Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 19 Jun, 2020

By Koel Ghosh

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

The previous blog highlighted the significant shifts to passive investing in India. However, Indian passive trends have continued to favor plain vanilla indices due to their ease of understanding, rather than exploring alternative thematic indices, such as the S&P Kensho New Economies Indices or factor Indices. However, once the acceptability and acceptance of passive investment grows, the need for variety will arise. The simple progression would be toward factor play initially.

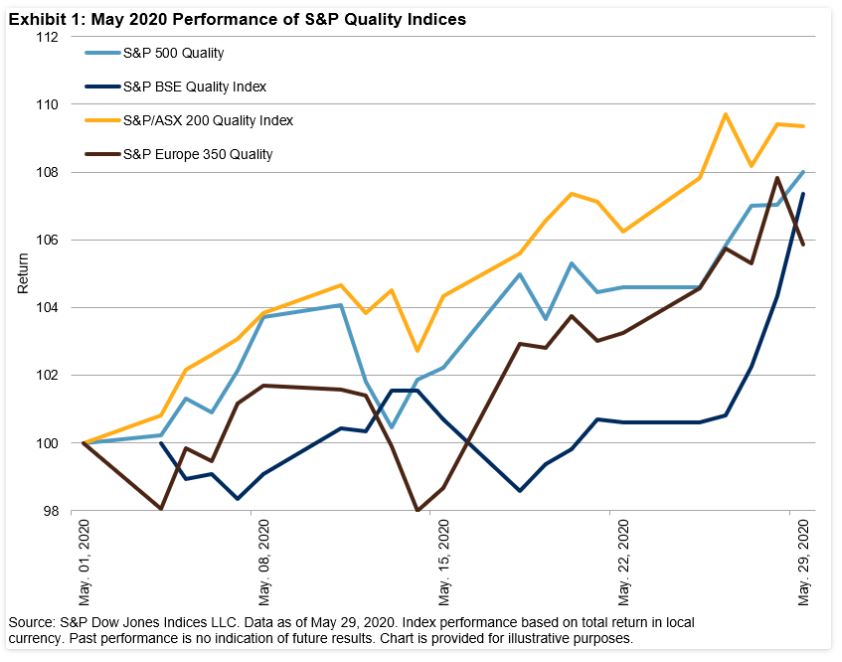

The month-end statistics for May 2020 revealed the parity of global and Indian markets in the quality factor. Companies with low leverage and high returns on equity have rewarded the quality factor. The S&P BSE Quality Index gained 2% in May 2020 and outperformed the S&P BSE SENSEX by 11%. The U.S., European, and Australian markets witnessed the same monthly trends (see Exhibit 1).

Taking a long-term perspective on any investment strategy is essential, including passive strategies. Exhibit 2 shows that market cycles over different time periods reflected different performance results for the quality factor, however, it was the long-term winner.

There is a need for more education and investor awareness on the benefits of passive investing. It is important that investors understand that passive investing involves an investment strategy that tracks or mimics an index. The advantages of diversification, low concentration risk, transparency, and lower costs strengthen the case for choosing this option. Index-based investing makes it easy for those who are not actively tracking markets by allowing them index-based returns.

Historically, Indian markets have been a pure active investing play in which funds were deployed by active fund managers in various strategies. With the dawn of passive investing, the value of low-cost indices with no active bias, consistent methodologies, and transparent rules started gaining attention. The SPIVA® (S&P Dow Jones Indices versus Active) India Scorecard added some more conviction to the passive claims. The SPIVA India Scorecard, which was first published in 2013, has laid witness to the fact that benchmarks have outperformed active funds. One such example has been the large-cap space that has witnessed a consistent 50% and above outperformance of benchmarks over active funds in the 5-year and 10-year investment horizons.[1]

The Indian passive wave has received the necessary nudge by initiatives from the Indian government, be it the Employees Provident Fund allocations to exchange-traded fund (ETFs) in benchmark indices, the disinvestment program being mobilized via the ETF route, or encouraging retail participation in fixed income via passive strategies. These initiatives have provided the necessary impetus to the passive market in India to gather more participation from product issuers and investors. While it is still early days for a wider selection and more innovative products, this is a great beginning to an optimistic growth trajectory for the Indian passive market.

Content Type

Theme

Location

Language