Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 14 Jul, 2020

By Fiona Boal

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

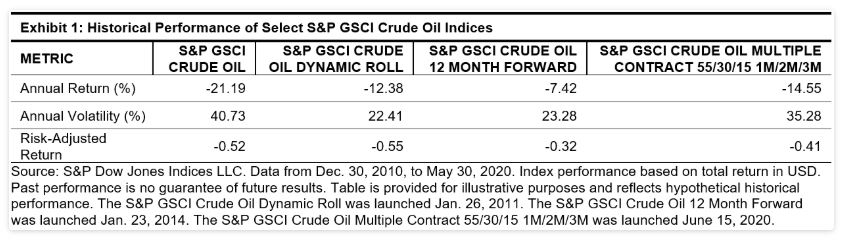

Over the past two decades, innovation in futures-based commodity indexing has allowed for the launch of commodity indices beyond broad market beta indices and into more sophisticated strategies with non-traditional roll mechanisms or contract selection.

In that vein, S&P Dow Jones Indices (S&P DJI) offers a wide variety of oil indices that offer exposure at different points along the crude oil futures curve, allowing market participants to select the index that best meets their investment requirements. For example, the S&P GSCI Crude Oil Dynamic Roll employs a flexible monthly futures contract rolling strategy and is designed to meet the demands of investors seeking to alleviate the negative impact of rolling during periods of contango.

Indices based on longer-dated contracts, such as the S&P GSCI Crude Oil 12 Month Forward, can also meet the needs of investors who prefer energy exposure with lower volatility or exposure that better reflects the long-term cost of oil production. Longer-dated indices can also be useful as a benchmark for real asset investments.

Oil indices based on multiple contracts are the newest offerings in commodity indexing. On June 15, 2020, S&P DJI launched the S&P GSCI Crude Oil Multiple Contract 55/30/15 1M/2M/3M. Instead of being represented by only one contract month, the index takes positions in three separate futures contract months. The S&P GSCI WTI crude oil contract production weights are distributed among the three contract months as follows: 55% is assigned to the contract month represented by the 1-month forward index, 30% is assigned to the contract month represented by the 2-month forward index, and 15% is assigned to the contract month represented by the 3-month forward index.

Multiple contract indices can add to or detract from index performance depending on the shape of the futures curve. During periods of contango, the indices benefit, but the reverse would take place during periods of backwardation. In light of the ongoing discussions among regulators, futures exchanges, and sponsors of financial products regarding position limits in commodity futures, financial products that are based on multiple contract indices may also find it easier to manage risk.

There are energy indices based on a broader range of petroleum products, ranging from Brent crude oil to oil products such as gasoline and heating oil. While crude oil product markets can be less liquid than crude oil, periods of deep structural contango generally occur less often in these markets, which may make indices based on these commodities more appealing to long-only investors with extended investment time horizons.

A broad range of energy indices exist today in the market, each tracking the performance of the oil market across different market segments and across the futures curve.

Content Type

Theme

Segment

Language