Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global Platts — 12 Aug, 2020

Settling in with a favorite film can be comforting in times like these. There’s something reassuring about seeing the same familiar scenes play out on screen.

I still laugh at Rodney Dangerfield’s obnoxious tycoon, Al Czervik, in “Caddyshack” or the scene in “Office Space” where disgruntled co-workers take out their frustrations on an unreliable fax machine.

Those are classic comedies, though. A repeat viewing of a mob drama like “Goodfellas” can generate the same anxious feelings and emotions I had the first time I saw it. Even though I know what’s coming, there’s an impending sense of doom that just can’t be shaken.

That may be the same feeling some market participants had last week when the Trump administration announced it was re-imposing 10% tariffs on imports of Canadian P1020 and higher-purity aluminum products.

It must have seemed to some like they had seen this movie before. For buyers of aluminum, the last time they saw it wasn’t a particularly pleasant experience.

Who can blame them for wondering whether they’re in for a repeat of the volatility and higher pricing seen the last time tariffs were in place on Canada – the largest exporter of aluminum to the US?

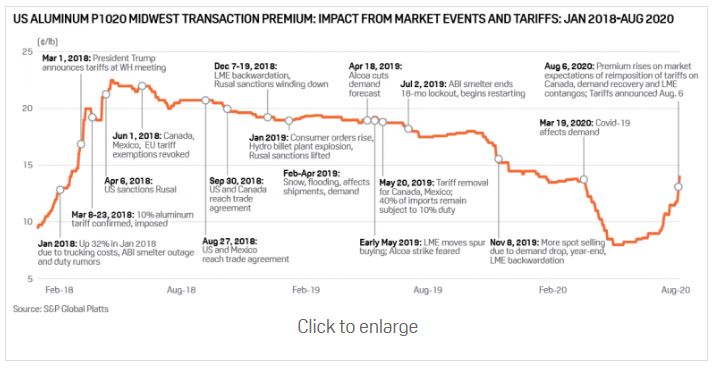

It was back in March 2018 when the president imposed tariffs on US aluminum imports. The next month, the US imposed sanctions on Russian producer Rusal, as well.

The tariffs, sanctions and other market conditions combined to quickly drive up the US Midwest aluminum transaction premium (MWP) to a multi-year high of 22.5 cents/lb.

In January 2019, the US removed the Rusal sanctions. In May of that year, the tariffs on both Canadian and Mexican aluminum exports to the US also were removed.

The MWP set out on a mostly downward trajectory in the ensuing months, and as Covid-19 bit hard into the global economy in the early part of this year, the MWP fell as low as 8 cents/lb in late April.

Then the pandemic appeared to ease and demand picked up somewhat. Canadian exports were on the rise and a US presidential election campaign went into full swing. Market chatter emerged that the president was again eyeing tariffs on America’s northern neighbor.

From the end of June to August 5, tariff talk and higher tradable values, bids, offers and transaction levels helped push up the spot market value of aluminum in the Midwest from a premium of 8.6 cents/lb to 12 cents/lb.

On August 6 – the day the Canadian tariff re-imposition was announced – the MWP rose to 13.25 cents, as market tariff expectations and fears of higher replacement costs became real. Over the next few days the MWP ticked up higher, closing August 10 at 14.5 cents/lb.

In other words, the same MWP script from early 2018 appeared to be back in late 2020.

Whether the scenes being repeated now will be comforting or drama-inducing depend very much on the viewer’s perspective. Tariffs historically have resulted in higher prices. The market will be watching how things play out this time around.

Content Type

Segment

Language