Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 12 May, 2020

By S&P Global

To go out or stay in? That is the question. Citizens across the U.S., Europe, and Asia face mixed signals regarding the safety and structure of entering life after lockdowns are lifted. The White House ordered its officials to wear face masks after Trump administration aides tested positive for coronavirus. U.K. Prime Minister Boris Johnson released a three-stage plan to bring Britain back to work that garnered criticism for conflicting messages. Wuhan, China reported a new cluster of infections approximately one month after lifting its lengthy lockdown.

Nonetheless, as economic activity restarts in these regions, the future for the aviation industry is flying in the balance.

Globally, non-commercial aviation flights are up more than 50% from lows in April but commercial flights remain down 76%, according to S&P Global Platts.

Compared to this week last year, the number of scheduled flights worldwide is down 70%, due largely to a drop in outbound flights from the U.S. and despite a slight uptick in travel elsewhere in the world, according to travel data provider OAG. The firm reported that scheduled airline global flying capacity for this week rose this week by 600,000 seats week-on-week to 29.8 million, down approximately 80 million seats below the level for this time last year.

U.S. passenger traffic and demand for future U.S. related air travel are both down 94%, according to the trade group Airlines for America. In January and February, domestic flights in the country carried between 85 to 100 passengers but are now only transporting an average of 23. Travel to Hawaii is down 98% year-over-year. Half of airline providers’ 6,215 planes are grounded and idling.

During the coronavirus-caused lockdowns in Asia, all eight Chinese airlines exhibited a sharp increase in their market implied probability of default, according to S&P Global Market Intelligence, but the relative probability of defaults within the industry are not historically rare. The Chinese airline industry, perceived to be resilient, is likely to revert to the long-term credit level seen pre-crisis.

This is not the case for the industry in nearby regions. UAE-based Emirates, the world's largest operator of long-haul flights and biggest owner of A380 and Boeing's 777 fleet, said on Sunday that it “expect[s] it will take 18 months at least, before travel demand returns to a semblance of normality.” The company also reported a "fuel hedge ineffectiveness" at the end of the period and that it is “actively engaging with regulators and relevant stakeholders as they work to define standards to ensure the health and safety of travelers and operators in a post-pandemic world.”

The UAE’s jet fuel demand in 2019 accounted for more than 30% of the Middle East region’s jet fuel consumption and more than 2.5% of the global jet fuel demand, not including refueling aboard of UAE's international flights, according to S&P Global Platts Analytics.

Colombia-based Avianca, the world’s second-oldest airline and one of the largest in Latin America, filed for Chapter 11 bankruptcy on Sunday. Last week, Boeing announced its plans to cut manufacturing rates for its 787 jet models to 10 units a month from 14 units a month in 2020, with a further decline to 7 units a month by 2022, as reported by S&P Global Platts. On May 2, Berkshire Hathaway’s Warren Buffet sold his positions in Delta, Southwest, American, and United Airlines, which could potentially have a large-scale effect on broader investment strategies.

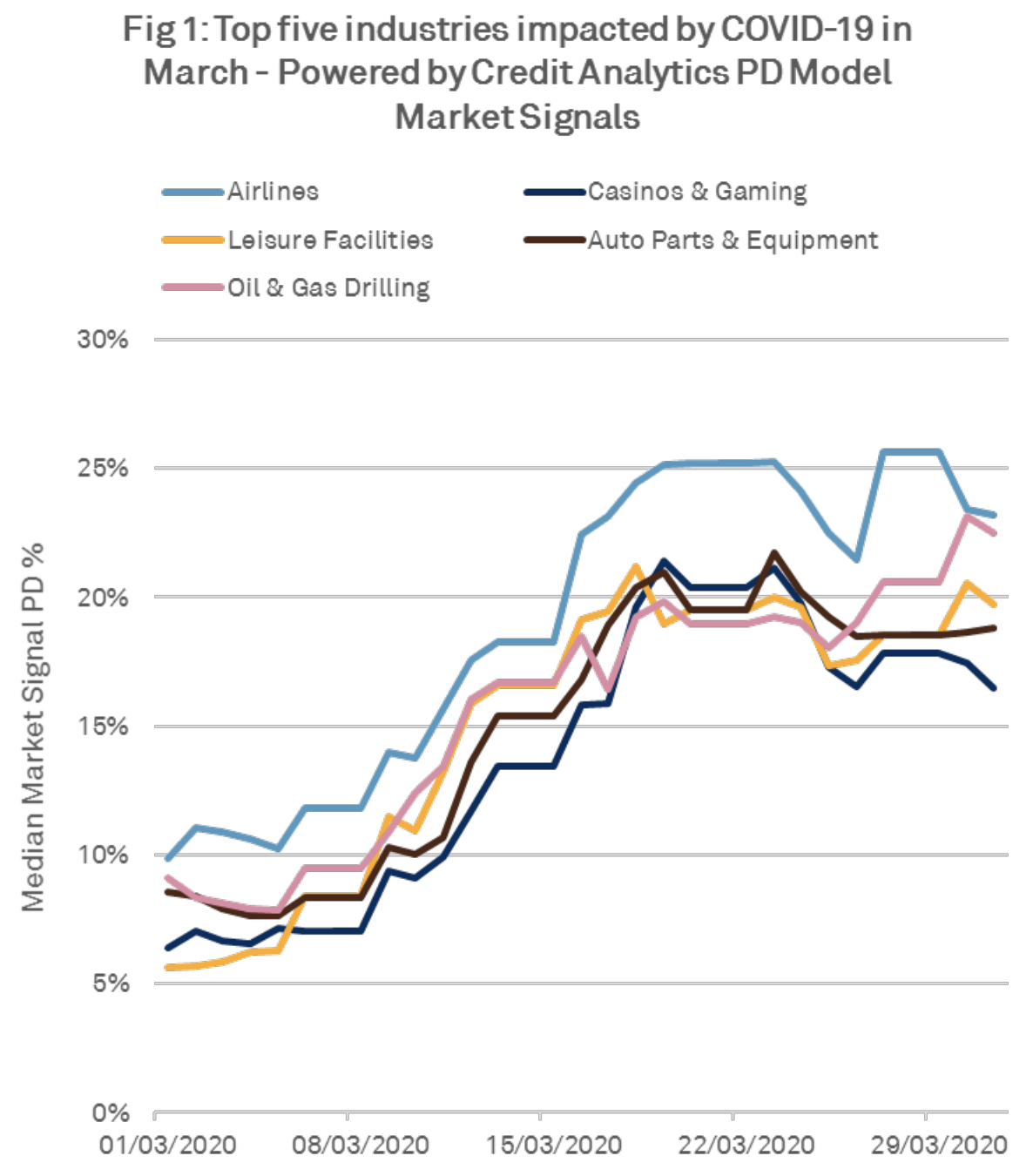

In the two-week period between March 15 and March 27, S&P Global Ratings lowered its ratings for all nine of the U.S.’s passenger airlines. The airline industry in March had the highest probability of default of all industries, driven by mass grounding of air traffic, border closures, and global stay-at-home mandates. The median probability of default for the airline industry was 9.84% in the beginning of that month, mapping to a CCC+ credit score, and soared to 25.2% (or CCC-) by March 23. The U.S. government stimulus package, which included $58 billion in relief for airlines, marginally decreased the probability of default to 21.5% (or CCC) on March 26, but it then rose again to 25.6% (or CCC-) the next day, according to S&P Global Market Intelligence.

The auto industry may see a recovery sooner rather than later. According to S&P Global Platts, traffic data in the U.S. indicates that volumes across the country are back to 80% of normal activity, with Europe showcasing 40 to 70% of traffic activity recovered. China's vehicle output and sales in April grew 46.6% and 43.5%, respectively, compared to March, and 2.3% and 4.4% compared to 2019, as shown by China Association of Automobile Manufacturers data. This marked the first year-on-year growth this year.

Yet even as travel declines, rates of coronavirus transmission remain high and new outbreaks are expected to surge again. Second waves of infection will deepen the current demand despair and erase any marginal gains. More than 4.1 million cases of infection have been reported worldwide and more than 286,000 people have died, according to Johns Hopkins University data. Cautioning against assumptions that communities will develop immunity if social distancing measures are not enforced, Dr. Mike Ryan, executive director of the World Health Organization’s health emergencies program, said that while lifted lockdowns represent “some hope,” nations need to show “extreme vigilance” because “if the disease persists at a low level without the capacity to investigate clusters, there's always the risk that the virus takes off again.”

Today is Tuesday, May 12, 2020, and here is today’s essential intelligence.

EMEA Private Equity Market Snapshot: Issue 25

As we have seen during this unprecedented time, no area of our lives or the economy is immune to the impact of COVID-19. The PE market is no exception. That said, while there is a general downturn evident across EMEA in terms of deal-making, S&P Global Market Intelligence’s analysis shows that divestments activity is up and some sectors are experiencing growth, largely on account of the global pandemic. Following an overview of General Partners' investments in EMEA, this report undertakes a review of the industries most and least impacted by COVID-19 by way of S&P Global Market Intelligence’s Credit Analytics Probability of Default Model Market Signals (PDMS), which calculates a one-year Probability of Default (PD) according to stock price movements and asset volatility.

—Read the full report from S&P Global Market Intelligence

Credit FAQ: How Oman Could Weather Tough Funding Conditions Ahead S&P Global Ratings recently lowered the ratings on Oman to 'BB-/B' and again assigned a negative outlook to reflect weak fiscal and external positions, exacerbated by lower oil prices, repercussions from the coronavirus pandemic, and capital outflows from emerging markets. S&P Global Ratings currently expects that funding conditions for Oman will improve in the second half of 2020 as global economic conditions gradually recover and oil prices track slowly rising demand. S&P Global Ratings’ baseline scenario expects the government of Oman will meet its sizable funding needs (including debt redemptions)—totaling almost $50 billion over 2020-2023—through external debt issuance (63%), drawdowns of domestic and external liquid assets (18.5%), domestic debt (15%), and other financial transactions (3.5%). Nonetheless, if Oman were to consider the pricing of funding in international capital markets prohibitive or foreign investors were unwilling to roll over maturing debt, the country's depletion of external assets would accelerate, and confidence in the Omani rial's peg to the U.S. dollar could diminish.

—Read the full report from S&P Global Ratings

Latin America COVID-19 Weekly Update The COVID-19 outbreak, and its associated economic and financial implications, will push LatAm into a deeper downturn this year, than during the 2008-2009 GFC. S&P Global Ratings forecasts Latin America’s GDP to contract just over 5% in 2020. However, growth is expected to bounce to a bit over 3% in 2021. S&P Global Ratings sees stronger recoveries in in economies such as Chile and Peru, due where the combination of more effective viral outbreak containment policies and robust economic responses will help more rapidly repair the damage to labor market and investment dynamics. Conversely, a weaker recovery is foreseen in places like Mexico were stimulus measures have been limited, and economic weakness preceded the COVID19 pandemic. Brazil and Colombia fall in the middle of the pack.

—Read the full report from S&P Global Ratings

Economic Research: U.S. Biweekly Economic Roundup: With Unprecedented Job Losses, Unemployment Soars It's hard to fathom that the Bureau of Labor Statistics' (BLS) estimate of 20.5 million jobs lost in April can be considered good news. But at least it was "better" than S&P Global Ratings Economics’ expectation of a drearier 26 million jobs lost for the month. While better than feared, the unprecedented pace of payroll job losses in the past two months (21.4 million combined in March and April) vaulted over the job losses of the Great Recession (8.7 million losing streak from January 2008 to February 2010), bringing overall payrolls down to levels not seen since February 2011.

—Read the full report from S&P Global Ratings

The Outlook For Corporate Credit Risk; COVID-19 Pandemic And Macroeconomic As public companies began to publish financial reports for the first quarter in 2020, investors were getting a first glimpse of how severely the COVID-19 pandemic affected companies worldwide. However, the financial results in the initial few months will not yet show the full extent of the global lockdown, and macroeconomic projections are painting a dire picture of what is yet to come. The full extent of the pandemic fallout on the financial performance of private and public companies will be revealed with a lag and during the course of many months. To help navigate through these turbulent times, S&P Global Market Intelligence conducted an analysis of how the credit risk of firm’s may change based on macroeconomic projections employing S&P Global Market Intelligence’s Macro-Scenario model, which leverages the historical statistical relationship between macroeconomic conditions and corresponding changes in credit risk to assess the impact of future macroeconomic conditions. This analysis focuses on macroeconomic conditions in the United States and assesses the potential credit risk impacts for private and public companies across various industries.

—Read the full report from S&P Global Market Intelligence

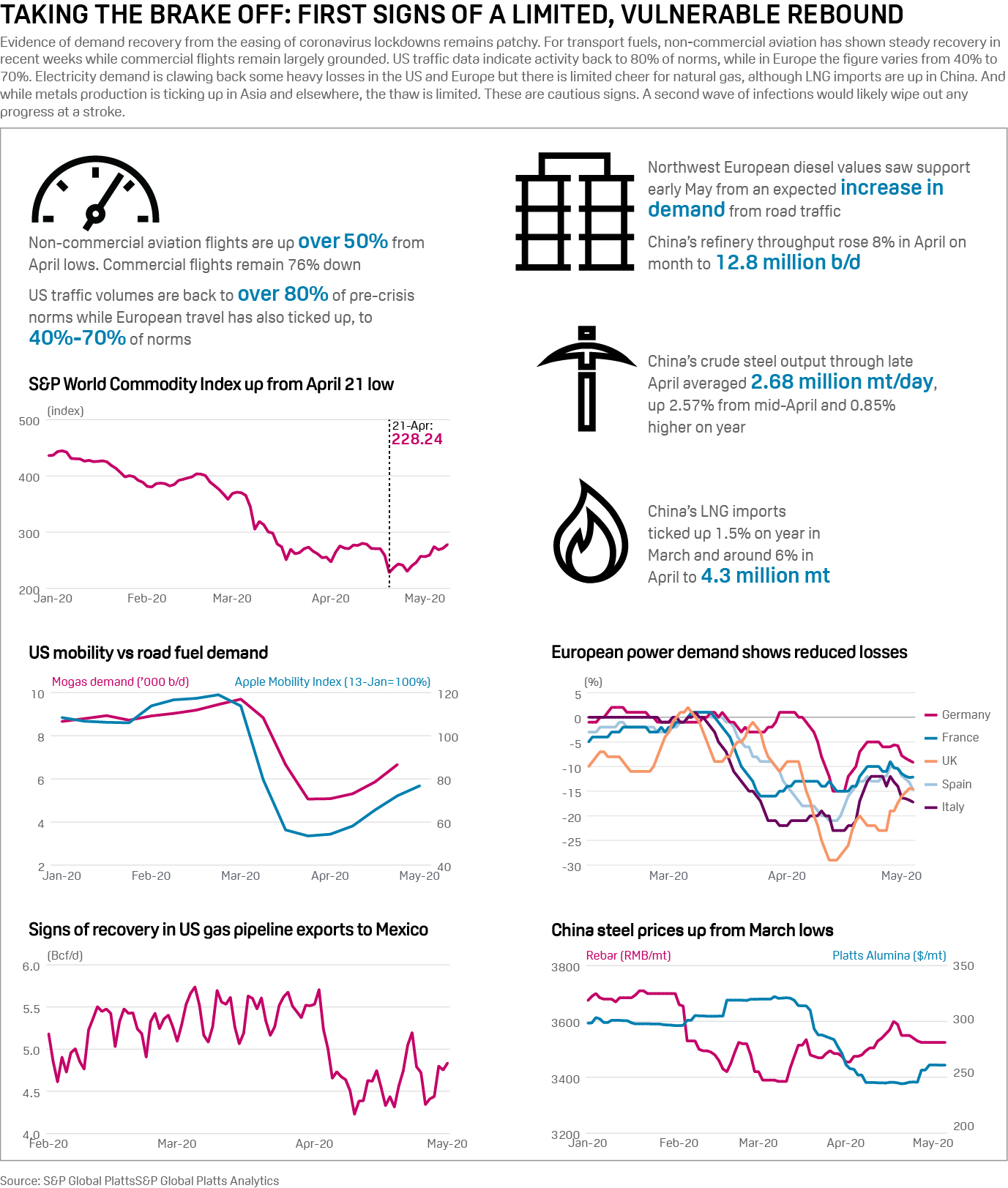

Taking the brake off: first signs of a limited, vulnerable rebound

Evidence of demand recovery from the easing of coronavirus lockdowns remains patchy for some commodities, non-existent for others. For transport fuels, non-commercial aviation has shown a steady recovery in recent weeks while commercial flights remain largely grounded. US traffic data indicate activity back to 80% of norms, this some way ahead of Europe and much of Asia. Electricity demand is clawing back some heavy losses in the US and Europe but there is limited cheer for natural gas, although LNG imports are up in China. And while metals production is ticking up in Asia and elsewhere, the thaw is limited. These are cautious times and a second wave of infections would likely wipe out any progress at a stroke.

—Read the full article from S&P Global Platts

Bottom in global flight activity reached: OAG, Flightradar24 Global commercial airline activity may have bottomed, according to OAG data on scheduled seat capacity and Flightradar24 data on the number of commercial flights. Scheduled airline global flying capacity for this week has risen by 600,000 seats week-on-week to 29.8 million, to be some 80 million seats below the level this time last year, digital flight information provider OAG said Monday. Signs of recovery were seen in eight out of 17 major regional markets analyzed, including China and Hong Kong, South America and South Asia, with the potential reopening of domestic services in India before May 15, OAG said. OAG highlighted the large level of last-minute cancellations being made by US airlines due to scheduled capacity not being met by customer demand. Elsewhere, Flightradar24 data showed the seven-day moving average in the number of global commercial flights at 31,878 Sunday, up from a low of 27,969 flights on April 18.

—Read the full article from S&P Global Platts

How Covid-19 Impacts Chinese Airline Companies This paper aims to provide an illustrative case of Covid-19 impact on Chinese airline companies. Along with recent coronavirus outbreaks around the world, there are a series of major events adding to the market turmoil, such as the crude oil crash and several major markets index movements. These shocks have significantly affected the equities of the corresponding publicly traded companies and, in turn, the market-implied credit default probabilities. Considering the focus on many frontline industries, Examining the insights provided by S&P Global Market Intelligence’s Credit Analytics scores for Chinese airlines, this analysis seeks to assess the severity of the impact of the pandemic through market-driven credit indicators and the airline industry’s resilience by performing a simple financial statement-based stress analysis.

—Read the full article from S&P Global Market Intelligence

UAE's Emirates says travel demand won't return to 'normality' before 18 months Emirates, the world's biggest operator of long-haul flights, said Sunday it doesn't see travel demand returning to "normality" before 18 months as the coronavirus outbreak cut passenger numbers in its latest financial year ended March 31. The company also reported a "fuel hedge ineffectiveness" at the end of the period. Emirates, the world's biggest owner of A380 and Boeing's 777 fleet, halted most of its passenger operations in March as the UAE suspended flights, except for cargo and evacuation flights. Emirates resumed limited outbound flights on April 6 and said on May 9 it is operating limited passenger flights to carry travelers from select destinations back to the UAE.

—Read the full article from S&P Global Platts

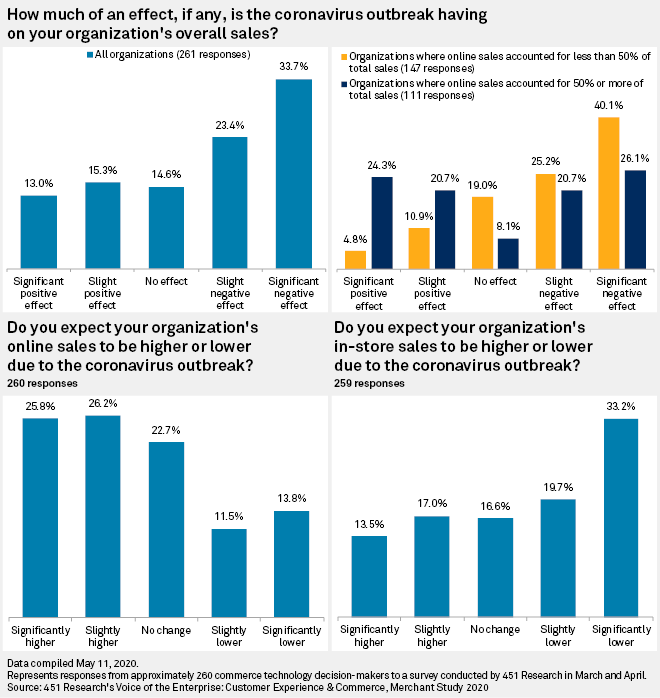

Retailers review payment, pickup options and fraud prevention in coronavirus era

As the coronavirus crisis lingers on, North American retail companies are paying increasing attention to areas such as fraud prevention, curbside pickup options and contactless payment methods to better compete with the likes of Amazon.com Inc. and Walmart Inc., according to a new survey. 451 Research's "Voice of the Enterprise: Customer Experience & Commerce Merchant Study 2020" highlights how more than 260 small, midsize and large retailers are navigating the economic fallout of the virus to win customers at a time of social distancing. The retailers span the apparel, hospitality, home improvement and grocery segments. 451 Research is an offering of S&P Global Market Intelligence. Retailers that adapt their businesses could ultimately make their businesses stronger in the long run, well after the pandemic subsides, said Jordan McKee, research director at 451 Research.

—Read the full article from S&P Global Market Intelligence

Facing revenue drought, middle-market companies, PE owners talk covenant relief Companies backed by private equity sponsors and their private credit lenders are gearing up for tough talks about how to bridge the abyss of revenue lost from coronavirus-related shutdowns. And lawyers are combing through loan covenants to identify how both sides may try to boost liquidity — including interest cuts, equity infusions, or added leverage. Conversations between sponsors and lenders in the early days of the pandemic had been largely collegial and constructive, market participants say. The crisis has highlighted why direct lending is often easier than a broadly syndicated loan, with borrowers having to negotiate with one or a handful of lenders, instead of dozens.

—Read the full article from S&P Global Market Intelligence

Neiman Marcus to face flak, possible probe, over MyTheresa transfer Bankruptcy court filings in connection with the Chapter 11 proceedings of Neiman Marcus Group Ltd. LLC suggest that despite the company's contention that its proposed restructuring is supported by a "significant majority" of its creditors, the company will face headwinds as it seeks to confirm a reorganization plan. But Marble Ridge Capital LP, the company's largest unsecured creditor, said in a May 8 court filing, that "certain pre-petition transactions … may well form the basis for substantial estate recoveries." It added that "[b]eginning in early 2017, the debtors, at the behest of the LBO sponsors, worked diligently to devise and implement a scheme to fraudulently transfer away from creditors the MyTheresa assets worth nearly a billion dollars by some estimates."

—Read the full article from S&P Global Market Intelligence

COVID-19 premium rebates far from universal among Europe's top insurers Europe's largest insurers are taking a wide variety of approaches to refunding customers' premiums if the coronavirus pandemic is reducing their propensity to claim. Most major car insurers in the U.S. have enacted some form of premium rebate program, including discounts on future renewals and refunds of a proportion of the amount paid for certain months. In Europe, several companies have reported lower claims frequencies in certain lines of business because of government restrictions designed to curb the spread of the virus, particularly personal lines motor. But while most companies are seeing broadly similar trends, there is a patchwork of responses.

—Read the full article from S&P Global Market Intelligence

Watch: Market Movers Asia, May 11-15: Mideast crude OSPs to Asia, US-China trade deal in focus

The highlights in Asia's commodity markets this week: Market eye Middle East crude official selling prices after hikes by Saudi Aramco and ADNOC, China to receive first US crude cargo since December 2019, and Asian importers await production forecasts for US corn and soybeans. Also in this episode: Indonesian thermal coal prices are expected to remain rangebound, while China's appetite for copper is expected to impact prices as demand outside of the country remains lackluster.

—Watch and share this video from S&P Global Platts

Interview: Brazil corn exports, domestic demand to stay firm this season despite coronavirus: CEPEA Brazilian corn exports and domestic demand are expected to remain strong despite concerns about the huge surplus in the US and weaker consumption due to the coronavirus pandemic, researcher with Brazil's agricultural think tank Center for Advanced Studies on Applied Economics (CEPEA) Lucilio Rogerio Aparecido Alves told S&P Global Platts in an interview. A lves said the data so far did not indicate that exports would be lower than forecast for the current marketing season that started in February 2020 and ends in January 2021. CEPEA produces agribusiness price indexes, costs estimates, risk evaluations and detailed domestic and global markets information, covering about 30 agribusiness supply chains in Brazil.

—Read the full article from S&P Global Platts

INTERVIEW: Europe's 2020 wind additions seen 30% below forecast: WindEurope European wind developers are set to install 30% less capacity this year than forecast due to coronavirus-related restrictions, WindEurope CEO Giles Dickson told S&P Global Platts Monday. Projects face delays after 19 of roughly 150 production facilities across Europe suffered interruptions at some point, mainly in Italy and Spain. "We expect at least 12 GW of new wind capacity to be installed this year," Dickson said. For now, however, the association is not factoring any of the impacts into its five-year forecast or its 2030 outlook, he said. In terms of operation, wind accounted for 17% of European electricity in the first quarter and has not been affected by the pandemic. Further, "we now see most factories reopened," Dickson said.

—Read the full article from S&P Global Platts

Listen: Are banks freezing out the US upstream over climate or economic concerns?

Plunging demand, collapsing prices and a reeling global economy are creating an extremely tough climate for the US upstream oil and gas sector. US Senator Dan Sullivan, Republican-Alaska, argues another factor is basically kicking the sector while it's down. Sullivan says some of the largest US banks are no longer willing to lend the sector money -- not because of these economic concerns -- but because of their environmental impact. He and 15 other US senators asked the White House to investigate this practice, which they argue is unfair because the banks are benefiting right now from Congress' coronavirus relief packages. We also asked Sullivan if Arctic oil is still needed, how Alaskan operations are faring, and his campaign to increase US pressure on the Saudis for the recent oil price war.

—Listen, subscribe, and share this episode of Capitol Crude, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language