Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 25 Aug, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Cryptocurrency’s advance from Wall Street to Main Street has established digital assets far from the fringe. Now that crypto is joining the mainstream, regulation and decarbonization are the next frontiers for decentralized assets.

In the U.S., digital-asset investors have expressed concern over two amendments in the proposed infrastructure bill that, if passed, could change the industry by imposing stricter rules on the taxation of digital assets and requiring crypto firms to report certain transaction information to the Internal Revenue Service. In Asia, experts believe more cohesive regulations on crypto assets can protect banks and customers from the complex and volatile aspects of the market, according to S&P Global Market Intelligence.

Separate from regulatory oversight, digital asset companies are searching for solutions to the enormous energy demands of mining cryptocurrencies. One bitcoin transaction requires 1,695 kilowatt hours of electricity, comparable to what an average U.S. household uses in 58 days, and produces 805 kilos of carbon dioxide—equivalent to the carbon footprint of 1.8 million Visa transactions, according to Dutch economist and blockchain expert Alex de Vries, as reported by S&P Global Market Intelligence.

"ESG is something that many institutional investors inquire about as they explore digital assets, just as they ask about volatility and other considerations for this nascent asset class," a spokesperson for Fidelity Digital Assets Services, a subsidiary of Fidelity Investments and a provider of cryptocurrency custody and other services to institutional investors, told S&P Global Market Intelligence. "Today, a substantial portion of bitcoin mining is powered by renewable energy or energy that would otherwise be wasted (stranded gas) and miners are increasingly seeking more efficient and cleaner energy.”

Swiss trading house Mercuria announced at a June 16 conference hosted by S&P Global Platts that the company is providing bitcoin producers with renewable energy to reduce emissions generated from crypto mining and trading. Blockchain platforms like Re|Source are aiming to bring transparency into battery metal supply chains by allowing users to trace the origination of critical commodities like cobalt.

This year has seen rapid change for the crypto market participants.

Recovering from a rollercoaster soaring from $65,000 in January, to lows of near $20,000 in July, Bitcoin is currently trading at around $50,000. Goldman Sachs has begun trading crypto futures, with other banks set to follow shortly. Insurers have begun to explore the possibilities of investing in crypto. Communities with large unbanked populations, like in Indonesia, are turning to gold-based blockchain systems to expand financial inclusion. Cryptocurrency exchanges are generating millions in revenue daily. S&P Dow Jones Indices has launched four new decentralized currency indexes this year that demystify digital assets and measure the market performance of their respective currencies: the S&P Bitcoin Index, S&P Ethereum Index, and S&P Crypto Mega Cap Index in May, and the S&P Cryptocurrency Broad Digital Market Index in July.

Meanwhile, there have been high-profile cyber scandals involving decentralized assets this year, including the cyberattack on Colonial Pipeline in May, which was resolved with a nearly $4.5 million Bitcoin ransom paid to the DarkSide criminal hacker group, and the $600 million in decentralized assets seized this month from the cryptocurrency platform Poly Network and returned to the company this week by the hackers themselves.

Today is Wednesday, August 25, 2021 and here is today’s essential intelligence.

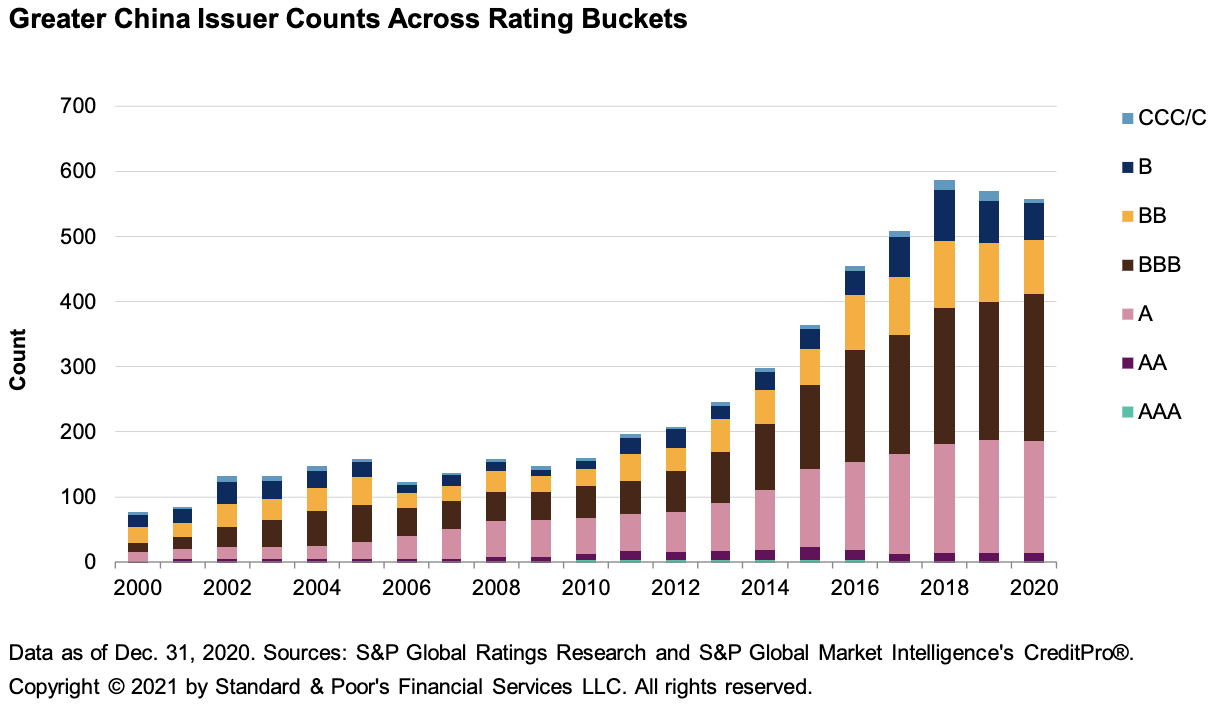

Default, Transition, and Recovery: 2020 Annual Greater China Corporate Default and Rating Transition Study

Greater China's speculative-grade default rate increased to 4.2% in 2020, from 3.1% in 2019. Globally, the 2020 speculative-grade default rate was 5.5%, up from 2.5% in 2019. By number of companies, seven rated by S&P Global Ratings (including two confidential issuers) defaulted in Greater China in 2020, compared with nine defaults the prior year.

—Read the full report from S&P Global Ratings

Why Now Is A Good Time To Own European Bank Stocks

Unloved for the better part of the last decade, bank shares are among the top performers in the European stock markets in 2021, as a COVID-19 rebound, higher earnings expectations and the return of dividends bolster the sector.

—Read the full article from S&P Global Market Intelligence

U.S. Northeast Spot Natural Gas Prices Jump As Henri Storm System Weakens, Temperatures Rise

Cash prices for next-day flows of natural gas in the US Northeast saw a double-digit increase in Aug. 23 trading amid a firm demand outlook, as hot weather appears in the forecast and work begins to restore power in New England following Hurricane Henri.

—Read the full article from S&P Global Platts

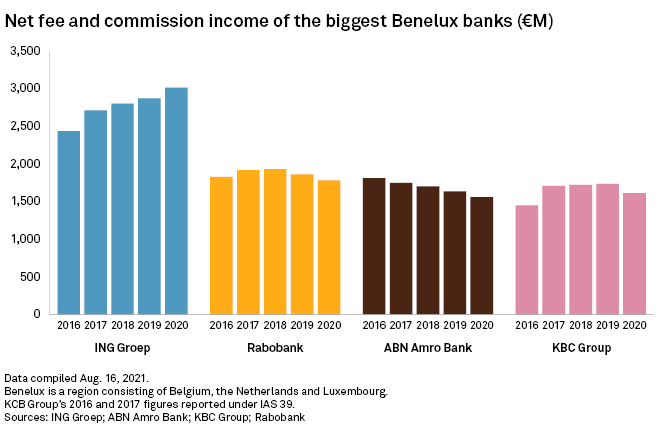

Benelux Banks Turn To Fees As Low Rates Stunt Net Interest Income

As pressure from low interest rates lingers, big banks in the Netherlands and Belgium are turning their focus to fee income to hold their profitability steady.

—Read the full article from S&P Global Market Intelligence

Quotes Of The Quarter: APAC Bankers Optimistic About Growth Amid Uneven Recovery

Top bankers in Asia-Pacific are cautiously optimistic about the industry's growth prospects, though they are mindful of uneven economic recovery and the emergence of new variants of COVID-19.

—Read the full article from S&P Global Market Intelligence

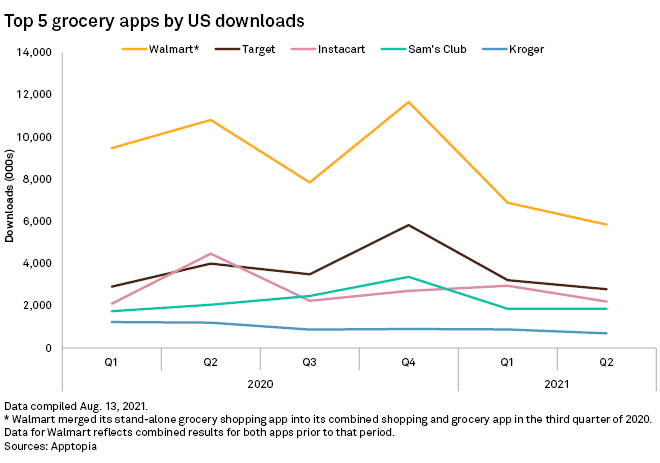

U.S. Online Grocery Sales Growth Set To Reaccelerate As COVID-19 Concerns Grow

Though grocery retailers saw a pick-up with in-store shopping over the summer, a new wave of COVID-19 infections could drive some U.S. consumers back online. Walmart Inc. and Target Corp., which rank among the country's top grocery retailers both in stores and online, reported strong in-store shopping in the quarter ended in July. Analysts warn, though, that August could look very different due to the emergence of the highly transmissible delta variant of the coronavirus in the U.S. and the return of mandates around mask-wearing.

—Read the full article from S&P Global Market Intelligence

Nextera's Robo Remains Highest-Paid U.S. Utility CEO In 2020

For the third year in a row, NextEra Energy Inc. Chairman, President and CEO James Robo was the highest-paid utility executive in the U.S. based upon a combination of cash compensation, stocks and options granted, and non-equity incentive plan compensation.

—Read the full article from S&P Global Market Intelligence

Cellnex Plans Next European Shopping Spree Amid Antitrust Scrutiny

An antitrust review in the U.K. may give deal-hungry tower operator Cellnex Telecom SA pause in other established markets as it seeks to spend freshly raised capital, analysts and lawyers said.

—Read the full article from S&P Global Market Intelligence

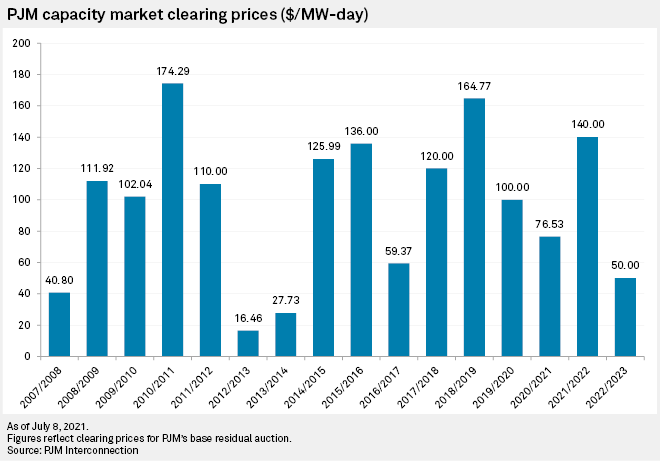

Critics: PJM's Minimum Offer Price Rule Overhaul Will 'Crater' Capacity Market

The PJM Interconnection is facing fierce pushback to its proposed replacement for a highly contentious minimum offer price rule, or MOPR, used to blunt the effect of member states' clean energy policies in the grid operator's multibillion-dollar capacity market.

—Read the full article from S&P Global Market Intelligence

Listen: Marine Fuels of the Future: Methanol

Ahead of London International Shipping Week 2021, a six-part S&P Global Platts podcast miniseries looks into the pricing of alternative marine fuels for the global shipping industry. In each episode of Marine Fuels of the Future, Platts editors investigate the current state of the major fuel alternatives, as the shipping sector seeks to reduce its greenhouse gas emissions ahead of stringent caps in 2030 and 2050. Episode three looks at methanol – a cleaner-burning hydrocarbon that is proving popular amongst shipowners.

—Listen and subscribe to Future Energy, a podcast from S&P Global Platts

Market Movers Europe, Aug 23-27: Nord Stream 2 Regulatory Issues, Oil And Gas Demand In Focus

In this week's highlights: Oil markets keep an eye on road fuel consumption, the European gas market remains focused on supply issues, with Nord Stream 2's progress still dominating the backdrop, while petrochemical markets are grappling with a shortage of methanol supply.

—Watch and share this Market Movers video from S&P Global Platts

Oil In Floating Storage Rebounds To Three-Month Highs

The volume of crude oil and condensate in tankers worldwide is starting to once again rebound as sanctioned Iranian oil starts to mount up, while oil offshore China is also on the rise as its crude demand starts to slow.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Language