Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 30 Apr, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

The world’s largest banks have grown larger. Small institutions, too, have strengthened. Broadly, earnings are making a comeback. Despite the pandemic’s immense pressures on global banks, the outlook for the industry has improved along with the economic recovery.

Even as banks have battled declining asset quality and creditworthiness during the coronavirus crisis, 39 banks worldwide have reported assets above $1 trillion this year—more than the 29 in 2020, according to S&P Global Market Intelligence’s annual global bank ranking.

The four biggest banks in China, representing a combined asset value of $17.3 trillion—Industrial & Commercial Bank of China, China Construction Bank, Agricultural Bank of China, and Bank of China—maintained their positions as the largest in the world. Having benefited from fewer (or at least flat) nonperforming loan ratios in the first quarter, the so-called Big Four may experience more gradual earnings growth due to a potential slowdown in loans and continued pressure on margins amid low interest rates. Nonetheless, analysts expect these banks’ asset quality to improve as the world’s second-largest economy recovers from the sudden-stop downturn.

Japan’s Mitsubishi UFG Financial Group has remained the world’s the fifth-largest bank. To counteract the COVID-19 crisis’ implications, lenders across the country utilized their expanding deposits and battled sluggish loan growth by increasing their purchases of government bonds and other financial instruments, according to S&P Global Market Intelligence.

Across the U.S., most community banks reported better first-quarter earnings than the previous quarter and a year earlier. Regional banks in the country also enjoyed higher earnings. Such growth is indicative of the stabilizing operating conditions as the country races toward a return to some sense of normality. Seven of the 12 U.S. banks on S&P Global Market Intelligence’s ranking have improved in standing this year, particularly with JPMorgan Chase & Co.’s 26% year-over-year increase in assets pushing the U.S.-based bank one ranking higher, to become the sixth-biggest bank internationally. The megabank reported the largest negative provisioning figure of the 40 U.S. banks that did so, totaling $4.16 billion, according to S&P Global Market Intelligence. But strategies vary across both large and small institutions. Some banks are releasing billions of dollars of excess cash into securities, while others are holding back on taking any major actions before deposits slow down and loan growth speeds up.

HSBC Holdings fell to eighth in the global ranking this year, from No. 6, with assets totaling $2.98 trillion. In Europe, the U.K.-based bank dropped to No. 2—bested by BNP Paribas, which became the region’s largest lender, according to S&P Global Market Intelligence. HSBC earlier this year announced plans to move the majority of its business to Asia and more recently has prioritized expanding its wealth and personal-banking business through acquisitions.

Across the Middle East and Africa, Qatar National Bank kept its position as the largest bank by assets for the sixth consecutive year, according to S&P Global Market Intelligence's regional ranking. The bank was followed by the United Arab Emirates’ First Abu Dhabi Bank and Emirates NBD Bank, Israel's Bank Leumi le-Israel, and South Africa's Standard Bank Group. In South Africa, the country’s four biggest banks may soon see an uplift in earnings as their impairments from 2020 reverse.

Today is Friday, April 30, 2021, and here is today’s essential intelligence.

Biden's 1st 100 Days: Business Likes Econ Moves but Is Wary of Taxes, Regulation

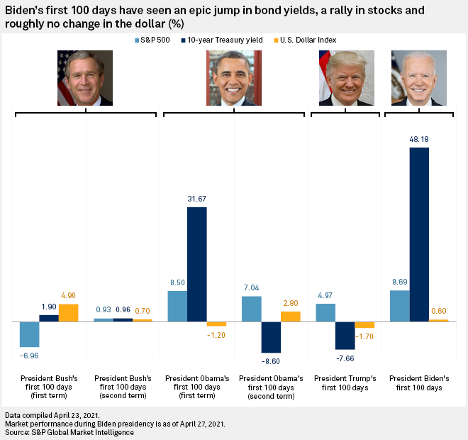

President Joe Biden has spent his first 100 days in office tackling two goals: pulling the country from the depths of the coronavirus crisis and reshaping broad swaths of the U.S. economy. Since he was inaugurated Jan. 20, Biden has tackled climate change, promoted oversight of the financial industry, supported pandemic-hammered businesses and issued stimulus checks to consumers. His administration is also urging Congress to pass legislation to boost corporate taxes and pump trillions into a range of infrastructure proposals through the American Jobs Plan.

—Read the full article from S&P Global Market Intelligence

U.S. Sets Preliminary Antidumping Duties on Aluminum Foil From Four Countries

The U.S. will begin collecting antidumping duties on imports aluminum foil from four countries after an investigation determined sales from Armenia, Brazil, Oman and Russia were made in the U.S. at less than normal value, according to a preliminary determination from the Commerce Department.

—Read the full article from S&P Global Platts

China Tech Stocks May Recover as Most Regulatory Risks Priced In, Analysts Say

Some of the biggest tech stocks in China, including Tencent Holdings Ltd., Alibaba Group Holding Ltd., Baidu Inc., NetEase Inc. and Meituan, have tumbled in Hong Kong and the U.S. since their February highs, amid Washington's threats to delist Chinese companies, a record $2.8 billion antitrust fine on Alibaba and an unwinding of massive bets following the collapse of Archegos Capital.

—Read the full article from S&P Global Market Intelligence

Woodstock for Capitalists

Berkshire Hathaway is scheduled to hold its annual shareholders’ meeting this Saturday, May 1. This is the second consecutive year in which the meeting will be virtual; in 2019, attendance was nearly 40,000, which makes social distancing somewhat difficult. S&P Dow Jones Indices noted two years ago that Berkshire’s investment performance, though formidable over the long run, had lately become more pedestrian. Neither conclusion has changed in the interim. $100 invested in Berkshire stock at the end of 1968 would have grown to more than $960,000 by the end of 2020; a comparable investment in the S&P 500® would have grown to $16,800.

—Read the full article from S&P Dow Jones Indices

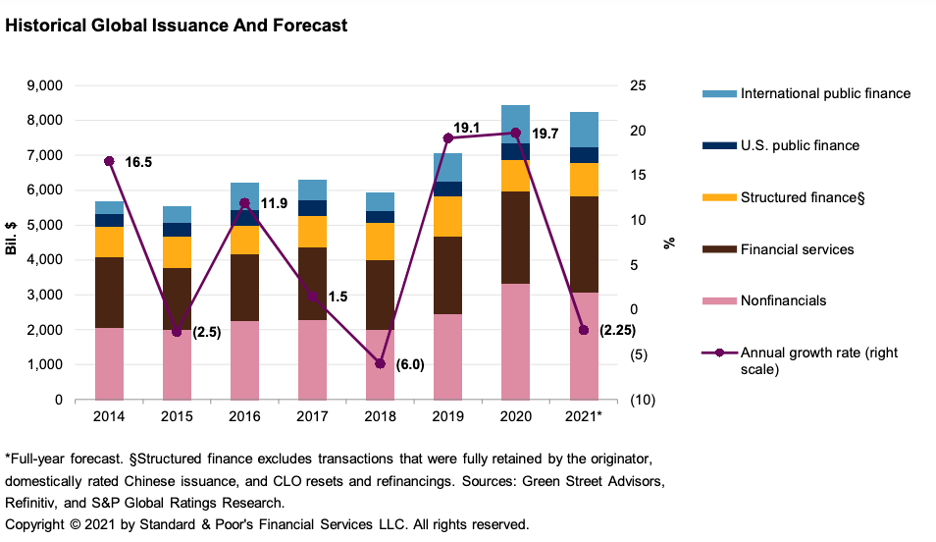

Credit Trends: Global Financing Conditions: Bond Issuance Could Decline 2.25% In 2021 to $8.2 Trillion

Borrowing costs have remained low despite recent increases in U.S. Treasury yields, leading to continued strong issuance totals from most sectors in the first quarter. A robust corporate merger and acquisition pipeline along with still favorable financing conditions could produce a solid issuance total in 2021, though it might fall short of the record-breaking amount in 2020. While S&P Global Ratings believes inflation worries may be overblown, it is likely interest rates will rise from their current lows, which, along with somewhat saturated markets, could keep issuance totals below the record-setting levels of 2020.

—Read the full report from S&P Global Ratings

Inside Global ABCP: Economic Recovery to Underpin Modest Issuance and Stable Ratings

Asset-backed commercial paper (ABCP) outstanding in the U.S. peaked in March-April 2020 as alternative funding sources for liquidity became scarce and the term market was relatively inaccessible during that time. However, improved access to other sources of funding in the second half of 2020 muted growth in ABCP issuance. S&P Global Ratings expects issuance to remain stable or go up slightly this year, in view of a modest projected rebound in the U.S. economy, ongoing market uncertainties, softer job market, low interest rates, and strong bank deposits relative to loans.

—Read the full report from S&P Global Ratings

Federal Aid Helps Lift the Cloud Over U.S. State Budgets

It's been more than a year since the initial economic shock of the COVID-19 pandemic, and most state budgets have stabilized. In S&P Global Ratings' view, many states have shown resiliency as they have been able to keep their budgets afloat utilizing budgetary control mechanisms such as adjusting expenditures and using budgetary reserves built during the expansion following the Great Recession.

—Read the full report from S&P Global Ratings

U.S. Travel Industry's Recovery Is on Standby

Air travel to domestic and nearby international vacation spots will pick up first. Business and more-distant international travel will take longer to recover. Some degree of demand for business travel may be lost permanently. Hotel revenues will not return to 2019 levels until 2023 at the earliest, and the ratings bias in the subsector is overwhelmingly negative.

—Read the full report from S&P Global Ratings

IT Remains Top Pick for European PE, VC Dealmakers In Q1'21

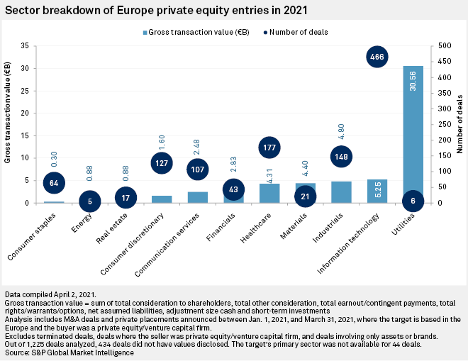

Information technology reigned as a top investment sector for private equity and venture capital deal-makers in the first quarter, with 466 entries worth a combined €5.25 billion announced, according to S&P Global Market Intelligence data. Gross transaction value was down 29.5% year on year, but deal volume rose 2.9%. IT entries accounted for 38% of the 1,225 deals signed across all sectors during the first quarter.

—Read the full article from S&P Global Market Intelligence

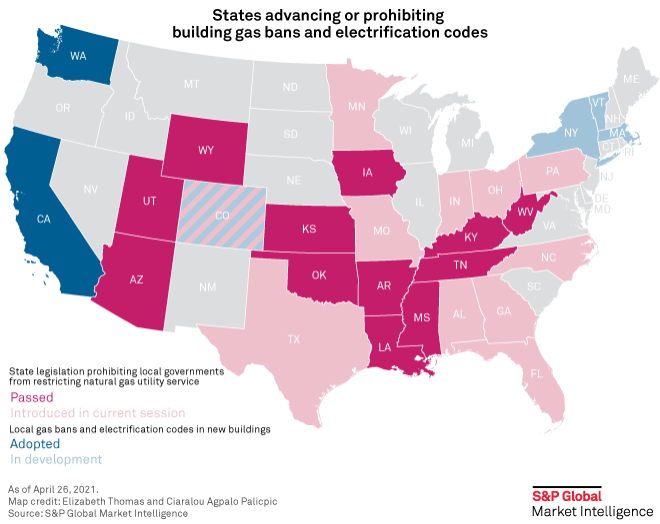

Gas Ban Monitor: Vt. Building Carbon Fee Advances as More States Outlaw Bans

Burlington, Vt., has made swift progress toward joining the ranks of cities implementing policies to restrict natural gas use in new buildings. Meanwhile, roughly a quarter of U.S. states have now passed laws prohibiting building gas bans. Several more could soon follow suit, as climate activists grow concerned about the expanding scope of the so-called energy choice bills in some legislatures.

—Read the full article from S&P Global Market Intelligence

1st 100 Days: New FERC Chair Eyes Power Market Reforms, Environmental Justice

President Joe Biden's first 100 days have brought a shift at a key independent regulator with oversight over energy markets and interstate gas pipelines, thrusting a Democrat with a strong interest in climate into a leadership position.

—Read the full article from S&P Global Market Intelligence

Interview: UK's National Grid Looks to Prove Case for Hydrogen Blending

The UK's National Grid is looking to make the case for blending hydrogen into the natural gas network as it navigates its role in the country's transition to a low-carbon economy, the company's Project Director for Hydrogen, Antony Green, told S&P Global Platts.

—Read the full article from S&P Global Platts

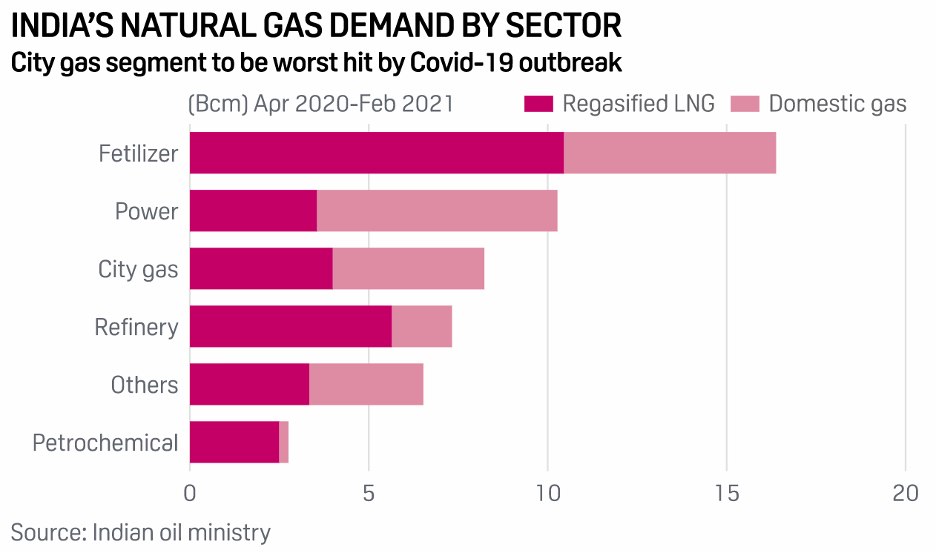

India's City Gas Demand May Drop by 25%-30% as COVID-19 Cripples Key States

India's city gas demand is expected to drop by around 25%-30% in the coming months as the COVID-19 pandemic spreads across large cities and states that are also the main consumers of natural gas with the highest penetration of gas pipeline networks, according to government officials and gas company executives.

—Read the full article from S&P Global Platts

Italy’s Shifting Gas Sector Dynamics Make Strong Case for Easing Storage Rules

Italy's heavily regulated gas storage system is starting to look like a poor fit with the current realities of the domestic and European gas markets. Could its reform help tackle high energy prices?

—Read the full article from S&P Global Platts

Smaller Pipeline Firms Could Delay Consolidation 'End Game' as Sector Shrinks

The North American oil and gas midstream sector is seeing renewed momentum in corporate mergers, and at least one industry expert saw the sector completing the consolidation process fairly soon.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Segment

Language