation [CLO], residential mortgage-backed securities [RMBS]) totaled more than $54 billion in May 2021, bringing the year-to-date (YTD) total to $270 billion, up 63% year over year from $166 billion for the same period a year ago.

—Read the full report from S&P Global Ratings

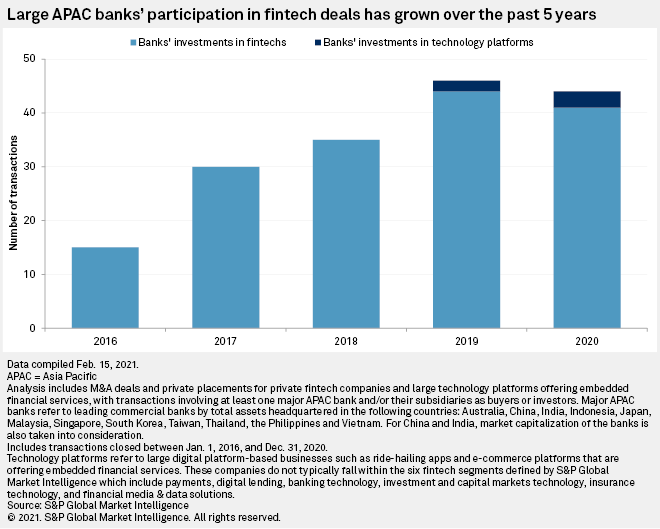

Large APAC Banks Upping Fintech Bets

Major banks in the Asia-Pacific region could grow to become a larger source of capital for financial technology startups as lenders seek to future-proof their business.

—Read the full article from S&P Global Market Intelligence

Surprise Ceo Departure, Poland Politics Drive Uncertainty at PKO Bank

Under Zbigniew Jagielło's tenure, PKO Bank Polski SA made a string of acquisitions and more than doubled its asset size, but the CEO's surprise resignation has raised questions about whether Poland's largest bank will face growing political interference.

—Read the full article from S&P Global Market Intelligence

Where Gulf Cooperation Council National Champion Banks Stand After Wave of M&A

Saudi National Bank posted first-quarter net income of $909 million in its maiden earnings season, marking Saudi Arabia's entry into the fray among the Gulf Cooperation Council's so-called national champion banks. Saudi National Bank, or SNB, was established through a merger between National Commercial Bank and Samba Financial Group that created an entity with greater scale and a larger foothold in the corporate banking segment.

—Read the full article from S&P Global Market Intelligence

Indonesia Eyes Greater Financial Inclusion With Gold-based Blockchain System

The Indonesian government's plan to launch a blockchain-based, precious metals-backed payments and savings platform outside the banking system will likely drive financial inclusion further in a country where about 51% of adults, or 95 million citizens, are unbanked.

—Read the full article from S&P Global Market Intelligence

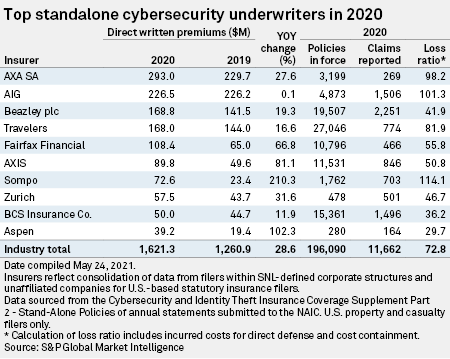

Cyber Insurers Hike Rates, Tweak Coverage as Loss Ratio Rises Again In '20

Cyber liability insurance premiums continued to climb by double digits in 2020, but the industrywide loss ratio grew at a faster pace, forcing underwriters to adjust coverage and hike rates to cover escalating costs from breaches and ransomware attacks.

—Read the full article from S&P Global Market Intelligence

HSBC’s U.S. Retail Exit Makes Sense But Is Unlikely to Impact Bottom Line

HSBC Holdings PLC's withdrawal from mass market retail banking in the U.S. represents a logical step in the U.K.-based group's strategy, analysts said, but data suggests it is unlikely to significantly affect its performance. The bank will sell 90 of its 148 U.S. branches in several transactions and turn 20 to 25 locations into international wealth centers. Between 35 and 40 residual branches not subject to sale or repurposing will be shuttered, the lender announced May 26.

—Read the full article from S&P Global Market Intelligence

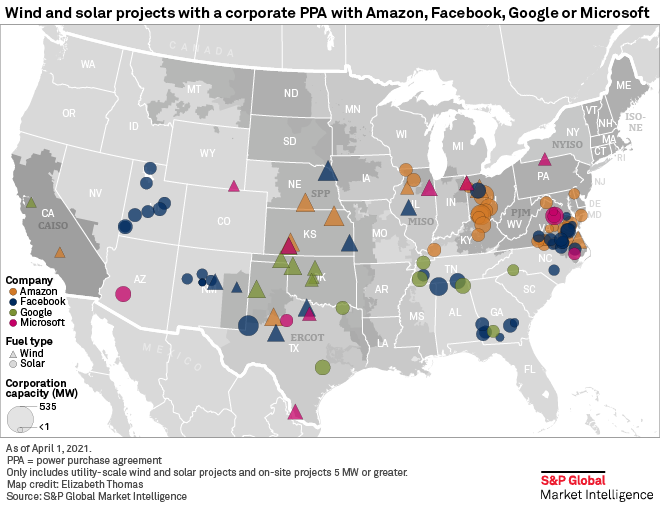

Corporate Renewables Market Flourished In 2020 Despite Pandemic

The COVID-19 pandemic proved to be a significant disruption for many corners of the global energy industry, but the corporate renewables market plowed ahead as if nothing had happened. S&P Global Market Intelligence tracked over 20,000 MW of new corporate wind and solar capacity throughout the year, making 2020 the most active year yet in the rapidly growing segment.

—Read the full article from S&P Global Market Intelligence

Utility Green Tariffs Contribute to Over 20 GW of Corporate Renewables Contracts

The corporate renewables market has become a major segment of the energy industry over the last five years and in the U.S. specifically, just over 41,000 MW of wind and solar capacity has been contracted to non-utility corporate off-takers. In vertically integrated electricity markets, these corporations often need to work with local utilities to procure the necessary renewable capacity to offset their consumption.

—Read the full article from S&P Global Market Intelligence

Experts Seek Standardized Rules for Climate-related Disclosures by Companies

Countries in Asia-Pacific should adopt standardized rules on climate-related financial disclosures by companies, as sustainability is increasingly becoming an important consideration in investment decisions, said industry leaders at an event organized by S&P Global.

—Read the full article from S&P Global Market Intelligence

New England Offshore Wind Could Shift Canada-U.S. Power Trade Balance

A flood of cheap power generated by planned U.S. offshore wind projects could find its way onto Canada's power grid, reversing a long-standing trend of mostly one-way trade that sees massive exports of Canadian hydropower to the U.S.

—Read the full article from S&P Global Market Intelligence

Shipping’s “Dirty Fuel” Stages A Comeback as Emissions Targets Loom

"Dirty and unwanted" was how many market participants summarized the prospects for high sulfur fuel oil after IMO 2020 took effect, but more than a year on, this outlook has refused to materialize.

—Read the full article from S&P Global Platts

Biden Budget Proposes Repealing Raft of Tax Benefits for Fossil Fuel Producers

U.S. President Joseph Biden proposed eliminating a slew of tax benefits for oil, natural gas, and coal producers in favor of electric vehicle and other low-carbon energy alternatives as part of his $6 trillion budget for the next fiscal year.

—Read the full article from S&P Global Platts

Analysis: Big Oil, Stung by Activist Campaigning, Not Yet Out for the Count

Global oil and gas producers, facing a pummeling from environmental activists and shareholders, can rely at least for a while on persistent oil demand and a need for their expertize and scale, even as pressure increases for them to diversify.

—Read the full article from S&P Global Platts

Saudi Oil Minister Calls IEA’s Net-Zero Roadmap 'La La Land Sequel'

Saudi energy minister Prince Abdulaziz bin Salman has read the International Energy Agency's recent blockbuster report outlining a roadmap for the world to achieve net-zero carbon emissions by 2050 and is not impressed.

—Read the full article from S&P Global Platts

Watch: Market Movers Asia, May 31-june 4: China's New Consumption Tax Sends Ripples Across Oil, Petrochemical Sectors

On this week's Platts Market Movers Asia with Associate Editor Ashna Mishra: oil companies in China are expected to cut gasoline and gasoil exports in June by up to a quarter from May following Beijing's plans to impose a consumption tax on mixed aromatics imports from June 12.

—Watch and share this Market Movers video from S&P Global Platts

OPEC+ Commits to July Oil Output Rise, Keeps Options Open After

OPEC and its allies will follow through on plans to hike crude production through July, ministers announced June 1, as oil prices broke through the $70/b ceiling amid forecasts of a tight market ahead.

—Read the full article from S&P Global Platts

U.S. Coal-Fired Power Output Decline Continues with Last PSEG Coal Plant Retirement

Public Service Enterprise Group said June 1 that it had retired its last remaining coal-fired power plant, the 400-MW Bridgeport Harbor Station Unit 3 in Bridgeport, Connecticut, which operated since 1968, and is part of a continued US trend toward coal plant retirements.

—Read the full article from S&P Global Platts

Listen: Mexico's Federal Elections to Have Broad Impact on Energy

The upcoming federal elections in Mexico, the largest in recent history, are expected to have broad implications across many energy sectors. Commodities Focus spoke with Adrian Duhalt, post-doctorate fellow in energy studies at Rice University in Houston, about the implications for the energy industry.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language