Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 22 Sep, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Investors’ concerns over climbing coronavirus case totals in Europe and the prospect that U.S. legislators won’t pass a new stimulus package before the November presidential election led to sell-offs across global equities markets on Sept. 21.

The Stoxx Europe index 600 slipped 3.2%, London’s FTSE fell 3.5%, and Germany’s DAX sank 4%--marking its worst day since June. The U.S.’s S&P 500 fell 1.2% for its fourth consective decline, with 10 of the 11 sectors in the benchmark index falling. The Dow Jones Industrial Average dropped 509.72 points, or 1.8%.

Nearly 50,000 new coronavirus cases could materialize daily in the U.K. by the middle of next month, with 200 people dying every day by mid-November, if the country doesn’t change its containment approach, according to Chris Whitty, the government’s chief medical advisor, and Patrick Vallance, the chief scientific advisor. The two experts warned on Sept. 21 that the U.K. would need to take the situation “collectively very seriously” for the next six months because “if we do too little, this virus will run out of control.” In response, Prime Minister Boris Johnson is expected to announce today new restrictions to close restaurants and bars at 10 p.m. to curb a second wave of the virus.

“Nobody underestimates the challenges the new measures will pose to many individuals and businesses,” the prime minster said, according to an excerpt of his remarks shared by Downing Street.

Meanwhile, following the death of U.S. Supreme Court Justice Ruth Bader Ginsberg at age 87 on Sept. 18, Republican lawmakers have started searching for a replacement to fill the vacancy on the bench. Many political observers and market analysts expect the race to find and confirm a nominee during an election year will overshadow the stalemated discussions about an additional stimulus package.

“The odds of us getting a stimulus package before the election are probably as close to zero as we are going to get,” Jim Tierney, AllianceBernstein’s chief investment officer for concentrated U.S. growth, told the Wall Street Journal. “The stocks that needed stimulus are getting hit hard today.”

After indicating last week that the Federal Reserve won’t raise interest rates for at least the next three years, Chairman Jerome Powell told the U.S. House Financial Services Committee in prepared testimony on Sept. 21 that “direct fiscal support may be needed” to aid small- and medium-sized enterprises.

Volatility leading up to the election will likely continue.

“Markets expect elevated volatility surrounding the U.S. presidential election, now just six weeks away. The VIX futures curve currently peaks in November, but as long ago as April a close observer could detect expectations of electoral volatility,” Craig Lazarra, the managing director and global head of index investment strategy at S&P Global Dow Jones Indices, said in a Sept. 21 commentary.

“Maybe a correction is all that is needed, however: gold and VIX, which are typical indicators of fear, have so far been muted this month,” Chris Bennett, S&P Dow Jones Indices’ director of index investment strategy, said in a Sept. 21 note to clients the morning ahead of the stock market losses. “We saw similar decline in June for the S&P 500 before a strong rebound; could this pruning also help the market grow again?”

Today is Tuesday, September 22, 2020, and here is today’s essential intelligence.

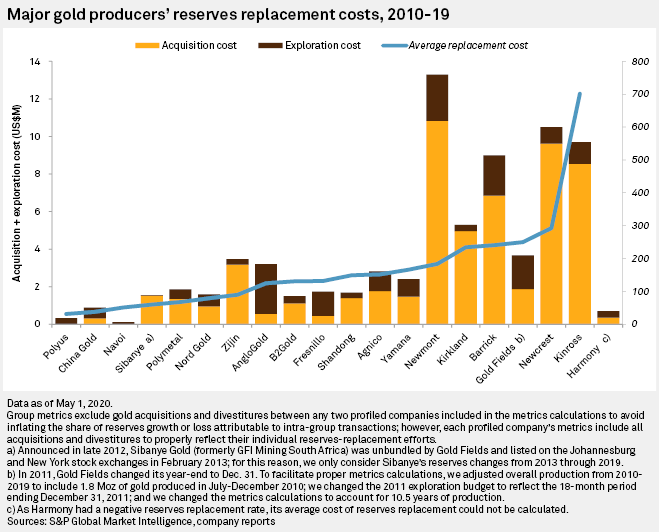

Gold RRS 2020 — Top Gold Producers' Reserves In Decline

Hampered by a lack of new discoveries and a shift away from growth-focused strategies toward margin preservation, the world's major gold miners have seen their economically minable gold reserves decline over the past 10 years. With top producers facing declining production profiles, shrinking reserves and rising production costs, S&P Global Market Intelligence expects many to supplement their depleted pipelines by expanding organic exploration in the near term while leveraging targeted acquisitions.

—Read the full article from S&P Global Market Intelligence

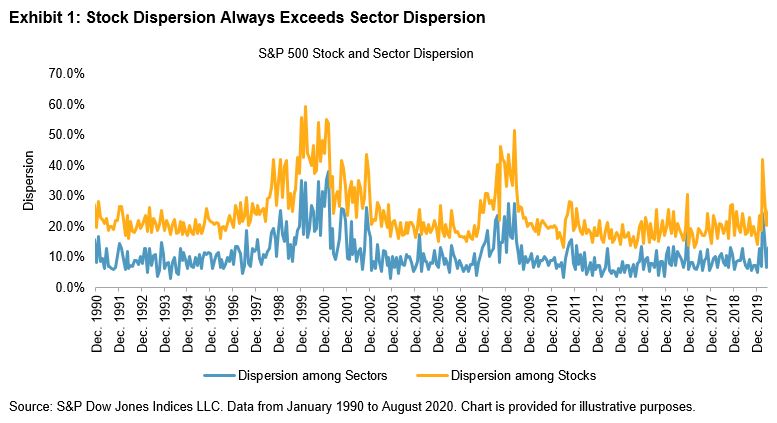

Sectors and Electors

Markets expect elevated volatility surrounding the U.S. Presidential election, now just six weeks away. The VIX futures curve currently peaks in November, but as long ago as April a close observer could detect expectations of electoral volatility. Increased volatility may create an unusual opportunity for sector allocators. To understand why, we need to remember that volatility is directly connected to dispersion, which measures the spread among the returns of an index’s components. When volatility goes up, dispersion tends to rise as well, as the gap between winners and losers widens; we saw a spectacular example of this in the first quarter of 2020. The greater the spread, the greater the opportunity to add (or subtract) value.

—Read the full report from S&P Dow Jones Indices

Gold Price Set To Lose Momentum Beyond Pandemic After 28% Increase In 2020

The price of gold has risen 28% since the start of 2020, spurred by the coronavirus pandemic, but it is difficult to predict just how much higher it could go in the coming months and beyond. Gold was priced at US$1,950.85 per ounce as of Sept. 18, jumping from US$1,520.55/oz at the start of 2020. Most analysts expect the pandemic and its economic fallout to further buoy the precious metal, but price expectations begin to diverge markedly as they look further ahead. Though macroeconomic conditions appear likely to remain fundamentally supportive for demand in the short term, supply is set to expand more quickly than in previous years.

—Read the full article from S&P Global Market Intelligence

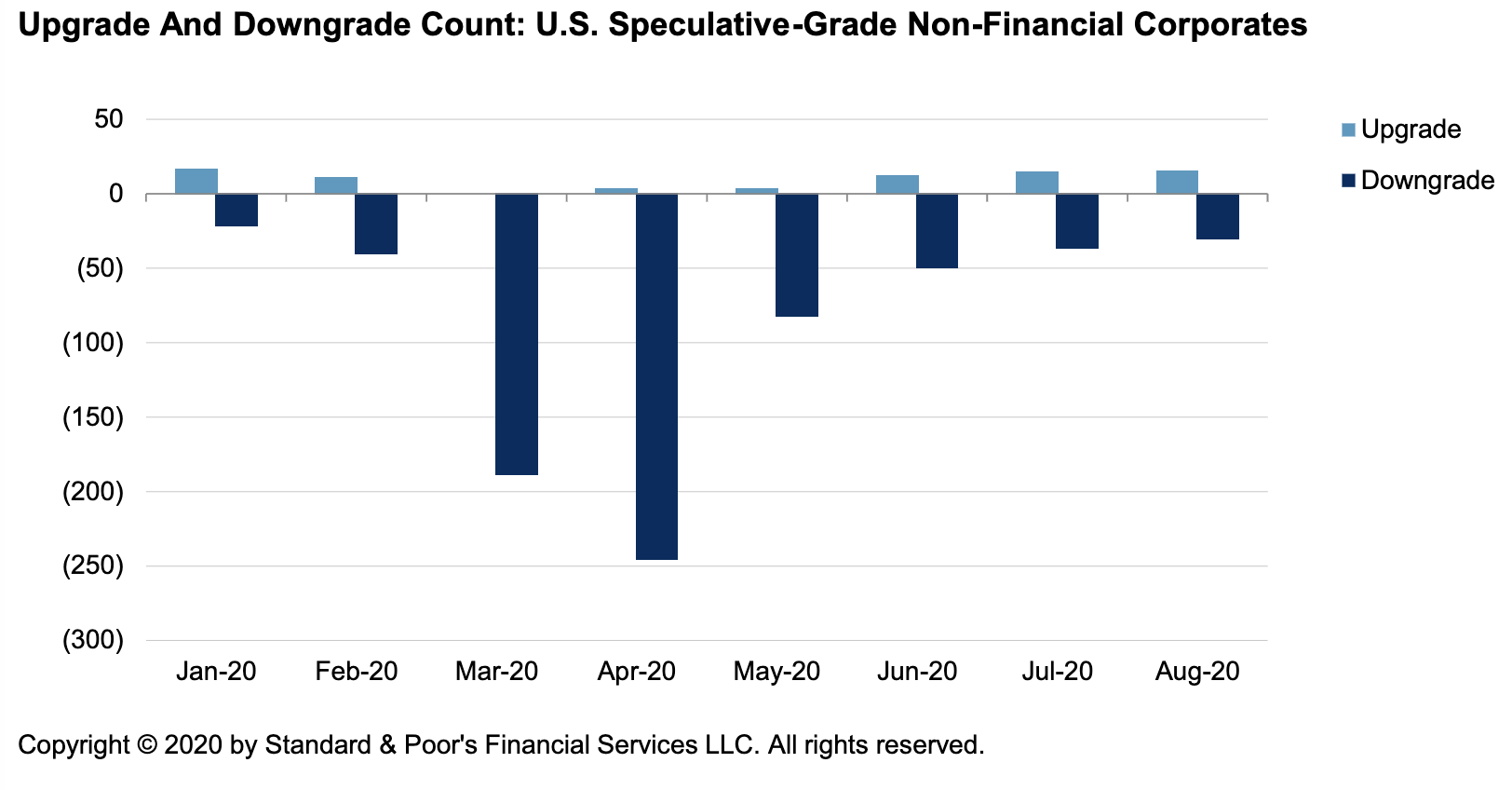

CLO Insights: More Than 10% Of U.S. CLO Ratings Lowered In Q3; Stabilized O/C Ratios Expected To Slowly Improve Heading Into October

During the third quarter, the number of U.S. speculative-grade corporate downgrades continued to level off, along with a smattering of upgrades. As S&P Global Ratings approaches the end of the quarter, S&P Global Ratings resolved many of the COVID-19-related CreditWatch negative placements on ratings on corporate issuers, sometimes without a downgrade. As of this week, less than 4% of the CLO Insights 2020 Index's (the Index) portfolio exposures are on CreditWatch negative.

—Read the full report from S&P Global Ratings

Recession Woes To Counter Property Market Bounce From Record Low Interest Rates

Before COVID-19 shook the world, the global property sector was awash with capital. For several years, real estate had been enjoying a boom as sustained low interest rates encouraged yield-hungry investors to look beyond poorly paying bonds. The prospect of interest rates inching up as the world's largest economies concluded their recovery from the 2008 global financial crisis and its messy aftermath appeared to be one of the few major concerns among industry figures. COVID-19 has changed that.

—Read the full article from S&P Global Market Intelligence

U.S. Leveraged Loan Market Wraps 6-Month Trek From COVID Lows To Positive Returns

Year-to-date returns in the U.S. leveraged loan market entered positive territory last week, finally recouping staggering losses the $1.2 trillion asset class saw in March, as the coronavirus shut down economies around the globe. The move back into the black for loans lags other broad asset classes — notably high yield bonds and investment grade debt — which saw direct or tacit support from the Federal Reserve after the pandemic's onset. Leveraged loans, which have seen intense scrutiny over the past few years from regulators and investors alike due to overall declining credit quality and aggressive deal structures, received no meaningful support from the Fed.

—Read the full article from S&P Global Market Intelligence

Private High-Yield Issuers' Superior Downside Protection Refuted

In previous analyses in this space S&P Market Intelligence reported that, in the severe market downturn of March 2020, bonds within the ICE BofA CCC & Lower US High Yield Index that were issued by private companies outperformed bonds issued by public companies. The 138 private-issuer bonds delivered a higher unweighted average return than the 125 public-issuer bonds, -19.70% versus -37.13%, with a lower standard deviation, 19.44% versus 26.21%. With 99% confidence, the difference in mean returns was statistically significant.

—Read the full article from S&P Global Market Intelligence

Infrastructure Issues: Understanding and Mitigating Risks

Infrastructure assets and projects face a bigger economic and financial test from the coronavirus pandemic than during the financial crisis of 2008-2009, when they proved to be fairly resilient. Ultimately, all players involved, be it governments or private players, must satisfy a risk-return equation. This requires an evaluation of performance risk, which is the risk that an infrastructure project will not perform as initially intended, with one or more parties possibly breaking the contractual agreement. The objective of assessing performance risk is not to eliminate it, but to highlight potential areas of concern so they can be recognized and effectively managed. Given this, a performance risk framework should be employed by all parties involved in a project, not just those taking financial risks.

—Read the full article from S&P Global Market Intelligence

Credit FAQ: The Key Sovereign Rating Considerations For Brazil Amid COVID-19

Brazil has been one of the sovereigns worst affected by the COVID-19 pandemic globally, although the pace of new cases has slowed recently. Social distancing measures—the severity of which has varied from state to state—have hit the economy hard, but substantial fiscal and monetary support implemented by the authorities will likely mitigate their impact. The pandemic exacerbated some of Brazil's key structural weaknesses, primarily low economic growth and a high government debt burden, limiting the government's ability to withstand the short-term shock while preserving fundamentals. S&P Global Ratings expects the economic recession and government support measures to lead to a record fiscal deficit and a significant surge in government debt in 2020. Moving into the fourth quarter of 2020, attention has returned to fiscal adjustment and progress on the government's reform agenda, both of which are necessary conditions to ensure debt sustainability over the medium term.

—Read the full report from S&P Global Ratings

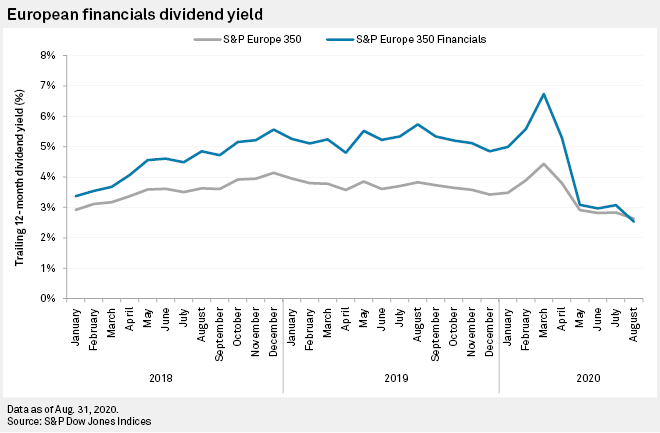

Prolonged Dividend Ban In Europe Could Adversely Impact Banks, Nonbank Sectors

A prolonged dividend ban on European banks could have significant adverse consequences for the financial sector, but also for other industries and local communities dependent on bank dividends as a source of income, according to analysts. The warning comes in light of the European Central Bank's request on July 28 that Europe's lenders postpone dividend payments and share buybacks until January 2021. This was a three-month extension of an original dividend ban imposed by the regulator earlier in the year, designed to help banks absorb losses and support lending throughout the coronavirus crisis.

—Read the full article from S&P Global Market Intelligence

UBS Clients In Asia Seek Sustainable Investments In Renewed Interest For ESG

UBS Group AG has seen a sharp increase in its clients in Asia seeking sustainable investments this year as the coronavirus pandemic helped sharpen the focus on environmental, social and governance issues globally. UBS's Global Wealth Management clients in Asia who subscribed to the bank's 100% sustainable investment strategy grew 50% in the six months starting February. The Swiss bank's assets under management classified as 100% sustainable rose to US$1.5 billion by July, from US$1.0 billion in February, Mario Knoepfel, the head of sustainable and impact investing advisory in Asia-Pacific at UBS Global Wealth Management told S&P Global Market Intelligence in an interview.

—Read the full article from S&P Global Market Intelligence

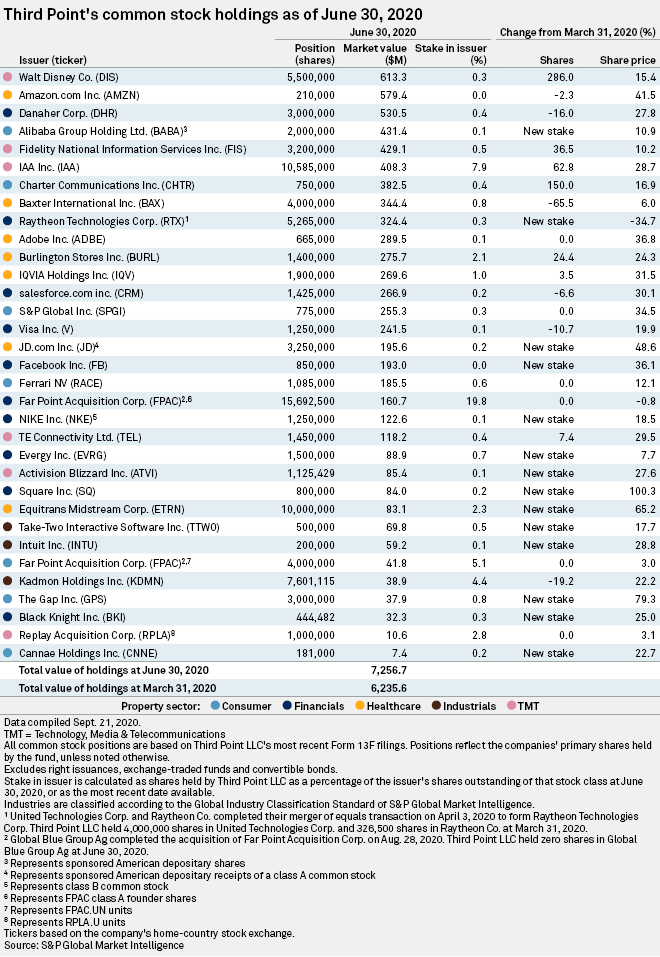

Third Point Buys Stakes In Facebook, Alibaba In Q2, Exits Sony, Allergan

Third Point LLC acquired new stakes in Facebook Inc. and Chinese e-commerce companies Alibaba Group Holding Ltd. and JD.com Inc. during the second quarter of 2020 as it divested positions in Sony Corp. and drugmaker Allergan PLC. The hedge fund purchased 2 million shares of Alibaba, which were worth $431.4 million as of June 30, according to S&P Global Market Intelligence's compilation of U.S. SEC data. The New York-based fund, run by Daniel Loeb, initiated a $193 million stake in Facebook and a $195.6 million stake in JD.com.

—Read the full article from S&P Global Market Intelligence

UK Mps To Quiz Tiktok On Data Privacy As Government Mulls Restrictions

U.K. members of Parliament are to question Chinese video-sharing app TikTok as part of an investigation into how online content-sharing platforms should be regulated. A subcommittee of the Digital, Culture, Media and Sport Committee will talk to TikTok's Director of Public Policy for Europe, the Middle East and Africa, Theo Bertram, on Sept. 22. According to its website, the subcommittee can gather evidence for two inquiries: "Online Harms and Disinformation" and "Online Harms and the Ethics of Data." Chaired by Conservative Member of Parliament Julian Knight, the subcommittee is made up of six Conservative MPs, four Labour MPs and one from the Scottish National Party.

—Read the full article from S&P Global Market Intelligence

From Theater Closures To Credit Defaults, AMC's Wild Year

Prior to the start of year, AMC's stock had already been struggling. The company's shares eroded by more than 40% in 2019 as its new subscription strategies ate into profitability and studios such as The Walt Disney Co. announced streaming platforms. That downward pressure escalated in 2020 as the pandemic hit, forcing theater closures. All told, AMC has seen its market capitalization cut in half since the start of 2019, falling from $1.33 billion on Jan. 2, 2019, to $619.8 million on Sept. 18, 2020.

—Read the full article from S&P Global Market Intelligence

Further Film Delays Leave U.S. Theater Owners 'High And Dry' – Analysts

Exhibitors spent all summer eagerly awaiting the release of Warner Bros.' "Tenet," the sci-fi blockbuster from director Christopher Nolan that was supposed to bring moviegoers back to multiplexes. But after the film debuted to just $20.2 million stateside, studios began postponing releases for other big-budget titles, leaving theaters owners without a major film release through October. While some exhibitors may be able to weather the dearth of blockbuster titles into 2021, others are entering dangerous territory.

—Read the full article from S&P Global Market Intelligence

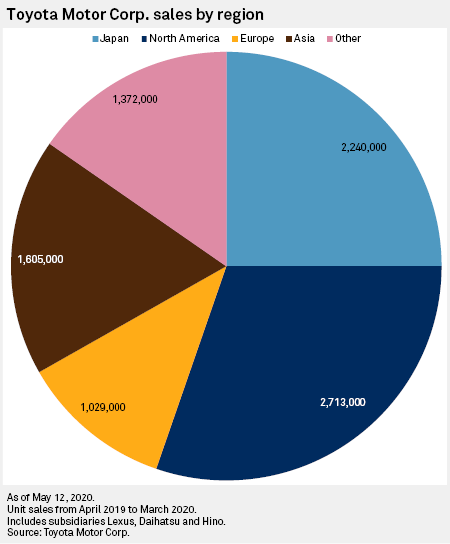

Toyota Plots Late Arrival To Electric Vehicle Party

Toyota Motor Corp. takes pride in being the pioneer of the hybrid powertrain, introducing the emissions-reducing technology with its first-generation Prius in 1997. But the Japanese carmaker is taking a much different approach when it comes to the next great evolution in the industry, the battery-electric vehicle. Except an electric C-HR crossover in China launched earlier this year and a Lexus SUV coming in 2021, Toyota has no plans to produce a mass-market battery-electric vehicle, or BEV, until 2025. In contrast, Volkswagen AG has said it intends to produce 1.5 million BEVs by the same year, a goal that will require some €33 billion of investment to achieve, and General Motors Co. has committed to bringing no fewer than 20 electric models to market by 2023.

—Read the full article from S&P Global Market Intelligence

Market Expects Key Announcements On Batteries At Tesla's Industry Event

There was much hype in the battery world Sept. 21, as attention focused on electric vehicle flag-bearer Tesla, and what it may, or may not announce at its Battery Day scheduled Sept. 22. Tesla's CEO Elon Musk is no stranger to controversy, nor speaking his mind, and it is for that very reason that many are betting on a big announcement from the company following its annual general meeting Sept. 22. Back in January, Musk, with not untypical bombast, said the event would "blow your mind." Recently he toned it down a bit, teasing "many exciting things."

—Read the full article from S&P Global Platts

UK Launches COP26 Energy Transition Council

The UK has announced it will launch an Energy Transition Council in a bid to speed up a shift from coal to renewable energy in developing countries. The announcement came at the start of Climate Week in New York City, and comes as the UK lays the groundwork for hosting the COP26 annual climate talks in Glasgow in November 2021 -- delayed by a year due to the COVID-19 pandemic. The COP26 Energy Transition Council will "bring together leaders in the power sector across politics, finance and technology to speed up the transition from coal to renewables in developing countries," the UK's Department for Business, Energy and Industrial Strategy said in a statement Sept. 21.

—Read the full article from S&P Global Platts

Human Behavior Biggest Challenge In Race To Model Pandemic Risk

Capturing how individuals and governments respond to pandemics is one of the key challenges to developing risk models that could underpin future insurance solutions, according to specialists. The race is on to develop risk models to support the development of pandemic insurance schemes, which are being discussed in several countries after COVID-19 exposed gaps in non-damage business interruption cover. Insurers have said they cannot bear pandemic risk alone, so many of the solutions being discussed envisage public-private partnerships with governments acting as the insurers of last resort. Quantifying pandemic risk will be key to determining its insurability, and at what price, and therefore how the risk should be divided between the insurance industry and governments.

—Read the full article from S&P Global Market Intelligence

Regulator Candidates Differ Over Using Credit Scores, Gender In Underwriting

Voters in Delaware, Montana, North Carolina, North Dakota and Washington will choose their state insurance regulators in the upcoming November elections. Insurance commissioner races have the potential to effect massive changes in states given the offices' abilities to approve mergers and acquisitions; their responsibilities to approve, disapprove or renegotiate insurance premium rate increases; and their powers to enact decisions to protect consumers. S&P Global Market Intelligence breaks down the candidates' platforms in each race.

—Read the full article from S&P Global Market Intelligence

Watch: Market Movers Europe, Sep 21-25: OPEC+ Compliance Takes The Spotlight; Nord Stream 2 Meets Political Controversy

In this week's highlights: Compliance with OPEC+ commitments will be at the forefront of the oil market's mind; the West African oil market will be looking for signs of a pick-up in demand from Chinese refiners; the German government is expected to pass a reform of the renewable energy law; and the row intensifies over a controversial gas pipeline.

—Watch and share this Market Movers video from S&P Global Platts

Libya Shapes Up For Production Reboot; Outlook Choppy

Libya's conflict-battered oil sector is slowly gearing up for a return after the self-styled Libyan National Army ended an eight-month blockade, with exports from its key onshore terminals expected in the next few days, sources said Sept. 21. Some of the country's key oil fields such as the 300,000 b/d Sharara and other key fields in the eastern region are preparing for a restart, but the ramp-up is likely to be gradual due to technical and operational glitches along with political volatility.

—Read the full article from S&P Global Platts

Listen: Trump's Shifts On Offshore Drilling, Biofuels Ahead Of November

In this two-part episode, S&P Platts look at how both US presidential candidates' energy platforms have evolved since the start of campaigning. They have had to respond to massive market shifts, a string of natural disasters signaling a changing climate, and waning poll numbers in key states. In Part 1, S&P Platts look at President Donald Trump's platform with Dan Eberhart, a Republican donor and CEO of Canary, a Denver-based drilling services company. S&P Platts ask Eberhart about Trump's recent actions to ban drilling offshore Florida, placate biofuel producers in the Midwest, distance himself from the climate concerns surrounding this year's wildfires and hurricane seasons, and lend rhetorical support to oil and gas producers.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Language