Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 19 Jan, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Over the course of 2020, the price of Bitcoin skyrocketed more than 300%. Earlier this month, the digital currency soared to an all-time high of nearly $42,000—pushing its market value past $1 trillion. Despite the 6% decline in the cryptocurrency's value over the seven-day period from Jan. 10 to 17—its worst fall since September, according to the cryptocurrency tracker CoinDesk—it's unclear whether this marks the end of Bitcoin’s bull market.

What is evident is that cryptocurrencies, once considered an alternative trend, have become mainstream. Blockchain technology is beginning to democratize global energy trading. Latin American banks are taking advantage of the recent boom. Even central banks around the world are exploring the creation of their own digital currencies.

S&P Dow Jones Indices will this year begin offering global cryptocurrency asset index capabilities, publishing the price movements of different cryptocurrencies through its partnership with Lukka, a leading New York-based crypto-asset software and data company. This development points to a legitimization of the unregulated assets alongside traditional storers of value.

“With digital assets such as cryptocurrencies becoming a rapidly emerging asset class, the time is right for independent, reliable, and user-friendly benchmarks,” Peter Roffman, Global Head of Innovation and Strategy at S&P Dow Jones Indices, said in a December statement announcing the partnership.

Traditional businesses are also capitalizing on cryptocurrencies, and more are likely to join in.

Payment providers in the U.S. including PayPal, Venmo, Square, Visa, and Mastercard let their users conduct transactions with cryptocurrencies and have signaled that they want to expand such capabilities. In particular, PayPal, Visa, and Mastercard are eager to assert themselves as key players in the move toward crypto- and digital currencies, said Jordan McKee, research director at 451 Research, a division of S&P Global Market Intelligence. "They feel they need to put a stake in the ground," he told S&P Global Market Intelligence.

Although cryptocurrencies are decentralized and beloved for their abilities to make currency widely and easily available on an international scale, geopolitical changes like Brexit may prime new locations for fintech innovation.

"While Brexit brings considerable uncertainty to the U.K. financial industry, such uncertainty is nothing new for the crypto and DeFi [decentralized finance] space. Brexit can also be an opportunity for the fintech community and policymakers to create further innovation-friendly policies and lead in DeFi and digital assets as well," Stani Kulechov, the founder and CEO of the London-based fintech Aave, which focuses on infrastructure for decentralized finance, told S&P Global Market Intelligence.

Today is Tuesday, January 19, 2021, and here is today’s essential intelligence.

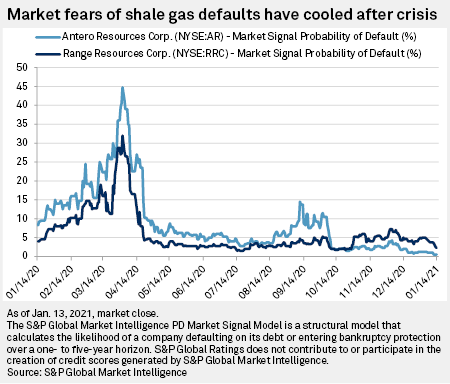

Credit Window Reopening For Shale Gas Drillers As 2021 Outlook Improves

With shale gas producers showing discipline by holding off on drilling new wells despite a tempting forward curve and investors hungry for higher yields, the credit window has reopened for gas drillers in the new year.

— Read the full article from S&P Global Market Intelligence

A 'Smoking Hole In The Ground': Blackjewel's Coal Bankruptcy Plan Raises Concern

During a recent wave of bankruptcies in the U.S. coal sector, Blackjewel LLC and its affiliates emerged as a vehicle for some of the least-wanted assets of larger producers looking to lean operations.

— Read the full article from S&P Global Market Intelligence

Leveraged Finance & CLOs Uncovered Podcast: A Deep Dive Into European Corporate Defaults

Hina and Sandeep are joined by David Gillmor, Sector Lead for Leveraged Finance, to discuss his recent publication titled “European Corporate Defaults: Owners Step Up To Mend Pandemic-Hit Capital Structures”.

—Listen and subscribe to Leveraged Finance & CLOs Uncovered, a podcast from S&P Global Ratings

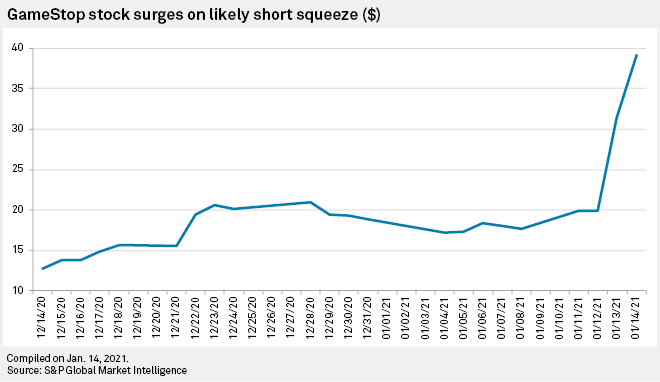

Most-Shorted S&P 500 Stock Of 2020 Surges, Putting Squeeze On Short Sellers

GameStop Corp., the most shorted company on the S&P 500 in 2020, saw its stock more than double this week, leaving investors who previously bet on the video game retailer's demise scrambling to liquidate their short positions.

— Read the full article from S&P Global Market Intelligence

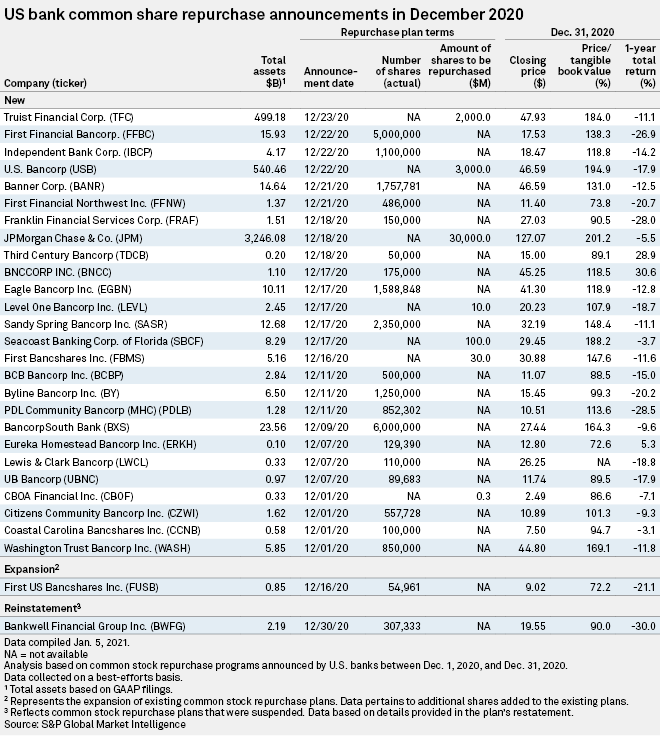

Big Banks Restart Buybacks As Fed Gives Conditional All-Clear

The U.S. banking industry carried on with share repurchase activity in December 2020, which saw a few big banks announce new buybacks after an easing of regulatory restrictions.

— Read the full article from S&P Global Market Intelligence

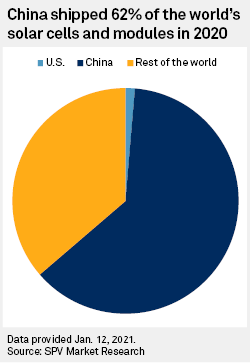

Biden Faces Uphill Climb Making U.S. A Green Manufacturing Power

SunPower Corp.'s recent decision to close its only solar manufacturing plant in the U.S. underscores the challenges President-elect Joe Biden faces as he tries to boost domestic production of clean energy technology, a cornerstone of the incoming administration's economic and climate strategy.

— Read the full article from S&P Global Market Intelligence

Chile Identifies $12 Billion In Green Hydrogen Projects

Investors are lining up projects worth up to $12 billion to tap Chile's potential to produce green hydrogen, the country's economic development agency CORFO has reported.

— Read the full article from S&P Global Platts

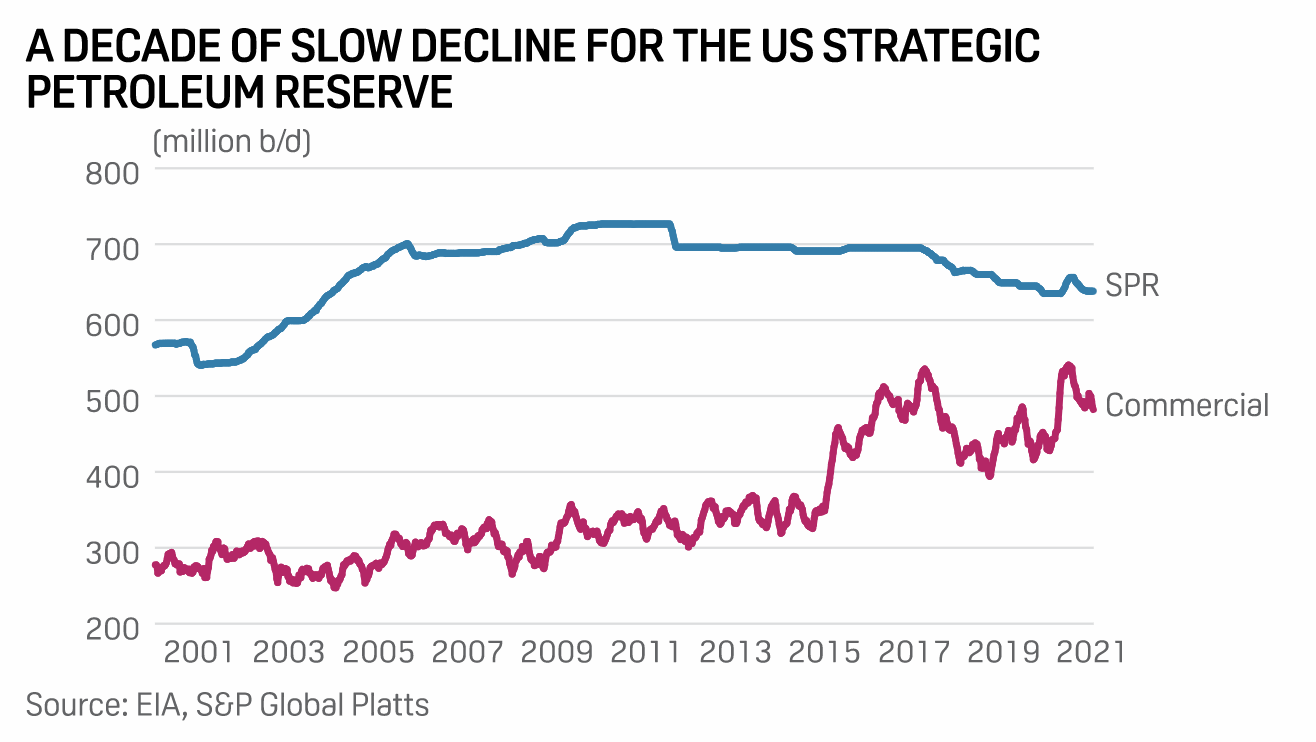

US Strategic Petroleum Reserve To Start Unloading Crude Barrels As Soon As April

A federal effort to sell roughly 20 million barrels of crude oil from the US Strategic Petroleum Reserve could begin deliveries as early as April and continue well into 2021.

— Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language