Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 13 Mar, 2021

By Craig Lazzara and Anu Ganti

EXECUTIVE SUMMARY

A SIMPLE QUESTION

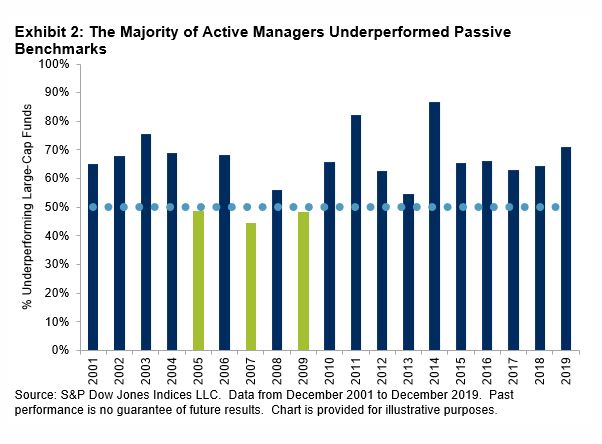

The evidence that most active portfolio managers typically underperform passive benchmarks appropriate to their investment style is extensive—both historically and geographically. Exhibit 2, for example, summarizes data from our firm’s SPIVA® Scorecards, which have documented the performance of U.S. managers since 2001 (with shorter histories for other markets). Of the 19 full calendar years for which we have U.S. SPIVA results, the majority of large-cap active managers outperformed the S&P 500® in only three.

This paper asks a simple question: what (if anything) distinguishes the three years when most active managers outperformed from the 16 years when the majority failed?