Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 18 Feb, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

As coronavirus cases dramatically decline in India, the world’s second-most populous country is on track for a strong economic recovery.

After recording nearly 100,000 new daily cases of COVID-19 in mid-September, India’s total number of infections swiftly declined to roughly 11,000 per day this month, according to Johns Hopkins University. India has reported approximately 11 million cases and 156,000 deaths since the onset of the pandemic, and began vaccinating its population of 1.4 billion people last month.

“The Indian economy is on track to recover in fiscal 2022. Consistently good agriculture performance, a flattening of the COVID-19 infection curve, and a pickup in government spending are all supporting the economy,” S&P Global Ratings said in a report this week, explaining that India’s strengthening macroeconomic conditions should limit key sectors’ downside credit risks. “We estimate that India faces a permanent loss of output versus its pre-pandemic path, suggesting a long-term production deficit equivalent to about 10% of GDP … This means that fiscal 2022's high real GDP growth forecast is largely a function of various economic activities coming back online.”

Nonetheless, the rebound from the first-ever recession recorded for the $2.83 trillion economy will lift its banking and energy industries, as well as capital markets.

While banks in the country have been supported by various forbearance measures implemented by the government, as evidenced by the stronger earnings in the fourth quarter of last year, analysts believe their long-term stability hinges on India’s economic recovery, according to S&P Global Market Intelligence.

Oil demand in India, bolstered by fiscal stimulus, is set to make a full recovery this year, according to S&P Global Platts Analytics, which forecasts demand growth of 470,000 barrels per day following last year’s decline of the same amount as mobility returns. Over the longer-term, the International Energy Agency expects India to enjoy the world’s biggest increase in energy demand by 2040, largely driven by oil consumption.

Following the first three months of 2020, when the pandemic pummeled markets, all of India’s sector indices enjoyed bullish returns, according to S&P Dow Jones Indices. A strong recovery could perhaps continue this trend.

S&P Global Ratings sees the more transmissible COVID-19 variants circulating the globe that could permeate the vaccine-derived immunity and the possibility that global fiscal stimulus will be withdrawn too soon as the greatest risks to India’s recovery. Across most emerging markets, vaccination rollouts are lagging for developed nations’, making their return to normal elusive.

“We view COVID vaccinations as critical to India's recovery over the next few years, and as key to normalizing demand. The government has set an ambitious inoculation target of 300 million by around the middle of 2021, and may be able to vaccinate most of the country by the end of 2022,” S&P Global Ratings said.

Today is Thursday, February 18, 2021, and here is today’s essential intelligence.

Vaccine Rollouts Offer Path Out of Pandemic, Hopes of 2021 Global Recovery

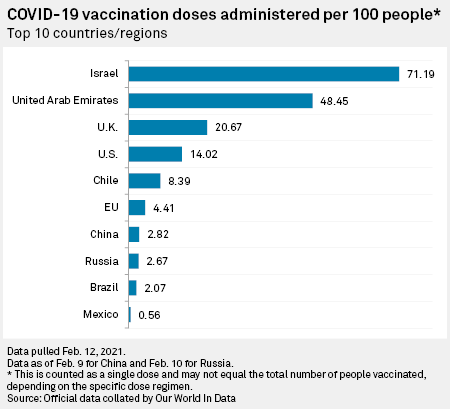

As many nations near the anniversary of social restrictions aimed at slowing the spread of COVID-19, hopes for economic recovery have been closely tied to the rollout of a growing number of approved vaccines. But a reliance on regions pulling out of the pandemic together, as well as countries' varying vaccination efforts, means estimates for when this recovery will occur range from as early as the second quarter to the end of the year.

—Read the full article from S&P Global Market Intelligence

COVID-19 Heat Map: Some Bright Spots In Recovery Amid Signs of Stability

S&P Global Ratings is updating its COVID-19 sector recovery expectations, with those views beginning to stabilize. Consistent with previous expectations, there is tremendous variance of recovery prospects across different corporate sectors. S&P Global Ratings still believes it will take until well into 2022 or, in some cases, 2023 and beyond for many sectors to recover to 2019 credit metrics.

—Read the full report from S&P Global Ratings

Investor Sees Legs In Strong Credit Performance, U.S. Bank Stock Rally

Bank stocks have surged in recent months as the outlook for credit quality and the broader economy has improved, but community bank valuations might have even more room to run, according to one investor.

—Listen and subscribe to Street Talk, a podcast from S&P Global Market Intelligence

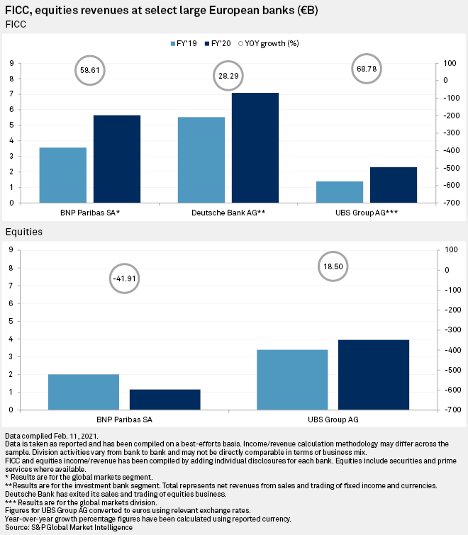

European Investment Banks Set For Strong Finish To Boom Trading Year 2020

With Deutsche Bank AG, BNP Paribas SA and UBS Group AG reporting strong fourth-quarter trading revenues earlier in February, other leading European investment banks such as Credit Suisse Group AG, Barclays PLC and HSBC Holdings PLC are also expected to end the boom trading year 2020 on a high note.

—Read the full article from S&P Global Market Intelligence

Industry Report Card: Large U.S. Banks' Earnings Should Improve In 2021 While Profitability Will Lag Pre-Pandemic Levels

The U.S. global systemically important banks reported mixed fourth-quarter 2020 results compared with the same period in 2019—benefiting from lower provisions and strong capital markets but hurt by reduced net interest income. Bank earnings will likely improve on lower credit loss provisions in 2021, although pandemic-related asset quality challenges and decades-low net interest margins will keep profitability ratios below 2019 levels.

—Read the full report from S&P Global Ratings

Fed Stress Tests Could Put An End To Big Banks' Capital Return Limits

Banks' dividend and share repurchase plans have been limited since the COVID-19 pandemic began, but some are looking toward the second half of 2021 for the Fed to lift its restrictions. That would follow the completion of the Fed's latest round of stress tests for big banks, whose health will be tested against a hypothetical stress scenario that is in some ways easier than those of prior Fed examinations.

—Read the full article from S&P Global Market Intelligence

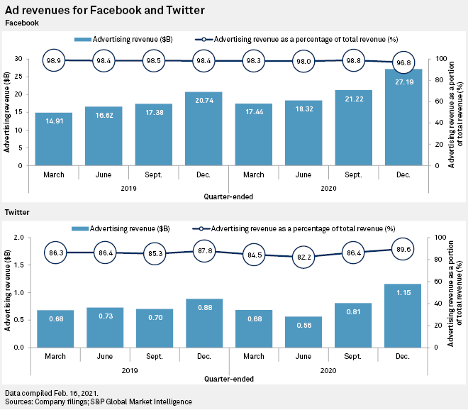

Can A Subscription Service Solve Twitter's Engagement Problem?

Twitter touts itself as a site built for rapid-fire dialogue between users, but a sticking point for the company compared to peers like Facebook Inc. has been figuring out how to keep users engaged for longer, analysts noted. Introducing a premium offering unique to Twitter could fill that gap, they said, by attracting new users and boosting engagement from existing ones.

—Read the full article from S&P Global Market Intelligence

How Lawmakers Could Unpack Gamestop's Wild Ride At 1st Congressional Hearing

Washington is working to understand what it can and should do in the wake of the sudden and unexpected boom-and-bust of GameStop Corp. shares.

—Read the full article from S&P Global Market Intelligence

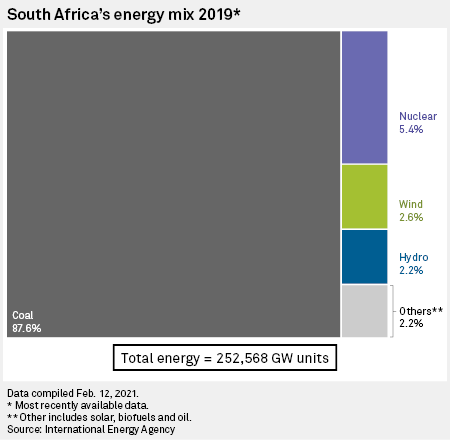

Banks' Fossil Fuel Exposure Criticized As South Africa Plans 'Just Transition'

South Africa's major banks need to improve transparency around their financing of fossil fuel industries, according to industry observers, who describe the current disclosures as "trivial" and "not meaningful."

—Read the full article from S&P Global Market Intelligence

Blackrock Heading To Net-Zero but Holds Large Fossil Fuel Investments for Now

BlackRock Inc. is pressing companies worldwide to start planning for a net-zero economy, but the world's largest asset manager still has substantial investments in fossil fuel companies, including coal producers.

—Read the full article from S&P Global Market Intelligence

JPMorgan Issues 1st Social Bond For $1B To Fund Affordable Housing Projects

JPMorgan Chase & Co. has dipped its toes in the social bond market with a $1 billion issuance aimed at funding affordable housing projects.

—Read the full article from S&P Global Market Intelligence

Maersk Plans To Operate First Carbon-Neutral Container Ship By 2023

AP Moller-Maersk, owner of the largest shipping company in the world, is aiming to operate the world's first carbon-neutral vessel by 2023, seven years ahead of schedule, it said Feb. 17.

—Read the full article from S&P Global Platts

EU Carbon Price Short-Term Risk Skewed To Downside: Socgen

EU carbon allowance prices face short-term downside risks moving into the spring, with warmer temperatures in Europe potentially weighing on natural gas prices, Societe Generale senior energy analyst Lueder Schumacher said in a report Feb. 17.

—Read the full article from S&P Global Platts

More UK Gigafactories Required To Assist Auto Sector To Meet Brexit's Rules Of Origin

The UK's new rules of origin standards, following Brexit, have become a hot topic for the battery industry business in recent weeks, with increasing calls for homegrown electric vehicle (EV) production and investment in battery gigafactories to keep the UK auto sector alive.

—Read the full article from S&P Global Platts

Listen: Pirates of the Gulf of Guinea

Rising levels of piracy in the Gulf of Guinea are having a direct impact on tanker owners' preferences, altering both crude and refined trade flows in and out of the West African coast. S&P Global Platts Shipping editors Charlotte Bucchioni, Chris To, and Sam Eckett take a deep look into how the markets are changing as a result of these attacks, from Nigeria's removal of the Security Anchorage Area to increasing numbers of ships with armed guards on board.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

U.S. to Continue to Monitor Nord Stream 2 Activity, Sanctions 'Applicability'

The U.S. remains on standby to impose sanctions against companies involved in completing the Nord Stream 2 gas pipeline from Russia to Germany, while diplomatic efforts to reach a compromise over the controversial project continue.

—Read the full article from S&P Global Platts

Insight From Moscow: Russia's Strong Economic Position Among OPEC+ Members Underpins Its Negotiating Power

In early 2021 Russia secured an increase to its oil output quota under the OPEC+ agreement for February and March, the latest sign that Russia's comparatively strong economic position is allowing it to push for better terms under the deal.

—Read the full article from S&P Global Platts

After A Year, Pandemic Has Shown 'Vulnerability' of Shale: Occidental CEO

he coronavirus pandemic, which has caused U.S. production to drop by nearly 2 million b/d in the last year or so, has shown the vulnerability of shale development when capital is not reinvested, the top executive of Occidental Petroleum said Feb. 17.

—Read the full article from S&P Global Platts

Mining M&A In 2020 — Deal Activity Bounces Back In H2 After Disrupted H1

The deal value of mining industry M&A in 2020 declined by almost one-third year over year — mostly due to the pandemic's disruption of normal activity in the first half — including a 17-year low in the number of base metals deals.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Language