Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 21 Aug, 2020

By S&P Global

California reported the greatest number of new coronavirus cases of any state on Aug. 20—9,134 new infections in 24 hours, according to Johns Hopkins University data—as the pandemic has infected more people in Los Angeles County than in any other county across the U.S. during the entirety of the crisis.

More than 367 wildfires, 23 of them major and all caused by an unusual storm that produced roughly 11,000 lightning strikes, are currently raging across the state. Authorities began urging citizens in parts of California to evacuate their homes yesterday as many of the fires doubled in size. The air quality in Northern California, where the most concerning blazes are centralized, was the worst in the world on Aug. 19.

A scorching heatwave has pushed temperatures to nearly 130 degrees Fahrenheit in the Death Valley and upwards of 105 degrees Fahrenheit in most of California for seven days and counting.

As the U.S.’s most populous state battles simultaneous health and climate crises, millions of residents have experienced rolling power outages starting on Aug. 14 for the first time in 20 years. California’s energy mix of solar, wind, and imported electricity from out of state may be to blame.

The California Independent System Operator issued an additional statewide order for the third consecutive day on Aug. 19 urging people to raise their air-conditioning temperatures, refrain from using major appliances, turn off lights, and take other measures to conserve electricity and ease pressure on the grid. This is the first time since 2001 that the Cal-ISO has ordered utilities to implement rotating power outages. The grid operator had declared a State 3 grid emergency and ordered rotating power outages starting on Sunday after a 470-megawatt power plant malfunctioned and 1,000 megawatts of wind power were lost, pushing power reserves to a dangerously low level during the extreme heat.

"California's record-breaking heat wave has put extraordinary strain on the ISO electric system, as air conditioners are working harder and longer to keep spaces cool during the high temperatures," the Cal-ISO said this week. Consumers' reduced-use of power "in the most critical time of the afternoon and early evening, when temperatures remain high and solar production drops," prevented further outages on Aug. 17 and Aug. 18.

“Today, we believe, will be another challenging day, but we’re up to the task. You’re up to the task. You’ve proven that Sunday night, you proved it on Monday, you proved that on Tuesday, last night,” Governor Gavin Newsom said at a news conference on Wednesday. “We really need everybody to do everything in their power to flex their power use and consumption.”

Power prices in the Western U.S. reached record highs alongside the spiking temperatures that drove up power demand and threatened additional power outages. Both solar and wind generation have been weak due to the current conditions. Gas prices in particular reached the highest levels seen all summer.

Approximately one-third of California’s power is imported from neighboring states like Arizona and Nevada, which are also experiencing record heat. Renewables make up more than 32% of the state’s energy mix, which faces intermittent challenges in the evenings when solar and wind power are not readily available.

Gary Ackerman, the former executive director of the electric market membership organization Western Power Trading Forum, told S&P Global Platts in an interview that because grid-connected solar generation accounts for approximately 12,000 megawatts of energy capacity in California, while wind generation supplies only about 4,000 megawatts in the state, the state’s battery storage doesn’t currently have enough capacity or duration to ensure electricity generated by solar facilities to be available at nighttime.

Power generators, policymakers, and sustainable energy advocates are pointing fingers at one another to place responsibility for the power outages.

"We told the California Public Utilities Commission of a 4,700-megawatt need through 2022 and that gap started in 2020. Despite all that, only 3,300 megawatts was authorized for procurement and none starting until 2021," Cal-ISO CEO Steve Berberich said during an Aug. 17 special telephone conference of the Cal-ISO Board of Governors, according to S&P Global Platts.

"I know the commissioners," Mr. Berberich said at a separate Aug. 17 media briefing on the blackouts, referring to the PUC leaders which previously created resource sufficiency requirements but stopped short of requiring long-term commitments from utilities and other entities. "They are thoughtful, well-meaning people ... dedicated to reliability as much as we are, but they do have ponderous processes and those processes are difficult when you have a rapidly evolving environment as we are in now."

The Cal-ISO, the PUC, and various power producers in the state have repeatedly warned that power shortages could unfurl if steps were not taken to ensure adequate resources were available to cover peak energy demand periods, according to S&P Global Platts.

“California residents, who are battling challenging conditions of a heat wave combined with a global pandemic in which we have encouraged people to stay at home as much as possible, were forced to fend without electrical power—a basic necessity,” Governor Newsom wrote in an Aug. 17 letter to the state’s Cal-ISO, PUC, and Energy Commission. “Collectively, energy regulators failed to anticipate this event and to take necessary actions to ensure reliable power to Californians. This cannot stand.”

At the request of Governor Newsom, the Cal-ISO and energy regulators in the state are investigating why the rotating blackouts occurred at the onset of the heat wave, according to S&P Global Market Intelligence.

“California’s renewable electric system proved unprepared over the weekend to ramp up after the sun went down and wind power slowed. Our state did not have enough reliable, back-up power and hundreds of thousands of Californians were left in the dark,” Julia Prochnik, the executive director of the advocacy organization Long Duration Energy Storage Association of California, said in an Aug. 17 statement. “As the state works to integrate even more intermittent renewable energy into the grid to reduce our reliance on fossil fuels and meet our climate goals, we need long duration energy storage to ensure we have enough in-state, clean, and reliable energy to keep the lights on.”

The wildfires are not currently threatening the power system. "At least we don't have that to deal with,” Mr. Berberich said during a separate media briefing on Aug. 19.

The private equity firm Capital Dynamics, which is headquartered in Switzerland, and the Nebraska-based energy company Tenaska announced plans on Aug. 19 to develop nine battery energy storage systems with approximately 2,000 megawatts of capacity in the Cal-ISO market to "help integrate" renewables "in the light of the rolling blackouts in California.”

"California is poised for continued significant growth in energy storage demand," Benoit Allehaut, a managing director within Capital Dynamics’ Clean Energy Infrastructure team, told S&P Global Platts, adding that the state currently "relies heavily on carbon-emitting fossil-fueled power resources to meet peak energy needs, typically occurring after midday solar energy supplies drop off."

Mr. Berberich said the state has only about 200 megawatts of storage currently available.

Today is Friday, August 21, 2020, and here is today’s essential intelligence.

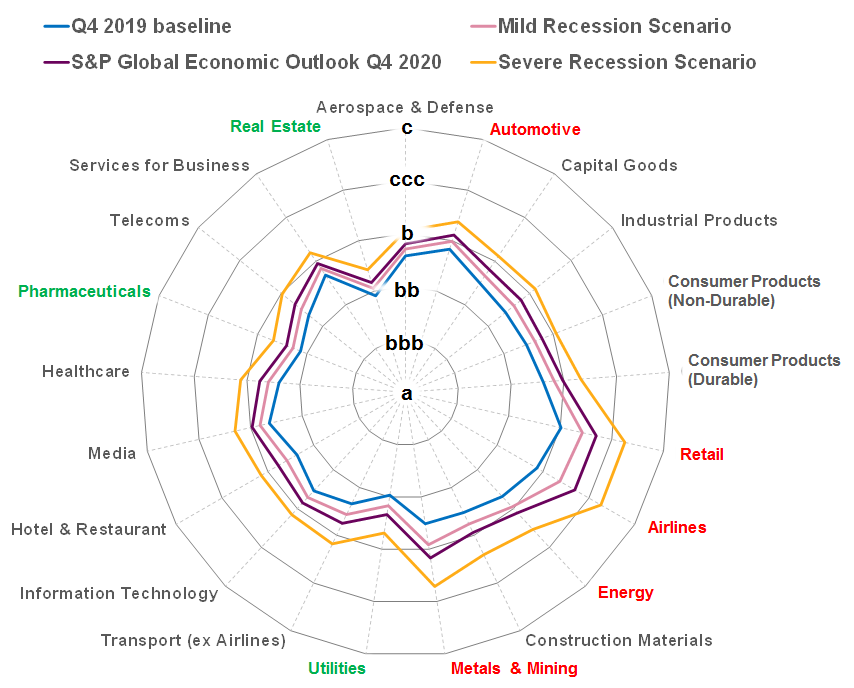

European Corporate Credit Risk Outlook; COVID-19 Pandemic and Macroeconomic Scenarios

As European countries are slowly starting to ease COVID-19 related restrictions, a bumpy road to economic recovery begins. Many European governments provided extensive support to businesses and individuals to help ease the impacts of multiple weeks of lockdowns. However, the macroeconomic projections indicate the road to recovery will be slow and twisted, as many factors will determine the final extent of the pandemic fallout.

—Read the full article from S&P Global Market Intelligence

Credit FAQ: Implications Of Brazilian Meat Processors' Juicy Second-Quarter Results

Brazil-based meat processors posted very strong second-quarter results, especially JBS S.A., Marfrig Global Foods S.A., and Minerva S.A., and to a lesser extent, BRF S.A. The COVID-19 outbreak affected consumer eating habits and production standards, but these companies were able to adjust their portfolios and channels. At the same time, their sound diversification in terms of plants and protein types offset disruption in sales.

—Read the full report from S&P Global Ratings

Swedish mortgage market grows amid pandemic; incumbent banks regain lost ground

Confining people within their homes more than ever before, the global coronavirus pandemic has left many to reconsider their housing situation. In Sweden, pandemic-related trends are not only causing mortgage lending to grow, but are also changing the dynamics of the market — and the large, incumbent banks are benefiting. The second quarter of 2020 saw an accumulative growth in mortgage loans in Sweden of 53 billion kronor, a 1.5% growth rate, according to Nordic Credit Rating. This was up from 1.3% the year before.

—Read the full article from S&P Global Market Intelligence

BankMobile digs in on banking-as-a-service model in independence

New Haven, Conn.-based BankMobile will be looking to further develop its banking-as-a-service model as a stand-alone company following its Aug. 6 sale agreement with Megalith Financial Acquisition Corp. Customers Bancorp Inc. had been trying to sell or spin off its BankMobile unit since 2015, with one other attempted sale falling through when the buyer was unable to raise enough capital. The bank's sales efforts accelerated when Customers went over the $10 billion threshold Dec. 31, 2019, said CEO Jay Sidhu. Banks below the $10 billion asset threshold are not subject to restrictions from the Durbin Amendment, which limits interchange fees on debit card transactions. Since BankMobile does not charge other account fees, the fees it receives from debit card transactions are crucial for profitability, said David Patti, director of communications and marketing at Customers Bancorp.

—Read the full article from S&P Global Market Intelligence

Nordic banks' agreement on one KYC standard a 'unique advantage' for new utility

For most businesses, the term "know your customer," or KYC, conjures dread and denotes inefficiency. In the Nordics, where the KYC burden has worsened in the wake of large money-laundering scandals, banks want to implement a standardized utility model to tackle the problem. For some companies, providing KYC documentation to their banks ties up as many as three full-time employees, delays opening accounts and causes duplication of effort, according to a survey of treasurers by Swift and EuroFinance last year. It is costing banks their corporate clients.

—Read the full article from S&P Global Market Intelligence

Fees and expenses require scrutiny from private funds in wake of SEC risk alert

Private fund managers should take an overly cautious approach to assigning fees and expenses attached to investment in their funds, particularly in the wake of the coronavirus pandemic, as the Securities and Exchange Commission maintains a laser-like focus on the issue. The warning follows an SEC Risk Alert, which said some private fund managers have inaccurately allocated fees and expenses; did not provide adequate disclosure regarding the role and compensation of operating partners; and have had issues around valuation and monitoring board, deal, fees and fee offsets. It is the second of three areas of deficiency found by the regulator's Office of Compliance Inspections and Examinations.

—Read the full article from S&P Global Market Intelligence

UK financial institutions failing to nurture a pipeline of senior female leaders

Unless financial institutions do more to foster a pipeline of senior female leaders, the U.K. is unlikely to see female leaders being appointed to CEO or other "C-suite" roles at a major bank any time soon, a new report warns. As it stands today, Alison Rose of NatWest Group PLC is the only female CEO of a large incumbent bank in the U.K., while there is not a single female board chair, according to a new report from The Pipeline, a diversity and inclusion specialist. Women make up 11% of executive committee members on main banking public limited banks as of April 17, according to the Women Count 2020 report. Though a 5% increase on the previous year, banking continues to lag other parts of the sector analyzed using this metric.

—Read the full article from S&P Global Market Intelligence

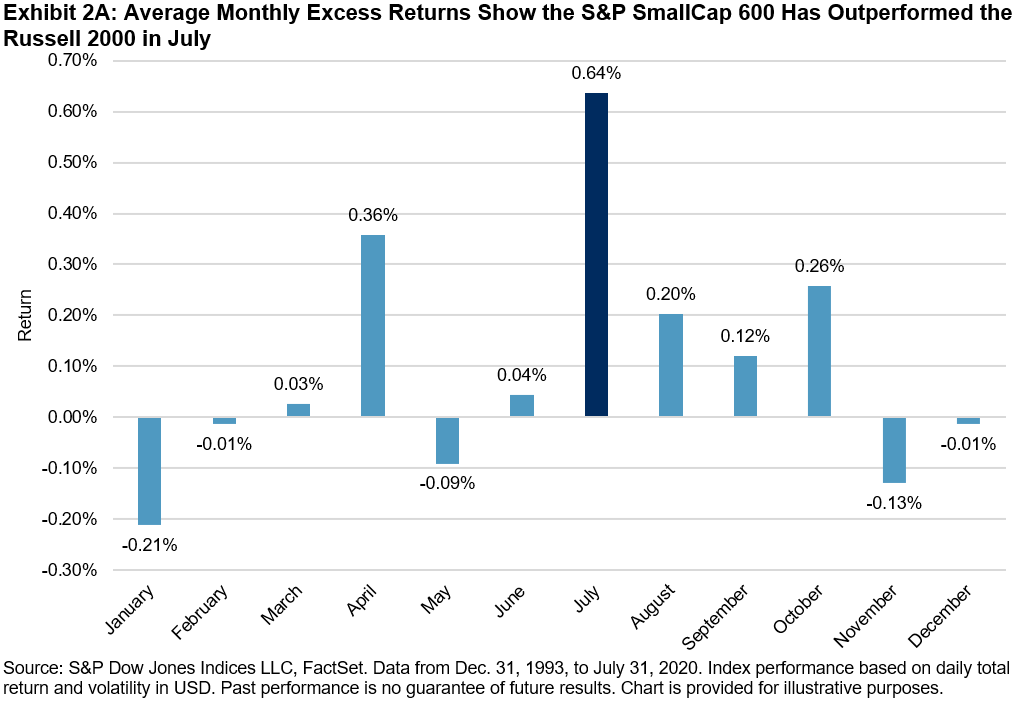

Recalled to Life: The S&P SmallCap 600’s Persistent Outperformance after the Russell Reconstitution

S&P DJI’s paper, A Tale of Two Benchmarks (first published in in 2009 and later updated in 2015 and 2019), showed that the S&P SmallCap 600® has structurally outperformed the Russell 2000, primarily benefiting from S&P DJI’s index inclusion criteria for profitability, liquidity, and public float. The paper also delves deeper into several secondary attribution analyses, including one of the most well-known market anomalies: the excess returns around the Russell reconstitution, which S&P Dow Jones Indices explores more deeply here.

—Read the full article from S&P Dow Jones Indices

Fridson on Finance: ESG, Energy companies, and downside protection for investors

A previous commentary, "ESG outperformed as COVID hit, but does not guarantee alpha," received some thoughtful press coverage. The Financial Times article generated a lively online discussion of our findings. We hope the demonstrated investor interest in this topic will encourage others to conduct research on environmental, social and corporate governance factors in high-yield returns. Many avenues remain to be explored.

—Read the full article from S&P Global Market Intelligence

Price transparency a key factor in expanding hydrogen trade flows in Asia

The outlook for hydrogen Asia-Pacific has become a lot more positive over the last six to 12 months, with companies from Australia to Japan stepping up efforts to formulate policies and plan projects in the hope that the clean fuel can play a big role in the energy transition process. But at this point there are probably more questions than answers. How quickly can new hydrogen projects come up? How fast can governments formulate polices? And how soon can trade flows and a transparent market place develop.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

'As important as oil was in the past': Hydrogen rises up the agenda in Q2

Considered a distant dream by many just a year ago, hydrogen has reached the European utility mainstream in recent months. Evidence of a gear change shone through in recent second-quarter earnings calls, as power generators and network operators outlined their planned involvement in a future market for the fuel. Policy certainty is responsible for much of the hype, with the EU's hydrogen strategy setting out the blueprint for 40 GW of installed electrolysis capacity by 2030 and national governments following suit with their own targets.

—Read the full article from S&P Global Market Intelligence

Fortescue, Hyundai and Australia's top research body to collaborate on hydrogen

Australian iron ore producer Fortescue Metals Group has inked another agreement on hydrogen in a bid to potentially scope out a new export opportunity and decarbonize its Western Australian operations. The Perth-based miner said Aug. 20 that it had signed a memorandum of understanding with South Korea's Hyundai Motor Company and Australia's main research body, the Commonwealth Scientific and Industrial Research Organisation, or CSIRO, to collaborate on renewable hydrogen technology.

—Read the full article from S&P Global Platts

Democrats eye swift action on climate if Biden wins White House

If former Vice President Joe Biden wins the presidential election in November, a significant portion of voters will be expecting bold action to implement a federal climate policy and return the US to a position of leadership in combating global warming on the world stage, speakers at the Democratic National Convention said Aug. 18. The unconventional convention, as it was dubbed by celebrity presenters and others, is taking place virtually Aug. 17-20 as the US continues to battle the coronavirus pandemic. Democrats late Aug. 18 officially nominated Biden as the party's presidential nominee, following a virtual roll-call vote that featured videos of support from delegates in every US state and territory.

—Read the full article from S&P Global Platts

Democrats adopt platform promising strong action on climate change, energy

During the second day of the Democrat's national convention, the party Aug. 18 announced that it had adopted a party platform that included planks reflecting many of the priorities of progressive climate hawks and the provisions of presidential nominee Joe Biden's climate and clean energy plan. However, the 92-page document does not include several items on the progressives' wish list, such as the elimination of fossil fuel subsidies and tax breaks or prohibitions on fracking. The convention's evening program set for Aug. 19 will address climate change and energy issues explicitly. But during events the day before, several climate action advocates touted Biden's climate platform and recommended actions he could take, if elected, in the first 100 days to help mitigate global warming.

—Read the full article from S&P Global Market Intelligence

In Calif. heatwave, dramatic conservation efforts stave off blackouts

Facing the threat of more power outages on the sixth day of a scorching heat wave, the California ISO on Aug. 19 called for residents and businesses to again power down for a significant part of the day. California's primary wholesale grid manager issued another statewide "flex alert" calling for voluntary electricity conservation from 2 p.m. to 9 p.m. PT, urging people to raise air-conditioning thermostat temperatures, delay using major appliances, turn off lights and take other measures to ease pressure on the grid." Today, we believe, will be another challenging day, but we're up to the task," Gov. Gavin Newsom said during an Aug. 19 media briefing.

—Read the full article from S&P Global Market Intelligence

Legal experts call for Congress to ban COVID-19 vaccine emergency authorizations

Congress should consider banning the U.S. Food and Drug Administration from granting emergency use authorization to experimental COVID-19 vaccines, a group of legal experts said, citing concerns over political pressure to rush those products to Americans before they are ready. The recommendation came in a lengthy report from over 50 U.S. legal and policy experts from multiple academic institutions, who outlined a number of concerns with how the nation has handled the COVID-19 pandemic, calling the response a "massive failure of executive leadership."

—Read the full article from S&P Global Market Intelligence

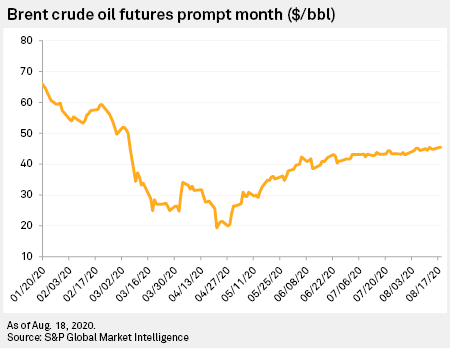

Analysts see global oil prices rebounding to pre-pandemic levels by 2021

Assuming a second coronavirus-induced lockdown is averted, global crude oil prices will continue their slow grind higher, reaching $50 per barrel by year's end and closing in on pre-pandemic levels near $60/bbl by the end of 2021, according to recent forecasts from analysts. Oil prices will advance in 2021 and trend toward a level between $55/bbl and $60/bbl by the end of 2021, Evercore ISI analyst Doug Terreson said during an Aug. 19 webinar.

—Read the full article from S&P Global Market Intelligence

Project deferrals, spending cuts set the tone during North American midstream sector earnings

UK-listed upstream junior SDX Energy -- which is focused on mostly gas-producing assets in Egypt and Morocco -- plans to scale up its business in Egypt through more drilling and possible asset acquisitions, its CEO Mark Reid said Aug. 20. In an interview, Reid said SDX had identified a "significant amount" of additional prospectivity at its flagship South Disouq concession onshore Egypt, with new exploration drilling set for late-2021/early-2022. SDX -- which started production at South Disouq in November last year -- said earlier Aug. 20 that gross production from the concession performed ahead of expectations in the first half at 50 MMcf/d (1.5 million cu m/d) of dry gas and 486 b/d of condensate.

—Read the full article from S&P Global Platts

UK's SDX looks to scale up Egypt gas business, eyes Morocco growth

The market value of mining companies grew by a median of 22.3% month over month in July, extending gains for the fourth month in a row. The industry's 25 largest players — consisting of 13 precious metals-focused companies, six base metals companies, five diversified commodities companies and a single bulk commodities company — all had higher market cap than in the previous month. Industry indexes similarly remained on the uptick month over month. The SNL Metals & Mining Index climbed 12.1% between June 30 and July 31, while the SNL Precious Metals Index rose 17.9% over the same period. The SNL Base Metals Index grew 14.0% and the SNL Diversified Mining Index gained 9.3% month over month.

—Read the full article from S&P Global Market Intelligence

South African coal industry looks toward post-coronavirus recovery

South Africa's domestic and export coal industry is tentatively bullish about a post-coronavirus recovery after weathering the initial supply disruptions and recently experiencing an increase in export demand. Speaking at the 2020 Coal Industry Day Online Edition on Aug. 20, panelists discussed the current state of coal production in South Africa, developments in key export markets as well as the future of coal in the global energy mix.

—Read the full article from S&P Global Platts

FEATURE: Moldova Set For Gas Diversity As Romania Link's Launch Imminent

The former Soviet state beholden to Russia for its gas supply for decades -- is on the verge of a new chapter in its gas history with an expanded connection linking to Romania just days from being launched. The 120-km (74-mile) pipeline from the Ungheni entry point on the border with Romania to the Moldovan capital Chisinau will enable up to 1.5 Bcm/year of gas to flow from Romania into Moldova, bringing much needed supply diversity.

—Read the full article from S&P Global Platts

China's Steel Mills Mull Altering Sinter Feed Blend As Iron Ore Hits 6-Year High

Chinese steelmakers are considering adjusting their sinter feed blending ratios as the price of popular medium grades hit multi-year highs, increasing the value-in-use advantage of high grade ores, although practical limitations make widespread changes unlikely, market sources said Aug. 19. A surge in iron ore prices over the past month on the back of tight supply for medium grade fines has narrowed the spread to high grade iron ore cargoes.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language