Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 28 Jul, 2020

By S&P Global

With more than 16 million COVID-19 confirmed cases worldwide and more than 650,000 reported COVID-19 deaths, the pandemic continues to ravage economies and upend social norms. The World Bank’s baseline economic forecast sees a 5.2% contraction in global GDP this year.

“These downturns are expected to reverse years of progress toward development goals and tip tens of millions of people back into extreme poverty,” The World Bank wrote in early June.

Talk of multiple waves of infections has added to the uncertain outlook, as observers try to determine whether individual countries are on their first or second waves of the outbreak.

Dr. Lisa Maragakis, a specialist in infectious disease at Johns Hopkins Medicine, doesn’t believe the U.S. has entered a second wave.

“We’re still in the first wave,” she said. “In some sense, the spread of the coronavirus so far has been more like a patchwork quilt than a wave. The COVID-19 pandemic in the U.S. is affecting different areas throughout the country in different ways at different times.”

No official definition of pandemic waves exist. A wave is generally considered to be a peak in infections followed by a substantial reduction—meaning that a second wave requires a new peak to form. However, since the coronavirus spreads at the community level rather than the national level, country- or even state-level data is unhelpful in trying to track a second wave. Previous epicenters such as New York City, Milan, and Wuhan haven’t yet shown signs of a subsequent rise in cases.

China recorded 61 new cases on Monday, its biggest daily gain since April, resulting in renewed restrictions on activity in Hong Kong. The country has seen isolated spikes based on super-spreader events in the past two months and has moved aggressively to control them.

Discussion of a second wave comes in part from the historical experience of the 1918 global influenza epidemic. In that case, the first wave of infections wasn’t very deadly. Some experts believe that the virus that caused the 1918 epidemic may have become more deadly through mutations, leading to second and third waves in 1918-1919, and with far higher mortality. The coronavirus appears to be more stable and less prone to mutation than the influenza virus.

The lesson of the century-old influenza epidemic may come from that virus’s third wave, which occurred after social-distancing restrictions were relaxed and the global death was in the millions.

The upcoming flu season presents the most immediate danger for a second wave. According to Marc Lipsitch, an epidemiologist at Harvard University speaking recently to Scientific American, “the worst-case scenario is both [the coronavirus and the flu] are spreading fast and causing severe disease, complicating diagnoses and presenting a double burden on the health care system.”

Today is Tuesday, July 28, 2020, and here is today’s essential intelligence.

Listen: Biden victory could yield some opportunities for oil, gas sector

A massive regulatory shift could occur if US President Donald Trump loses the White House in November. Former Vice President Joe Biden has embraced energy and climate priorities that swing further left than many of the Obama administration's, as evidenced by his recently announced four-year, $2 trillion climate plan focused on clean energy infrastructure and jobs. Ellie Potter of S&P Global Market Intelligence spoke with David Livingston, senior analyst at the Eurasia Group, to help us understand the potential shift that is in store. He said that while some regulatory changes could burden companies, Biden's proposals could also offer opportunities for the sector.

—Listen and subscribe to the podcast from S&P Global Platts

Watch: Market Movers Europe, Jul 27-31: Gold price hits new highs; OPEC+ countries plan to dial back cuts

In this week's highlights: Gold continues to be a safe haven for investors; the energy and metals markets will track results from key companies; the OPEC+ oil producer pact is set to dial back its production cuts; and European sugar beet gets a health check.

—Watch the video from S&P Global Platts

How Factors Behaved Differently in the Australian Market in the First Half of 2020

In S&P Global Dow Jones Indices’ paper “How Smart Beta Strategies Work in the Australian Market,” S&P Global Dow Jones Indices examined the long-term performance characteristics of S&P DJI’s Australian factor indices in different market trends. In the first half of 2020, the Australian equities market had a roller coaster response to the coronavirus outbreak, global market crash, and government stimulus packages. While most of the factor indices behaved similarly to their long-term performance characteristics, some did not. In this blog S&P Global Dow Jones Indices divided the first six months of 2020 into three time periods based on the varying price trends of the S&P/ASX 200 and reviewed how the Australian factor indices reacted in each of these different periods with the decomposition of their returns based on factor attributions for periods.

—Read the full article from S&P Dow Jones Indices

Observing a Regime Change

In politics, “regime change” denotes the replacement of one governmental structure with another; in economics, S&P Global Dow Jones Indices uses the same term to indicate a shift in the interactions of various parts of the economic or financial system. Political regime changes are easy to identify (after all, a military coup is hard to miss). Defining when an economic regime change has occurred can be more difficult. One way to do it is to observe the interaction of sector and factor indices.

—Read the full Report from S&P Global Dow Jones Indices

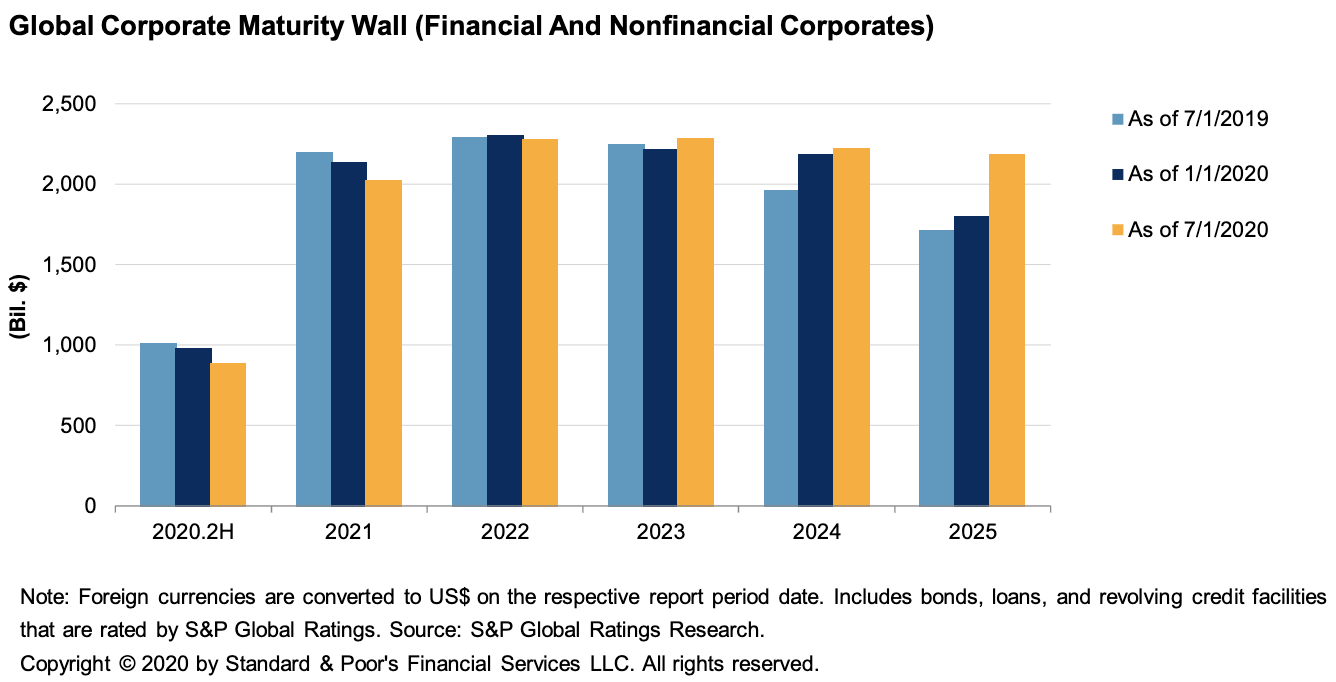

Credit Trends: Global Refinancing--Rated Corporate Debt Due Through 2025 Nears $12 Trillion

S&P Global Ratings rates $11.86 trillion in corporate debt (including bonds, loans, and revolving credit facilities) that is set to mature globally from July 1, 2020, through Dec. 31, 2025. The amount of debt maturing over this period has risen by 2.3% year-to-date. After record volumes of debt issuance in the first half of 2020, companies have paid down, refinanced, or otherwise reduced about 4% of the debt that was scheduled to mature through 2022. This helped to push back the year when maturities reach their peak to 2023 (with $2.28 trillion maturing), from 2022 (when $2.30 trillion was scheduled to mature).

—Read the full Article from S&P Global Ratings

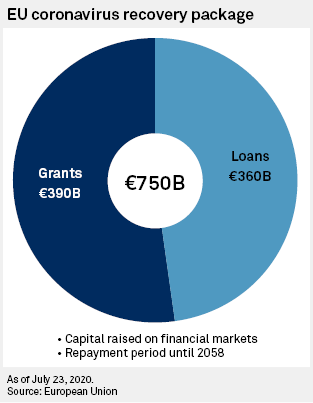

As €750B package creates safe asset, EU banking union inches closer

The European Union's €750 billion coronavirus rescue package has been hailed as a big step toward a full-blown "banking union," but major obstacles remain. The EU unveiled its plan to kick-start the bloc's economy in the wake of the pandemic on July 21, marking the first time that the European Commission would issue its own bonds on a significant scale. It plans to raise €750 billion over two years in long-term debt, so establishing a federal deficit for the EU for the first time. It creates a contingent liability for the 27 member countries based on member states' guarantees and in line with their share of the total gross national income of the union.

—Read the full article from S&P Global Market Intelligence

EMEA Financial Institutions Monitor 3Q2020: Low Profitability Lingers On

S&P Global Ratings considers that weaker asset quality and revenue pressure due to the combined effects of the COVID-19 pandemic and the low oil price challenge the profitability of many financial institutions operating in Europe, the Middle East, and Africa (EMEA). Supported by various stimulus measures, European economies have started to reopen since the first wave of the pandemic appears to have passed its peak. It is too early to gauge the full severity of the recession and the associated costs as the virus has not disappeared and the exact shape of the recovery remains unclear. However, the fiscal and monetary policy responses--including a recently agreed €750 billion support package aimed at funding post-pandemic economic-relief measures across the EU--have been immediate and robust, improving financing conditions and reducing liquidity risks for many companies and households. These measures have also supported bank borrowers' performance in the second quarter of 2020.

—Read the full report from S&P Global Ratings

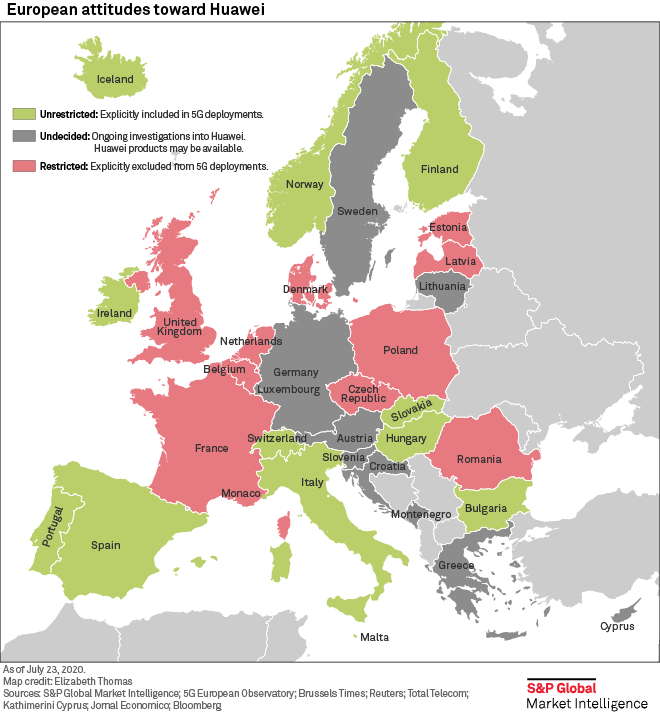

Europe lacks unified approach to Huawei despite yearlong assessments

Over a year since the European Commission instructed countries in the region to review and strengthen the security of their mobile networks, data compiled by S&P Global Market Intelligence shows a patchwork of approaches. Amid calls from the U.S. for countries to ban Chinese telecoms equipment supplier Huawei Technologies Co. Ltd., the EC issued a non-binding recommendation March 26, 2019, for member states to "take concrete actions to assess cybersecurity risks of 5G networks and to strengthen risk mitigation measures." Since then, the EU has created a "toolbox" for 5G security, aimed at ensuring a "coordinated approach" to next-generation wireless network rollouts.

—Read the full article from S&P Global Market Intelligence

Amazon shares could reach new highs if Q2 revenue jumps – experts

Amazon.com Inc.'s already sky-high share price could rise even higher if the company delivers on expectations that its second-quarter revenue will surge on coronavirus-induced online shopping and a recent boom in cloud computing, experts say. Any further momentum would underscore the growth of Amazon, which has emerged as a beneficiary of the pandemic that has hit the retail sector hard, forcing store closures and contributing to a spike in retail bankruptcies. Amazon reports its second-quarter earnings on July 30.

—Read the full article from S&P Global Market Intelligence

UAE to build Gulf's first waste-to-solar project amid clean energy push

The UAE's emirate of Sharjah, the third biggest in the seven-member federation, plans to build the Gulf's first waste-to-solar energy facility amid a push to produce at least 44% of the country's power from clean energy by 2050. Sharjah-based Bee'ah, a waste management and renewable energy company, will transform 47 ha of a landfill area into a solar energy facility once the landfill is capped, it said July 27 in a statement. The project will generate more than 42 MW of power a year from waste in a landfill and from the sun once it is complete.

—Read the full article from S&P Global Platts

UK net zero needs 'immediate action' across technology, policy, behavior: Grid

The UK will need over 11 million electric vehicles by 2030 and 30 million by 2040 to achieve net zero greenhouse gas emissions by 2050, according to National Grid's latest future energy scenarios published July 27. Under an ambitious Leading the Way scenario, by 2050 up to 80% of households with an EV will be "smart charging" their car outside of the evening peak period, while 45% of homes would actively help balance the grid via vehicle-to-grid technology, offering up to 38 GW of flexible electricity, the transmission system operator said.

—Read the full article from S&P Global Platts

Commodity Tracker: 5 charts to watch this week

The relentless rise of gold prices is in focus this week in S&P Global Platts editors’ roundup of energy and raw materials trends. Plus, freight rates react to Brent’s slight recovery, coal generation in Germany fizzles out, and more.

—Read the full article from S&P Global Platts

China becomes net steel importer first time in 11 years in June

China became a net importer of steel for the first time in 11 years in June, despite record daily crude steel production during the month. This indicates the extent of China's stimulus-fueled economic recovery, which has supported rising domestic steel prices, while other markets are still recovering from the impact of the coronavirus pandemic.

—Read the full article from S&P Global Platts

Gold hits all-time high, eyes $2,000/oz

The gold price has hit an all-time high and is now eying $2,000/oz as the world contends with a growing number of coronavirus cases and ballooning government debt worldwide, causing demand from physically backed exchange traded funds to soar. "Gold roared out of the gates this morning, opening more or less where we closed and sharply ripping to $1,910/oz" analysts at precious metal refiner MKS PAMP said July 27.

—Read the full article from S&P Global Platts

'Flat is the new up': Investors will forgive low shale gas volumes, prices in Q2

Investor expectations for the second-quarter earnings in the pure-play shale gas sector are muted, with analysts looking for signs of spending discipline and free cash flow generation rather than production growth. "We now believe flat is the new up," Stifel Nicolaus & Co.'s E&P, or exploration and production, team told clients July 19. "Regarding capital discipline and Q2 2020 sector messaging, we expect management teams to pivot further away from growth and towards returns as the sector prepares for a lower-for-longer environment."

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Location

Language