Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 12 May, 2020

By Koel Ghosh

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

In the battle against the COVID-19 pandemic, the importance of healthcare has gained significance. Markets are witnessing new trends across asset classes, while meeting new challenges. Asset-allocation strategies are being reviewed to adjust to the new conditions. Equity sectors are facing the heat of these unprecedented times, but some trends are similar for both global and Indian markets.

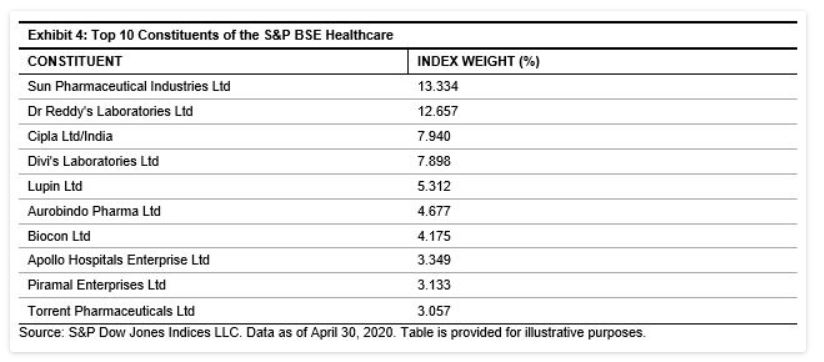

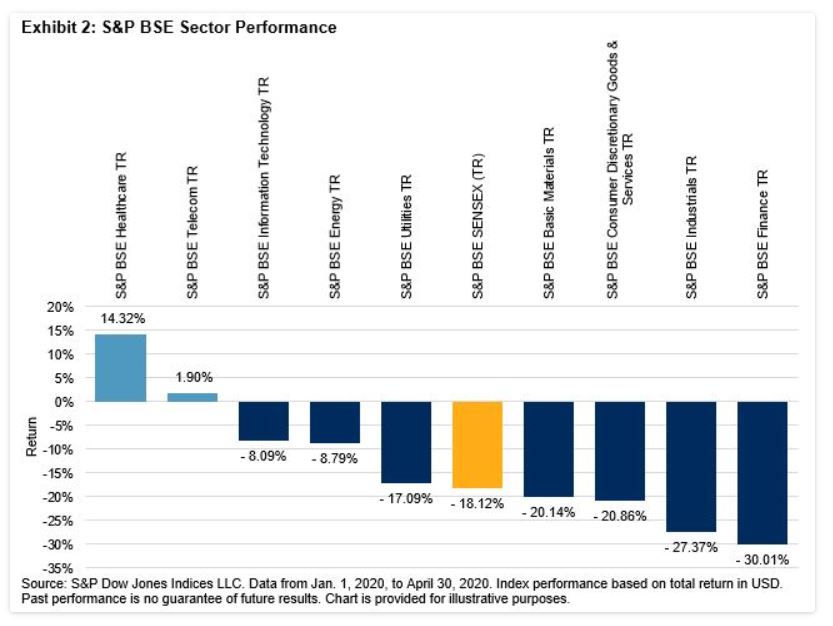

The Health Care sector has been one such case. Not only has it outperformed over these past few months of uncertainty, but it also has had a good historical track record. Comparing the Health Care sectors of the Indian and U.S. markets, similar trends of outperformance versus their benchmarks were visible over different time periods. In the U.S. market, the Health Care Select Sector, which consists of all components of the S&P 500® that are classified in the Health Care sector, had a 10-year annualized return of 14.63%, as compared with an 11.69% return from the S&P 500. In Indian markets, the S&P BSE Healthcare had a 10-year annualized return of 11.11%, as compared with a 6.74% return from the S&P BSE SENSEX (as of April 30, 2020). A study on the Australian market and its Health Care sector performance relative to its benchmark showed similar trends (read more here).

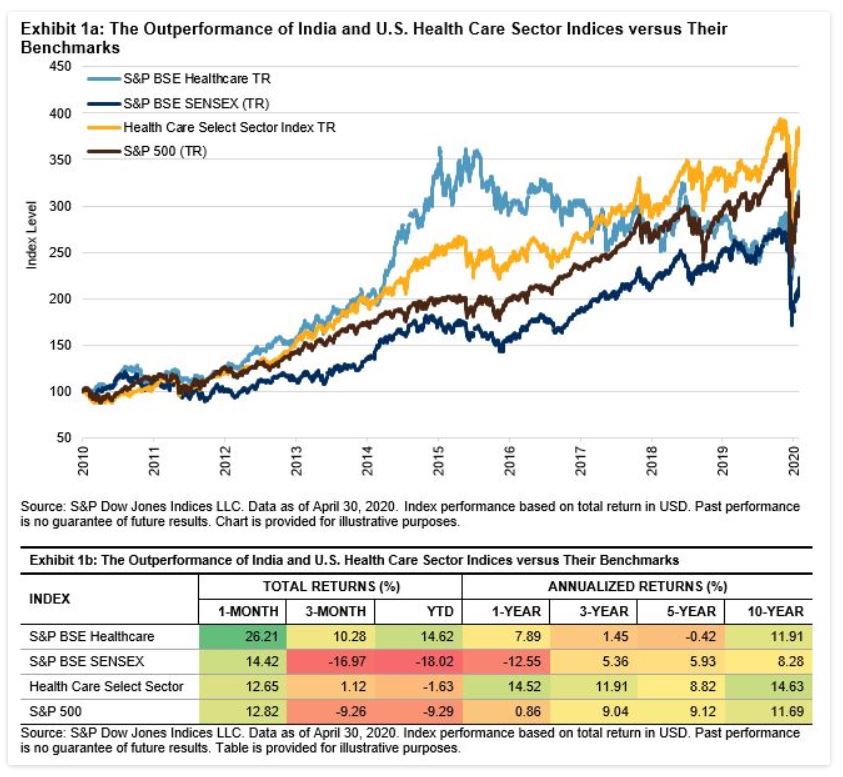

A comparison of the Health Care sector performance since January 2020 revealed that the majority of the sectors in the S&P BSE SENSEX, other than Health Care and Telecommunications, underperformed, including the S&P BSE SENSEX itself. The S&P BSE Finance, at -30.01%, and S&P BSE Industrials, at -27.27%, reflected the top sector laggards. The S&P BSE SENSEX, at -18.12%, was well below the S&P BSE Healthcare, which returned 14.32% for the period from Jan. 1, 2020, to April 30, 2020.

Taking an overview of this sector relative to other Indian benchmarks, such as the S&P BSE 100 and S&P BSE 500, further reflected the consistent outperformance of the S&P BSE Healthcare.

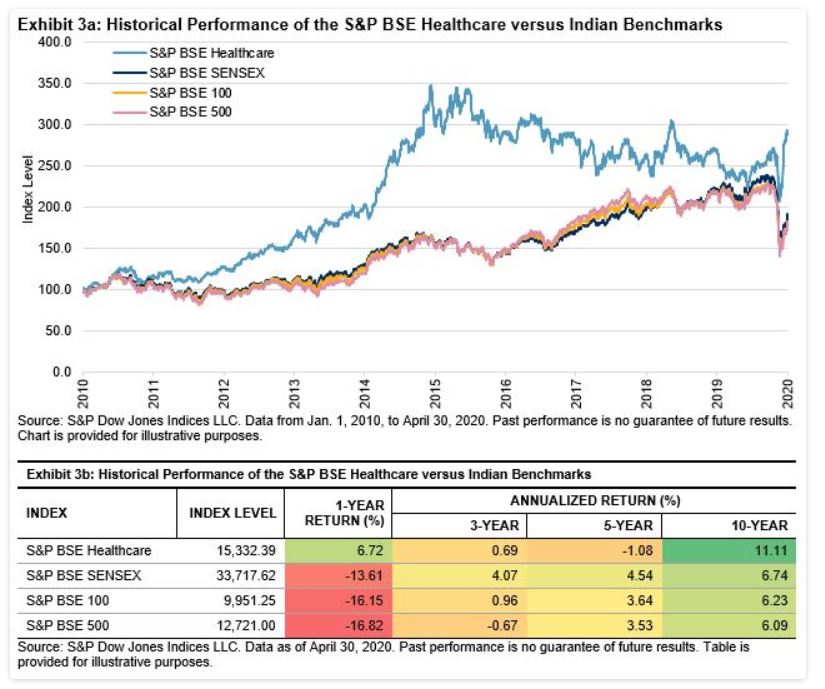

Of the 69 constituents in the S&P BSE Healthcare, the top 10 constituents were 65.53% of the total index weight as of April 30, 2020. Sun Pharmaceutical Industries Ltd and Dr. Reddy Laboratories, with index weights of 13.33% and 12.65%, respectively, constituted the top weights in the index.