Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 30 Jul, 2021 — Global

By S&P Global

The Daily Update will be on vacation from August 2 through August 16. Subscribe to start every business day after the break with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

With more and more companies and countries detailing the specific actions they’ll take to achieve net-zero carbon emissions, the widespread adoption of renewable energy seems increasingly likely.

The International Energy Agency proclaimed 2020 as the year of fastest growth for global renewable electricity sources in two decades. Amid the coronavirus crisis’ hit to energy markets, renewable energy continued to grow globally in 2020 by a "colossal" 238 gigawatts—50% more than at any time in history—led by solar and wind generation, BP chief economist Spencer Dale said during a Columbia University Center on Global Energy Policy panel discussion earlier this month, according to S&P Global Platts. China accounted for a large amount of the increase. Renewable energy was the second most-used electricity source in the U.S. last year, following natural gas and jumping ahead of coal-fired generation and nuclear power, according to U.S. Energy Information Administration data released yesterday. Non-fossil fuel sources, including renewable energy, accounted for 21% of U.S. energy consumption last year, marking the highest quantity since the early 1990s.

In the meantime, the momentum has continued. Foreign investors are pouring money into Spain’s thriving renewables market. Governments and fossil fuel companies are looking to reduce their emissions exposure. Oil, gas, and, electric power companies are investing in clean-energy initiatives. Gas pipeline giants are merging and acquiring renewables companies to widen their decarbonization efforts. Offshore wind technology is ready for industrialization as projects expand while the U.S. navigates its energy-transition challenges. Steelmakers are pushing for decarbonization and enjoying the benefits that renewable projects bring to those ambitions.

Even greater growth may be on the horizon. Widespread adoption of and investment in renewables will likely be critical to curbing carbon emissions while maintaining GDP growth by mid-century.

Commitments and strategic decarbonization plans announced by leading emitters including China, Europe, Japan, and the U.S. have prompted a surge of green bond issuance and market support for including clean energy in economic planning.

China’s top economic planner, the National Development and Reform Commission, announced July 19 that it will support domestic companies’ green bond issuance to bolster the country’s long-term carbon neutrality goals. The E.U.’s accelerated 2030 target of reducing greenhouse-gas emissions by at least 55% below 1990 levels and sweeping climate policy package, announced July 14, both advocate renewables to make up 40% of the bloc’s final energy demand. Japan’s principle energy policy, titled the Strategic Energy Plan, outlines the country’s expectation that non-fossil fuel power sources will make up approximately 60% of the energy mix in the fiscal year 2030 due to climate policy measures the country aims to begin implementing in the near-term. The U.S.’s proposed $1 trillion infrastructure deal could provide ample funds for clean-energy research alongside the $3.5 trillion budget agreed upon by Democrats on July 13 that could create the foundation for aggressive climate action, according to S&P Global Market Intelligence.

Today is Friday, July 30, 2021, and here is today’s essential intelligence.

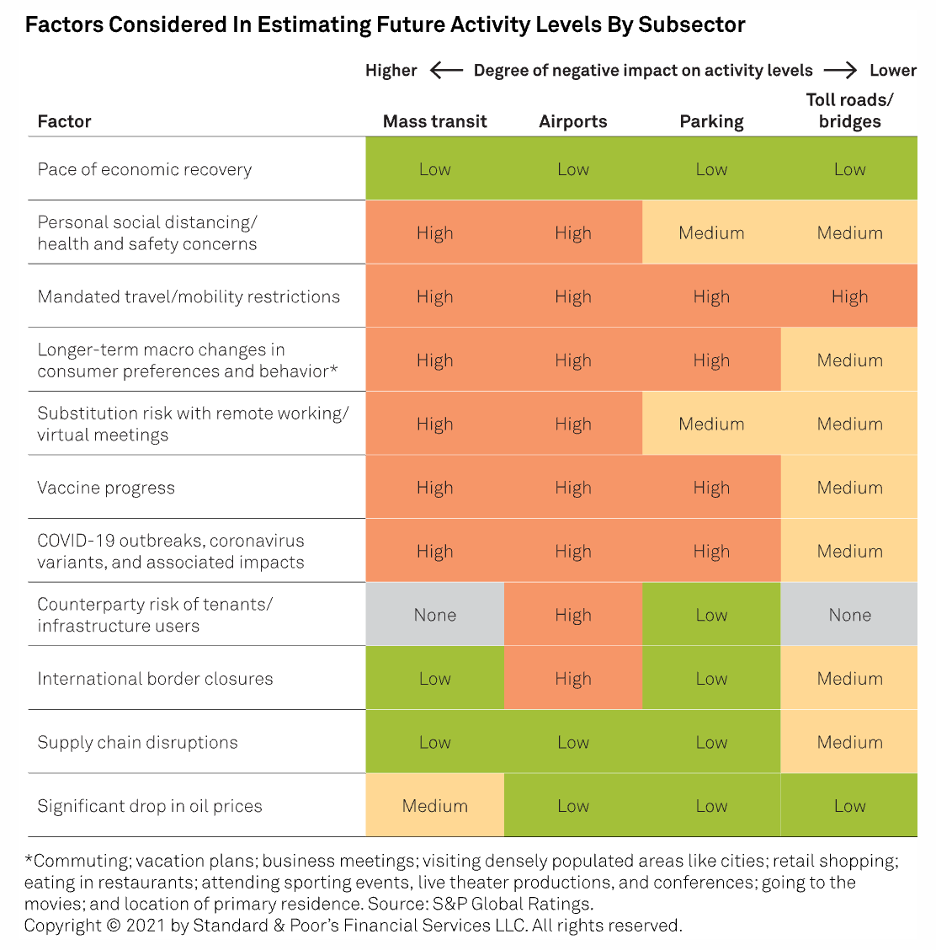

Updated Activity Estimates for U.S. Transportation Infrastructure Show Recovery for Air Travel Demand Accelerating and Public Transit Lagging

The combination of federal stimulus aid, vaccine progress, easing mobility restrictions, strong economic growth, and pent-up demand is improving the recovery curves for our activity estimates among certain asset classes like air travel, while the prospect of a continued or permanent shift to remote or hybrid work and the growth of online shopping will limit the recovery in public transit ridership for the foreseeable future.

—Read the full report from S&P Global Ratings

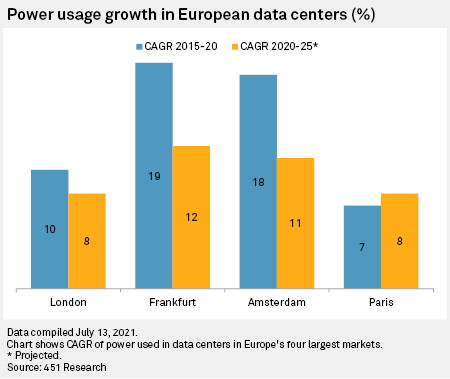

Pandemic Drives Record European Data Center Investment

As Europe's major cloud providers seek to future-proof their server capacity amid surging demand, data center investment in the region is reaching record highs.

—Read the full article from S&P Global Market Intelligence

Australia Starts Public Consultation to Enroll More Technologies In Its Emissions Reduction Fund

As Europe's major cloud providers seek to future-proof their server capacity amid surging demand, data center investment in the region is reaching record highs.

—Read the full article from S&P Global Platts

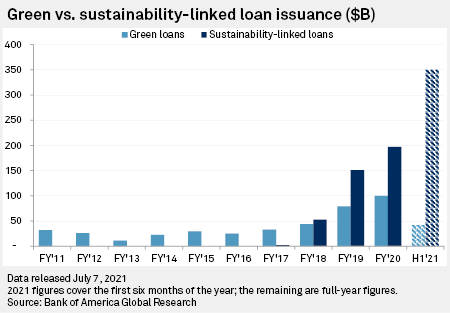

Sustainability-Linked Loan Supply Outpaces Green Bonds and Loans Amid U.S. Surge

Global issuance of sustainability-linked loans has far surpassed that of green loans and bonds as companies in the U.S., including those in transition sectors, rapidly embrace the instrument as an alternative to traditional environmental, social and governance debt.

—Read the full article from S&P Global Market Intelligence

Commoditization of Carbon Credits Proves Bearish for Prices: Sources

The commoditization of voluntary carbon credits on exchanges worldwide is increasingly proving to be bearish for the prices of those credits, due to the lower level of specific information offered on the credit itself or the underlying project, market participants have said.

—Read the full article from S&P Global Platts

Calif. Power Grid Faces 'Precarious Transition Period' Amid Gas Outages

A series of punishing heat waves and a ferocious start to wildfire season are exacerbating concerns over power supplies in the severely drought-stricken western United States, especially in California, which has been hard-pressed at times over the past two months to keep the lights on in the world's fifth-largest economy.

—Read the full article from S&P Global Market Intelligence

Valero Sees Favorable Refining Margins for 2021 as It Hikes Renewable Diesel Output

Valero Energy has a favorable outlook for refining margins for the rest of 2021, as more vaccinations roll-out and refinery rationalizations continue, while it looks to quadruple its renewable diesel production over the next few years as low carbon fuel policies continue to expand, CEO Joe Gorder said on the July 29 results call.

—Read the full article from S&P Global Platts

Climate Change 'Already Happening In the UK' as Temperatures Climb: Met Office

In a warning for power markets in the world's fifth largest economy, evidence of climate change in the UK is growing with 2020 the first year to see temperature, rain and sunshine rankings all in the top 10 on record, the Met Office said July 29.

—Read the full article from S&P Global Platts

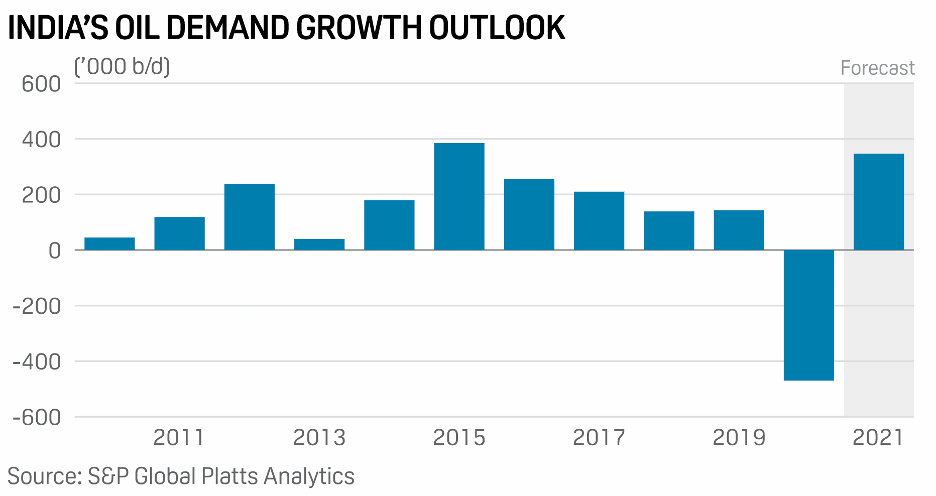

India Liberalizes Oil Reserves Policy to Manage Price Risk, Woo Investors

India has decided to further liberalize its strategic oil reserve policy by allowing to trade part of the volumes, while leasing out another portion of the barrels, steps that will help to achieve the twin objectives of managing price risk and generating revenue, the head of India's SPRs told S&P Global Platts.

—Read the full article from S&P Global Platts

U.S. Steel, Aluminum Groups Urge Congress to Pass Infrastructure Bill

US metals groups have issued support for the framework of a new infrastructure bill the Senate voted to advance late July 28 after weeks of negotiations.

—Read the full article from S&P Global Platts

China's Infrastructure Steel Demand Seen Soft In H2 Amid Lackluster Fiscal Spending: Sources

A modest outlook for China's fiscal spending in the second half of 2021 is expected to keep infrastructure steel demand over the period flat or lower from a year earlier, sources said.

—Read the full article from S&P Global Platts

ERCOT Stakeholders Push Back on Governance Reforms, Larger Reserve Purchases

Stakeholders in Electric Reliability Council of Texas' Technical Advisory Committee pushed back on governance reforms and expanded ancillary services procurement efforts.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language