Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 9 Dec, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

The COVID-19 crisis’ exacerbation of income inequality is, for many, nearly impossible to ignore. Devastated by greater infection and death rates due to higher exposure to health risks and more likely to be sidelined by unemployment and a lack of food security because of the crisis’ economic implications, low-income communities around the world have suffered the most from the pandemic.

And yet, the wealthy may impede an economic recovery.

In the U.S., high-earning Americans’ saving their cash, rather than spending it on travel, expensive meals, fancy cars, or luxury accommodation, is holding up the country’s economic recovery by sending the personal savings rates soaring and creating an imbalance in consumer spending, according to S&P Global Market Intelligence.

In April, after the pandemic took hold of the U.S., consumer spending across all income classes decreased dramatically. Data from the Harvard University-based research group Opportunity Insights shows that now, 10 months into the crisis, medium- and high-income households’ spending is down 1.8% and 5.7%, respectively, from pre-pandemic levels—while spending among low-income earners has recovered and grown 1.8% from activity seen before the crisis.

"Once a vaccine is broadly implemented across broad swaths of the population, both domestic and overseas, high-income Americans will start travelling again and going out to restaurants," Oren Klachkin, Oxford Economics’ lead U.S. economist, told S&P Global Market Intelligence in an interview. "Once the crisis is fully behind us, the balance between consumer services and goods spending will likely return to pre-pandemic trends."

A coronavirus vaccine itself is becoming a vector for inequality, as wealthy individuals seek to secure special or early access to inoculation.

After the U.K. became the first Western country to approve a vaccine, granting regulatory authorization for Pfizer and BioTech’s candidate on Dec. 2, public health officials and companies assured the public that individuals wouldn’t be able to pay their way toward early or private vaccination.

“I can say clearly and confidently that there are no plans to supply the private sector for the foreseeable future—no chance at all,” Pfizer U.K. Country Manager Ben Osborn told the Financial Times. “Equity is at the heart of our decision to supply only the NHS [National Health Service].”

Some experts suggest that the U.S. healthcare system is prone to being taken advantage of by wealthier individuals. “When we talk about the concept of individuals being able to get to the front of the line, that’s not difficult, because our system is designed to advantage those people with means like that,” Glenn Ellis, a visiting scholar at the National Center for Bioethics in Research and Health care at Tuskegee University and a narrative bioethics fellow at Harvard Medical School, told STAT News. “They don’t have to really do anything sinister. All they have to do is access the system that they are a part of.”

While the U.S., U.K., and other developed nations have already purchased millions of doses, only one in every 10 people across 67 poor countries will receive the COVID-19 vaccine by the end of next year, according to recent research by Oxfam and Amnesty International’s People’s Vaccine Alliance collation.

Calls to implement wealth taxes to help countries’ cover the economic costs associated with the crisis are growing louder.

The U.K.’s Wealth Tax Commission, made up of leading policymakers, academics, and tax experts, called for the country to put a one-time 1% tax on millionaire couples with earnings over £1 million. Such a tax has the potential to raise £260 billion in the next five years and could cover most of the £260 billion that the U.K. government has spent on measures to combat the economic crisis.

Argentina has established a similar tax. On Dec. 4, the country’s government passed a bill to implement a one-time tax of at least 2% on individuals with more than 200 million pesos ($2.4 million) in personal wealth in efforts of generating federal funds to cover costs of health supplies and economic relief.

Today is Wednesday, December 9, 2020, and here is today’s essential intelligence.

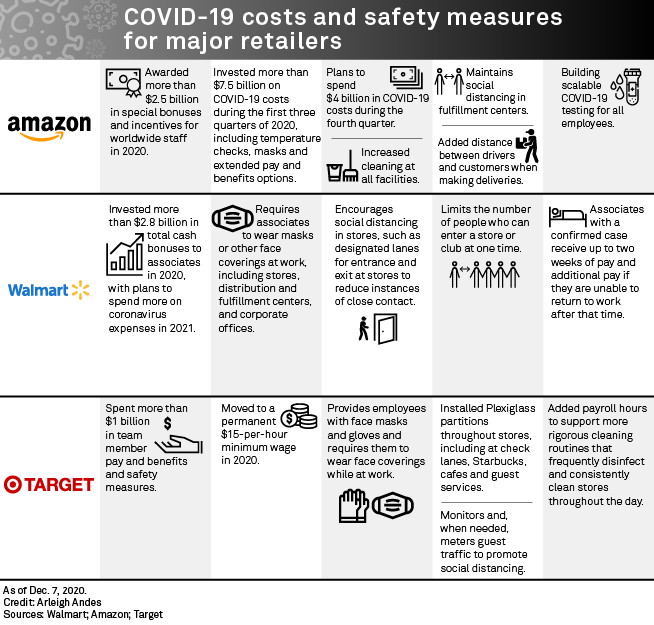

Retailers Likely to Face Covid-19 Safety Rules Under Biden – Analysts

Amazon.com Inc. and other major retailers could face new national safety mandates starting in 2021, put in place by President-elect Joe Biden to protect essential workers from COVID-19 exposure, according to policy and labor experts.

—Read the full article from S&P Global Market Intelligence

Trump's Congratulatory Covid-19 Vaccine Summit Will Not Include Manufacturers

No biopharmaceutical manufacturers will be attending President Donald Trump's White House event to congratulate efforts to quickly get a COVID-19 vaccine to the U.S. market but a top regulator who will be making the final decision on those products will be the key speaker.

—Read the full article from S&P Global Market Intelligence

China Nears Promised Purchases of U.S. Goods in October But Pace Seen Slowing

China came within striking distance of its monthly purchase commitments of U.S. goods under the countries' "phase one" trade agreement for the first time in October, though it may reflect a short-lived spike due to the seasonality of China's agricultural demand.

—Read the full article from S&P Global Market Intelligence

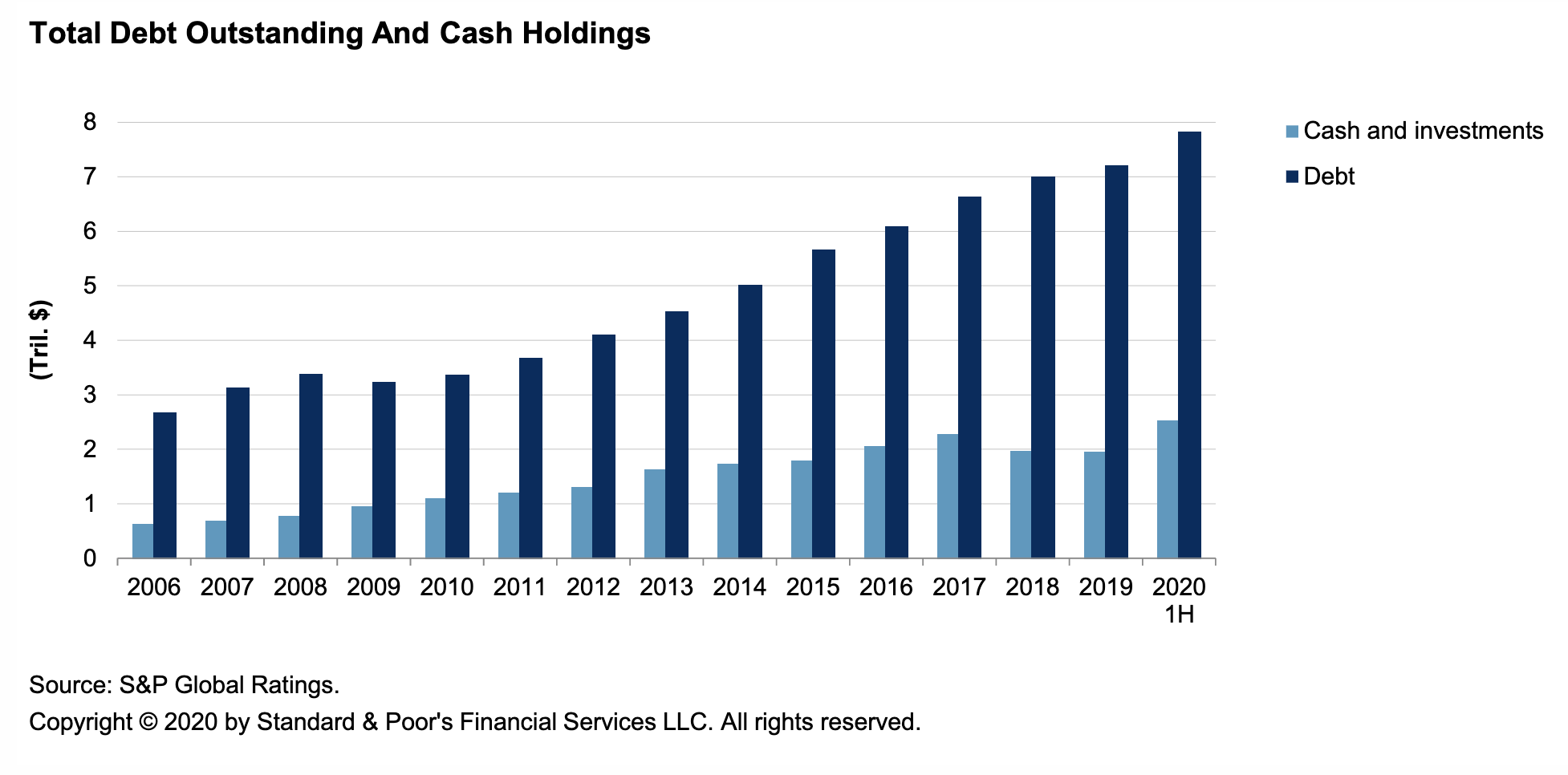

U.S. Corporates Hold Record $2.5 Trillion Cash to Meet Pandemic Shock; Debt Reaches $7.8 Trillion

The pandemic has led many corporate borrowers to reverse the shedding of cash from their balance sheets that began in early 2018 in the wake of passage of the Trump administration's corporate tax cut. While this has eased near-term liquidity concerns for all but the highest-risk issuers, the trajectory of post-pandemic cash balances will depend on management teams' decisions about whether to use the added cash to proactively ensure liquidity, pay down debt, or put it toward shareholder-friendly activities and acquisitions.

—Read the full report from S&P Global Ratings

Default, Transition, and Recovery: U.S. Recovery Study: Clouds Loom as Defaults Rise

The U.S. corporate speculative-grade default rate rose to 6.3% as of Oct. 31 as the COVID-19 pandemic, economic lockdowns, and a collapse in oil prices pressured companies. With defaults on the rise, investors are increasingly focused on potential recovery values.

—Read the full report from S&P Global Ratings

The U.S. Lodging Sector Faces a Challenging Recovery From the Effects of the COVID-19 Pandemic

The lodging sector has been one of the most heavily affected by the COVID-19 pandemic due to government travel restrictions, state mandated closures, and consumers' fear of travel. Recovery will be slow, especially for properties that depend on corporate, and meeting and group demand.

—Read the full report from S&P Global Ratings

Alternative Approaches for Assessing Credit Risk Using Consensus Estimates

The unprecedented times caused by the COVID-19 pandemic have shown that traditional credit risk analysis that uses the latest published financials for companies creates challenges in capturing the true impact of the pandemic on the economy and businesses. As an alternative, analysts can use consensus data from equity analysts to add independent views of the pandemic’s impact on businesses within each industry.

—Read the full article from S&P Global Market Intelligence

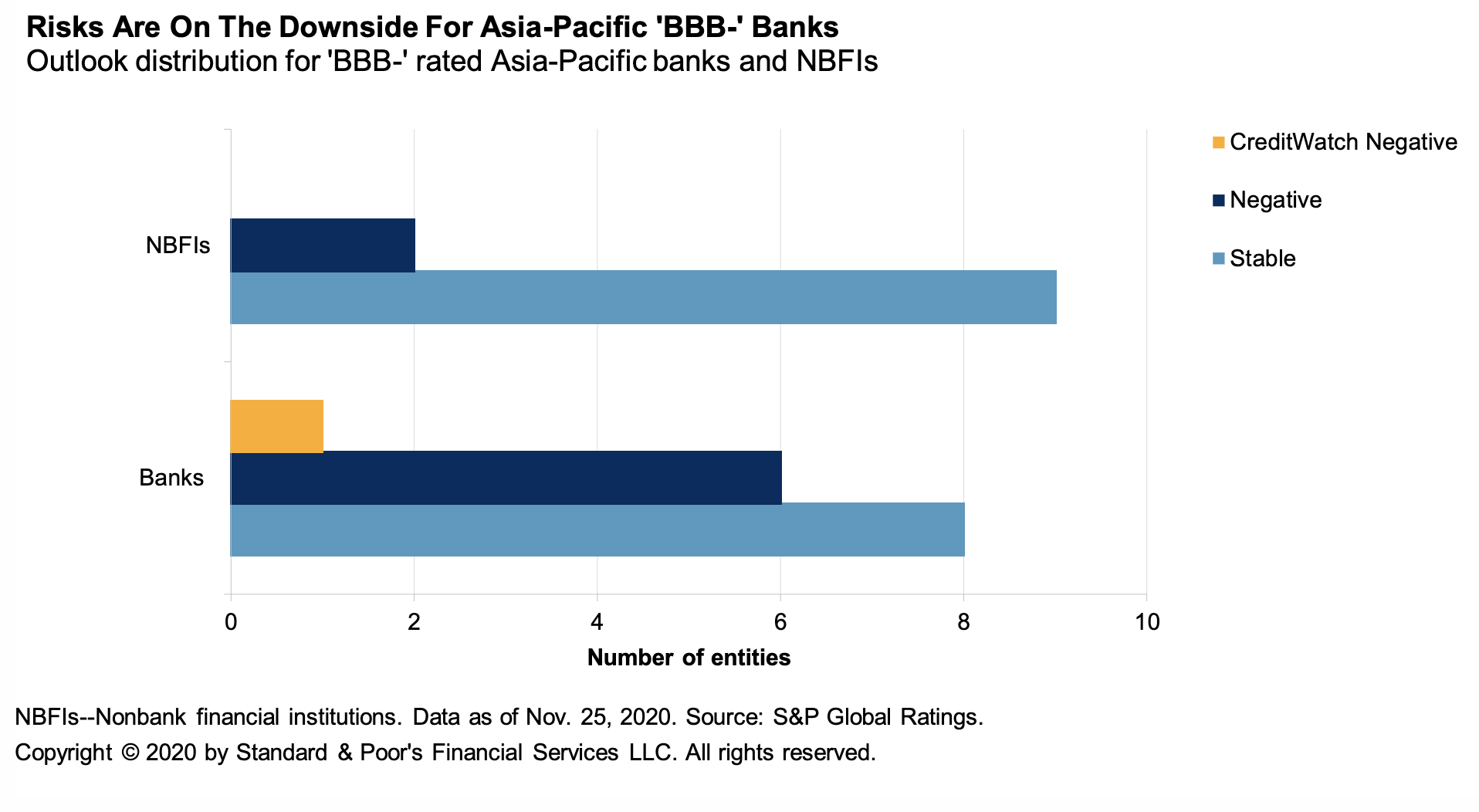

Credit Trends: Seven Potential Fallen Angel Banks Across Asia-Pacific Face COVID-19 Threat

S&P Global Ratings sees a significant risk that more banks in Asia-Pacific will join the list of fallen angels in the next two years.

—Read the full report from S&P Global Ratings

Norway's DNB Faces Money-Laundering Fine, But Repeat of Danske Scandal Unlikely

A possible anti-money-laundering fine of 400 million kroner, or about $45 million, is manageable for Norway's DNB ASA and has not prompted concern among analysts.

—Read the full article from S&P Global Market Intelligence

Singapore's Banks May Hold Their Own Against New Digital-Only Challengers

Singapore's four new digital lenders will likely leverage on their existing businesses to carve a share in the island nation's busy banking space where dominant local players already have a head start in engaging with customers online.

—Read the full article from S&P Global Market Intelligence

Pandemic Squeezes UAE Bank Results — But it Could be Worse

A loan deferment program and extensive central bank support have supported earnings at the United Arab Emirates' top banks, although net interest margins slid and impairments will likely increase as repayment holidays end.

—Read the full article from S&P Global Market Intelligence

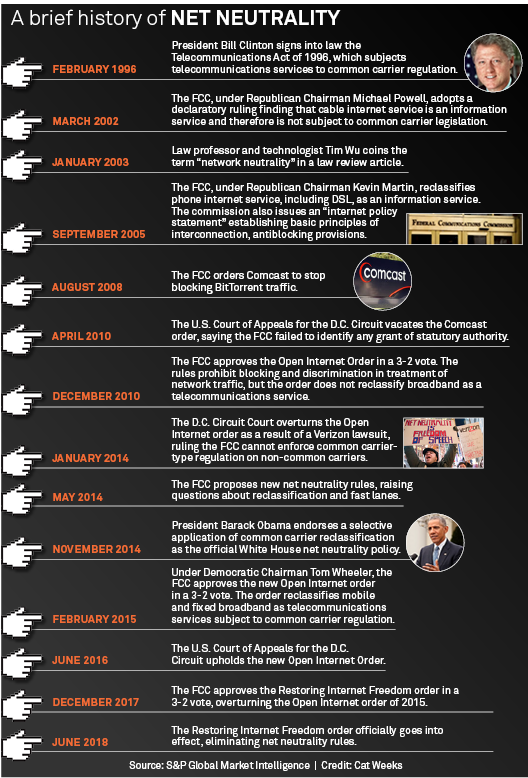

Policy Experts Warn of Partisan 'Deadlock' at FCC in 2021

A change in administration usually means big policy changes for the U.S. Federal Communications Commission, but experts warn President-elect Joe Biden's commission faces the real risk of partisan gridlock.

—Read the full article from S&P Global Market Intelligence

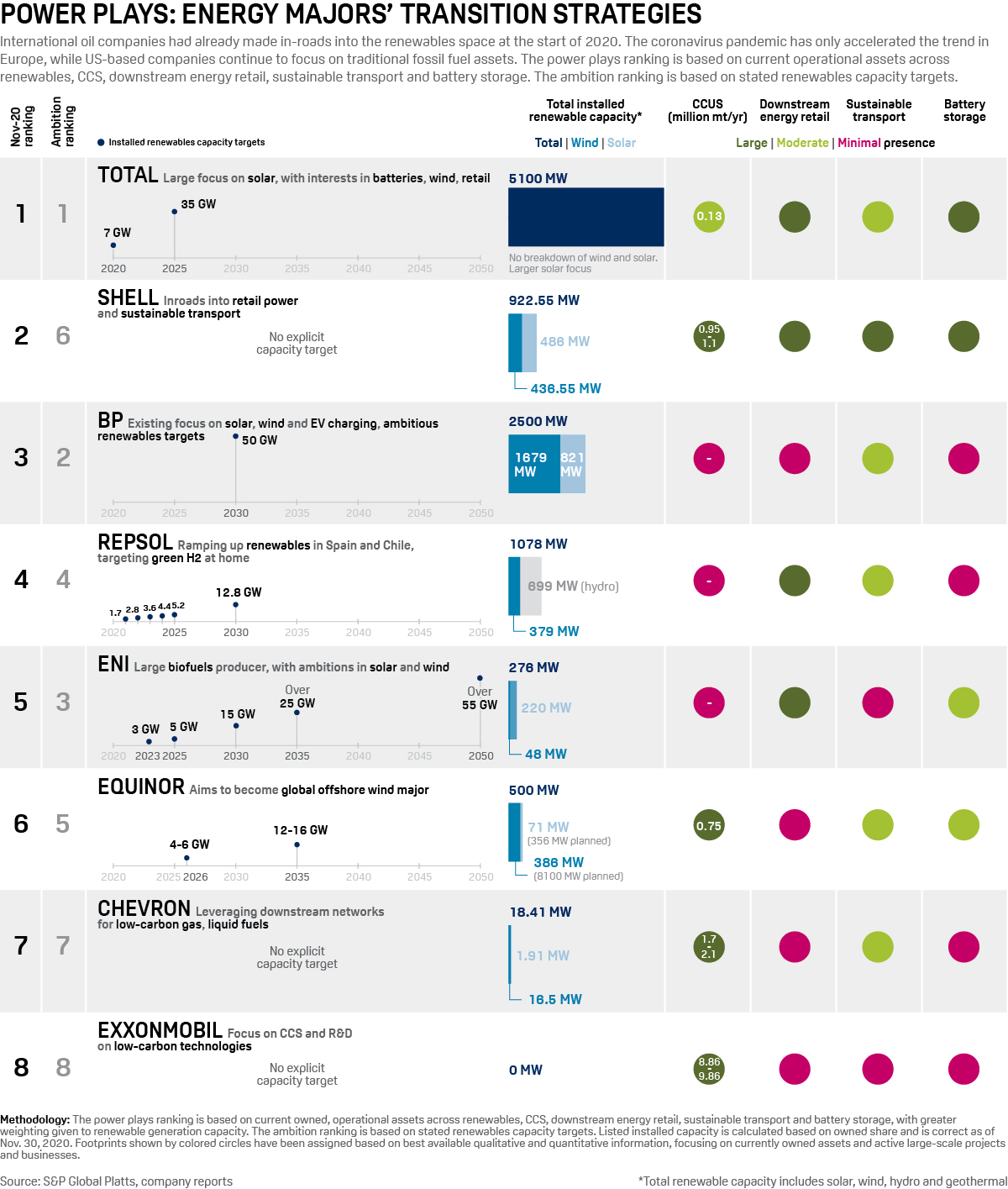

Power Plays: European Oil Majors Ramp up Targets For Renewable Power

Just as leading international oil companies were revealing ambitious plans in the renewable energy space early this year, the coronavirus pandemic turned energy markets on their heads, upending demand forecasts and forcing companies to revise their assumptions and outlooks.

—Read the full article from S&P Global Platts

ESG-Compliance Seen Costly Near Term, But Paying Dividends Further Out

The market needs to be a little more realistic about environmental, social and governance matters, and accept that balance-sheets could take a hit near term, yet yield potential dividends further down the line, market participants and analysts say.

—Read the full article from S&P Global Platts

Watch: Market Movers Europe, Dec 7-11: Nord Stream 2 Works Resume Amid Sanction Worries, as New Power Interconnectors Come Online

In this week's highlights: OPEC+ cuts January production ahead of online event; work resumes on the controversial Nord Stream 2 gas pipeline; a power interconnector between Norway and Germany is due to start full operation; and low Rhine water levels complicate petrochemicals logistics.

—Watch and share this Market Movers video from S&P Global Platts

PA Shale Gas Permitting Continues to Fall in November

Permits for shale gas wells in Pennsylvania dropped 57% year over year in November, according to the latest state data, continuing a decline in the state's drilling activity that began in April after the bust in the oil markets.

—Read the full article from S&P Global Market Intelligence

Libya's Rapid Rebound Drives OPEC+ Output to 6-month High: S&P Global Platts Survey

OPEC and its allies in November pumped their most crude oil since implementing historic production cuts in May, the latest S&P Global Platts survey found, driven largely by Libya's brisk recovery and a rebound in the UAE's output.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language