Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 8 Jul, 2020

By S&P Global

In the time of coronavirus, protecting and promoting the health of both the global population and the global economy is a complex balancing act.

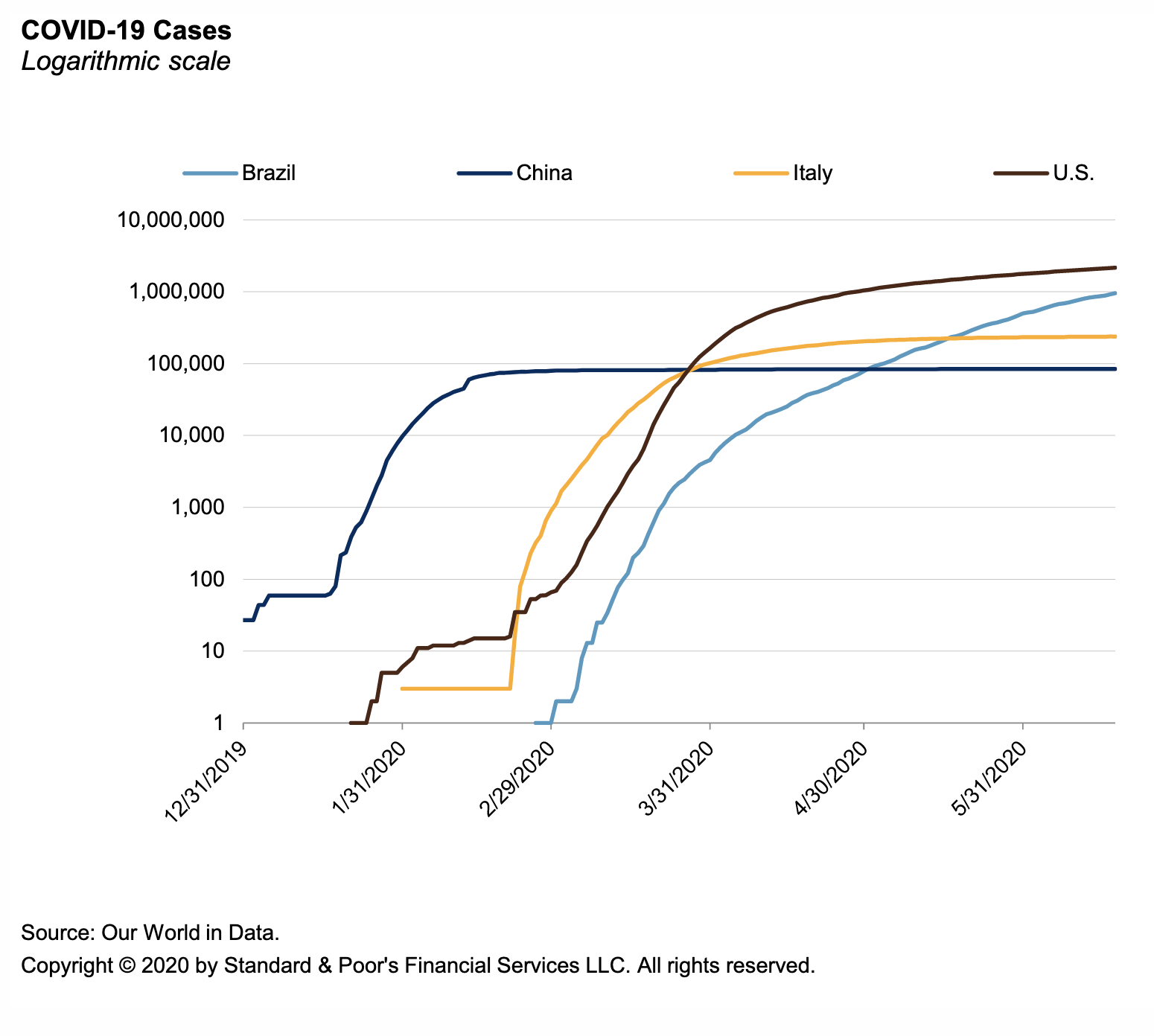

“While the COVID-19 narrative across East Asia, then Europe, and the U.S. has been broadly consistent despite variations in the intensity of measures, emerging markets are struggling to contain the spread of the virus,” S&P Global Ratings Chief Economist Paul Gruenwald said in a recent report. “Infection curves aren't flattening at the same rate as elsewhere. Indeed, the global epicenter of the virus has now shifted to Brazil.”

Brazilian President Jair Bolsonaro, who has long denied the threat of the contagion, said on July 7 that he tested positive for the coronavirus.

“Everyone knew that sooner or later it would affect a good part of the population… But if the economy doesn’t work, it will bring new forms of death and suicide,” he said at a press conference, which he concluded by taking off his mask. “The number of deaths has increased not because of the virus, but because of the fear of the virus. The virus is like the rain, it will hit you.”

“When you look at what we can do, we know works—it’s the use of masks and physical distance and avoiding crowds,” Dr. Anthony Fauci, director of the U.S. National Institute of Allergy and Infectious Diseases, said during a virtual event yesterday. “Individual mandates [requiring people to wear masks], wherever they come from, I think are important because when people get a signal that you may or may not wear a mask, which means it may or may not be helpful, that’s a very confusing signal.”

“By allowing yourself to get infected because of risky behavior, you are part of the propagation of the outbreak,” Mr. Fauci said at the event with U.S. Democratic Senator Doug Jones of Alabama. “There are so many other things that are very dangerous and bad about this virus. Don’t get yourself into false complacency.”

Approximately 11.8 million cases of coronavirus have been reported worldwide and more than 540,000 people have died, according to Johns Hopkins University. The number of infections in the U.S.—currently totaling 3 million—is rising faster than testing can accommodate. At least six U.S. states recorded record new case numbers on July 7. Experts in Brazil, the country with the second-highest amount of coronavirus cases and fatalities, say the real number of infected individuals could be 12 to 16 times greater than the 1.7 million confirmed cases.

“Life goes on. Brazil has to produce, the economy has to move,” Mr. Bolsonaro said.

As countries implemented containment measures and shut down economic activity, GDP declined 30% to 40% at an annualized rate, according to S&P Global Ratings. This pattern has held in China for a one-quarter shutdown from January-March, much of Europe in the first and second quarters, and the U.S. from April to June. Now, “the post-COVID-19 potential GDP path will be completely determined by the supply side of the economy since all transitional, demand-side effects are unwound,” Mr. Gruenwald said.

“The COVID-19 health and economic shock appears to have peaked in most developed countries and China, while many emerging markets struggle to contain the virus and the economic fallout. The focus has shifted to the recovery, which will be longer and more complicated than the downturn,” Mr. Gruenwald said, forecasting global GDP to contract 3.8% this year. This marks a worsened state from the 2.4% contraction previously anticipated and reflects a disproportionate decline in emerging markets, especially India. “We see a reasonably strong bounce in 2021-2023 with global growth averaging above 4%, but with permanent lost output from the COVID-19 shock.”

Additionally, “the crisis will cast a long shadow over the world and OECD economies,” the Organization for Economic Co-operation and Development said in its Employment Outlook report, projecting that global growth will decline by an annual 6%—even if a second wave of infections is avoided.

“In the first three months of the COVID-19 crisis, in OECD countries for which data are available, hours worked fell 10 times more than in the first three months of the 2008-2009 global financial crisis,” according to the report. “The OECD-wide unemployment rate is projected to be at 9.4% at the end of 2020, above any previous historical peak, and still 7.7% the year after.”

By next year, without another phase of infections, the crisis will take “real income per capita in the majority of OECD economies back to 2016 levels,” the OECD said.

Across the eurozone, growth will shrink by 8.7% this year, followed by a marginal boost of 6.1% next year, according to the European Commission’s summer economic forecast released yesterday. The EU economy will contract 8.3% this year and grow 5.8% next year.

“The economic impact of the lockdown is more severe than we initially expected. We continue to navigate in stormy waters and face many risks, including another major wave of infections,” Valdis Dombrovskis, the European Commission’s Executive Vice President for an Economy that Works for People, said. “Looking forward to this year and next, we can expect a rebound, but we will need to be vigilant about the differing pace of the recovery. We need to continue protecting workers and companies and coordinate our policies closely at [the] EU level to ensure we emerge stronger and united.”

Today is Wednesday, July 8, 2020, and here is today’s essential intelligence.

Economic Research: The Global Economy Begins A Slow Mend As COVID-19 Eases Unevenly

The COVID-19 health and economic shock appears to have peaked in most developed countries and China while many emerging markets struggle to contain the virus and the economic fallout. The focus has shifted to the recovery, which will be longer and more complicated than the downturn. S&P Global Ratings now forecasts global GDP to contract 3.8% in 2020, worse than the 2.4% contraction we previously expected, mainly reflecting a deeper, longer hit to emerging markets, led by India. We see a reasonably strong bounce in 2021-2023 with global growth averaging above 4%, but with permanent lost output from the COVID-19 shock.

—Read the full report from S&P Global Ratings

Stock market rally suggests rebound in P&C industry surplus

After equity market volatility in March fueled the largest sequential decline in U.S. property and casualty industry policyholders' surplus in recent memory, June 30 quarterly statements may prove similarly historic, but in reverse. The 20% plunge in the S&P 500 Index during the first quarter, its largest drop since the fourth quarter of 2008, gave way to a gain of nearly the same percentage in the second quarter, marking the largest increase for the index in any quarter since 1998.

—Read the full article from S&P Global Market Intelligence

Most European insurers' market caps grow in Q2

Seventeen of Europe's 20 biggest insurers saw their market capitalization increase on a percentage basis as markets rebounded in the second quarter following a brutal first three months of the year, according to an S&P Global Market Intelligence analysis. Germany's Munich Re recorded the biggest quarterly increase at 25.7%. Italy's Generali climbed to sixth place after seeing its market cap grow 9.0% to €21.21 billion, while Swiss Re AG dropped a spot to seventh as its market cap fell 2.0% in local-currency terms. The third decliner, Norway's Gjensidige Forsikring ASA, saw its market cap dip 0.5%.

—Read the full article from S&P Global Market Intelligence

June Heatwave for Metal and Petroleum Commodities

The S&P GSCI rose 5.09% in June and 10.47% for the second quarter of 2020. The recovery in the second quarter did not fully retrace the dramatic downside from the first quarter, as can be seen in the index’s -36.50% YTD return. Continued recovery in petroleum commodities contributed, but bullish sentiment in industrial metals such as copper helped keep the S&P GSCI in positive territory.

—Read the full article from S&P Dow Jones Indices

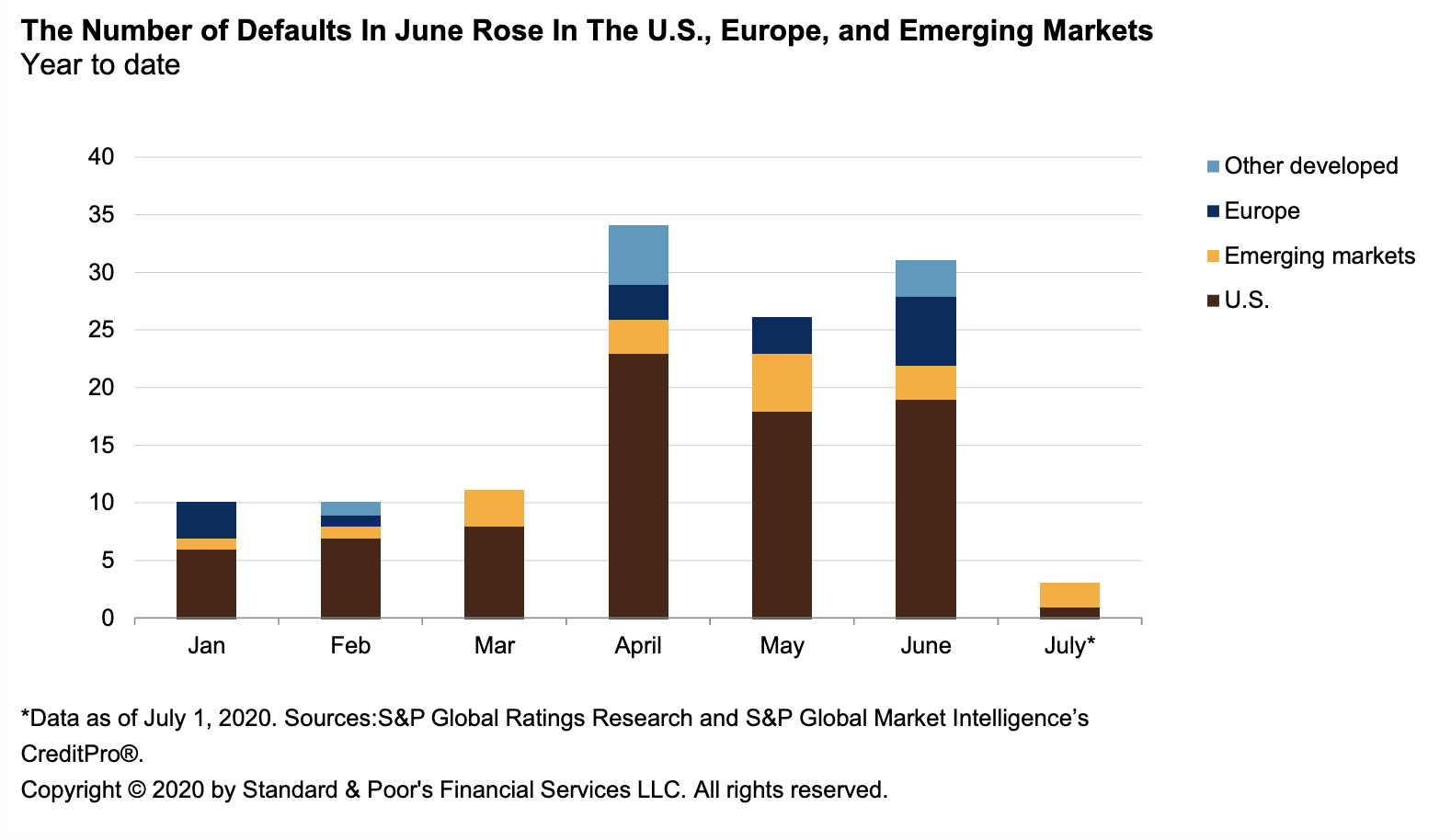

Default, Transition, and Recovery: The Number Of Corporate Defaults Tripled In Second-Quarter 2020

The 2020 global corporate default tally has reached 125 after six issuers defaulted since our last report. The defaulters are Texas-based dining center operator CEC Entertainment Inc., Texas-based exploration and production (E&P) company W&T Offshore Inc., Connecticut-based frac sand and industrial minerals producer Covia Holdings Corp., California-based oil and gas exploration and production company California Resources Corp., and two Mexico-based companies Grupo Aeromexico S.A.B. de C.V. and Grupo Posadas S.A.B. de C.V.

—Read the full report from S&P Global Ratings

US leveraged loan defaults total $23B in Q2, the most since 2009

The second quarter brought a fresh look at the fallout from the COVID-19 crisis for U.S. leveraged loans as ratings damage hit at record speed and the first of the pandemic-related defaults began to trickle through. Second-quarter default activity in institutional loans — the kind purchased by CLOs — though rapidly rising and topping prior milestones, was dominated for the most part by pre-pandemic situations, however. A record 11 defaults in April totaling $6.90 billion, followed by a six-year monthly high of $10.54 billion of defaults in May, helped finally push the S&P/LSTA Leveraged Loan Index past its 2.85% historical default average for the first time since 2015.

—Read the full article from S&P Global Market Intelligence

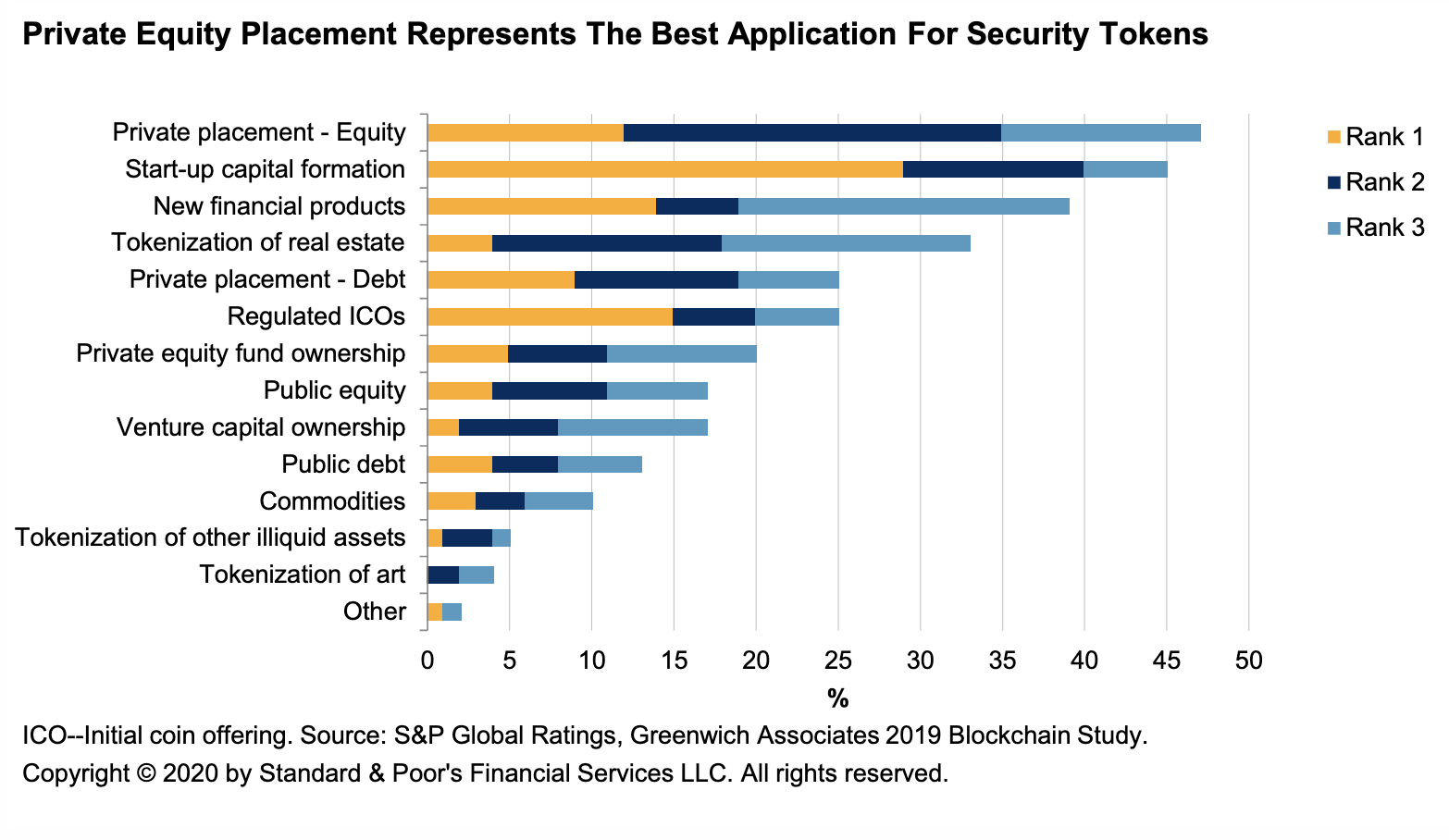

The Future Of Banking: Building A Token Collection

Investor interest in tokenization has increased over the past few months after the COVID-19 pandemic highlighted the importance of digitalizing the financial services industry. Although S&P Global Ratings has seen a primary focus on retail banking disruption, we think the ongoing pandemic will push greater financial innovation. If physical assets were in digital form, tokens, it would be much easier to divide them up, improving their liquidity and potentially increasing financial inclusion. We believe the most likely use of such tokens would be for raising capital and funding small and midsize enterprises (SMEs). Yet, as with any financial innovation, there are bound to be hurdles, including regulation, technology, and security of ownership. We think that tokenization will have a limited effect on financial institutions' profitability in the next few years.

—Read the full report from S&P Global Ratings

China's shadow banking likely to stay in contraction as lenders get cautious

China's shadow banking system, a key alternative funding source for companies with relatively weak credit profiles, will likely continue to shrink as even the nonbank lenders get cautious amid economic weakness and ongoing trade tensions between Beijing and Washington, analysts say. Disruptions triggered by the novel coronavirus have raised the risk of default, especially by weaker companies, and the government has only slightly loosened its grip on shadow banks as they are still seen as a source of financial risk that could have a systemic impact.

—Read the full article from S&P Global Market Intelligence

ECB Set To Ease Regulatory Hurdles To Eurozone Bank Consolidation

The COVID-19 pandemic may add new impetus to European bank M&A. The European Central Bank this week unveiled an accommodative stance on eurozone bank consolidation. This topic has been on the agenda for many years due to the sector's persistent excess capacity and low structural profitability. However, despite these powerful catalysts for action, equally strong inhibitors have limited dealmaking to domestic consolidation within the most fragmented national markets. S&P Global Ratings believes the economic disruption and low-for-even-longer interest rates triggered by COVID-19 may cause banks to see consolidation in a new light.

—Read the full report from S&P Global Ratings

Stress tests promise greater clarity around European banks' climate risk

For investors concerned about climate-related exposure at European banks, a new way of assessing risk is on the horizon. Regulators in Europe are fine-tuning their approach to climate stress tests, which can provide key data on exposure to so-called stranded assets and help with risk assessment amid concern about the economic impact of climate change, according to bankers and analysts. Global energy sector assets lost $1.4 trillion in value between 1997 and 2017, according to estimates by credit insurer Euler Hermes. A further $300 billion to $1.6 trillion may be lost in the future from "stranded" energy assets that may be rendered obsolete by a transition to a more sustainable economy.

—Read the full article from S&P Global Market Intelligence

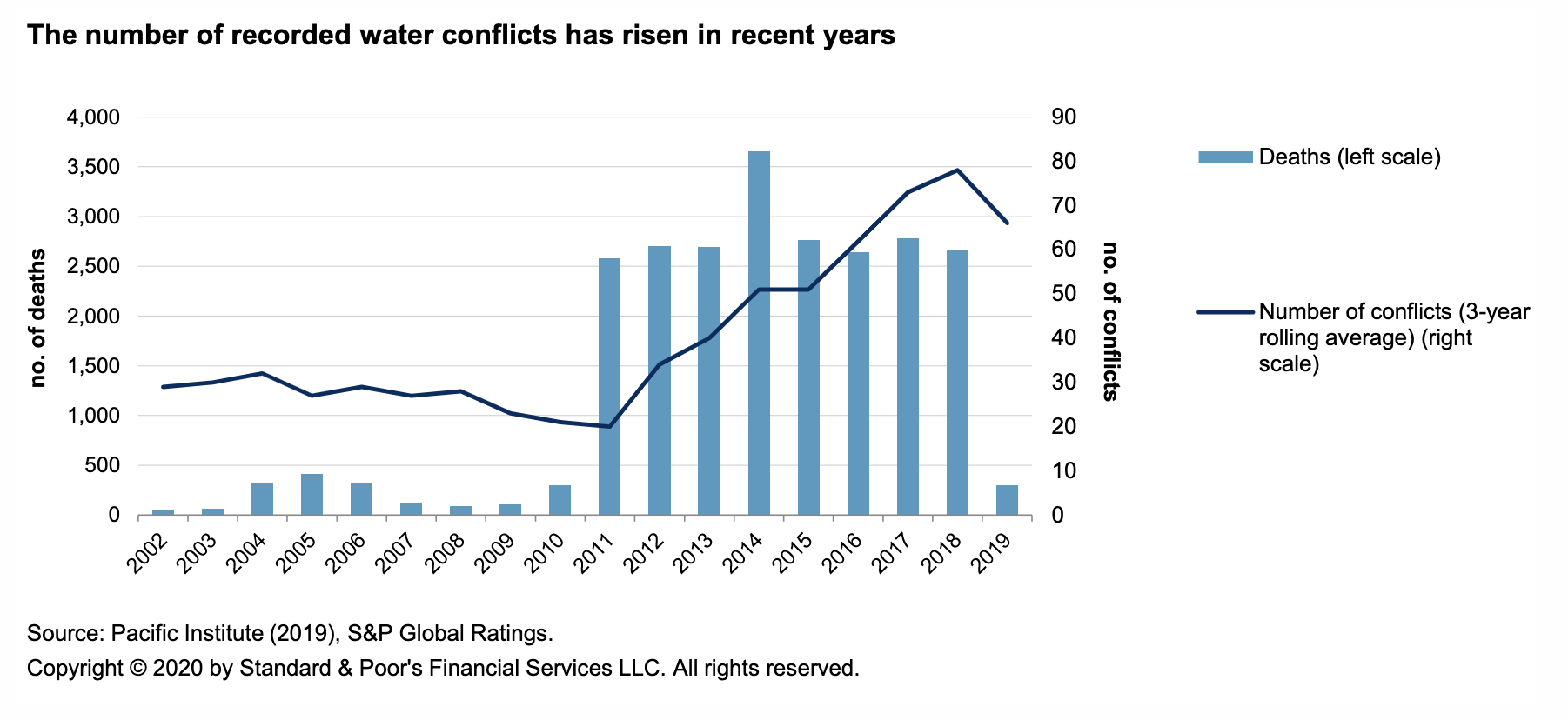

Environmental, Social, And Governance: Water Conflicts Are Heightening Geopolitical And Social Tensions Globally

Water conflicts are on the rise, according to Pacific Institute data. The World Economic Forum ranks water crises as higher in impact than infectious diseases. As part of our ESG Evaluation, S&P Global Ratings assesses a company's preparedness to face emerging and strategic risks--and water crises are an important consideration. As countries respond to water crises, geopolitical and social risks can emerge. The Taskforce for Climate-Related Financial Disclosures (TCFD) asks that business leaders disclose to investors how climate change might affect their businesses. Yet physical risks can indirectly affect businesses via the impact of water scarcity on communities and geopolitics, which can lead to under-reporting of climate risks in financial disclosures. Water crises stand to worsen as the climate changes, leading to more disputes and possible conflicts particularly when two sovereign entities compete for water from the same geological basin. That said, not all transboundary water disputes result in violent conflict, and some can be resolved via financial agreements.

—Read the full report from S&P Global Ratings

US judge orders Dakota Access crude pipeline shut by Aug 5, vacates permit

Energy Transfer's 570,000 b/d Dakota Access Pipeline must stop service and be emptied of crude oil by August 5, a US appeals court judge ruled July 6 in an unexpected blow to the system that delivers Bakken production to Gulf Coast refiners and exporters. The ruling by US District Court for the District of Columbia Judge James Boasberg vacates DAPL's permit allowing it to cross the Missouri River at Lake Oahe in North Dakota. Boasberg ruled that the seriousness of the Army Corps of Engineers' deficiencies in granting the easements "outweighs the negative effects of halting the oil flow" for the 13 months that the Corps said it would need to conduct a new environmental review.

—Read the full article from S&P Global Platts

EU opens Eur1 billion call for renewables, hydrogen, CCS projects

The European Commission on July 7 opened a Eur1 billion ($1.1 billion) call to fund large-scale innovative renewables, clean hydrogen, energy storage, and carbon capture and storage/use projects. The goal is to get companies to invest now in the low-carbon technologies needed for the EU to achieve its goal of being climate neutral by 2050. "The EU will invest Eur1 billion in promising, market-ready projects such as clean hydrogen or other low-carbon solutions for energy-intensive industries like steel, cement and chemicals," EC Executive Vice-President Frans Timmermans said on July 3, ahead of the call opening.

—Read the full article from S&P Global Platts

Watch: Market Movers Europe, Jul 6-10: Energy transition, and post-lockdown recovery in focus

In this week's highlights: The EU is to unveil its ambitious hydrogen strategy; the S&P Global Platts OPEC+ survey will give some insight into compliance; Europe's dwindling gas storage capacity will be in focus; and an update is due on the state of the European steel market.

—Watch and share this video from S&P Global Platts

OPEC+ cuts deeper in June on pressure to boost oil market recovery: Platts survey

OPEC slashed its crude output in June to a three-decade low, according to an S&P Global Platts survey, as the bloc and its allies, including Russia, continued their campaign to tighten the oil market in its emergence from the depths of the coronavirus crisis. OPEC's 13 members pumped 22.31 million b/d, the organization's lowest collective output since September 1990, when the launch of the first Gulf War nearly wiped out crude oil production in Iraq and Kuwait, the survey found.

—Read the full article from S&P Global Platts

Analysis: India delaying flight restart to weigh on jet fuel demand

India has deferred the resumption of international commercial flights until July 31 from its previous announcement of July 15 while also curtailing some domestic flights, marring the prospects of an aviation recovery in the world's second most populous country, and a major jet fuel consumer and exporter. The delay comes at a time when the coronavirus pandemic has severely restricted movement of people globally, including for air travel, and slowed down economies, bringing some to a grinding halt.

—Read the full article from S&P Global Platts

US 2020 coal production expected to fall 28.9% on year to 57-year low: EIA

The US is estimated to produce 501.3 million st of coal in 2020, the US Energy Information Administration said July 7, lowering its estimate from a month ago by 28.7 million st, or 5.4%. The 2020 production would be 28.9% lower than the 705.3 million st produced in 2019, while 2021 production is estimated at 535.9 million st, the EIA said in its July Short-Term Energy Outlook. The 501.3 million st expected in 2020 would be the lowest production since 477.2 million st was produced in 1963.

—Read the full article from S&P Global Platts

NYMEX prompt natural gas hits two-month high as force majeure cuts Appalachian production

NYMEX Henry Hub prompt-month prices surged to a two-month high in July 7 trading after a force majeure on Columbia Gas' Mountaineer XPress Pipeline cut Appalachian gas production by over 2.2 Bcf/d, amid no announced timeline for a return to service on the impacted segment. After trading into the low $1.90s, the August contract settled July 7 at $1.88/MMBtu – up more than 20 cents since the start of the month to its highest closing price since early May. In the cash market, Henry Hub gas rose about 4 cents on the day to $1.74/MMBtu, preliminary settlement data from S&P Global Platts showed.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language