Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

IN THIS DIGEST

Listen and subscribe on Apple Podcasts, Spotify, and our Podcast Page.

Here is today’s essential intelligence.

Sustainable fuels are drawing increased investment and gaining importance as high-carbon-emitting industries start transitioning away from oil, gas, and other fossil fuels. As demand for biofuels, renewable diesel, and sustainable aviation fuel looks set to swell in the U.S. this year, some market participants are pressuring policymakers to increase the volume of renewable fuels while others are vying for small refiners to remain exempt from renewable fuel mandates.

Discontent appears to be brewing across the market as producers await the Environmental Protection Agency's finalized Renewable Volume Obligation for 2020, 2021, and 2022 under the Renewable Fuel Standard, according to S&P Global Platts. Industry players are split over whether the EPA’s RFS volumes—20.77 billion gallons for 2022—are too low or too high. Similarly, market participants are divided over whether it will help or hurt the renewable fuel market if the EPA moves forward with its proposal to remove exemptions that allow small refineries with less than 75 barrels per day of capacity to sidestep the program if they can prove that a disproportionate economic hardship exists for their facilities.

Global Coronavirus Coverage

Access our global coronavirus coverageAmericas Coronavirus Coverage

Access our Americas coronavirus coverageEMEA Coronavirus Coverage

Access our EMEA coronavirus coverageAPAC Coronavirus Coverage

Access our APAC coronavirus coverage

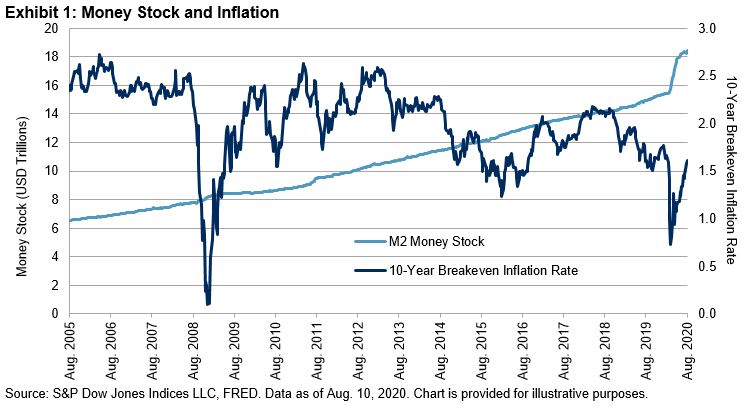

As the recovery from the Global Financial Crisis edged forward in the early 2010s, inflation hawks warned about the “certainty” of an imminent spike in inflation following the aggressive stimulus measures taken by global central banks. Unfortunately for the U.S. Federal Reserve and some of its other monetary counterparts, that certainty never materialized, and it then spent the better part of the next decade attempting to stoke what was once thought to be a sure thing.

Developing Markets: Credit Memo | July 2020

The default risk of companies in the developing markets is now back to levels last seen before the outbreak of COVID-19, according to our proprietary Probability of Default Model Market Signals (PDMS) model. PDMS is a structural probability of default (PD) model that incorporates stock prices and asset volatility to calculate a one-year PD. S&P Global Market Intelligence's sample portfolio of developing markets consists of 6,154 financial and non-financial corporates based in Central Asia, European Emerging Markets (EMs), Middle East and North Africa (MENA), Sub-Saharan Africa, and the Indian sub-continent.

Read the Full Article

As we start the second half of 2020, the COVID-19 pandemic continues to expand globally, with confirmed cases exceeding 10 million and emerging markets now the epicenter. The fight to contain the virus remains the priority until a vaccine or effective treatment is found, but progress has been sufficient enough in many countries to allow lockdowns to ease. Consequently, the focus has shifted to assessing the shape of the economic recovery.

The pandemic will likely leave profound scars on the world economy. A deeper hit than initially anticipated in emerging markets, notably for India, is now pushing our forecast to a 3.8% contraction in global GDP in 2020 (worse than the 2.4% previously expected). The dire effect of extended lockdowns on employment and consumer confidence also means that recovery will take longer than expected into 2021-2023, with a permanent loss in output.

Key Takeaways

Read our latest analyses and insights on oil markets, as the global oil production cut agreed upon by OPEC and OPEC+ nations takes effect and the coronavirus crisis continues to hamper global demand.

READ MORE ON THIS TOPICThe story of the pandemic-driven steep drop in output is by now familiar. Countries imposed strict social distancing measures to slow the spread of the virus and keep cases from overwhelming health systems. Businesses that were able to function remotely moved to working from home, while people-to-people businesses saw an unprecedented collapse of activity. GDP declined on the order of 30% to 40% at an annualized rate for a one-quarter shutdown in China (January-March), much of Europe (spanning the first and second quarters) and the U.S. (April-June).

Emerging Markets: The Long Road to a New Normal

S&P Global Ratings now forecasts a deeper economic contraction in 2020 for most key emerging market (EM) economies. Our downward GDP revisions mostly reflect the overall worsening pandemic for many emerging markets and a larger hit to foreign trade compared to our expectations at the end of April. We project the average EM GDP (excluding China) to decline by 4.7% this year and to grow 5.9% in 2021. Risks remain mostly on the downside and tied to pandemic developments.

As some analysts see storm clouds on the horizon, the danger of deteriorating economic and credit fundamentals looms. After an unprecedented era of easy credit, what will be the impact when the cycle turns?

READ MORE ON THIS TOPICThe U.S. economy regained 1.8 million jobs in July--according to the Bureau of Labor Statistics' (BLS) jobs report--as more businesses gradually returned to normal operations. With a total of 9.3 million jobs recovered since the crisis, this rebound is a little more than fourth-tenths (42%) of the 22.2 million jobs collapse in March and April. Still, the pace of recovery lost momentum across broad industry groups given the impact of surging COVID-19 cases on commerce.

That said, private payrolls (from the government report), at 1.46 million in July (8.2 million May through July), were dramatically larger than the surprisingly small 167,000 increase (7.8 million May through July) reported by the ADP private payrolls report. The two reports often aren't in line on a month-by-month basis, though a 1.29 million gap between the two releases is unusual by any stretch of the imagination. Over the long run, the reports do largely track each other. We'll be watching to see whether the BLS report will be revised down closer to the ADP report, or vice versa.

Economic Risks Rise as U.S.-China Disputes Heat up

U.S.-China relations have deteriorated markedly in recent weeks across different fronts, causing the risks of an economic spillover on credit conditions in both countries to rise. With criticism of China increasingly evolving into policy in the U.S., particularly in the areas of China's access to U.S. technology and financial markets, S&P Global Ratings views the risk trend of an economic spillover as worsening.

Read the Full Article

Latin America is now the global epicenter of the COVID-19 pandemic, with the number of new daily reported infections increasing, or remaining close to recent peaks, in most major countries. In some countries, this has meant the extension of stringent lockdowns, and in others, it has meant a slower relaxation of those measures. Across the board, households and businesses are more cautious. As a result, S&P Global Economics has lowered its GDP projection for Latin America by just over 2 percentage points to a contraction of roughly 7.5% in 2020. We expect growth to be just shy of 4% in 2021. Risks are mostly to the downside and tied to the evolution of the pandemic.

LatAm Expected to Reach Pre-COVID GDP No Sooner Than 2023

Prospects of a rapid economic recovery in Latin America have evaporated as the region grapples with the full impact of the coronavirus crisis. A slow transition back to normal activity could mean that it may be 2023 before GDP again reaches pre-COVID-19 levels, recently published estimates suggest.

Latin America and the Caribbean are expected to see GDP contract 9.4% in 2020, according to an International Monetary Fund report from June. Latin America's $5 trillion GDP could rebound at a pace of 3.7% in 2021 if the crisis abates.

At S&P Global Ratings we are continuously assessing the economic and credit impact of the COVID-19 pandemic around the world. Subscribe to our Coronavirus Bulletin today and we will ensure you have all our latest research and forecasts as they are published.

Subscribe to the NewsletterS&P Global Ratings now expects a steeper decline of economic growth in Asia-Pacific in 2020. We forecast a 1.3% contraction this year before growth of 6.9% in 2021, compared with our previous projection of 0.9% and 6.7%. This means our GDP forecast for the region for 2020 and 2021 is about $2.7 trillion lower than before the pandemic began.

Asia-Pacific has shown some success in containing COVID-19 and, by and large, responded with effective macroeconomic policies. This can help cushion the blow and provide a bridge to the recovery. Still, by the end of 2023, we expect permanent damage to the level of output of between 2% and 3%. Risks are more balanced as pandemic curves flatten but remain prominent.

Hong Kong's Trend Growth to More than Halve by 2030

Hong Kong's comparative advantage is a blend of ingredients that make it unique in the global economy and financial system. This blend cannot be replicated and has propelled its economy for decades. Now, however, these advantages are at risk of erosion. Rising policy uncertainty, fraying social cohesion, and greater competition from mainland China are making Hong Kong less special. S&P Global Ratings believes trend growth will more than halve through 2030 to about 1.1%.

Read the ResearchChina's Deflating Recovery Still Needs Stimulus

China's real GDP growth in the second quarter was an upside surprise for us and the markets. At 3.2% compared with the same quarter in 2019, it suggests that China's economy is well on the road to recovery and could grow above 2% for the full year. This clearly poses upside risks to S&P Global Ratings' 1.2% forecast for 2020.

Read the ResearchIn episode 5, Hina and Sandeep are joined by Paul Watters, head of EMEA Research at S&P to discuss global macro-economic conditions since the start of the Covid pandemic.

Listen in as we also discuss the shape of the economic recovery, the divergence in performance between corporate sectors and how recent trading by European CLO managers highlights a similar trend pattern.

The latest economic data is confirming S&P Global Ratings' view of a severe contraction in the eurozone economy in April and May because of lockdowns to slow the coronavirus pandemic. However, it's a little more pronounced than we expected, with economic activity likely to have dropped 11.4% in the second quarter, after a 3.6% contraction in the first. Therefore, we now expect eurozone GDP to contract 7.8% this year and rebound 5.5% next year (instead of our previous forecast of -7.3% and 5.6%). The services sector is taking the biggest hit because social-distancing measures are constraining consumers' ability to buy. That said, the manufacturing sector has been forced to adjust to a sharp drop in demand for consumer and capital goods as companies pull back investment. External demand has also collapsed, with the global economy facing a synchronized recession because of widespread containment measures.

Corporate Defaults in Europe Hit an All-Time High

Defaults in Europe have surpassed their 2009 financial crisis levels and reached a historical high of 23 defaults. While both the tally and default rate are high and rising, growth in the tally of speculative-grade issuers more generally will likely suppress the European default rate below its highs during the financial crisis. The number of speculative-grade issuers, particularly those in the 'B' and 'CCC' rating categories, have risen considerably in Europe and elsewhere in the last decade, characterized by low-interest rates and more aggressive financial policies pursued by many borrowers.

Moreover, about 18.2% of speculative-grade issuers in the region are weakest links (issuers rated 'B-' or lower by S&P Global Ratings with negative outlooks or ratings on CreditWatch with negative implications), an all-time high. This is a particularly important indicator of future defaults because their default rates are typically about eight times higher on average than speculative-grade counterparts.

Read the Full Article

S&P Global Ratings Research expects the U.S. trailing-12-month speculative-grade corporate default rate to rise to 12.5% by June 2021 from 5.4% as of June 2020. S&P Global Ratings economists think the U.S. economy will see growth in the third quarter, but high-frequency data paints a mixed picture, which is severely challenging the 22.2% annualized growth rate expected this quarter. S&P Global Ratings also saw both an uptick in defaults as well as a historically high number of downgrades and negative outlook and CreditWatch placements in the second quarter. The pace of downgrades and negative outlooks and CreditWatch listings has slowed significantly since April but is still elevated relative to the pre-COVID-19 pace in February.

A Credit Rating is an Informed Opinion

A credit rating is an educated opinion about an issuer’s likelihood to meet its financial obligations in full and on time. It can help you gain knowledge of—and access to—new markets, enhance transparency, serve as a universal benchmark, and assess and demonstrate creditworthiness. It’s not a guarantee or absolute measure, but is a crucial tool for investors in the decision-making process.

'BBB' Pulse: Market Liquidity for 'BBB' Rated Debt Remains Undeterred Despite High in Fallen Angels

Through the first half of 2020 there has been $323 billion in corporate fallen angel debt, with much of this concentrated in a handful of large issuers. The automotive, oil and gas, and transportation sectors saw the most fallen angels since March, which is consistent with S&P Global Ratings expectations for heightened credit stress for these sectors amid the COVID-19 pandemic.

In contrast, the 'BBB' segment has also seen record bond issuance after the Federal Reserve and European Central Bank included corporate bonds in their massive liquidity support programs in March.

COVID-19 has not receded in most key emerging markets (EMs) despite governments' efforts, while only few EMs have made progress. Many key EMs have tightened containment measures, delaying phased openings or re-introducing selected measures to contain the spread of COVID-19. These conditions cloud the panorama for a recovery. Downside risk to growth in EMs is also increasing, due to the rising threat of a second wave of COVID-19 infections in several developed economies.

A re-imposition of lockdowns in those economies, as they try to contain a potential second wave, could result in another bout of pessimism towards global demand, trade, and commodity prices, slowing the recovery that many EMs had seen in recent months. The impact of COVID-19 is now showing up in lower ratings and the rising pace in defaults.

Q&A Credit Risk Perspectives Series: COVID-19 Credit Risks and Recovery for Supply Chains

The impact of COVID-19 on the global economy is unique, as it has not only affected demand like many crises of the past, but has also severely restricted cross-border supply chains. Sidiq Dawuda, Director of Credit Risk Solutions speaks about how global supply chains will be a critical factor that will weigh on the creditworthiness of some sectors.

Read the Full ArticleStay up to date with the latest news and insight from S&P Global Market Intelligence on public health, the global economy, its sectors, and commodity markets. This newsletter will be sent every Thursday.

Subscribe to the Newsletter