Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 4 Aug, 2020

S&P Dow Jones Indices (S&P DJI) and BMV recently launched the long-awaited S&P/BMV Total Mexico ESG Index to great fanfare. The Mexican equities market is in the early stages of exploring ESG-related concepts, from sustainable assessments at the issuers’ level to sustainable investments for asset owners, asset managers, and regulators. The S&P/BMV Total Mexico ESG Index, which uses the world-renowned Corporate Sustainability Assessment (CSA) from SAM (part of S&P Global), is a local index that employs the latest international standards and best practices.

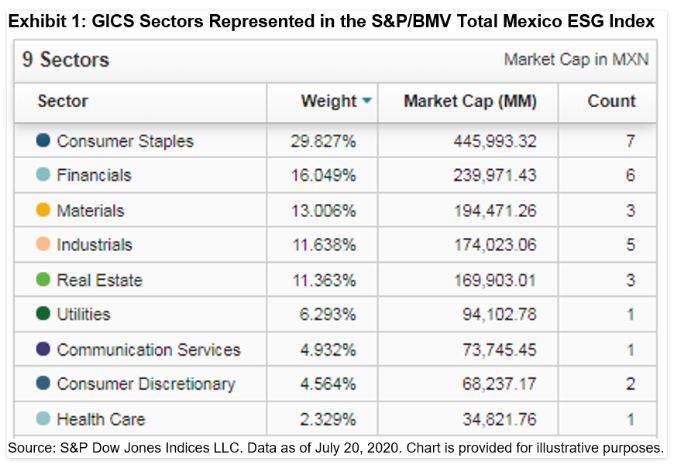

The following statistics aim to highlight the main characteristics of the S&P/BMV Total Mexico ESG Index:

How many of the constituents in the S&P/BMV Total Mexico ESG Index are included in the other S&P ESG Indices? Let’s see: 15 constituents of the S&P/BMV Total Mexico ESG Index are also constituents of the Dow Jones Sustainability MILA Pacific Alliance Index (55 constituents)—this is noteworthy considering that the methodology of each index is different per the following:

In addition, three companies in the S&P/BMV Total Mexico ESG Index are also members of the Dow Jones Sustainability Emerging Markets Index, which has 97 constituents in total.

Finally, it is important to mention that of the 29 index constituents, 26 completed the SAM CSA, while for the remaining three constituents, SAM performed the evaluation using their public information.

Considering these points, we see the S&P /BMV Total Mexico ESG Index complies with the characteristics of liquidity, representation, replicability, and diversification, which could allow it to be used as benchmark or in financial products such as ETNs.

Content Type

Segment

Language