Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 29 Apr, 2020

By Ved Malla

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

In recent years, socially responsible investing has gained importance worldwide. There has been a paradigm shift in investment strategy globally, whereby the number of market participants who have become socially conscious and want to hold investments in companies that acknowledge the relevance of environmental, social, and governance (ESG) factors in doing business has significantly increased. ESG investments have matured globally, and many fund managers are tracking ESG indices like the S&P 500® ESG Index and S&P Europe 350® ESG Index, among others. Passive fund managers use exchange-traded funds or structured products that track an ESG index to make investments for market participants, while active fund managers depend on ESG scores to make active investment bets.

In India, however, ESG investing is a new concept, with market participants in the country only recently starting to look at the importance of ESG factors for investing. ESG investing in India is expected to evolve further and align itself with global market trends. This shift is expected to gain importance in the next few years, with more market participants likely integrating ESG aspects into mainstream investment decisions, with the ultimate goal of long-term value creation.

The S&P BSE 100 ESG Index is designed to measure exposure to securities that meet sustainability investing criteria while maintaining a risk/reward profile similar to that of the S&P BSE 100, its benchmark index.

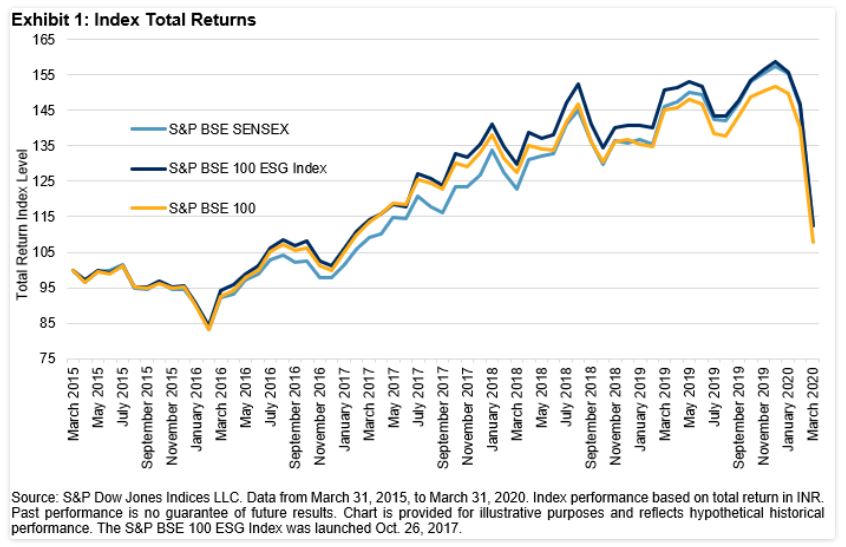

As seen in Exhibit 1, the S&P BSE 100 ESG Index slightly outperformed the S&P BSE 100 and S&P BSE SENSEX over a five-year period.

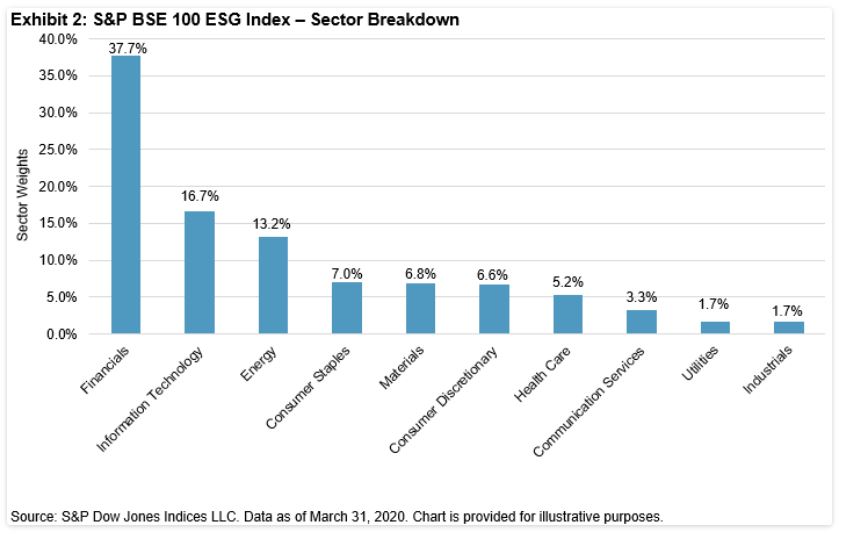

Exhibit 2 lists the sector breakdown of the S&P BSE 100 ESG Index as of March 31, 2020. Financials had the highest weight at 37.7%, followed by Information Technology and Energy at 16.7% and 13.2%, respectively. Utilities and Industrials had the least weight at 1.7% each.

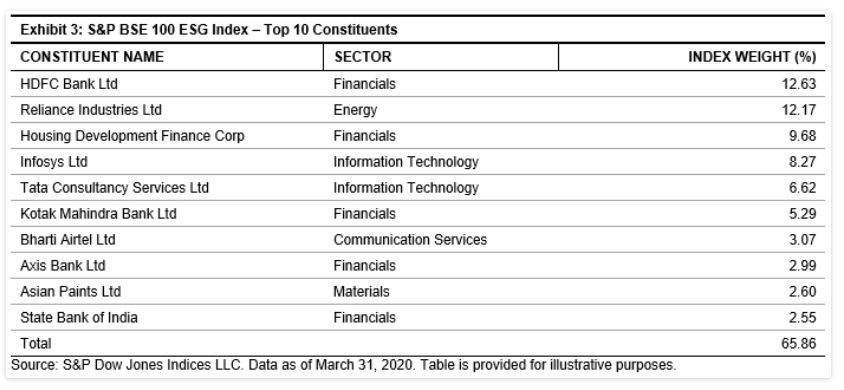

As of March 31, 2020, the S&P BSE 100 ESG Index had 64 constituents. Exhibit 3 shows the top 10 constituents in the index, which made up nearly 66% of the total index weight. HDFC Bank Ltd and Reliance Industries had the highest weights at 12.63% and 12.17%, respectively.