Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 1 Apr, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Introducing his administration’s $2 trillion infrastructure plan as “a once-in-a-generation investment in America” and “the largest American jobs investment since World War II,” President Joe Biden aims to make the U.S. economy more competitive and the country’s infrastructure and energy systems more resilient to the physical effects of climate change over the next decade.

Although the White House will still need to collaborate with Congress to draft the comprehensive legislation, the American Jobs Plan could transform the U.S. energy landscape if it can survive Republican opposition (and perhaps reluctance from some Democrats) alongside pushback from the oil and gas industry. Its provisions call for creating a federal energy-efficiency and clean- electricity standard, manufacturing electric vehicles and advancing charging infrastructure, and plugging abandoned oil and gas wells and reclaiming old coal, hard rock, and uranium mines across the nation, among others.

Last year, the U.S. suffered 22 weather and climate disasters, each with losses that surpassed $1 billion and in total the most extreme events on record, according to the National Oceanic and Atmospheric Administration.

"Whether it's freezing in Houston, or fires in California, or lack of clean water in Michigan, good infrastructure is critical to the energy transition ," Billy Gridley, a director in the Ceres investor network, said at a virtual panel sponsored by the sustainability nonprofit on March 25, according to S&P Global Platts. "Biden's whole-of-government and whole-of-society climate approach is a bright window of opportunity in energy and infrastructure. So we need an infrastructure blitz ... to build the new green, and green the old gray."

President Biden proposed financing the infrastructure investments through targeted tax increases, primarily on corporations.

"Historically, changes to the tax code have always been a part of an infrastructure discussion, and without question, we anticipate that changes to tax policy are going to be an important piece of the discussion both on transportation infrastructure and energy infrastructure," Louis Finkel, senior vice president of government relations for the National Rural Electric Cooperative Association, told S&P Global Market Intelligence. "We believe it's an appropriate conversation to be had.”

The American Society of Civil Engineers gave the U.S. economy a ‘C-’ grade in its latest quadrennial report card on infrastructure, citing the growing risk of extreme weather impacting transmission and distribution infrastructure as a major concern. This marked the first time in 20 years that the U.S. received anything higher than a ‘D’ grade, but the group said more investment is critical.

"This is not a report card anyone would be proud to take home," Thomas Smith, executive director of the ASCE, said in a March 3 statement announcing the report. "We have not made significant enough investments to maintain infrastructure that in some cases was built more than 50 years ago.”

Such a sizable infrastructure investment is needed to aid in the post-pandemic recovery now and into the future to expand the U.S.’s GDP, fuel job growth, and boost productivity, according to S&P Global Ratings Chief U.S. Economist Beth Ann Bovino.

“A $2.1 trillion boost of public infrastructure spending over a 10-year period, to the levels (relative to GDP) of the mid-20th century, could add as much as $5.7 trillion to the U.S. over the next decade, creating 2.3 million jobs by 2024 as the work is being completed. The additional 0.3% boost to productivity per year that it generates will lead to a net 713,000 more jobs on the books by 2029,” Dr. Bovino said in research published last May. “GDP growth in the past 10 years floundered at around 2.25%—one-third the rate of 1959 when the Eisenhower Interstate Highway System was built. The opportunity to build infrastructure (and create jobs) during the Great Recession in 2009 was missed. Right now, the U.S. may have a second chance.”

Today is Thursday, April 1, 2021, and here is today’s essential intelligence.

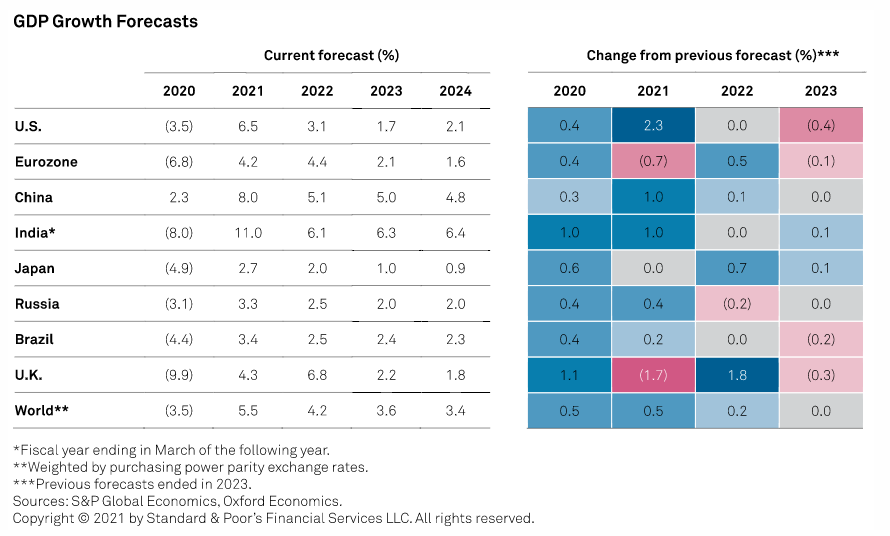

Global Economic Outlook Q2 2021: The Recovery Gains Traction as Unevenness Abounds

The economic recovery from COVID-19 looks set to accelerate in mid-2021, particularly in the U.S. on the back of a massive fiscal stimulus plan, although a high degree of unevenness and uncertainty persists. S&P Global Ratings revised its 2021 global GDP growth forecast up by 50 basis points, to 5.5%, reflecting brighter prospects for North America, China, and India. 2020 growth was revised up as well.

—Read the full report from S&P Global Ratings

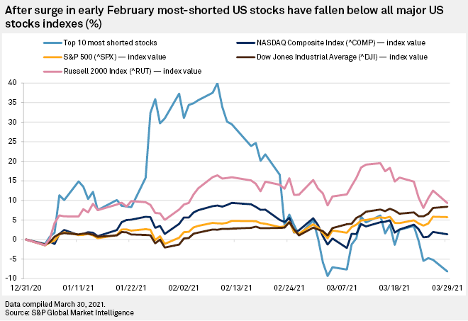

After Steep Rise, Most-Shorted U.S. Stocks Tumble Below Index Gains

After skyrocketing amid GameStop Corp.'s epic short squeeze and the retail trading mania that followed, the collective share prices of the most-shorted stocks in U.S. markets have tumbled, falling below the performance of the leading equity indexes.

—Read the full article from S&P Global Market Intelligence

'Exit 2.0' For Tech: Making Sense of Spacs

To understand the disruption SPACs are causing – and are likely to continue to cause – it's revealing to contrast the current market power of these acquisition vehicles with their decidedly humble origins several decades ago. They weren't all born in boiler rooms, of course, but few of the blank-check firms in the early days could claim any true Wall Street lineage.

—Read the full article from S&P Global Market Intelligence

Singapore Aims Tighter Rules Than U.S. to Attract Blank-Check Listings

Singapore Exchange Ltd. started a public consultation on March 31 for a regulatory framework for listing special purpose acquisition companies, which are skeleton organizations that launch with the intention of buying and reverse merging with a private company. Under the proposed rules, investors in these companies won't be allowed to cash out as soon as the SPAC merges with a private entity, and sponsors won't be allowed to vote on a business combination, two key departures from the regulation in the U.S.

—Read the full article from S&P Global Market Intelligence

Listen: Fixed Income in 15 – Episode 17

On the latest episode of Fixed Income In 15, Joe Cass is joined by Mohamed El-Erian, Chief Economic Advisor at Allianz and Martina Cheung, President of S&P Global Market Intelligence. There was lively conversation about ESG, Central Banks and the future of #markets in a post-pandemic world. There was also time to discuss personal insights, such as Mohamed’s experience of working for President Obama and what advice Martina would give to her teenage self.

—Listen and subscribe to Fixed Income in 15, a podcast from S&P Global Ratings

Global Credit Conditions Q2 2021: The Risks of an Uneven Recovery

Credit conditions should remain largely favorable across regions, as major central banks seem poised to support market liquidity well into 2023. In addition to strong central bank support, an improving economic outlook and vaccine progress are underpinning these favorable conditions. Against this backdrop, forward-looking credit trends point to a marked improvement.

—Read the full report from S&P Global Ratings

Credit Conditions Emerging Markets Q2 2021: Brighter Prospects Prone to Setbacks

Credit conditions in emerging markets (EMs) look brighter than last year, given that developed economies' recovery accelerates and vaccination progresses. These factors are supporting EMs' external demand and industrial activity. Nevertheless, many sectors will continue struggling amid an uneven economic recovery and lackluster domestic demand.

—Read the full report from S&P Global Ratings

Credit Conditions Europe Q2 2021: New Horizons, Old Risks

European credit conditions remain generally favorable but imbued with uncertainty around the evenness of the recovery path and how long it will take.

—Read the full report from S&P Global Ratings

Can European Retail Property Owners' Belt-Tightening Save Ratings From COVID and E-Commerce Headwinds?

European retail property companies reported a 15% drop in like-for-like rental income and a 6% decline in property value on average in 2020, amid COVID-19-related headwinds and intensifying e-commerce competition.

—Read the full report from S&P Global Ratings

Listen: Beyond the Buzz - Transition Finance: The Sustainable Debt Market’s Newest Tool

Corinne Bendersky chats with S&P Global Ratings Senior Research Fellow Mike Wilkins about transition finance, a newer development in the sustainable debt markets aimed at helping companies—especially those in “hard-to-abate” sectors—improve processes and invest in technologies to help reduce their carbon footprints. They delve into what transition bonds are and how they work, especially in relation to the new sustainability-linked asset class. Plus, how will transition finance evolve to meet global climate challenges?

—Listen and Subscribe to Beyond the Buzz, a podcast from S&P Global Ratings

Public Funds 'Must De-Risk Climate Projects In Developing World': IEA Summit

Public funds must be pooled to de-risk decarbonization projects in regions penalized by high interest rates, Canada's Minister of Natural Resources Seamus O'Regan told the IEA's Net Zero Summit March 31.

—Read the full article from S&P Global Platts

Nearly Half of UK's 100 Biggest Companies Link Executive Pay to ESG Measures

Nearly half of the U.K.'s 100 largest companies now use an environmental, social and governance measure when setting targets for executive pay, a sign of the growing acceptance of sustainability metrics in corporate boardrooms, according to a new report.

—Read the full article from S&P Global Market Intelligence

The Evolution of ESG Factors in Credit Risk Assessment: Social Issues

In the first blog, S&P Global Market Intelligence discussed how environmental, social, and governance (ESG) factors are becoming important considerations when assessing the credit risk of different industries and companies around the world.

—Read the full article from S&P Global Market Intelligence

Amazon Faces Labor Backlash In Europe As Worker Union Vote Proceeds In U.S.

As a historic vote count gets underway to determine whether Amazon.com Inc. workers in Alabama will form a union, the company is facing increasing resistance from its already unionized employees across Europe.

—Read the full article from S&P Global Market Intelligence

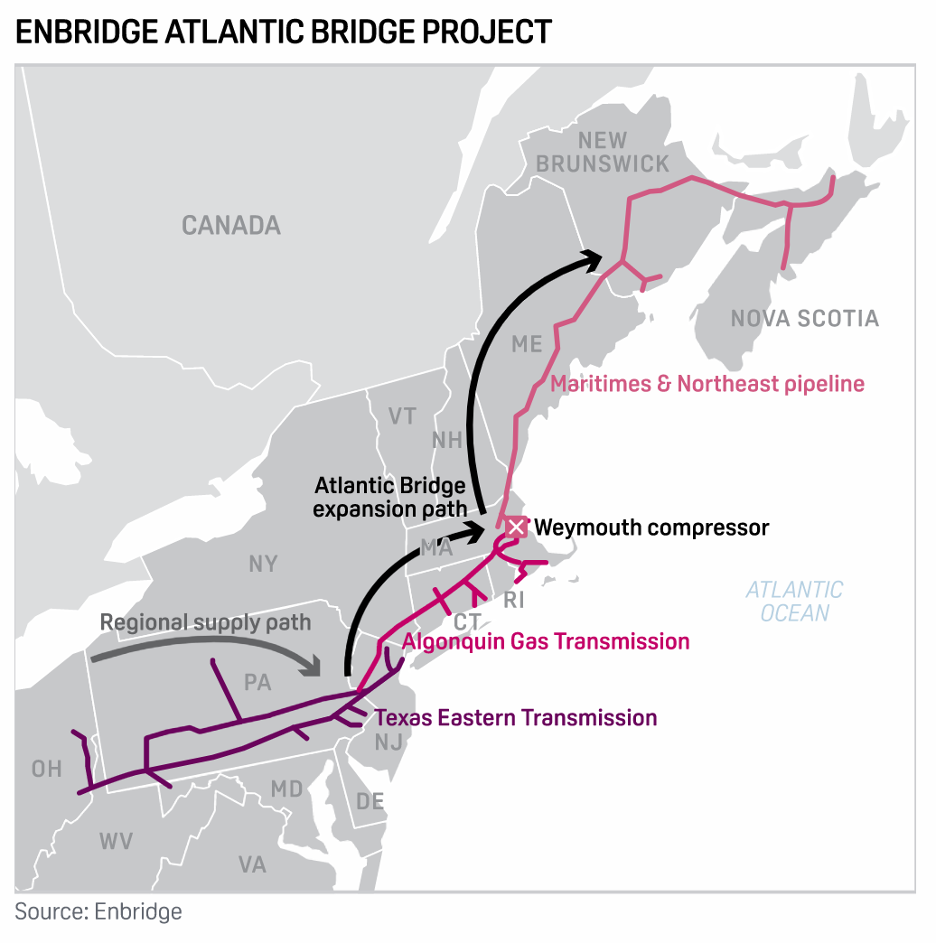

Senator Barrasso Presses FERC on Authority to Revisit Gas Pipeline Certificates

Senate Energy and Natural Resources Committee Ranking Member John Barrasso is questioning the Federal Energy Regulatory Commission about its authority to revisit final natural gas pipeline certificate orders in light of a recent decision that has sparked industry warnings of a threat to the finality needed for large infrastructure investments.

—Read the full article from S&P Global Platts

Oil Market Buffers Can Withstand Looming Supply Risks: IEA's Bosoni

The oil market is well positioned to avoid a supply crunch in the coming years despite a growing disconnect between upstream investment and oil demand growth, the head of the International Energy Agency's oil market division Toril Bosoni told S&P Global Platts in an interview.

—Read the full article from S&P Global Platts

Global Air Travel Still on Recovery Path but Outbreaks Cloud Jet Demand Outlook

Global air traffic is staging a steady comeback but remains 36% below pre-pandemic levels, tracking data shows, as the threat of new regional lockdowns and COIVD-19 variants looms over the oil demand recovery outlook.

—Read the full article from S&P Global Platts

Russia to Remain Dominant Gas Supplier for Europe to 2040: Platts Analytics

Russia is set to remain the dominant gas supplier to Europe up to 2040, according to the latest long-term European gas outlook from S&P Global Platts Analytics.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language