Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 24 Jan, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Stuck in the Middle With Singapore

Singapore’s position in global markets can be a blessing and a curse. With the easing of pandemic restrictions in China, Singapore stands to benefit significantly from pent-up demand. But Singapore’s export-driven economy has also been buffeted by geopolitical tensions and supply chain woes. When Washington or Beijing sneezes, Singapore gets a cold.

According to S&P Global Market Intelligence, Singapore’s economy grew by 3.8% in 2022, in part due to the easing of pandemic-related restrictions. Manufacturing and the service sector experienced some headwinds later in the year due to weak demand for global electronics and inflationary pressures. Next year, growth is projected to be lower in Singapore, due to tepid growth in the EU and the U.S. However, the biomedical and aerospace engineering sectors should be bright spots for future growth.

Louis Kuijs, chief economist for Asia-Pacific at S&P Global Ratings, wrote in late November 2022 that he projected tepid gross domestic product growth of 2.3% for Singapore in 2023, despite lower projected inflation of 3.8%. Kuijs further suggested that anticipated growth in China in 2023 should help export-dependent economies like Singapore, moderating the impact of a global slowdown.

Singapore’s three major banks are experiencing the same headwinds seen across Asia – an uptick in bad loans and slow loan growth. M&A activity in Singapore has been weak, reflecting the global trend of fewer deals. Singapore’s thriving technology scene will be challenged in 2023 as funding becomes harder to come by and investors place a greater emphasis on profitability. Standouts, like Singapore’s Grab Holdings and Sea, are working to preserve working capital and become cash flow-positive.

The Singapore Strait accommodates a huge amount of marine traffic due to its export-led economy. According to S&P Global Commodity Insights, there are about 1,000 ships anchored at Singapore at any given time, with a ship entering the port every 2-3 minutes. In 2022, sea robbery and piracy-related incidents in the Singapore Strait hit a seven-year high. While the number of incidents of piracy is still low compared with total volume, rates of insurance for ocean-going freight may increase if the trend continues.

Singapore’s economic outlook for 2023 will be largely determined by the economies of China, Europe and the U.S. A recession in any of those regions will necessarily impact an export-driven economy like Singapore. Further geopolitical conflict or even talk of decoupling will exacerbate these issues.

Today is Tuesday, January 24, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

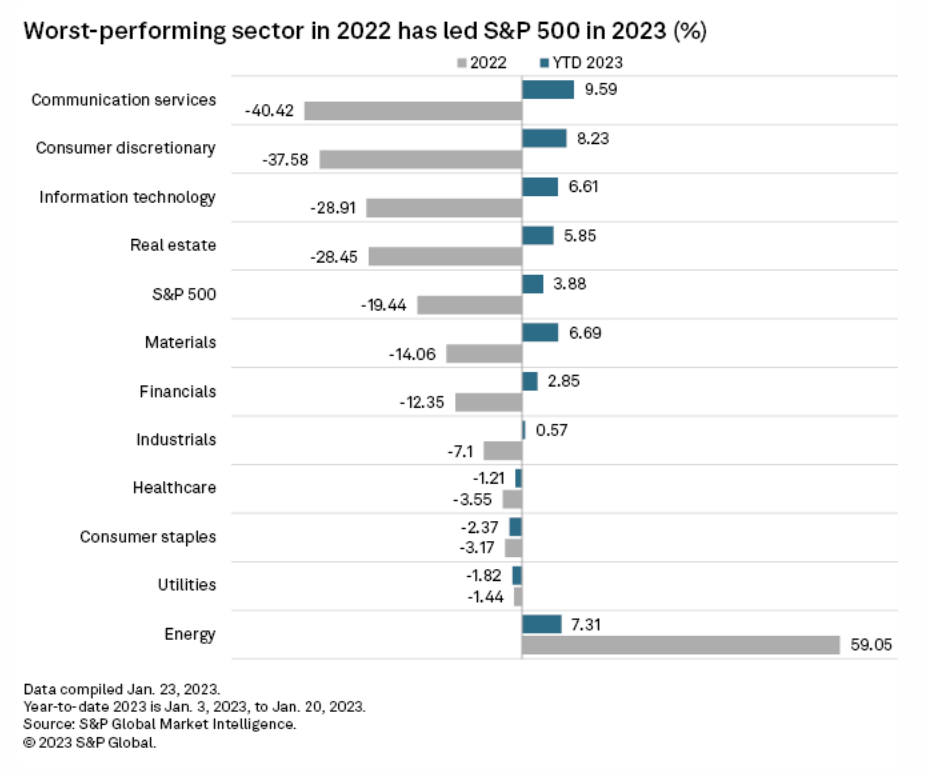

S&P 500's Worst-Performing Sector In 2022 Shows Signs Of Life

The S&P 500's worst-performing sector in 2022 has led a rally in 2023 as investors bet on an early rebound in U.S. equities. The S&P 500 communication services sector, which fell by more than 40.4% in 2022, has risen by about 9.6% so far in 2023, the best-performing sector in the large-cap index over the first three weeks of the year.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

French Banks Face Further Income Squeeze As Regulated Savings Rate Rises Again

France's largest banks face added pressure on their income following a government decision to increase the rate on the popular Livret A regulated savings scheme by 100 basis points to 3%. The latest hike to the rate, announced Jan. 13 and which takes effect Feb. 1, means deposit costs on Livret A accounts have increased by 250 bps for French banks since February 2022. The Livret A rate also provides a benchmark for rates on other popular regulated savings products in France, representing hundreds of billions of euros in additional deposits.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

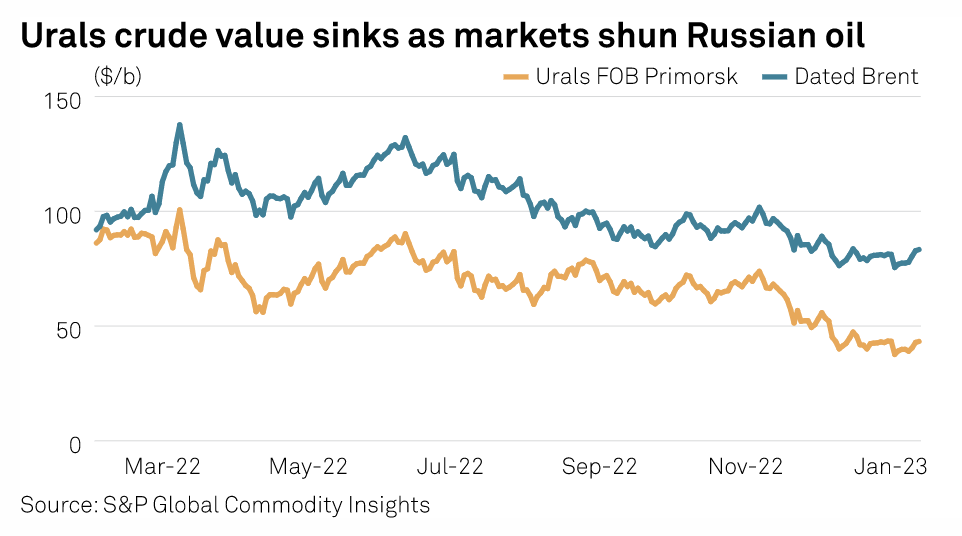

Market Watchers Expect U.S. To Back Little Change To Russian Oil Price Cap During Review

An expected review of the price cap on Russian crude has renewed calls by some countries for a lower price threshold to ratchet up pressure on Russia as it continues its invasion of Ukraine, but energy analysts expect the U.S. to push for maintaining the status quo as the cap is still in its early days. A cap of $60/b was imposed on seaborne Russia-origin crude oil Dec. 5, as EU prohibitions on ships and other maritime services needed to transport that crude took effect. Crude shipments loaded before the cap went into place were given a grace period to unload by Jan. 19 without impunity if the oil onboard was purchased above the price cap.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: How The Price Tag On US Climate-Related Disasters Hit $165 Billion In 2022

In 2022, the world experienced major climate-related disasters ranging from flooding and hurricanes to drought and extreme heatwaves. Moreover, 2022 was the sixth-warmest year on record, according to scientists at the U.S. National Oceanic and Atmospheric Administration, or NOAA. NOAA just issued its annual report on climate trends in the U.S. for 2022, which includes a review of the major climate-driven weather events that each cost at least $1 billion. NOAA reported 18 separate billion-dollar weather events that collectively cost more than $165 billion — the third-highest tally since 1980 — and resulted in hundreds of deaths.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

Listen: What The FERC Is Going On With Gas Policy And Regulations?

The Federal Energy Regulatory Commission is starting the new year with a 2-2 partisan split after former Chairman Richard Glick was forced to bid adieu to the agency after his renomination stalled out. The divide could complicate action on some of the thornier issues before the agency, and there is a risk of 2-2 deadlocked votes that could stall project authorizations. S&P Global senior editor Maya Weber joined the podcast to break down what's happening at FERC and what its agenda could mean for natural gas producers and other stakeholders. She also shed light on climate actions being pursued by the Biden administration that could impact the gas sector and provided some clarity on whether President Joe Biden is really trying to ban gas stoves.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

Netflix Sees Advertising Business Generating 10% Of Total Revenue As It Matures

Although it is still early days, Netflix Inc. executives predicted the company's new advertising-supported product could contribute 10% or more of the streaming leader's revenue base over time. Speaking on the company's Jan. 19 earnings call, CFO Spencer Neumann said Netflix would not have entered the ad arena "if it couldn't be a meaningful portion of our business," which the executive defined as at least 10% of revenue. Netflix reported $31.62 billion in total revenue for 2022.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >

CERAWeek by S&P Global — Navigating A Turbulent World: Energy, Climate and Security

Join global leaders, policymakers and executives from across energy, climate, finance, technology and industry at CERAWeek 2023 for timely dialogue, shared learning and connection.

—Register for CERAWeek