Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 1 Jun, 2020

By S&P Global

As the global pandemic and economic crisis have accelerated changes across markets, China's economy and geopolitical role in the international community have transformed in mere months—giving market observers a sense for what a post-COVID future may bring.

“Basically, throughout the cycle, the rate of the infection cases of the domestic outbreak in mainland China was a determining factor of how the Chinese equity market performed,” Priscilla Luk, S&P Dow Jones Indices’ managing director of Global Research & Design for Asia-Pacific, told S&P Global’s The Essential Podcast on Friday. “We noticed that as the consumer had to stay at home during the lockdown, a lot of activities [had to] be conducted through the internet. Because people were staying at home, and the time they spent on internet media, entertainment, and gaming also significantly increased. We noticed that companies that are engaging in business providing contactless services [like these] have performed quite well.”

Healthcare equipment, healthcare technology, and biotech were top-performing industries during the peak of the outbreak in China, while airlines, retailers, restaurants, and hotels suffered. Companies in interactive media, internet retail, and food and staples retail were least affected by the pandemic’s volatile pull on equity markets, according to Ms. Luk.

“Despite being the epicenter of the outbreak, Chinese equities have experienced lower volatility, minimal currency fluctuation, and less exposure to falling oil prices in the recent market environment in comparison with emerging market peers,” John Welling, director of product management at S&P Dow Jones Indices, wrote in an April article. “As investors grapple with the economic fallout of COVID-19 and seek to understand its impact, China has become an unexpected stabilizing force in emerging markets.”

“China's economy is healing. Indicators point to a U-shaped recovery assuming COVID-19 remains contained. Unsurprisingly, healing is uneven. Large firms are finding their feet faster than small firms, and industry is recovering faster than the service sector,” S&P Global Ratings’ Chief Asia-Pacific Economist Shaun Roache wrote in a May 25 report. “We estimate that just three months after the peak in COVID-19 cases in early February, large industrial firms were back at 95% of normal capacity. Manufacturing output rose by 5% in April compared with a year ago. Not all industries are firing at the same time, however. The technology sector has rebounded, autos have stabilized, and consumer goods are still below 2019 levels.”

The coronavirus crisis has spurred an unprecedented global economic downturn. While the effects are evident everywhere, each region is at a different stage of the crisis. Western developed countries have in recent weeks begun restarting their economies as new cases decline, while emerging markets are suffering the worst of the pandemic’s human and economic implications. Yet China, almost two months after its government lifted the 76-day lockdown on Wuhan on April 8, is showing visible signs of re-emergence and recovery—while embroiled in a ripening rift with the U.S.

“A renewed trade war with the U.S. has returned as a risk to [China’s] outlook along with COVID-19,” Mr. Roache said. Most recently, after China formally authorized a plan to impose national security laws on Hong Kong, the semiautonomous city that has for four decades served as a gateway between China and the rest of the world, U.S. Secretary of State Mike Pompeo said on May 28 that he “reported to Congress that Hong Kong is no longer autonomous from China.” U.S. President Donald Trump announced on May 29 that the world’s largest economy will revoke Hong Kong’s special trade and separate travel privileges and will sanction territory and mainland China officials.

President Trump continued his criticism of China’s handling of the coronavirus pandemic and moved to terminate the U.S.’s relationship with the World Health Organization, which he described as “China-centric”—redirecting the millions of dollars in funding it provides to the organization to other groups.

NYMEX oil futures rallied in the final minutes of trading, when President Trump’s Friday address began, to settle sharply higher amid optimism that the U.S. and China could avoid a renewed trade war despite the rising tensions. Nonetheless, while his hardline rhetoric didn’t translate into significant policy actions against China, signaling to markets that Mr. Trump is unwilling to risk the Phase 1 trade deal for now, the U.S.’s move to no longer recognize Hong Kong's independence could lead to new tariffs and a potential collapse of the deal that promised $50 billion in U.S. energy purchases through 2021, S&P Global Platts reported.

Since its start in early 2018, the U.S.-China trade war has erased $1.7 trillion in American firms’ market capitalization, according to a May 28 Federal Reserve study, which found that by the end of last year, the tariffs had decreased U.S. investment growth by 0.3 percentage points, and by end-2020 would shrink an additional 1.6 percentage points. Fed research has shown that “U.S. firms bore virtually all of the cost of higher U.S. import duties, which likely reduced the expected profitability of their operations” and “U.S. firms that export to China, either directly or through their subsidiaries, became less profitable because Chinese tariffs made them less competitive.”

Today is Monday, June 1, 2020, and here is today’s essential intelligence.

Listen: The Essential Podcast, Episode 11: A View to the Future – China Beyond the Pandemic

Priscilla Luk, Managing Director, Head of Global Research & Design, Asia Pacific at S&P Dow Jones Indices, joins The Essential Podcast to discuss the early signs of an economic recovery in China, the changing relationship between China and emerging markets, and the challenges for deleveraging the Chinese economy during the recovery. Listen and subscribe to this podcast on Spotify, Apple Podcasts, Google Podcasts, Deezer, and our podcast page.

—Listen and subscribe to The Essential Podcast, a podcast from S&P Global

China Looks Forward

The global pandemic and economic crisis have served to accelerate long term changes in the markets. This is especially visible in China where early signs of recovery and a post-COVID status quo are emerging. China's economy and role in the world have evolved in a few short months, giving market observers a sense for the future.

—Read the full digest from S&P Global

Default, Transition, and Recovery: Bankruptcies Rise This Week, Pushing The Corporate Default Tally To 88

The 2020 global corporate default tally has reached 88 after six companies defaulted last week. Missed interest and principal payments have led defaults so far in 2020, with 37. However, bankruptcy-related defaults led additions last week with three, including Illinois-based generic pharmaceutical manufacturer Akorn Inc., Oklahoma-based oil and gas exploration and production company Unit Corp. and Chile-based transportation service provider Latam Airlines Group S.A.

—Read the full report from S&P Global Ratings

Default, Transition, and Recovery: The U.S. Speculative-Grade Corporate Default Rate Is Likely To Reach 12.5% By March 2021

S&P Global Ratings expects the U.S. trailing-12-month speculative-grade corporate default rate to rise to 12.5% by March 2021 from 3.5% in March 2020. To reach this baseline forecast, 233 speculative-grade companies would need to default. In S&P Global Ratings’ optimistic scenario, we expect the default rate to rise to 6% by March 2021 (112 defaults), and in our pessimistic scenario, we expect the default rate to expand to 15.5% (289 defaults). This historically wide range of possibilities reflects the uncertain path of the global economy amid the COVID-19 pandemic: Current financial market indicators appear quite optimistic relative to both credit and economic indicators. By some measures, markets may be overly optimistic, and our downside scenario anticipates a historically high default rate as liquidity concerns give way to basic solvency ones. Further monetary or fiscal policy support could lessen defaults over the near term, but all support to date adds to existing debt piles at a time when basic revenue is lacking, which could lead to a protracted period of higher defaults, rather than typical cyclical behavior.

—Read the full report from S&P Global Ratings

Economic Research: U.S. Business Cycle Barometer: Digging Out Of A Deep Hole

Leading indicators of the business cycle show the economy is digging out of a deep hole. Green shoots have appeared in most data flow, and among all the indicators, the equity market indicator is the lone shining star with a positive signal for now. The most recent jobless claims data reveals that the labor market has finally turned the corner after over 40 million claims over last 10 weeks. S&P Global Ratings foresees an initial burst of recovery in employment in tandem with wider reopening of the economy this summer, followed by a more gradual pace of rebound as lingering fears and capacity restrictions are likely to be in place. Recurrence in pandemic spread with another round of stay-at-home directives and macropolicy fatigue are key risks lurking around the emerging recovery. Intersection with higher macrofinancial vulnerability of the private sector—especially the nonfinancial corporates—means risks are tilted further to the downside even beyond the near term.

—Read the full report from S&P Global Ratings

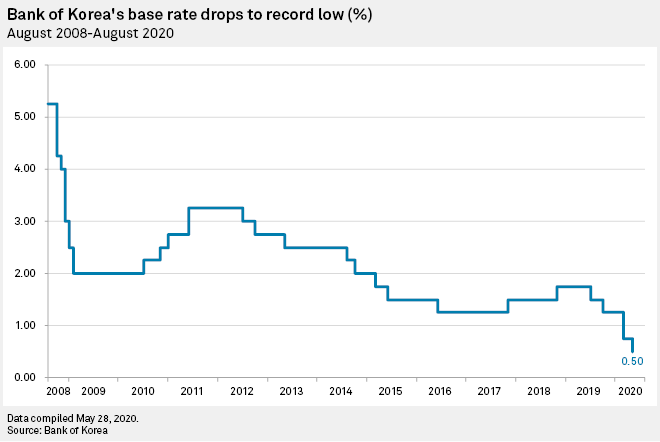

Record-low interest rates in South Korea to crimp banks' margins

South Korean banks, already hit by rising credit costs, face more pressure on their margins after the nation's central bank cut its benchmark rate to a record low to support an economy reeling from the coronavirus pandemic. The Bank of Korea cut its base rate by 25 basis points to 0.50% on May 28, citing slowing domestic economic growth, sluggish consumption and a significant decline in exports. The central bank also left the door open for further easing after its second rate cut of 2020, saying that it would "maintain its accommodative monetary policy stance."

—Read the full article from S&P Global Market Intelligence

US bank margins plunge to 3-year low

U.S. bank margins dropped for the fifth period in a row in the first quarter of 2020 and could see further pressure in the second quarter due to lower interest rates and the presence of low-yielding loans associated with the government's emergency small-business lending program. Bank margins plunged 9 basis points in the first quarter, with the industry's taxable equivalent net interest margin falling to 3.14% from 3.23% in the prior quarter and 3.38% a year earlier, according to bank regulatory data as of May 15. Institutions were allowed to delay filing first-quarter call reports for 30 days, but banks holding nearly 98% of the industry's assets had filed as of mid-May.

—Read the full article from S&P Global Market Intelligence

Banks report mixed demand for Fed Main Street loans as launch nears

Banks are gearing up to start lending under the Federal Reserve's new Main Street program, but how quickly businesses will seek loans remains uncertain as the program approaches its launch. The Fed took a major step last week to get the $600 billion Main Street program operational, releasing sample loan agreements and details on what each loan document must include. A start date has not yet been set, though top Fed officials have said they expect loans to begin in the coming days. Banks, particularly smaller lenders, are reporting mixed interest from small and medium-sized businesses thus far. Some smaller businesses have already reached out to banks to ask about Main Street loans, and larger publicly traded companies have also disclosed their interest in the program. But bankers say many businesses have yet to start inquiring about Main Street loans, perhaps because they have been more focused on how to safely re-open as states begin lifting stay-at-home orders.

—Read the full article from S&P Global Market Intelligence

Key Credit Risk Factors When Assessing Banks In The Context Of COVID-19

Banks across the world will inevitably face an impact on creditworthiness through 2020 as a result of the significant effects of the coronavirus pandemic, oil price shock, and heightened market volatility. This report highlights how to monitor credit risk across banking institutions and geographies in the context of COVID-19 using S&P Global Market Intelligence Banks Scorecard. Due to a number of factors linked directly or indirectly to COVID-19 and the oil price shock, the rated and unrated universe may see an increase in the number of defaults. The magnitude will vary by industry, geography, and rating level. According to S&P Global Ratings, the main near-term risk for banks remains asset quality; in the longer term, profitability concerns will increase compared to pre-COVID-19. It will underpin the need for further structural changes, possibly consolidation in a number of banking systems and increased regulatory scrutiny.

—Read the full report from S&P Global Market Intelligence

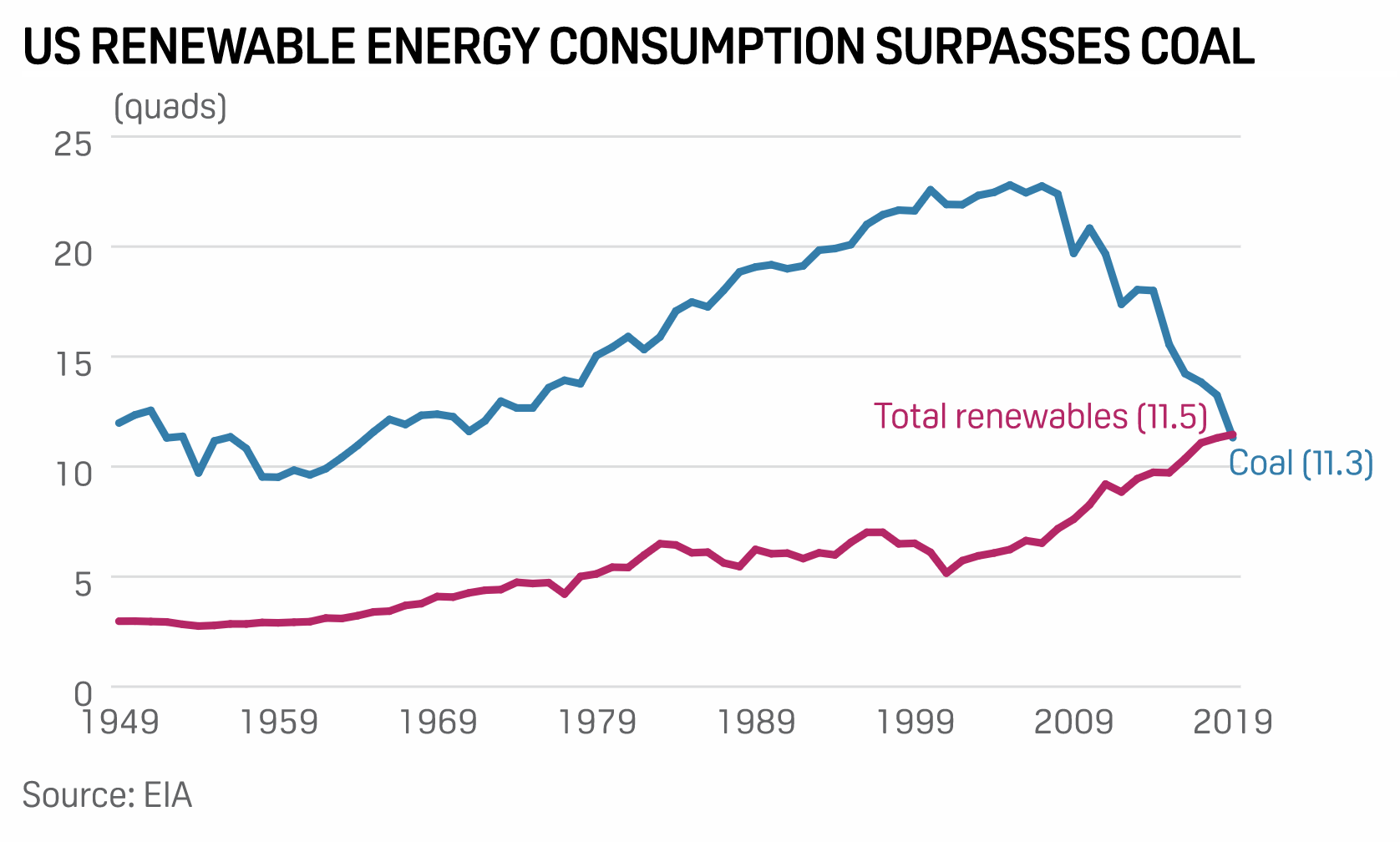

ANALYSIS: Renewable energy consumption topped coal in 2019 for the first time since 1885: EIA

US renewable energy consumption in 2019 surpassed coal energy consumption for the first time in 130 years as coal used for electricity continues to decline while more renewables are joining the grid as part of an energy transition to cleaner power sources, according to the U.S. Energy Information Administration's Monthly Energy Review.

—Read the full article from S&P Global Platts

All the green elements of the EU's €750B recovery proposal

The EU's proposal for an unprecedented spending package to fuel the bloc's recovery from the coronavirus pandemic has been tied explicitly to green principles, although the plans are still lacking in detail and environmental groups have criticized the continued support for some fossil fuels. The European Commission's proposal would see the EU raise €750 billion in recovery funds by issuing bonds, with €500 billion doled out to member states in grants and the rest in loans. This comes on top of €540 billion in postcrisis funding already agreed in April and a newly reinforced budget for 2021-2027 to the tune of €1.1 trillion. Combined, the funding amounts to the largest European spending plan ever proposed. The debt repayments would come through new funds raised by member states, including through levies on imports of carbon-intensive goods from outside the bloc, revenues from the EU's Emissions Trading System and a tax on tech giants.

—Read the full article from S&P Global Market Intelligence

COP26 climate talks rescheduled for November 2021 in UK's Glasgow

The UK has been cleared to host the re-scheduled COP26 UN climate talks in November 2021, having been delayed by a year due to the coronavirus pandemic. "The Bureau of the Conference of the Parties, with the UK and its Italian partners today ... agreed new dates for the COP26 UN Climate Change Conference, which will now take place between 1 and 12 November 2021, in Glasgow," the UN said in a statement late Thursday.

—Read the full article from S&P Global Platts

German offshore wind draft law sets 40 GW target by 2040

Germany's cabinet is set to finalize a new offshore wind law on Wednesday, enshrining a 20 GW target for 2030 and setting a new 40 GW ambition for 2040. In an online webinar Friday, German utility EnBW, developer of Germany's 610-MW Hohe See/Albatros offshore wind farm, welcomed the more ambitious long-term targets, but said the most important near-term goal was to avoid a pile-up of zero-subsidy bids. "A draw between a number of zero bids" in the next tender needed to be ruled out, EnBW's head of generation Dirk Guesewell said.

—Read the full article from S&P Global Platts

Environmental Impact and Outperformance

Environmental, social and governance issues are at the forefront of many, if not all, corporations’ minds as we enter the new decade. The rise of ESG awareness amongst corporate management, and the investors who finance them, has been undeniable, with some $137.3 billion allocated specifically to ESG-focused investments funds as of the start of 2020. Whether due to an increasing frequency of climate-related events, focused international regulation and initiatives such as the Paris Agreement (2016) and TCFD Reporting, or the increasing availability of data detailing company climate impact, the ‘E’, or environmental issues, have come to the forefront of recent ESG discussions. Nowhere was this more concisely evidenced than by the January 2020 release of ‘A Fundamental Reshaping of Finance’, Larry Fink’s letter putting forth BlackRock’s expectations for company environmental disclosures, advising effect from this year. Still, even when dealing with a more focused set of environmental metrics, the jury is still out on the optimum method of integrating ESG into the investment process. Here, S&P Global Market Intelligence outline an approach that expands a traditional method of portfolio construction with factors based on environmental data directly linked to companies’ financial performance.

—Read the full report from S&P Global Market Intelligence

Listen: Brazil's sugar and ethanol markets planning a post-pandemic strategy

Brazil, the top global sugar producer and second-largest ethanol producer, started its Center-South crop on April 1, targeting to crush 600 million tons, amid a global consumption crisis and huge uncertainty in the world's economy amid the coronavirus pandemic. S&P Global Platts senior analysts Beatriz Pupo and Claudiu Covrig join senior price specialist Nicolle Castro for a wide discussion about sugar and ethanol production, consumption and price expectations during and after the pandemic.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

Big investors cut net holdings in most oil majors in Q1 after prices tumble

Large institutional investors decreased their net holdings in many of the world's largest integrated oil and gas majors in the first three months of the year as measures to curb the spread of COVID-19 crushed petroleum demand, crashed oil prices and deflated market value for a long list of energy companies. However, that trend was bucked by some investors that entered the sector with the hopes of cashing in on the eventual recovery in oil prices.

—Read the full article from S&P Global Market Intelligence

Oil price shock saps 34% of Citadel Advisors' energy portfolio value in Q1

With the oil price crash in March, Citadel Advisors LLC's energy and utilities sector portfolio value in the first quarter declined 34.4% to $4.71 billion, compared to the previous quarter value of $7.18 billion, according to the fund manager's latest Form 13F filing. The majority of oil and gas exploration and production stake values declined due to their stock prices falling more than 50% during the quarter, which shuffled the fund manager's top investments. Duke Energy Corp. became the top investment of the fund manager after it increased stake in the electric utility by 73.1%, climbing seven spots from the prior-quarter ranking.

—Read the full article from S&P Global Market Intelligence

Keystone XL court ruling delays pipeline projects, but could help balance oil market

A US appellate court ruling Thursday that may delay crude oil pipeline construction nationwide could also play a role in helping to balance global supply and demand in the next couple of years as the energy sector recovers from the coronavirus pandemic. The court ruling is specific not only to the controversial Keystone XL crude pipeline from Canada to the US, but it also extends to stalling the US Army Corps of Engineers expedited review system for new pipeline construction.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language