Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 7 Jan, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Thousands of supporters of President Donald Trump stormed the U.S. Capitol in Washington, D.C., yesterday—forcing legislators gathered for the formal certification of President-elect Joe Biden's victory to adjourn. Lawmakers including Vice President Mike Pence, alongside Congressional leaders and staffers, were evacuated and placed on lockdown as rioters breached the Capitol complex, chamber floors, and legislative offices. Washington Mayor Muriel Bowser declared a citywide curfew starting at 6 p.m. Wednesday and lasting for 15 days through 6 a.m. Thursday, Jan. 15, as National Guard troops from the region, members of the Federal Bureau of Investigation, and local police clashed with the mob.

The chaos erupted around 2:15 p.m., hours after President Trump told supporters that “we will never give up, we will never concede” in a speech repeating falsehoods that the presidential election was rigged against him. During the speech, President Trump said he would join his followers and “walk down Pennsylvania Avenue” and “walk down to the Capitol” to go “cheer on our brave Senators and Congressmen and women. And we're probably not going to be cheering, so much for some of them, because you'll never take back our country with weakness, you have to show strength and you have to be strong.” He then returned to the White House while his supporters ultimately marched to the building, knocked over a barricade on its western side, and charged in shouting obscenities. Inside, the mob broke windows and pilfered offices and the chambers. Hours later, by nightfall, the Capitol was finally secured.

A joint session of the Senate and House was underway debating the certification of President-elect Biden’s election win. This quadrennial process of certifying Electoral College votes is a pro forma Constitutional procedure of the peaceful transition of power. Before the rioting halted the certification, both Vice President Pence and Senate Majority Leader Mitch McConnell rebuked the efforts to reject the election results.

The Capitol Police were unable to control the mob. Some police officers were documented taking photos with rioters, and many appeared to allow them to leave the Capitol freely despite their having trespassed on and damaged federal property, attacked authorities, and endangered lives. Few arrests appear to have been made, in stark contrast to the uses of force by police against protesters over the summer during the civil unrest against racial injustice.

At approximately 2:40 p.m., President Trump addressed the situation. “Please support our Capitol Police and Law Enforcement. They are truly on the side of our Country. Stay peaceful!” he wrote on Twitter without condemning the violence. Later, at nearly 3:15 p.m., he added: “I am asking for everyone at the U.S. Capitol to remain peaceful. No violence! Remember, WE are the Party of Law & Order – respect the Law and our great men and women in Blue. Thank you!”

U.S. lawmakers, the president’s own aides, industry leaders, and policymakers around the world took a different tone by admonishing the violence throughout the afternoon and into the evening.

Former White House Chief Of Staff Mick Mulvaney urged his former boss to act. "The President's tweet is not enough. He can stop this now and needs to do exactly that. Tell these folks to go home," he said on Twitter.

Former President George W. Bush and Arizona Republican Sen. Mitt Romney, a former presidential candidate, described the pro-Trump mob and its actions as “insurrection.” Former President Barack Obama characterized the events as “a moment of great dishonor and shame for our nation” and added that “we’d be kidding ourselves if we treated it as a total surprise.”

“This is a coup attempt,” Illinois Republican Rep. Adam Kinzinger tweeted in the early afternoon.

“There is nothing patriotic about what is occurring on Capitol Hill,” Sen. Marco Rubio, a Florida Republican, said on Twitter. “This is 3rd world style anti-American anarchy.”

“I don’t recognize our country today and the members of Congress who have supported this anarchy do not deserve to represent their fellow Americans,” Democratic Virginian Rep. Elaine Luria shared.

The U.S. National Association of Manufacturers described the scene as “disgusting,” “mob rule,” and “sedition,” and called for Vice President Pence to “seriously consider working with the Cabinet to invoke the 25th Amendment to preserve democracy.” The organization hosted President Trump’s daughter and advisor Ivanka Trump as a keynote speaker for an association event in 2020.

“This is not the vision of America that manufacturers believe in and work so hard to defend,” the organization’s president and CEO, Jay Timmons, who leads the association that represents manufacturers in all industrial sectors across every state in the nation, said in a statement. “We are trying to rebuild and economy and save and rebuild lives. But none that will matter if our leaders refuse to fend off this attack on America and our democracy—because our very system of government, which underpins our very way of life, will crumble.”

The Business Roundtable, an organization that represents the chief executive officers of America’s largest companies, said in a statement that “the chaos unfolding in the nation’s capital is the result of unlawful efforts to overturn the legitimate results of a democratic election. The country deserves better.” The BRT called for President Trump and government officials “to put an end to the chaos and to facilitate the peaceful transition of power.”

In separate statements, BRT members Jamie Dimon, the Chairman and CEO of JPMorgan Chase; Steve Schwarzman, the co-founder, Chairman, and CEO of Blackstone; Mary Barra, the Chairwoman and CEO of General Motors; and others called for an end to the violence, condemned the situation, and expressed support for the peaceful transition of power.

“I am deeply troubled by the events we saw unfold at the U.S. Capitol in an attempt to thwart the democratic process that has defined our nation since its founding. I am confident that the Constitutionally-mandated process to certify the election will continue and that our country will move forward together,” S&P Global CEO Doug Peterson, who is a member of the BRT, said in a statement on the evening of Jan. 6. “We must begin the process of healing, unite in the common goal of addressing division in our society, and restore civility.”

U.K. Prime Minister Boris Johnson, an ally of President Trump, described the scenes as “disgraceful” and heralded the democratic process. He wrote on Twitter that “the United States stands for democracy around the world and it is now vital that there should be a peaceful and orderly transfer of power.

Notably, countries typically scorned by the U.S. for their own insurgencies weighed in. “Venezuela condemns the polarization and spiral of violence that only reflects the profound crisis that the political and social system of the United States is currently experiencing,” the government of the Latin American nation said in a statement. “With this regrettable episode, the United States is suffering exactly what it has generated in other countries with their policies of aggression.”

“At this hour, our democracy is under unprecedented assault unlike anything we’re seen in modern times,” President-elect Biden said, addressing the nation at approximately 4:10 p.m., roughly two hours after the rioting began. “Let me be very clear: the scenes of chaos at the Capitol do not reflect a true America, they do not represent who we are. What we’re seeing is a small number of extremists dedicated to lawlessness. This is not dissent; it’s disorder, it’s chaos, it borders on sedition, and it must end now.”

“The words of a president matter,” President-elect Biden said. “At their best the words of a president can inspire. At their worst, they can incite. Therefore, I call on President Trump to go on national television now to fulfill his oath and defend the Constitution and demand an end to this siege.”

By 4:30 p.m., President Trump released a video recorded in the White House Rose Garden repeating the falsehood that the election was “stolen.” In the one-minute-long video, he told the mob that “we love you, you’re very special” and then urged his supporters to “go home.”

Twitter and Facebook later locked President Trump’s account on their platforms for 12 and 24 hours respectively due to their beliefs that his statements could contribute to additional violence and violated their policies.

House Speaker Nancy Pelosi (D-California) said in a letter to colleagues that the attack wouldn’t “deter us from our responsibility to validate the election of Joe Biden” and that “we now will be part of history, as such a shameful picture of our country was put out to the world, instigated at the highest level.”

Congress reconvened in the Capitol around 8 p.m. to continue the certification vote, which lasted into the night. “To those who wreaked havoc in our Capitol today, you did not win,” Vice President Pence said.

The dark day for American democracy overshadowed what would’ve already been a historic day in Washington. Democrat Raphael Warnock defeated Republican Sen. Kelly Loeffler and Democrat Jon Ossoff was victorious over Republican Sen. David Perdue, flipping Georgia’s upper chamber representation blue and delivering Democrats an effective majority, with Vice President-elect Kamala Harris holding the deciding vote in a 50-50 split. The election wins boosted financial stocks and benchmark equities indexes.

The Democrats’ blue sweep is likely to create momentum to tackle net neutrality and create greater opportunities for a climate-focused energy agenda. Still, President-elect Biden and the small advantage in the U.S. Senate and narrow majority in the House of Representatives may face legislative challenges in securing ambitious progressive climate legislation and passing additional economic stimulus to help lift the U.S. economy out of the coronavirus-caused economic downturn.

Today is Thursday, January 7, 2021, and here is today’s essential intelligence.

Outlook For U.S. Local Governments: Revenue Pressures Mount And Choices Get Harder

S&P Global Ratings’ view of the sector remains negative given the level of pressures brought by COVID-19 and the recession. While most credits are expected to experience only slight, if any, deterioration in 2021 and beyond, in the current environment S&P Global Ratings still expects downgrades to outpace upgrades.

—Read the full report from S&P Global Ratings

Here's What The U.S. Media And Entertainment Sector Has In Store For 2021

As we step into the new year, U.S. media and entertainment companies can begin to look forward to recovering from the pandemic and its fallout. Some segments of the industry survived the initial disruption better than others by revising business models, renegotiating contracts and relationships, cutting spending, using debt proceeds, and quickly adjusting to changing consumer behaviors. However, some went into the pandemic with high leverage or deficient liquidity, already testing rating boundaries and their credit quality. How companies used and will use debt proceeds will largely influence S&P Global Ratings’ outlook assessments and rating decisions.

—Read the full report from S&P Global Ratings

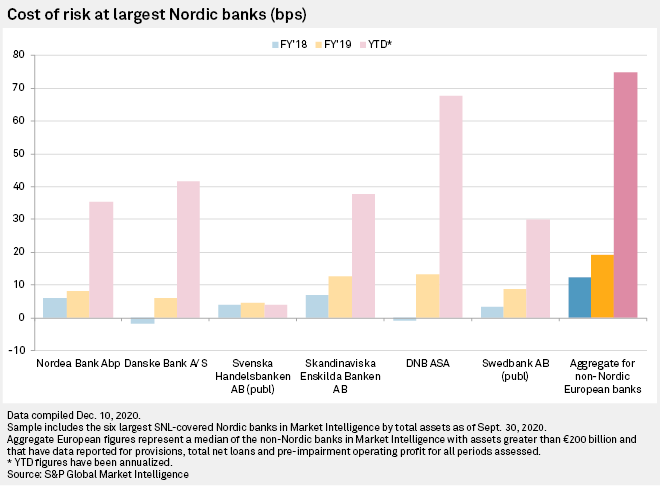

Nordic Banks Face Higher Loan Losses In 2021, With Some Exposures Vulnerable

Large Nordic banks have recorded significantly lower loan loss provisions than European peers during the pandemic, but there are risk factors that could end this track record this year, according to analysts.

—Read the full article from S&P Global Market Intelligence

As Rules Diverge, Scandinavian Banks Could Pay Dividends Far Higher Than ECB Cap

Scandinavian regulators' divergence from the European Central Bank's dividend policy could allow for lenders in Sweden, Norway and Denmark to pay out more generous dividends than their eurozone peers.

—Read the full article from S&P Global Market Intelligence

Big Tech Rather Than Banks To Drive Fintech M&A In 2021, With Payments Key

Banks will still have the appetite for financial technology M&A in 2021, but the economic uncertainty created by the coronavirus pandemic will make them more cautious in their dealmaking, analysts said.

—Read the full article from S&P Global Market Intelligence

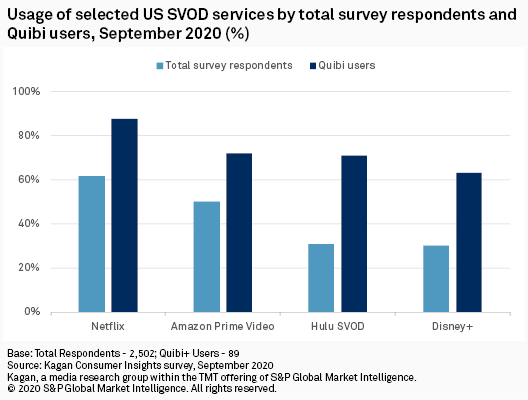

Quibi's $2 Billion Bet On Mobile Video Fizzles Out

Quibi's bold bet to take a quick bite out of the subscription video market quickly fizzled out as the service lasted less than a year before going dark in December 2020. The company raised about $1.75 billion in venture capital funding and presold its first year of advertising for a reported $150 million, but that war chest of roughly $2 billion proved to be too little to crack the hypercompetitive U.S. subscription video-on-demand arena.

—Read the full article from S&P Global Market Intelligence

Cable Nets Struggle With Cash Flow Declines Due To Cord Cutting, Pandemic

Cash flow margins for cable networks are not expected to contract significantly — to 37.4% in 2020 from 38.0% in 2019 — in large part because contracting ad revenue and flat-to-shrinking affiliate fees have been offset by reductions in selling, general and administrative as well as programming costs.

—Read the full article from S&P Global Market Intelligence

Apple To Face Continued Pressure To Curb Reliance On China Under Biden – Experts

Though 2021 brings a new U.S. president with a fresh agenda, analysts and industry experts expect companies like Apple Inc. to still face pressure to diversify production out of China.

—Read the full article from S&P Global Market Intelligence

The ESG Trends That Will Drive 2021

Environmental, social and governance investing gained huge momentum in 2020 and appears poised to continue growing in 2021. Experts from across the sustainability world explain the trends that will drive ESG in the latest episode of ESG Insider, an S&P Global podcast.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Market Intelligence

Desert Pipeline Tests Colorado River's Future

West of Lake Powell, along the Utah-Arizona border, lies a sparsely populated territory of high desert, deeply scored canyons and barren mesas. Here, Utah officials want to build a 140-mile-long pipeline to bring precious Colorado River water west to the thriving town of St. George, in the state's far southwestern corner.

—Read the full article from S&P Global Market Intelligence

Washington State Proposes Legislation To Phase Out Natural Gas Utility Service

Legislation developed by Washington Gov. Jay Inslee's office could substantially reduce — and potentially eliminate — natural gas utilities' role in delivering energy to many state ratepayers over the next 30 years.

—Read the full article from S&P Global Market Intelligence

China To Launch National Carbon Emissions Trading Scheme On Feb 1

China will launch a national carbon emissions trading scheme Feb. 1 as part of efforts to meet a 2060 carbon neutrality target by developing market mechanisms, according to the trial rules for the scheme released Jan. 5 by the Ministry of Ecology and Environment.

—Read the full article from S&P Global Platts

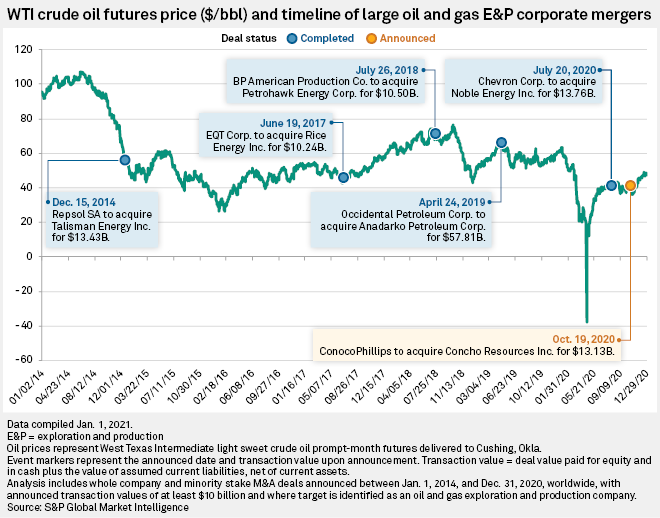

A Superlative Second Half Saves 2020 From Being A Slow Year For E&P M&A

An epic oil price collapse preceded a wave of M&A transactions in the second half of 2020 that included some of the largest in recent memory, which saved what had been an unusually slow year for M&A among global oil and gas producers.

—Read the full article from S&P Global Market Intelligence

Saudi Arabia Announces Unilateral Output Cut, Surprises Market, OPEC+

Saudi Arabia delivered what Russian Deputy Prime Minister Alexander Novak called "a New Year's gift" to the oil market with its surprise announcement that it will cut oil production by an extra 1 million barrels per day, blowing away expectations that the OPEC+ alliance would maintain its collective output ceiling.

—Read the full article from S&P Global Market Intelligence

US Crude Inventories Move Sharply Lower Amid Strong Exports, Rising Refinery Utilization

US crude oil inventories saw their largest decline since August in the week ended Jan. 1 on the back of strong exports and rising refinery demand, US Energy Information Administration data showed Jan. 6.

—Read the full article from S&P Global Platts

Listen: What’s In Store For Rice Supply And Demand In The Americas Going Into 2021

2020 was an unusual year for the global rice market. While much of the coverage focused on Asian markets, the Americas dealt with major production swings, huge influxes in demand and the resulting price volatility. In the latest Platts Agriculture Focus podcast, Peter Storey is joined by Raymond Shi and William Bland to discuss supply issues and harvesting in South America, demand for rice from the US South, in addition to a possible influx of Central American and Iraqi demand for Americas rice in Q1 2021.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language