Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 18 May, 2020

By S&P Global

Seventy-five corporates around the world have defaulted this year. Last week, seven companies—including New Jersey-based rental car service Hertz, Bermudian diamond company Petra Diamonds, and New York-based makeup giant Revlon—defaulted, putting the year-to-date global tally at the highest level since the 2008-2009 financial crisis, according to S&P Global Ratings.

Credit measures for many companies likely won’t recover from the crisis’ downside risks and effects until late-2021.

Since mid-March, S&P Global Ratings has taken negative ratings actions on more than 80% of 53 U.S. durable-goods and apparel makers, which heavily rely on consumer spending. Overall retail sales in the country declined by an unprecedented 16.4% in April, according to the U.S. Commerce Department. The Federal Reserve’s April 30 revision to thresholds for revenue and employee count for its Main Street Lending Program will help dozens of retailers and consumer companies previously too large to qualify for loans, according to a S&P Global Market Intelligence analysis.

While North American banks entered the crisis with some of the highest levels of capital, liquidity, and profitability seen in decades, earnings for U.S. and Canadian banks rated by S&P Global Ratings declined in the first quarter by nearly 70%. This is largely due to weakened confidence in the economy. However, North American banks have made up just 17% of total ratings actions on banks taken by S&P Global Ratings so far during the pandemic.

Unpredictable market volatility and tougher financing conditions means that U.S. finance companies will likely see rising financing costs as they aim to address maturities and refinance debt. Approximately $43.8 billion of debt—79% of it speculative-grade—will mature in the next five years for 53 of the U.S. finance companies rated by S&P Global Ratings. While this debt represents a small fraction of the more than $1 trillion in financial services debt that will come due, S&P Global Ratings sees the role of these U.S. nonbank finance companies increasing in importance as they provide funding and liquidity to leveraged borrowers. This risk of rising financing costs may translate to less credit availability across leveraged borrowers.

“For the economy to fully recover, people will have to be fully confident. And that may have to await the arrival of a vaccine,” Fed Chairman Jay Powell said in a CBS News interview yesterday. “Assuming there is not a second wave of the coronavirus, I think you will see the economy recover steadily through the second half of this year.”

The Fed chairman said that while a full recovery for the U.S. economy will happen, “it may take a while” and could “could stretch through the end of next year.”

By loosening its lockdowns and reopening much of its economy, Italy is “taking a calculated risk, aware that the contagion curve could rise again,” Prime Minister Giuseppe Conte said Saturday. “We are confronting this risk, and we need to accept it, otherwise we would never be able to relaunch” because the country “cannot wait for a vaccine.”

“There remains a very long way to go, and I must be frank that a vaccine might not come to fruition,” U.K. Prime Minister Boris Johnson wrote in a Mail on Sunday article. “We have to acknowledge we may need to live with this virus for some time to come.”

S&P Global Ratings anticipates that while negative outlooks on European banks are likely to increase, downgrades due to the coronavirus crisis will be limited this year. This is due to banks’ strong capital and liquidity and the support they will continue to receive from public authorities to encourage lending to both households and corporates. The forthcoming quarters will reveal the differences in banks’ provisions against credit losses, as evidenced by first quarter earnings showing some banks had taken more conservative approaches in estimating expected credit losses in their loan portfolios. High loan-impairment charges, or capital set aside in anticipation of customers’ unfulfilled or late repayments, that ultimately dents banks’ profits, will likely be seen across most European banking sectors in the second quarter.

While Europe faces the steepest recession in a lifetime, S&P Global Ratings expects that the gradual recovery next year will be markedly stronger than the recovery from the great financial crisis. Actions taken by the European Central Bank and national central banks have limited credit conditions’ deterioration. The recovery will likely see supportive and extremely loose monetary policy.

Banks in emerging markets are additionally exposed to risks, including their high reliance on external funding, concentrated economies, governments' lack of capacity to provide support, and higher risks of social tensions.

Emerging markets are emulating actions taken by the U.S. and Europe. Fernando Alonso, a spokesman at Banco Central de la República Argentina, told S&P Global Market Intelligence that banks in Argentina approved 199.7 billion pesos ($8.3 billion) of small- and medium-enterprise working capital loans from March 19 to May 6—equivalent to 9.6% of the country’s entire banking system's peso-denominated loans to the private sector, including those to individuals, according to BCRA central bank data.

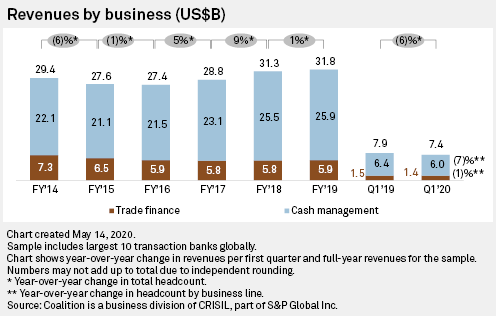

Globally, total revenues across the world’s top 10 global transaction banks fell in the first quarter by 6% year-over-year to $7.4 billion, the first decline in three years, according to research company Coalition. “We won't be surprised if we see a decline in every product in the second quarter," Eric Li, research director at Coalition, told S&P Global Market Intelligence.

More than 4.7 million coronavirus cases have been confirmed worldwide and more than 315,000 people have died, according to Johns Hopkins University data.

Today is Monday, May 18, 2020, and here is today’s essential intelligence.

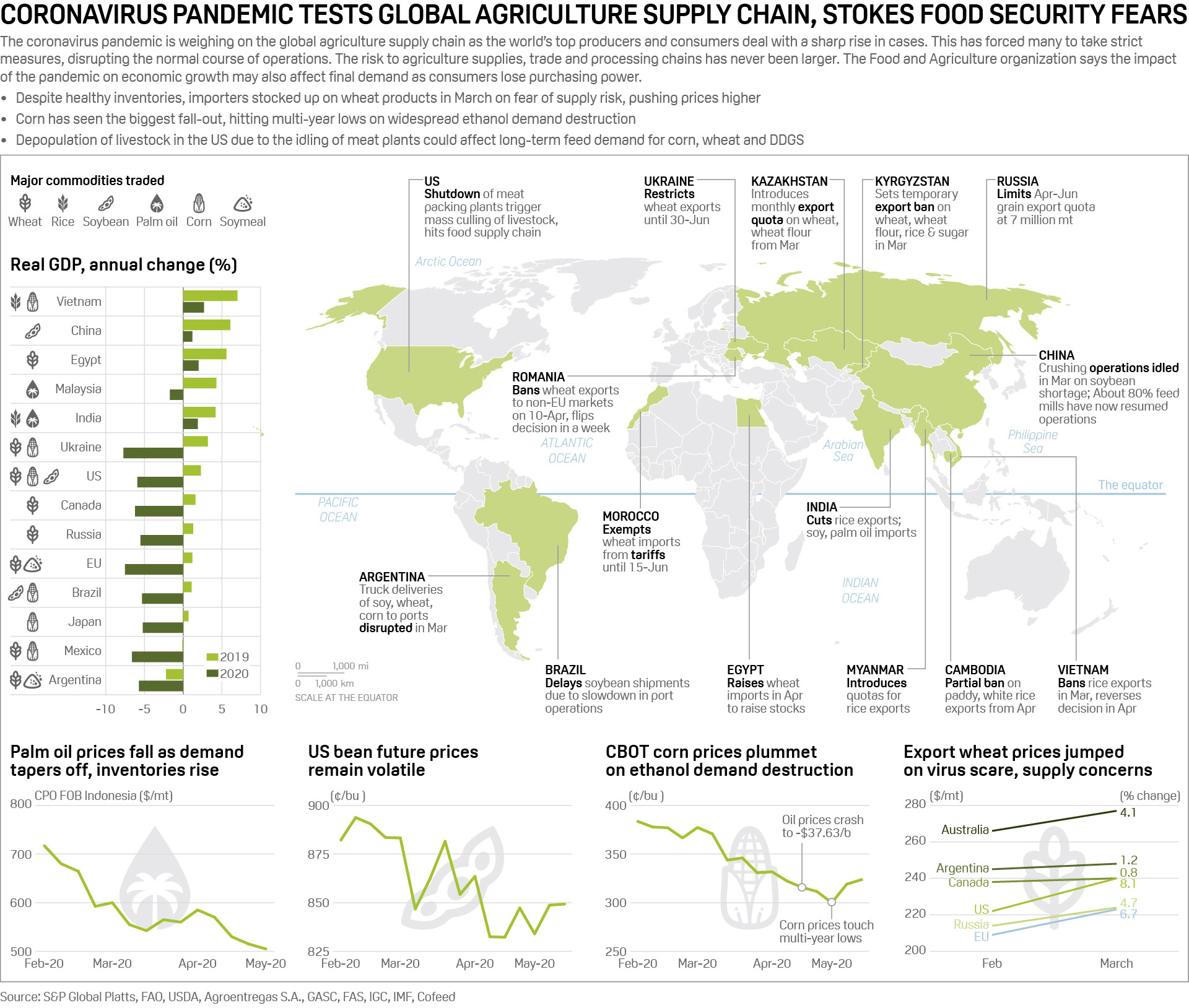

Coronavirus pandemic tests global agriculture supply chain, stokes food security fears

The coronavirus pandemic is weighing on the global agriculture supply chain as the world's top producers and consumers deal with a sharp rise in cases. This has forced many to take strict measures, disrupting the normal course of operations. The risk to agriculture supplies, trade and processing chains has never been greater. The Food and Agriculture organization says the impact of the pandemic on economic growth may also affect final demand as consumers lose purchasing power.

—Read the full article from S&P Global Platts

Economic Research: Government Job Support Will Stem European Housing Market Price Falls

S&P Global Ratings expects house prices to decline in all but one market this year due to the economic effects of the COVID-19 pandemic. Yet, by 2022 all markets except one should return to relatively strong house-price growth. Large-scale job support schemes deployed by governments across Europe will contain the rise in unemployment rates and, hence, the fall in house prices. Swift central bank action has limited the deterioration in credit conditions, and monetary policy should remain extremely loose and supportive, even as economies recover.

—Read the full report from S&P Global Ratings

May retail market: Historic US sales drop in April; 9 companies go bankrupt

U.S. retail sales plunged by a record 16.4% in April from the prior month as the coronavirus pandemic kept consumers at home. However, experts say the drop is likely the worst of the worst even as the sector faces an uncertain recovery. "This report was always going to be terrible, but it likely marks the floor, given the gradual reopening now underway or soon to be underway in 42 states," Ian Shepherdson, chief economist at Pantheon Macroeconomics, wrote in a research note. Meanwhile, as retail layoffs continued to mount, the pandemic triggered a wave of casualties across the sector as nine companies went bankrupt in late April through mid-May, according to an S&P Global Market Intelligence analysis. This includes high-profile filings by brick-and-mortar retailers J.Crew Group Inc., Stage Stores Inc. and Neiman Marcus Group Inc.

—Read the full article from S&P Global Market Intelligence

Dining out: April US restaurant sales fell nearly 50% amid widespread closures

U.S. restaurant and bar sales plummeted nearly 50% in April as coronavirus business restrictions continued to keep dining rooms shuttered and most people wary of public spaces. The sales decline brought spending at eating and drinking places to its lowest level since October 1984, according to the National Restaurant Association. Meanwhile, more than 5 million food service employees lost their jobs in April. As part of its ongoing response to the crisis, the U.S. eased eligibility criteria for the Federal Reserve's Main Street Lending Program, and Congress is debating a $3 trillion relief package that Democrats proposed May 12.

—Read the full article from S&P Global Market Intelligence

China-Australia tensions rattle world's most co-dependent trading relationship

Australian Prime Minister Scott Morrison sparked China's ire late April by demanding an international investigation into the source of the coronavirus. The two countries have been trading rhetorical blows ever since, compounding tensions that have gradually ratcheted up over the past two years. On Thursday, strident government-backed Chinese tabloid the Global Times described Australia as being "blinded by lust to act as a US attack dog" that threatened to "destroy ties" with its most important trading partner. Australia relies hugely on China for inbound tourism and foreign students. But most importantly, China is the major customer of Australian commodities, and increasingly energy.

—Read the full article from S&P Global Platts

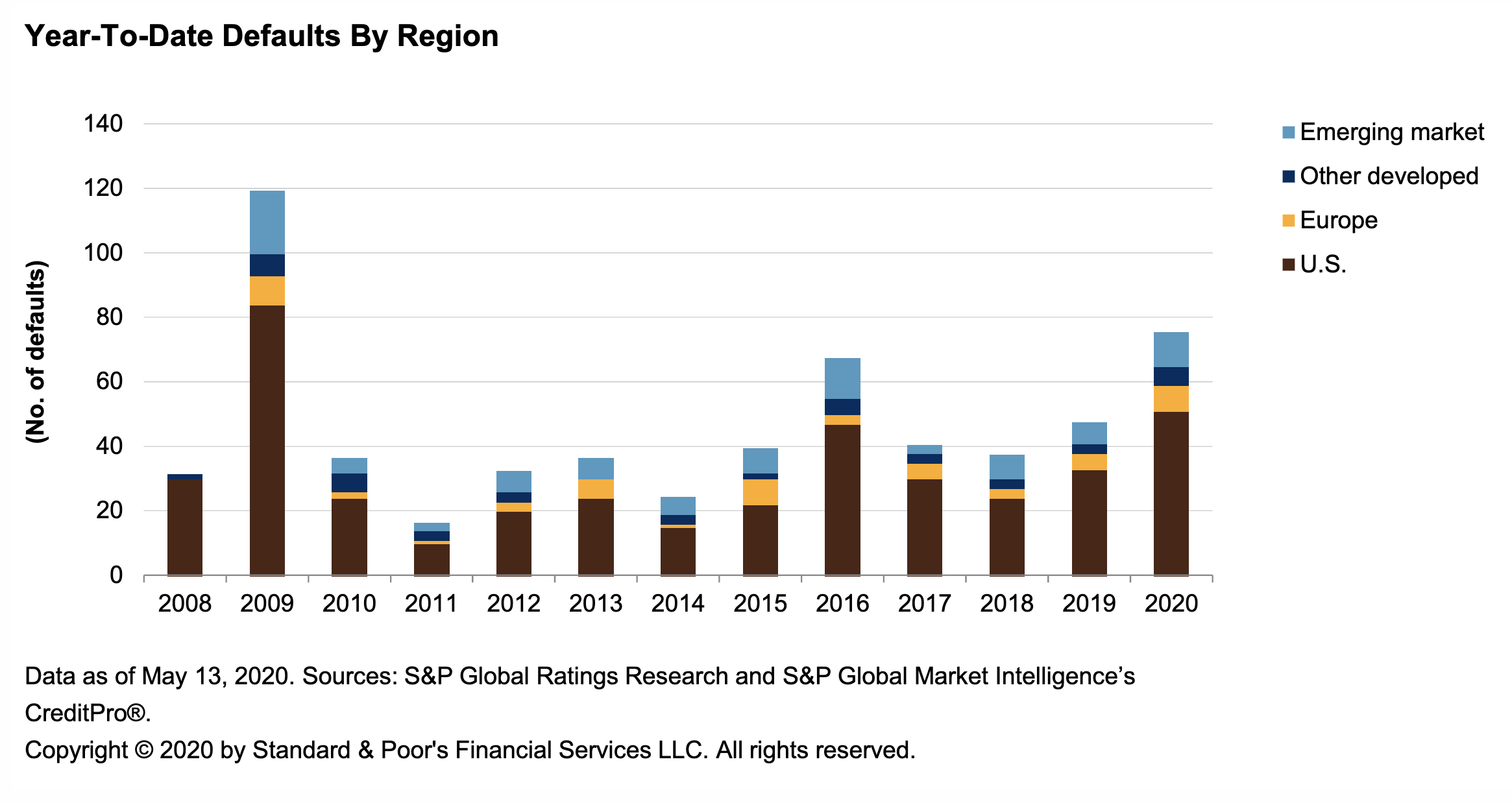

Default, Transition, and Recovery: Corporate Defaults Hit Highest Year-To-Date Levels Since 2009

The 2020 global corporate default tally has reached 75, after seven issuers defaulted last week. Since the onset of COVID-19, defaults across all regions have increased as the impact from social distancing measures to contain the spread of the disease are weighing on global economies. The 2020 year-to-date default tally as of May 13 has now surpassed 2016 levels, where we last experienced an influx of oil and gas defaults due to sustained drops in oil prices, and is the highest since the great financial crisis. S&P Global expects global GDP to fall 2.4% this year, with the U.S. and eurozone contracting 5.2% and 7.3%, respectively. By region, the U.S. leads the default tally with nearly 70% of global defaults.

—Read the full report from S&P Global Ratings

Default, Transition, and Recovery: More Than One-Quarter Of Speculative-Grade Issuers Are Weakest Links

The number of global weakest links (issuers rated 'B-' or lower by S&P Global Ratings with negative outlooks or ratings on CreditWatch with negative implications) has increased to 600, from 440 in S&P Global Ratings’ last report. The aftermath of the last recession created an elevated number of speculative-grade issuers and weakest links, and the number of weakest links over the total speculative-grade population has risen to an all-time high of 25.6%. Default rates among weakest links are typically about eight times higher on average globally—the trailing-12-month weakest links default rate is 28.2%, compared with a speculative-grade default rate of 2.8%. The media and entertainment, including hotels, gaming, and leisure (103 issuers); consumer products (82 issuers); and oil and gas (62 issuers) sectors lead weakest links—together they account for 41% of weakest links.

—Read the full report from S&P Global Ratings

U.S. Consumer Durables And Apparel Aren't Wearing Coronavirus Pressure Well

The majority of consumer durables and apparel issuers have been downgraded and/or have negative outlooks, reflecting further downside risk from the COVID-19 pandemic. S&P Global Ratings estimates calendar 2020 results will be poor, with unprecedented revenue and profitability declines, more severe than in previous recessions. While our economists forecast a gradual recovery beginning in the second half of calendar 2020, S&P Global Ratings does not anticipate a meaningful recovery in credit measures until the back half of calendar 2021 at the earliest for many companies. Liquidity is sufficient for most issuers, but those with upcoming debt maturities or in the 'B' and 'CCC' rating categories will have more difficulty refinancing, or face liquidity pressures due to declining cash flow.

—Read the full report from S&P Global Ratings

SF Credit Brief: Over Half Of CLOs In CLO Insights Index Have Ratings On Watch; About 10% Paid Down Senior Notes Due To Interest Diversion

About 9% of corporate obligors across the CLO Insights 2020 Index have issuer credit ratings on CreditWatch with negative implications, while more than 30% carry a negative rating outlook. Of the 410 transactions in the index, over 200 CLOs have at least one tranche rating currently listed on CreditWatch. Overall, ratings on more than 28% of U.S. BSL CLO collateral have been lowered or placed on CreditWatch since early March, while 418 tranches across 316 CLO transactions are currently listed on CreditWatch with negative implications.

—Read the full report from S&P Global Ratings

Municipal Bonds Are Being Left Behind

Corporate bonds have garnered a lot of attention lately, as the Federal Reserve continues to stabilize markets by establishing multiple facilities that support both the primary and secondary corporate bond markets. As a result, credit spreads have tightened significantly from where they were in March. Since March 23, 2020, the option-adjusted spread on the S&P U.S. Investment Grade Corporate Bond Index tightened more than 150 bps, and yields were within only 50 bps of their all-time lows as of April 30, 2020. Meanwhile, municipal bonds experienced greater spread widening in March and did not see the extreme tightening that investment-grade corporate bonds did. As of April 30, 2020, the yield of the S&P National AMT-Free Municipal Bond Index was still more than 100 bps above its pre-COVID-19 low.

—Read the full article from S&P Dow Jones Indices

Virus hits Q1 global transaction banking revenues; steeper drop expected in Q2

First-quarter revenues at the top 10 global transaction banks fell for the first time in three years as central banks cut interest rates to stimulate demand amid the economic impact of the COVID-19 pandemic, data by research company Coalition shows. Total revenues in the quarter fell 6% year over year to $7.4 billion, according to Coalition's transaction banking index. The revenue decline is expected to worsen in the second quarter with volumes projected to shrink across the board.

—Read the full article from S&P Global Market Intelligence

North American Financial Institutions Monitor 2Q 2020: COVID-19 Weighs On Earnings And Ratings

North American financial institutions are facing their greatest challenge since the 2008-2009 crisis. The COVID-19 pandemic and sudden recession has reversed what had been a few years of good fortune for these firms. Business activity has plummeted because of social distancing measures, millions have lost their jobs, and financial institutions are feeling the strain. Consumers are less creditworthy and less confident. They're spending less and putting off payments more, and bank earnings and revenue streams have dropped. In response to all of this, banks have sharply increased their allowances for loan losses. And nonbank financial institutions (NBFIs) are faring much the same—S&P Global Ratings expects profitability to fall for NBFIs, particularly revenue from asset-based fees, net interest income, and investment banking activity. Ultimately, credit and bottom-line losses, as well as many of S&P Global Ratings’ ratings on financial institutions, will depend on the length and severity of the downturn—and how effective government programs are at stemming it.

—Read the full report from S&P Global Ratings

U.S. Finance Companies Face Market Volatility And Tougher Financing Conditions Amid Fallout From COVID-19

Capital markets for speculative-grade issuers were temporarily dislocated in March and April as the COVID-19 pandemic spread and jolted world economies. Although S&P Global Ratings is seeing some very early evidence that markets are beginning to thaw, S&P Global Ratings expects debt issuance activity and financing costs for the largely speculative-grade nonbank finance companies we rate to be choppy and opportunistic. Issuances S&P Global Ratings has seen since mid-March have largely been to build liquidity as a defensive measure. There is $43.8 billion of debt maturing over the next five years across 53 nonbank finance companies that we publicly rate. Of these companies, 40% have an issuer credit rating that is lower than what they had one year ago at this time or the outlook has been revised to negative. As a result, finance companies will likely see their financing costs rise as they look to address maturities and refinance their debt in tougher conditions.

—Read the full report from S&P Global Ratings

EMEA Financial Institutions Monitor 2Q2020: Resilient But Not Immune To COVID-19

S&P Global Ratings considers that the impact of the COVID-19 pandemic combined with the oil price collapse will weigh on the profitability and asset quality of many financial institutions operating in Europe, the Middle East, and Africa (EMEA). S&P Global Ratings considers the following the top risks: the pandemic not being contained despite all efforts; a scarcity of financing for indebted corporate borrowers; the re-emergence of global trade tensions including between the EU and the U.K.; and asymmetric fiscal costs from the pandemic placing renewed pressure on the EU's cohesion. While S&P Global Ratings expects banks across Europe to remain resilient to the economic shock—thanks to measures to combat the coronavirus—asset quality, revenue, and profitability are likely to take a substantial hit, and capitalization will likely weaken. These negative trends were partially evident in banks' first quarter results, but are likely to become increasingly apparent in subsequent quarters, with weakness persisting into 2021. Banks in emerging markets are also exposed to additional risks, including high reliance on external funding, concentrated economies, governments' lack of capacity to provide support, and higher risks of social tensions.

—Read the full report from S&P Global Ratings

Argentine banks pushed into riskier SME lending

New government measures are driving Argentine banks to dramatically expand lending to small businesses, potentially raising their risk to a segment seen as especially vulnerable in the COVID-19 crisis. Between March 19 and May 6, 199.7 billion pesos' worth of SME working capital loans were approved, 156.8 billion pesos of which have already been disbursed, Fernando Alonso, a spokesman at Banco Central de la República Argentina told S&P Global Market Intelligence. The former amount is equivalent to 9.6% of the entire banking system's peso-denominated loans to the private sector, including those to individuals, according to May 12 central bank data. Banks were left with few alternatives after the central bank, or BCRA, limited March 19 the amount of Leliqs — short-term central bank notes that currently offer an annual interest rate of 38% — they can hold. The BCRA also reduced minimum reserve requirements and suspended dividend payments until after June 30, in an attempt to funnel the money that banks had stashed in central bank notes into lending to strapped-for-cash micro- and SMEs at a capped rate of 24%, more than 20% below expected inflation for 2020.

—Read the full article from S&P Global Market Intelligence

The Essential Podcast, Episode 9: The Shrinking Time Horizon – ESG in the Time of COVID-19

Reid Steadman, Head of ESG Indices at S&P Dow Jones Indices, joins The Essential Podcast to discuss the role of ESG in the midst of the global pandemic and a major economic slowdown. He explains how the experience of the lockdown may prepare us for further action on ESG and what the ESG market can do to expand its reach and appeal. Listen and subscribe to this podcast on Spotify, Apple Podcasts, Google Podcasts, Deezer, and our podcast page.

—Listen to this episode of The Essential Podcast from S&P Global

Global hydrogen demand expected to drop in 2020 due to pandemic: Platts Analytics

Global pure hydrogen demand will total 73.3 million mt in 2020, down 1.6% from the prior year, due to drops in oil product demand amid the global pandemic, S&P Global Platts Analytics said Thursday. Refinery production capacity will grow 1 million mt during the year, lower than previous projections of 1.7 million mt. "Despite tempered short-term growth, an increase of over 4.25 million mt H2/year within the next decade is still anticipated," Platts Analytics said in its quarterly Hydrogen Market Monitor report.

—Read the full article from S&P Global Platts

Coronavirus sets back Europe's push toward unsubsidized renewables

The economic repercussions of the coronavirus pandemic are souring some of the key ingredients for merchant renewables development, leading industry players to anticipate a short-term setback for unsubsidized wind and solar plants. But while certain transactions have been delayed by the crisis, momentum is expected to pick up again as nationwide lockdowns ease and investors realign their businesses to the new market reality. Developers had increasingly been building renewable power plants without government subsidies in countries from Spain to Norway and Germany before the pandemic hit. While many are backed by large companies buying electricity directly from projects to power factories and data centers, others are set to generate revenues pegged entirely to wholesale power markets.

—Read the full article from S&P Global Market Intelligence

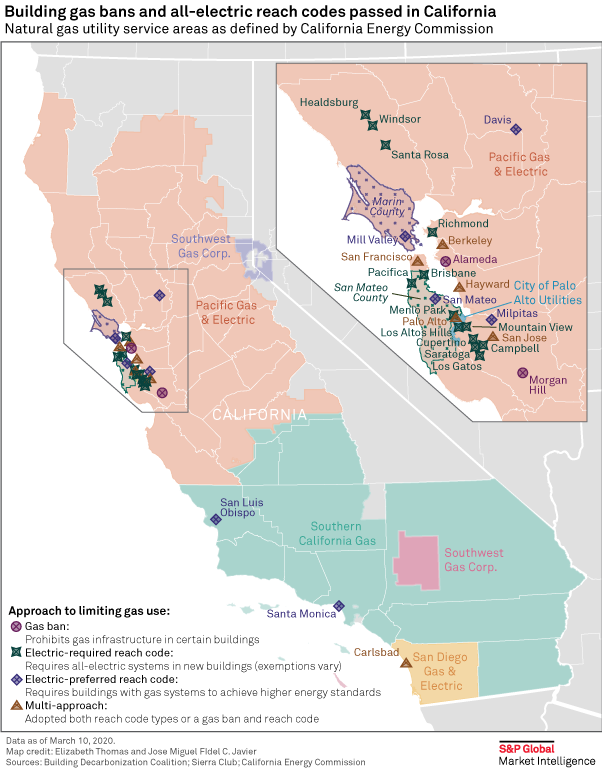

Gas Ban Monitor: Coronavirus brings building electrification votes to a halt

The steady pace of votes on local building gas bans and electrification codes throughout 2020 ground to a halt over the last seven weeks as states across the country imposed restrictions to contend with the coronavirus pandemic. Despite those limits, some local governments incrementally advanced measures to sideline natural gas use in buildings, and one more state Legislature voted to prohibit gas bans.

—Read the full article from S&P Global Market Intelligence

Analysis: Recession forecast brings grim outlook for power demand, prices: observers

S&P Global Platts Analytics projects US GDP to contract 4% over the course of 2020, but begin to rebound in the second half and grow by 4.6% in 2021, drawing varied reactions from industry observers about the impacts to US power market demand and prices. Morris Greenberg, Platts Analytics managing director of North American power, said that "based on the last cyclical downturn, this forecast would suggest a weaker power demand outlook than we have been expecting."

—Read the full article from S&P Global Platts

Listen: US power markets expected to rebound as coronavirus orders are phased out

As states begin to lift coronavirus pandemic stay-home orders and business start the process of reopening, power load is expected to slowly rebound from the increase in commercial demand. However, it could take some time as many states have a phased-in approach while many areas are still under local restrictions. By early May, 23 states had begun to lift stay-home orders with a handful of states expected to start the process by mid-May, but another handful of states still have no end date in sight.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

EU steel output outpacing demand despite cuts, auto restarts

European Union steelmakers need to be cautious about restarting capacity as COVID-19 lockdowns ease, as they risk producing into a demand vacuum which will intensify downwards pressure on prices, analyst and mill sources said. Although mills continue to restrict production, this is still outpacing demand across Europe, they said. As much as 18.9 million mt of steelmaking capacity was taken offline in Europe during the market slump caused by the pandemic – more than in any other global region – and so far only pockets of production have come back on stream in countries including Italy, France and the UK, in line with restarts in the automotive and construction sectors, according to data from VTB Capital Research, S&P Global Market Intelligence (MI) and S&P Global Platts.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language