Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 2 Dec, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Global equity markets outperformed in November, and are continuing their historic rally into the final month of the year.

Fueled by investor optimism about the effectiveness and progress of COVID-19 vaccines, U.S. stocks climbed to record closing levels on Dec. 1. The benchmark S&P 500 index advanced 1.1% and the technology-heavy Nasdaq Composite index gained 1.3%, while the Dow Jones Industrial Average was up 0.6%, or 185.28 points, to close at 29824. Across Europe, the Stoxx Europe 600 index rose 0.7%, Germany’s Dax added 0.7%, and the U.K.’s FTSE 100 rallied 1.9%—all largely encouraged by new data showing China’s manufacturing sector grew at the fastest rate in a decade last month.

The global rally comes on the back of a buoyant November, which saw several markets and sectors that had suffered from the pandemic’s tumult and volatility recover the majority of their losses.

Rising an overall 11% in November, the S&P 500 reached historic highs on four different dates during the month—on Nov. 13, 16, 24, and 27. The month marked the S&P 500’s biggest gain since April, and its best November since 1928, when the index climbed 12%, according to S&P Global Market Intelligence.

“November was a month of reversals for recently downtrodden sectors and factors of the S&P 500,” Chris Bennett, director of index investment strategy at S&P Dow Jones Indices, said in a Dec. 1 note. “Only 38 members of the S&P 500 ended the month down, while the biggest winner, Occidental Petroleum, gained 73%.”

Following losses of 49.9% from the start of this year through October, the S&P 500’s Energy sector finished November up 28%. Still, the sector’s performance year-over-year remains down 36.5%. By contrast, the Information Technology sector, which has outperformed so far this year, enjoyed gains of 11.4% in November, according to S&P Dow Jones Indices.

The S&P 500 Energy sector’s rapid recovery "is 100% related to the success on the vaccine front and the ability of the market to look through the temporary demand weakness towards a post-COVID world," Eric Nuttall, a partner and senior portfolio manager at the investment management firm Ninepoint Partners, told S&P Global Market Intelligence.

Industrial commodities likewise benefited from the positive news of potential vaccines’ efficacy. The headline S&P GSCI index, which tracks commodities, outperformed the S&P 500 with gains of 12% in November, according to S&P Dow Jones Indices. Notably, the S&P GSCI Gold ended the month near a five-month low, with the typical safe haven asset down 5.6%.

Optimism surrounding progress in coronavirus vaccines was also responsible for driving down investors’ short interest in all of the S&P 500’s sectors during the first half of last month, according to S&P Global Market Intelligence data.

Meanwhile, shares of electric-vehicle maker Tesla swelled 3% on Dec. 1. The move followed S&P Dow’s announcement on Monday night that the company will be added to the S&P 500 on Dec. 21 at its full float-adjusted market cap weight of $538 billion all at once, rather than in separate increments.

Today is Wednesday, December 2, 2020, and here is today’s essential intelligence.

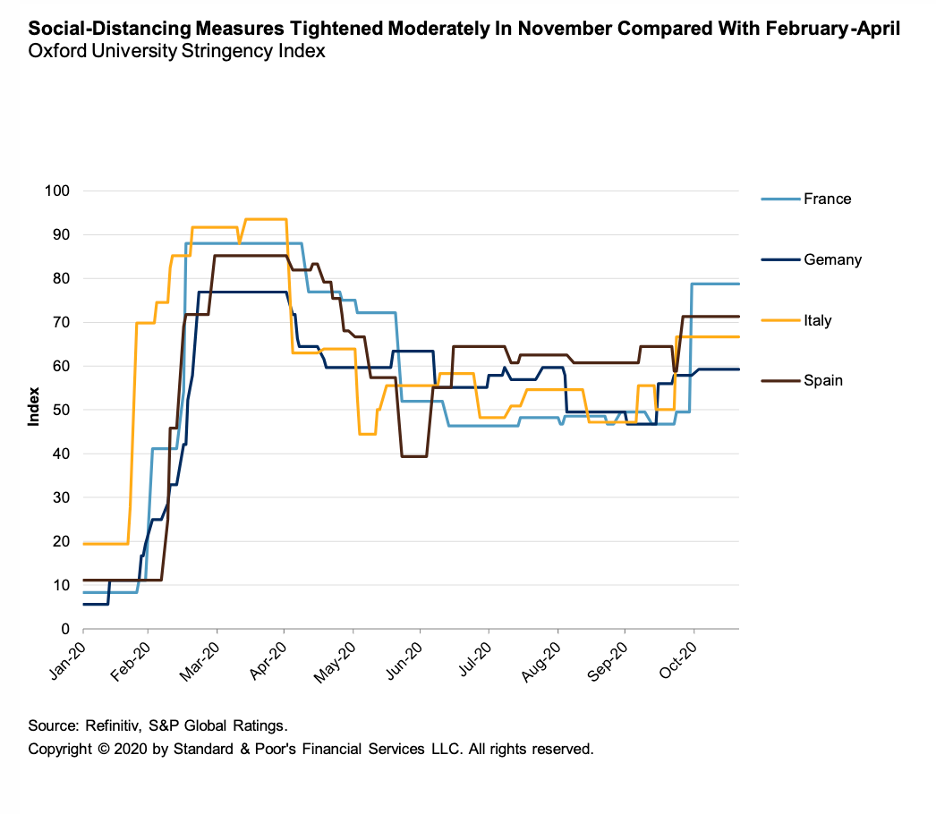

Economic Research: The Eurozone Can Still Rebound In 2021 After Lighter Lockdowns

S&P Global Ratings now expects the eurozone's real GDP to be 6.5% below last year's levels in the fourth quarter, compared with 14.8% below in the second quarter of 2020. This leaves S&P Global Ratings’ 2020 GDP forecasts broadly unchanged, given that S&P Global Ratings also underestimated the strength of a rebound in the third quarter.

—Read the full report from S&P Global Ratings

Economic Research: Asia-Pacific Forecasts Stabilize, Risks Now Balanced

S&P Global Ratings still sees the region's economy shrinking 2% in 2020 and expanding almost 7% next year. The region will get back to pre-COVID activity levels only at the end of 2020. For the region excluding China, activity will not return to pre-COVID levels before the third quarter of 2021.

—Read the full report from S&P Global Ratings

G20 Sovereign Debt Suspension: To Apply, or Not To Apply

Many qualified sovereigns have not applied for the G20 debt service suspension initiative for low-income countries despite the near-term budgetary relieves that it offers. S&P Global Ratings believes cost-benefit considerations were behind some of the qualifying governments' decisions not to apply for debt suspension.

—Read the full report from S&P Global Ratings

COVID-19 Tests The Resilience of European CLOs In 2020

The coronavirus pandemic has spurred a number of corporate rating actions this year, which has led to deterioration in CLO portfolios' underlying credit quality. This has pressured European CLO ratings, predominantly in junior parts of the capital structure at the 'BB' and 'B' rating categories.

—Read the full report from S&P Global Ratings

China Defaults: What To Expect When

China's rising corporate defaults are jolting the country's US$15 trillion bond market, but post-default resolutions in the country are improving. A series of high-profile defaults by state-owned enterprises are getting quicker judicial resolution, and more privately owned enterprises are likely to follow.

—Read the full report from S&P Global Ratings

Sustainable Covered Bonds: Assessing The Impact Of COVID-19

In terms of issuance volumes, sustainable covered bonds are lagging behind other types of sustainable issuance from financial institutions: having passed the €20 billion mark, covered bonds still represent only about 5% of total sustainable bond issuance (euro-denominated, minimum size of €250 million). The positive news is that the covered bond segment has been the only part of the wider sustainable financials debt landscape that has witnessed a modest rise in supply this year to €8 billion.

—Read the full report from S&P Global Ratings

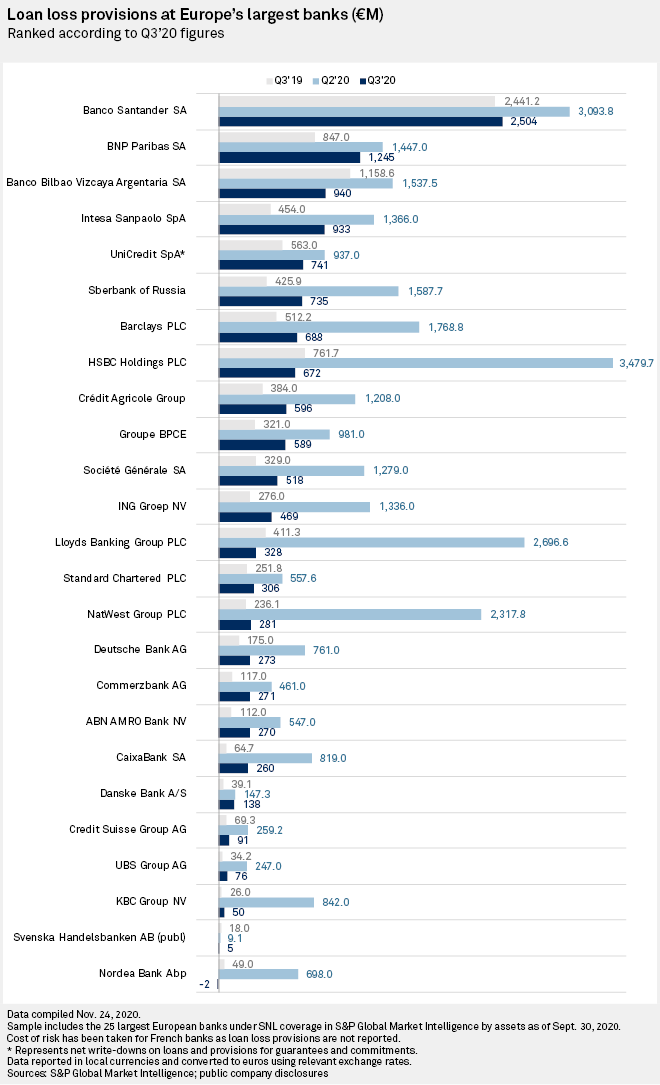

Gloomy Uncertainty for European Banks' Provisions Despite Promising Q3 Decline

Third-quarter loan loss provisions at Europe's largest banks dropped from second-quarter highs but analysts expect increases to resume in the fourth quarter and early 2021 as the COVID-19 impact, delayed by loan moratoriums and government aid schemes, hits the sector.

—Read the full article from S&P Global Market Intelligence

National Bank Of Greece Sees Uptick In Digital Users, Braces for Bad-Loan Inflow

The number of digital subscribers at National Bank of Greece SA has grown amid the pandemic, and the lender is looking to ramp up digitization efforts in 2021 and beyond, CEO Pavlos Mylonas said in an earnings call for the third quarter. The bank is preparing for the securitization of a portfolio of €6.1 billion of nonperforming loans.

—Read the full article from S&P Global Market Intelligence

As French Tourism Numbers Fall, The Risk for Banks Could Rise

The coronavirus pandemic has brought an eerie still to the usually teeming streets of Paris, and the usual throngs of tourists at the city's top tourist spots such as the Eiffel Tower and the Louvre have disappeared.

—Read the full article from S&P Global Market Intelligence

Vietnam Falls Behind Goal of Listing 13 Banks In 2020 Amid Lukewarm Interest

The Vietnamese government is falling behind its stretch goal of having 13 domestic joint-stock commercial banks listed in 2020, as there has been insufficient investor interest and market liquidity due to the pandemic and the small sizes of IPO candidates, analysts say.

—Read the full article from S&P Global Market Intelligence

Salesforce's Expected Slack Buy A 'Shot Across The Bow' at Microsoft – Analysts

>

With salesforce.com inc. widely expected to announce a combination with Slack Technologies Inc., analysts are bullish, noting such a deal could bolster both companies' competitive stance and spur a wave of consolidation in the workforce collaboration space.

—Read the full article from S&P Global Market Intelligence

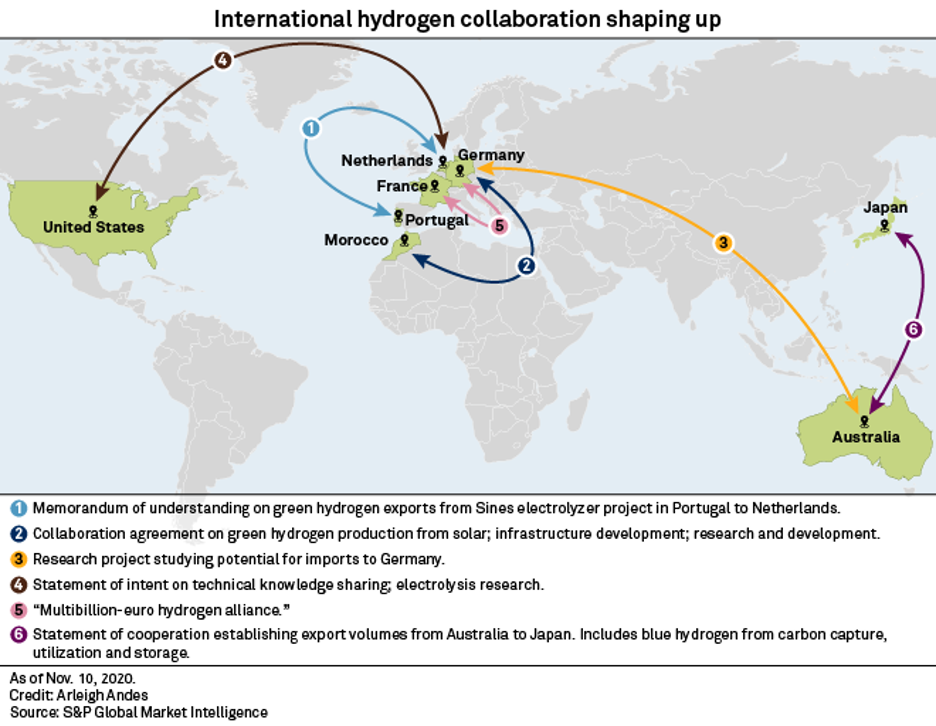

Europe Vies for Pole Position In Global Race to Hydrogen Economy

With 30 years left to eliminate its emissions, Europe is going full steam ahead on hydrogen. By taking a lead, Europe hopes to sell critical hydrogen technologies to the rest of the world and decarbonize its economies earlier and more cost effectively than others.

—Read the full article from S&P Global Market Intelligence

Utility Union Presses Biden to Ease Energy Transition's Impact on Coal Workers

With the shift to cleaner power sources displacing workers in coal-reliant communities, one of the largest US trade unions for the utility sector hopes that President-elect Joe Biden will expand an Obama administration program to ease the economic effects of the energy transition.

—Read the full article from S&P Global Platts

Construction, Renewable Energy Buyers Join Steel Producers to Push Zero Carbon Steel

A global shift to net-zero carbon steel requires a 10-30 year phased approach that starts with driving demand through policy and aligning costs against traditionally produced steel, rather than expecting consumers to pay significantly more for green production, according to industry experts speaking Dec. 1.

—Read the full article from S&P Global Platts

Watch: Market Movers Asia, Nov 30-Dec 4: Markets Await OPEC+ Decision Over Oil Production Cut Extension

The highlights this week on S&P Global Platts Market Movers Asia with Senior Oil Analyst Oceana Zhou: Asia, home to the world's largest crude buyers, awaits OPEC+ decision on production cuts; Beijing to start allocating 2021 quotas; Australian coal imports unable to land at Chinese ports as geopolitical tension between the two countries persists; metals market participants focus on China's November manufacturing data; colder winter seen supporting LNG purchases, but COVID-19 resurgence in Japan could dampen demand; toluene 2021 term negotiations underway; and ean tankers eye fresh highs in freight rates

—Watch and share this Market Movers video from S&P Global Platts

OPEC Hopes to Salvage A Deal From Saudi-UAE Standoff With A Few Days of Oil Diplomacy

OPEC is hoping a couple of days away from the market's glare will allow cooler heads to prevail and rescue a deal to extend production cuts that analysts say is needed to prevent an oil glut in the months ahead.

—Read the full article from S&P Global Platts

Insight From Dubai: Middle East Seeks Refuge In Petchems Amid Bleak Oil Demand Forecasts

Despite global oil demand plunging an unprecedented 8% this year and drastic OPEC+ cuts, Middle Eastern energy producers are still counting on higher petrochemicals production to temper a bleak outlook for peak oil consumption that has spooked crude markets.

—Read the full article from S&P Global Platts

European Refiners Look to Demand Recovery, Plant Closures to Reverse Dire Margins

European refiners are struggling with their weakest market in decades. But some industry watchers have become cautiously optimistic that improved demand, plant closures, and longer OPEC+ supply cuts could put a floor under margins.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language