Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 21 Apr, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Misgivings Mount About the Almighty Dollar

Currency is necessary for global trade. Whatever the market or commodity, some form of money needs to change hands. For decades, the global reserve currency for international trade has been the US dollar. Of course, the dollar also serves as the domestic currency for the US. The dollar’s twin roles can create discomfort for participants in global trade. The decision by the US and its allies to sanction Russia over the invasion of Ukraine, especially the decision to exclude Russia from the Swift messaging network, has awoken misgivings about the dollar’s role in trade. While some countries and world leaders have begun to question the need for dollar-denominated trade, the absence of an appropriate replacement may protect the dollar’s status for a bit longer.

During a recent episode of the “Platts Oil Markets” podcast from S&P Global Commodity Insights, commodity investor Jim Rogers of Beeland Interests and three S&P Global oil market experts had a wide-ranging discussion on the role of the dollar. The episode, titled “Non-dollar oil trade: a distant dream or a feasible reality?,” focused on the discomfort over US sanctions and the possibility of the Chinese renminbi eventually replacing the dollar.

Sanctions have become a preferred tool of US diplomacy. The range of sanctioned countries poses a particular challenge for participants in oil markets. Sanctions against Russia have intensified and sanctions against Iran and Venezuela remain in place. While these sanctions are unproblematic for an oil exporter such as the US, oil importers such as India and China are reluctant or unwilling to join the US and its allies in imposing sanctions. Some observers suggested the limited participation in the sanctions regime against Russia has damaged the effectiveness of sanctions as a deterrent and fostered concerns about the potential weaponization of dollar-based international trade. While Russia failed in early 2022 to successfully demand payment in rubles for natural gas, other countries are wondering if non-dollar trade is feasible.

Given the size of the Chinese economy and its pivotal position within international trade, it is unsurprising that the renminbi is being examined as a potential replacement for the dollar. According to S&P Global Market Intelligence Chief China Economist Todd C. Lee, discussions are intensifying around the potential emergence of the renminbi as a major reserve currency, although challenges remain. The renminbi accounted for 4.3% of total foreign exchange trades in 2019, according to the Bank for International Settlements. The dollar, by way of contrast, accounted for 88.3% of all trades. Maintaining tight discipline over a domestic currency is quite difficult when that currency is used extensively for international trade, as the US has learned, sometimes to its detriment. Beijing has not shown much inclination to hand over the renminbi to the vagaries of international trade.

However, international discomfort about the dollar’s role continues to grow. During a recent state visit to China, President Luiz Inácio Lula da Silva of Brazil questioned the need for dollar-denominated trade. This followed the Brazil-China Economic Seminar in Beijing, at which over 20 agreements were signed to facilitate and expand bilateral trade between the two countries. It is notable that China and Brazil have resisted efforts by the US and its allies to join in sanctioning Russia.

Today is Friday, April 21, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

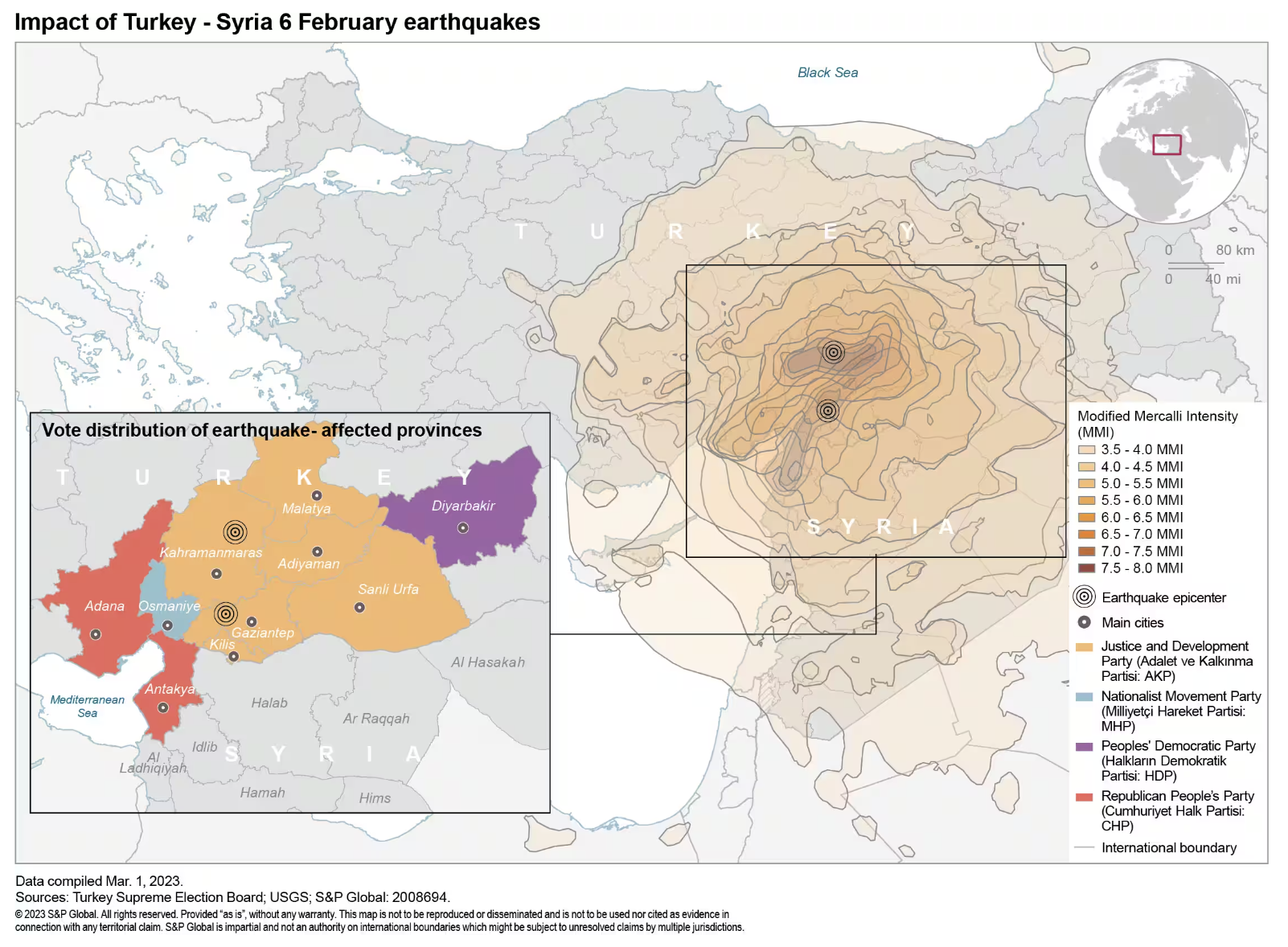

Political Scenarios For Turkey’s Presidential And General Elections

Turkey's joint presidential and general elections are scheduled for May 14, brought forwards from June to avoid the Hajj pilgrimage and university exam season to enable an increased voter turnout. A second-round vote for the presidency will occur on May 28, if no candidate achieves over 50% of the vote. The results will determine whether the government continues with a presidential system under incumbent President Recep Tayyip Erdoğan and his Justice and Development Party (Adalet ve Kalkınma Partisi: AKP)-led "People's Alliance" or elects Republican People's Party (Cumhuriyet Halk Partisi: CHP) opposition presidential candidate Kemal Kılıçdaroğlu and the ideologically diverse, six party CHP-led "Nation Alliance."

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

European Banks To Keep Calm, Carry On With Billions In Buybacks, ECB Repayments

European banks are preparing to deliver on massive share buyback plans and repay hundreds of billions of euros in cheap central bank funding as they look to calm investors spooked by recent turmoil in the sector. Meanwhile, regulators have cautioned banks to be conservative with dividends and buybacks in the wake of the collapse of California-based Silicon Valley Bank (SVB) and UBS Group AG's emergency takeover of Credit Suisse Group AG. Dangers have also been highlighted regarding the repayment of funds from the ECB's third targeted longer-term refinancing operations program (TLTRO III), which could cause a shortfall in liquidity at some banks.

—Read the report from S&P Global Market Intelligence

Access more insights on capital markets >

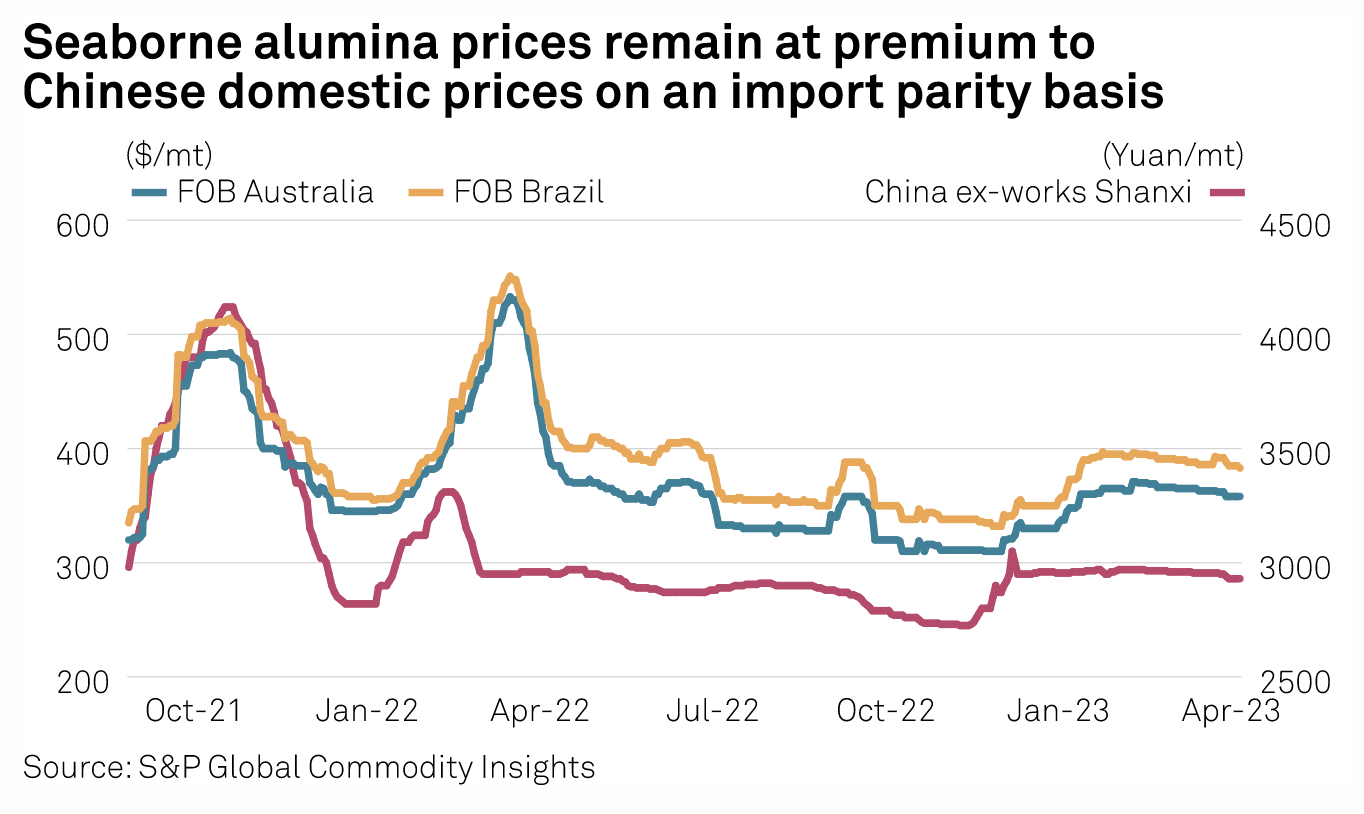

Q2 Alumina Balance Hinges On Supply Disruption Risks, Lackluster Aluminum Demand

Supply disruption risks and lackluster downstream aluminum demand are expected to circumscribe global alumina price moves in the second quarter of 2023, following gains in the first quarter on the back of output curtailments and stockpiling activity. The first quarter saw supply interruptions in the Pacific and Atlantic basins in the form of a force majeure involving the Kwinana Alumina Refinery in Western Australia and a belt system failure at Brazil's Alumar refinery.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

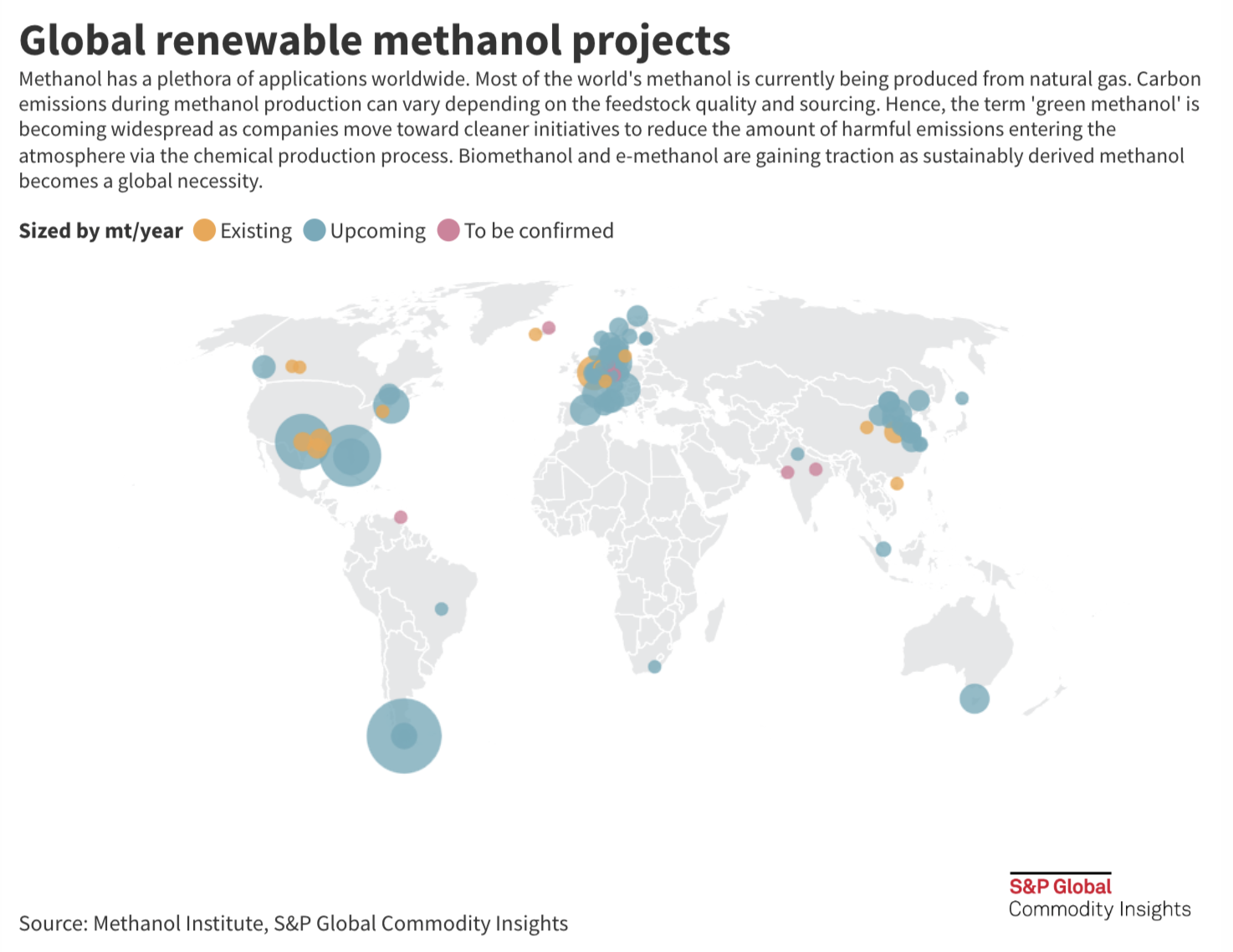

Global Initiatives Shaping The Future Of Green Methanol Production

Demand for green methanol, a more sustainable and functionally equivalent alternative to conventional methanol, is projected to grow substantially on the back of its growing popularity primarily as a marine fuel as the world focuses on cutting down carbon emissions. Methanex, the world's largest methanol producer, estimated that global methanol demand was approximately 88 million mt in 2022 and is expected to grow at a CAGR of approximately 3% or more than 14 million mt over the next five years. This increase would be supported by a gradual shift to renewable methanol.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Listen: Italy’s Eni Finds Success In Mexico’s Oil Upstream

Italy's Eni has been one of the most successful drillers in Mexico. One of many E&P companies active in Mexico's upstream auctions following the country's 2013-2014 liberalization, Eni was the first independent to produce in Mexican waters in 2019. Most recently, Eni announced a 200 million boe discovery at the Yatzil well in the Salina sub-basin, and has just been given approval to drill another offshore exploration well. Jeff Mower, director of Americas oil news, and Sheky Espejo, Mexico energy correspondent, discuss what Eni's success means for Mexico's struggling oil output.

—Listen and subscribe to Platts Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

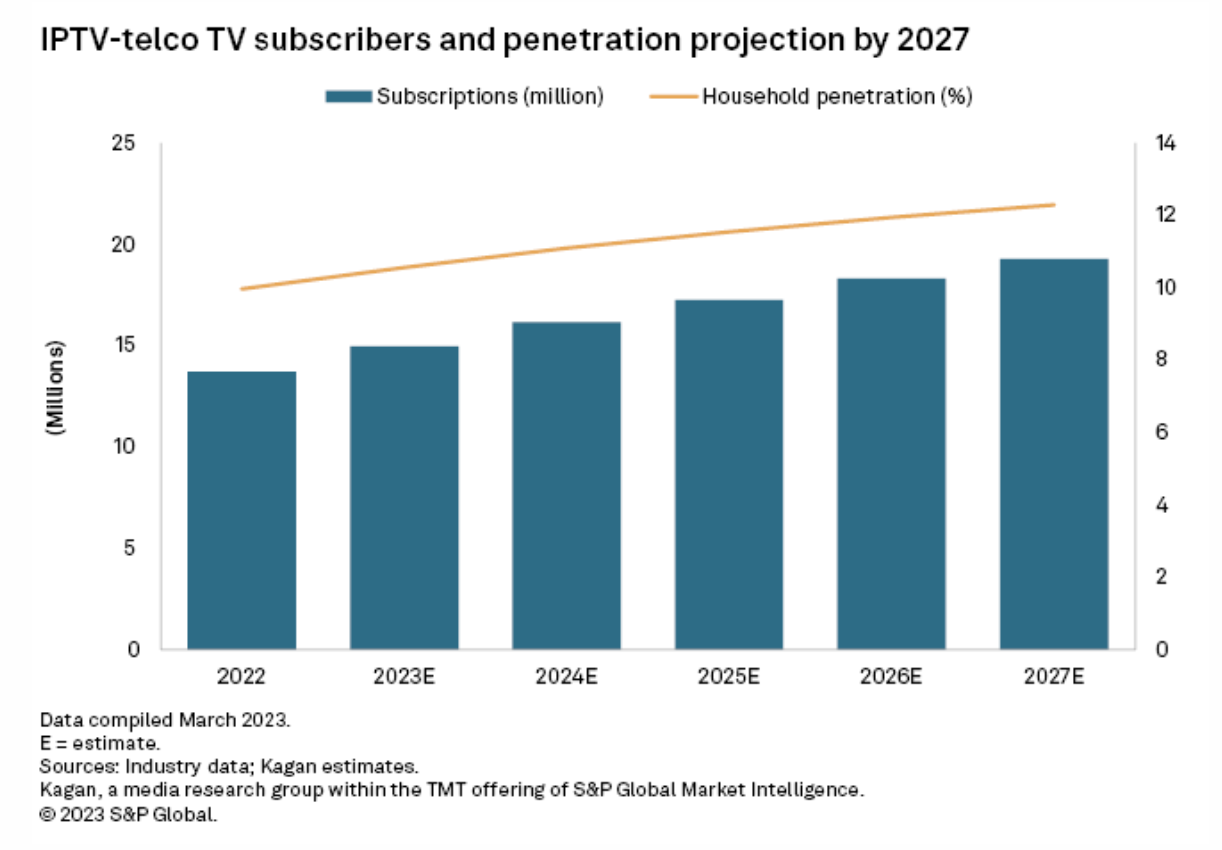

Bundle Offers Push IPTV Growth In Southeast Asia, IPTV To Lead By Year-End 2023

Cable has been Southeast Asia's longest-reigning top pay TV platform. In 2023, however, S&P Global Market Intelligence’s data show that cable's dominance is expected to end as IPTV takes over the spot with a 33.7% subscriber share of multichannel households. Southeast Asian telco operators from Indonesia, Malaysia, Singapore, Thailand and Vietnam invest in offering IPTV and fiber broadband bundles, and give IPTV and the multichannel sector, in general, room for growth in the coming years.

—Read the article from S&P Global Market Intelligence