Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 11 Jun, 2021

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Countries’ approach to international tax policy is changing rapidly, but implementation of new regulations and the implications of any new laws won’t actualize for years.

The Group of Seven finance leaders—from the U.S., U.K., Canada, France, Germany, Italy, and Japan—agreed this past weekend to try to reform the global tax landscape by instituting a minimum tax of at least 15% on large companies across the globe, as well as to tax companies according to where the bulk of their goods and services are sold. The landmark agreement aimed at curtailing tax havens, where multinational companies stockpile earnings to avoid paying taxes, signifies the start of a global policy overhaul that will likely take years to come into fruition. The proposal will need to be vetted by the Group of 20 and a coalition led by the Organization for Economic Co-operation and Development, and individual nations will ultimately need to enact and pass legislation to align their respective tax laws with the eventual outcome.

Analysts told S&P Global Market Intelligence that the work involved in substantiating and solidifying the deal will minimize risks to tech giants' financial positions in the near-term.

While the push to adopt a standard global minimum corporate tax rate has been in the works for several years, "it's still a very vague agreement so far," Elke Asen, a policy analyst at the independent tax policy nonprofit Tax Foundation, said in an S&P Global Market Intelligence interview. "We only know, yes, it should be a 15% minimum rate, but there's so many details that still need to be worked out, including, and very importantly, the tax base. So, what exactly should be taxed at 15%?"

In the world’s largest economy, U.S. Treasury Secretary Janet Yellen is leading the charge toward broad tax reform--including raising the corporate tax rate to 28%, as promised by President Joe Biden. The move would erase half of the reduction provided by the Tax Cuts and Jobs Act of 2017, which shrunk the nominal rate to 21%, from 35%. If enacted, companies could see a decline in earnings due to the increased taxes, especially across technology-focused and banking industries.

“Multinational corporations with substantial overseas earnings largely in sectors such as technology and health care would be subject to significant international tax changes to end offshoring and profit-shifting incentives under the Biden tax proposal. We believe most U.S. companies would have somewhat higher effective tax rates and pay higher cash taxes, and multinational corporations with foreign earnings would pay even more absent tax planning,” S&P Global Ratings said in a recent report. “Despite the potential effects on cash flow, we don't foresee rating changes directly attributable to the passage of the Biden tax proposal into law. Rating actions would more likely be due to companies offsetting lower cash flows via strategic, structural, or financial policy changes (e.g., shareholder returns). Highly leveraged borrowers could be pressured without using tax planning, net operating losses, or tax credits to offset the tax increases.”

However, any changes to the corporate tax U.S. rate would need to be passed by budget reconciliation, as the tax proposal likely won’t receive Republican support, and wouldn’t go into effect until 2022, according to S&P Global Ratings.

Today is Friday, June 11, 2021, and here is today’s essential intelligence.

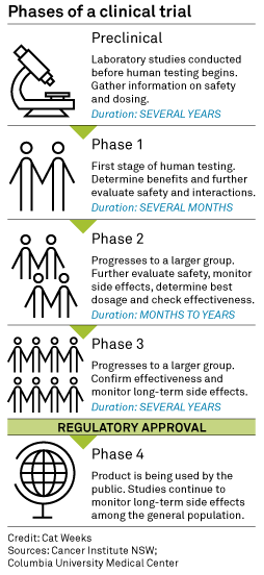

Small Companies Bear Large Burden of Developing Superbug Treatments – Report

Companies large and small rushed in to develop COVID-19 therapies and vaccines once the pandemic took hold, motivated by government funding and the massive market potential. The picture looks different for infectious diseases that resist treatment with antibiotics, antivirals and other medicines designed to eradicate microscopic attackers.

—Read the full article from S&P Global Market Intelligence

Emerging Markets Monthly Highlights: Long Road Ahead, Despite the Year’s Promising Start

Q1 GDP reports surprised to the upside in most emerging markets (EMs), but renewed lockdowns in several countries will likely dampen Q2 activity and afterwards. Surprisingly upbeat growth pace mostly stemmed from a stronger-than-expected domestic demand, and in many cases, from better-than-expected performance of services.

—Read the full report from S&P Global Ratings

Several U.S. Insurers Begin to Dabble with Cryptocurrency Investments In Q1

Six insurers in the first quarter picked up shares of digital currency investment vehicles offered by Grayscale Investments, LLC.

—Read the full article from S&P Global Market Intelligence

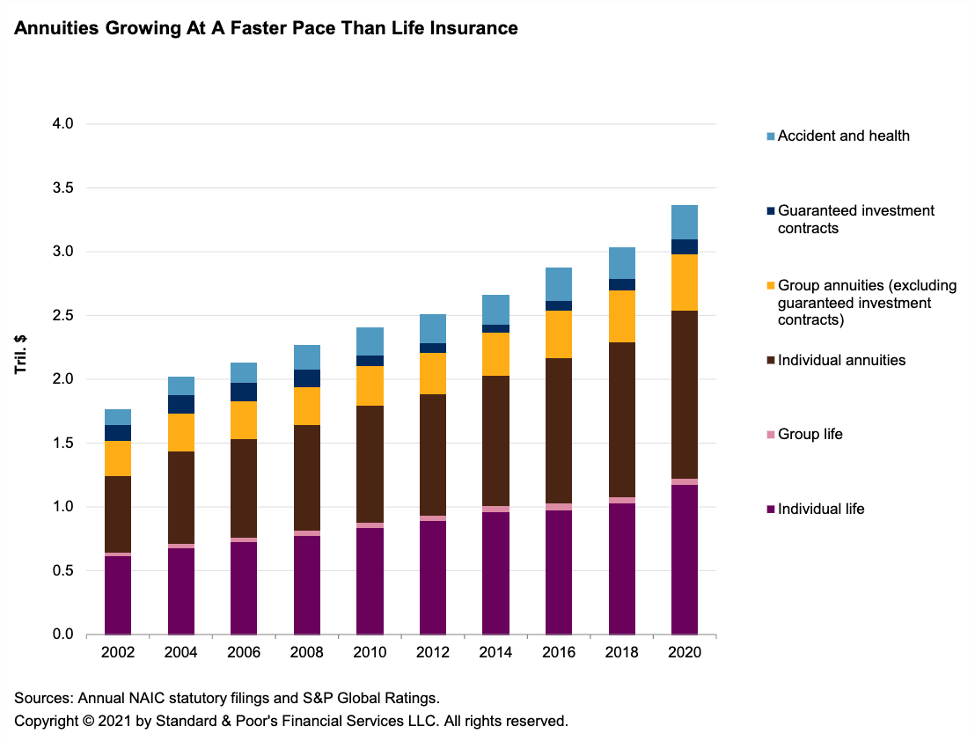

How Prolonged Low Interest Rates Could Affect U.S. Life Insurers

The dramatic decline of the 10-year U.S. Treasury yield to historic lows in 2020 raised concerns in the life insurance industry about the increased likelihood of lower-for-longer interest rates and companies' value propositions.

—Read the full report from S&P Global Ratings

Austrian Covered Bonds Harmonization Proposal Merges Three Laws Into One

On April 1, 2021, the Austrian government published a detailed draft proposal and request for comments to merge the three covered bond laws (Hypothekenbankgesetz, Pfandbriefgesetz, and the Gesetz betreffend fundierte Bankschuldverschreibungen) into one new covered bond law. The request for comments period ended on April 30, 2021.

—Read the full report from S&P Global Market Ratings

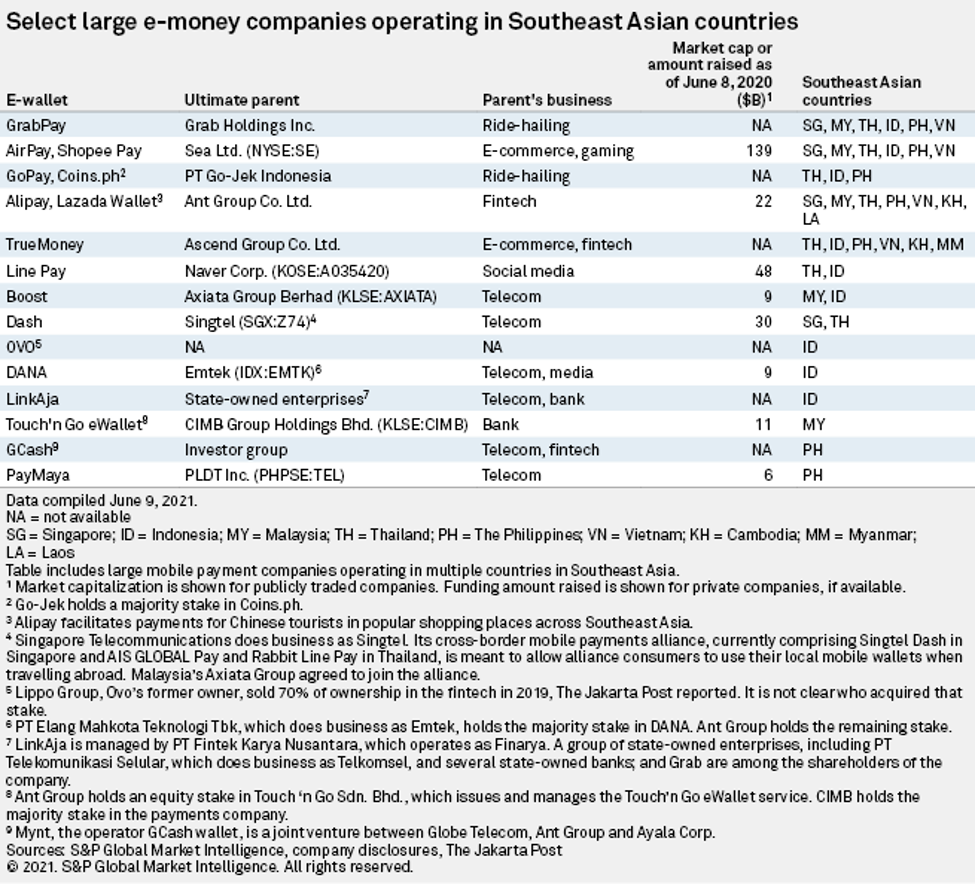

Merger of 2 Biggest Indonesian Unicorns to Create Challenger for Fintech Giants

The merger between two of Indonesia's best-known unicorns will create a new financial technology giant that will seek to monetize relationships with its combined customer base. However, it will face competition from Chinese and regional fintech players seeking to carve a slice of the growing wealth in Southeast Asia.

—Read the full article from S&P Global Market Intelligence

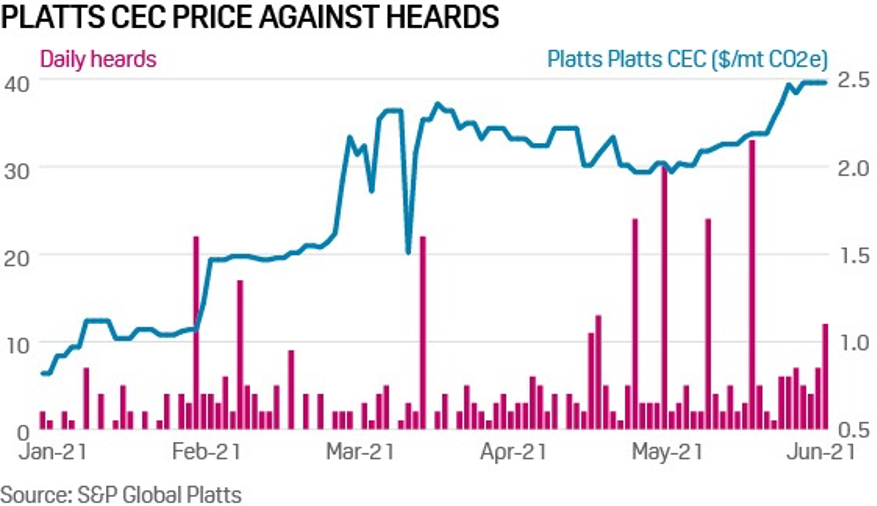

Voluntary Carbon Markets: How They Work, How They’re Priced and Who’s Involved

2021 will probably be remembered as the year when carbon finance emerged as a talking point among a wide range of industries.

—Read the full article from S&P Global Platts

These Utilities Want More Than An 'ESG Wrapper' Around Climate Financing

Edison International is the latest U.S. utility to issue a results-based financing strategy to generate funds for targeted clean energy, transportation and carbon reduction projects and cement its commitment to net-zero greenhouse gas emissions by 2045.

—Read the full article from S&P Global Market Intelligence

Gas Treatment, Infrastructure Tensions Hamper Clean Electricity Standard Efforts

The Biden administration's push for Congress to enact a national U.S. clean electricity standard, or CES, is pitting utilities with substantial natural gas-fired capacity against environmental groups that want the fuel excluded from potential clean power standards. Those tensions represent yet another hurdle to establishing a mandatory federal CES, a key piece of U.S. President Joe Biden's goal of decarbonizing the power sector by 2035.

—Read the full article from S&P Global Market Intelligence

Energy, Emissions Front and Center as NATO Militaries Look to Future

NATO powers are pushing their militaries to lead by example on climate change and rein in operational emissions, even as threat assessments point to a continued need for long-distance operations in remote and diverse locations, creating a need for new types of fuel and innovation.

—Read the full article from S&P Global Platts

Policy Change Needed Now to Reach 2050 Clean Energy Transition Goal: Professor

A large-scale, national effort is needed to prepare the US power grid for the clean energy transition that is underway in order to achieve the goal of net-zero emissions by 2050, a speaker said June 9 during the EEI 2021 virtual conference.

—Read the full article from S&P Global Platts

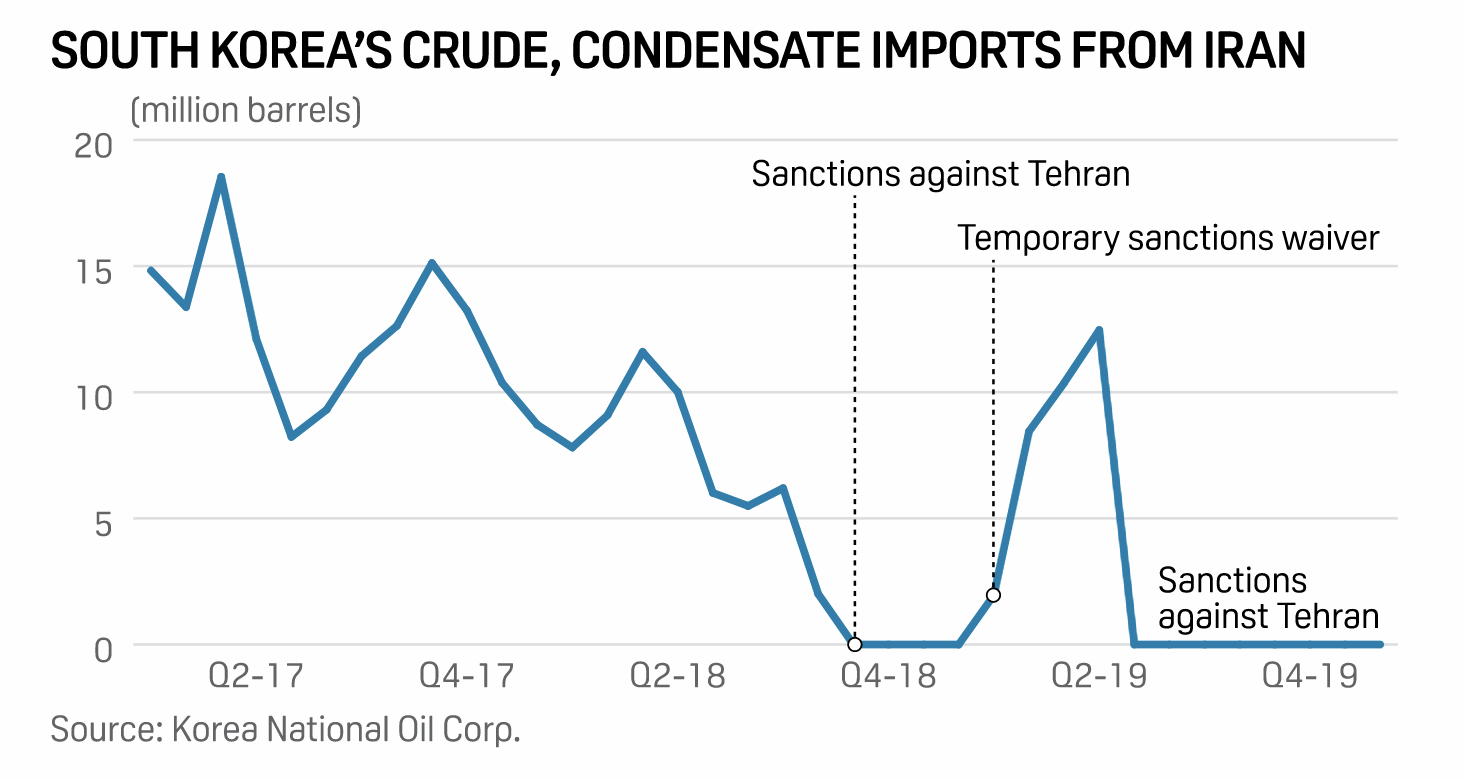

ANALYSIS: S Korea Could Shun Some Mexican, Russian Crudes If Iran Returns To Market

South Korea will likely alter its crude oil procurement and trading strategy when Iranian barrels return to the international market, with Mexican and Russian suppliers poised to lose a big portion of their market share in the world's fifth largest crude importer.

—Read the full article from S&P Global Platts

OPEC Forecasts More Demand For Its Oil With H2 Growth Quickening

OPEC still expects the global economy to accelerate in the second half of 2021, keeping its forecast of oil demand growth unchanged in its latest market analysis and pledging to remain vigilant to prevent prices from backsliding.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language