Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 25 Feb, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Changes that the pandemic has forced on people’s personal and professional lives have accelerated innovation across the global entertainment industry—but there will still be obstacles on the path to recovery.

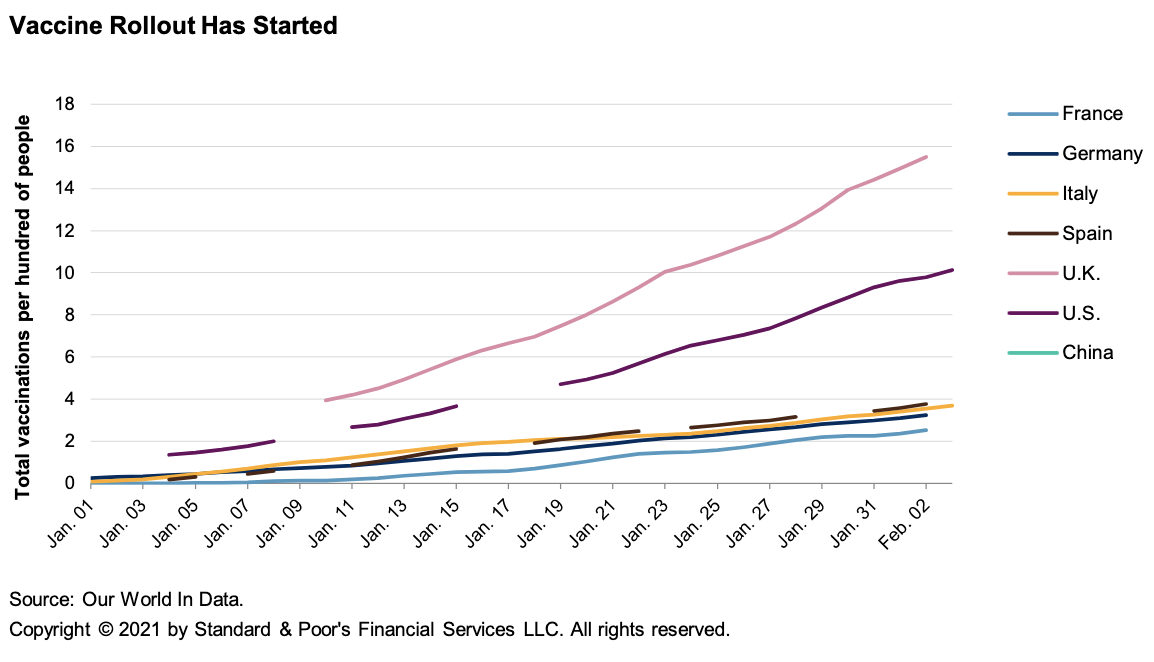

Outlooks show an uncertain picture, as some entertainment sectors may find their moment to shine while others could fall from the spotlight. Despite anticipations that coronavirus vaccines will be widely available by mid-2021, out-of-home entertainment is unlikely to recover until 2022, according to S&P Global Ratings. This year will likely bring forth increased spending on content, continued surges in online investments as subscription services become ubiquitous, and an increase in new direct-to-consumer services launching worldwide.

"I don't think we'll ever 100% go back to the way things were," Wade Holden, an analyst with Kagan, a media research group within S&P Global Market Intelligence, said. "I think we've hit an inflection point."

Shelter-in-place mandates solidified the streaming industry as a formidable force. Netflix surprised investors by adding 8.5 million net paid subscribers in the fourth quarter of 2020, which was more than its 6 million guidance and pushed its total number of global paid members to 203.7 million. The Walt Disney Co. is expected to surpass Netflix’s subscriber base, as the company has gained 146.4 million subscribers in one year versus Netflix’s 13. By 2024, analysts expect the two companies to be competitive leaders of the global streaming market and foresee other media conglomerates creating a second-tier offering of streaming services, according to S&P Global Market Intelligence.

Cable operators also enjoyed growth last year, prompted by the increased reliance on broadband that altered fundamentals for the sector. Still, cable networks’ cash flow margins are likely to shrink in the coming years as the crisis’ impacts are likely to be long-lasting, according to S&P Global Market Intelligence.

As much as the at-home entertainment market has expanded, in-person sectors have contracted. Although the Asia-Pacific region saw the number of new film releases climb 2.9% year-over-year in November, box office revenue declined 71.8% year-over-year, to $3.81 billion in the first 11 months of last year, according to data from OpusData compiled by S&P Global Market Intelligence. Latin American economies suffered an 82.2% year-over- decline to $300 million in the first 11 months of 2020 to $300 million as the region experienced a slow recovery. The U.S. experienced similarly blockbuster losses: admissions tanked by 80.7% year-over-year in 2020, to 236.9 million from nearly 1.23 billion prior to the pandemic, and total box office revenues dropped by 80.6% year-over-year in 2020, from roughly $11.23 billion in 2019 to $2.18 billion.

"The realist says if theaters come back, it may not be the same. It may just be for giant event movies," Karie Bible, an analyst at the entertainment research firm Exhibitor Relations, told S&P Global Market Intelligence. "I knew streaming was an encroaching threat. I think we all did. But if it weren't for the pandemic, I don't think we'd be having these conversations as soon as we are.”

Today is Thursday, February 25, 2021, and here is today’s essential intelligence.

As European Hotels Grapple With Prolonged Restrictions, Are Operators And Landlords Sharing The Pain?

With a negative sector outlook, the hotel and lodging industry has begun the year facing continued disruption due to the ongoing pandemic. As vaccine rollouts pick up pace, S&P Global Ratings expects that European hotel operators and landlords will recover gradually, starting from the second half of 2021, though S&P Global Ratings doesn’t expect a full recovery until 2023.

—Read the full article from S&P Global Ratings

What’s the Bottom Line: Credit Impact of COVID-19 on US Municipals

From October 2020 onwards, U.S. municipal issuers started reporting the first audited financial statements for the period ending June 30, 2020. Using S&P Global Market Intelligence’s Public Finance Automated Scoring Tool, (PFAST), S&P Global Market Intelligence analyzed the data contained in the reports from 1,548 municipal issuers to understand the impact of the pandemic on local governments. S&P Global Market Intelligence believes these are the first financial results that reflect the impact of COVID 19 on U.S. local governments.

—Read the full article from S&P Global Market Intelligence

Tech-Driven Oscar Health Sets 'Ambitious' IPO After Private Fundraising Success

Oscar Health has drawn strong funding support from private investors and will now look to garner similar support in public markets in an upcoming IPO.

—Read the full article from S&P Global Market Intelligence

Small-Cap Stocks Jump Ahead Of Larger Peers As US Limps Toward Economic Recovery

As stocks with a relatively small market capitalization have vaulted past their large-cap peers over the past three months, equity analysts see few hurdles to a continued rally for the market's smaller players on coronavirus vaccine hopes and economic recovery dreams.

—Read the full article from S&P Global Market Intelligence

U.S. Equity Valuations Increasingly 'Irrational' As Bond Yield Support Evaporates

Falling bond yields facilitated a boom in U.S. equities in the aftermath of the massive market blow from the coronavirus pandemic. But as yields rise, the expected hit to stocks has yet to materialize as experts see market valuations growing to increasingly irrational levels.

—Read the full article from S&P Global Market Intelligence

HSBC's Asia Pivot May Put It In Path Of Rivals Seeking A Share Of The Same Pie

HSBC Holdings PLC's plan to invest $6 billion to grow its top business segments in Asia, with a special focus on wealth management, will likely face the complex regional diversities across the continent that is already fiercely competitive.

—Read the full article from S&P Global Market Intelligence

ESG Hits The Mainstream For European Private Equity Sponsors

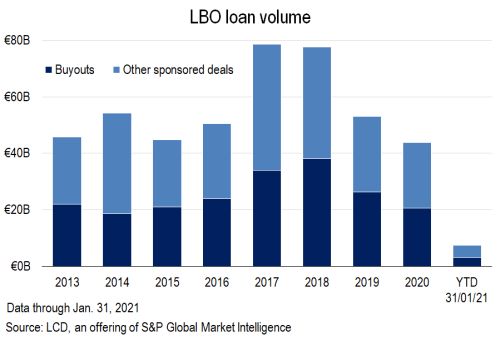

Europe's sponsored activity opened the year with a surge of new leveraged finance issuance in January, as private equity-backed borrowers hit the high-yield bond and leveraged loan markets for both new-money transactions and opportunistic deals.

—Read the full article from S&P Global Market Intelligence

EU Should Include 'Methane Performance' Standard In Emissions Legislation: Shell

The EU should include a "methane performance" standard in its upcoming legislative proposals to tackle the issue of methane emissions to ensure it only imports gas from countries with similar policies, a senior official from Shell said Feb. 24.

—Read the full article from S&P Global Platts

Out-Of-State ERCOT Board Members To Resign

In the wake of massive electric grid outages that left millions of Texans without power, four out-of-state directors currently serving on the Electric Reliability Council Of Texas Inc.'s board will resign at the end of a Feb. 24 meeting.

—Read the full article from S&P Global Market Intelligence

BP's Looney Defends Profitability Targets For Wind, Solar Push

BP remains confident that it can generate returns of 8% to 10% from its fast-growing renewable power business and has already walked away from many opportunities that fail to meet its investment criteria, BP CEO Bernard Looney said Feb. 24.

—Read the full article from S&P Global Platts

Analysis: Emerging Asia's Clean Energy Projects Limp Back To Normalcy After COVID-Stricken Year

Emerging Asia's clean energy projects are gradually crawling back to normalcy after delays caused by COVID-19-related lockdowns and movement restrictions, and as governments diverted their attention and spending towards economic relief measures and battling the virus.

—Read the full article from S&P Global Platts

Watch: Market Movers Europe, Feb 22-26: Platts London Energy Forum and IP Week at the fore

In this week's highlights: the S&P Global Platts London Energy Forum and IP week are set to dominate, ahead of the OPEC+ meeting; LNG deliveries into Europe are set to pick up; and storms in the US Gulf create uncertainty over European petrochemical imports.

—Watch and share this Market Movers video from S&P Global Platts

Oil In Floating Storage At One-Year Low As Market Strengthens

The volume of crude oil and condensate in tankers worldwide has fallen to a one-year low as the market's recovery gathers pace, and with a strongly backwardated structure in the Brent crude market discouraging storage.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language