Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

This guide highlights the key performance indicators for the healthcare REIT industry and where investors should look to find an investment edge.

A Real Estate Investment Trust (REIT) is a company that owns, operates, and/or finances income-producing real estate properties. Healthcare REITs specifically focus on investing in and managing income-producing real estate assets within the healthcare sector. These assets typically include properties such as hospitals, medical office buildings (MOBs), senior housing, assisted living facilities, skilled nursing facilities, and other healthcare-related properties.

Some of the key types of properties that healthcare REITs own and/or operate include:

This guide focuses mainly on healthcare REITs. However, we have separate industry KPI guides on other REIT industries, including hotel and retail. These guides provide in-depth insights into the key performance indicators relevant to each industry. If you’re interested in understanding the KPIs for the hotel REIT industry, please check out our guide on Hotel REIT KPIs. Similarly, please refer to our guide on Retail REIT KPIs for insights into the retail REIT industry.

Key performance indicators (KPIs) are an industry’s most important business metrics. When understanding market expectations for the healthcare REIT industry, whether at a company or industry level, some KPIs to consider include:

Total rental expenses: REITs incur expenses to operate the portfolio of properties they hold. These expenses are classified into four main categories:

Similar to other REITs, healthcare REITs generate income through the collection of rent from healthcare providers or operators leasing their properties. Lease agreements with healthcare providers, such as hospitals or senior living operators, form the basis of their income stream.

Healthcare REITs derive their income primarily from five segments; senior living facilities, medical office buildings (MOBs), triple-net leased properties, skilled nursing facilities, and life sciences facilities.

Income from senior living facilities is generated through resident fees and services provided within these facilities. Resident fees are paid by the residents of senior living facilities for accommodations, amenities, and healthcare services. These fees may include rent for living spaces, meals, housekeeping, and recreational activities. Healthcare REITs may derive additional revenue by offering or facilitating various other services within senior living facilities. These services could range from basic healthcare assistance to more specialized care for residents with specific medical needs.

Income from medical office buildings (MOBs) is derived by renting space within the MOBs to healthcare practitioners, hospitals, and other healthcare facilities. Healthcare professionals and institutions lease space within MOBs for medical practices, consultations, diagnostics, and outpatient services. The rent paid by these tenants forms a significant portion of the REITs’ income. MOBs are designed to meet the specific needs of healthcare providers, often including features such as specialized infrastructure, medical equipment, and compliance with healthcare regulations.

Another source of revenue for healthcare REITs is triple-net leased properties. Triple-net leased properties, often abbreviated as “NNN” leases, are a type of lease agreement where the tenant pays for all of the property’s operating expenses, such as property taxes, insurance, and maintenance costs, in addition to the base rent. So, the difference between total rental revenue and triple-net leased properties is the portion of rental revenue from properties where the operating expenses are not borne by the tenant. The “triple net” designation refers to the three net expenses that the tenant is responsible for:

The healthcare REIT, in turn, receives the base rent from the tenant, as well as any additional fees or reimbursements for specific expenses incurred.

Healthcare REITs also derive income from skilled nursing facilities by renting space to facilities that provide inpatient skilled nursing care to patients in need of medical, nursing, or rehabilitative services.

Finally, healthcare REITs also generate income from the life science segment by renting space to tenants involved in life science research. Life science tenants may include biotechnology, pharmaceutical, and other research and development companies. These tenants require specialized laboratory and office spaces for conducting experiments, developing new drugs, and other scientific activities. Life science leases are often long term and may involve complex facilities to meet the specific needs of the research conducted by tenants. The rent from these life science tenants contributes to the income of healthcare REITs.

Investors in healthcare REITs evaluate the profitability of REIT companies by looking at net operating income (NOI), funds from operations (FFO), and adjusted funds from operations (AFFO).

Here, acquisition/disposition/development NOI is acquisition/disposition/development volume multiplied by the cap rate.

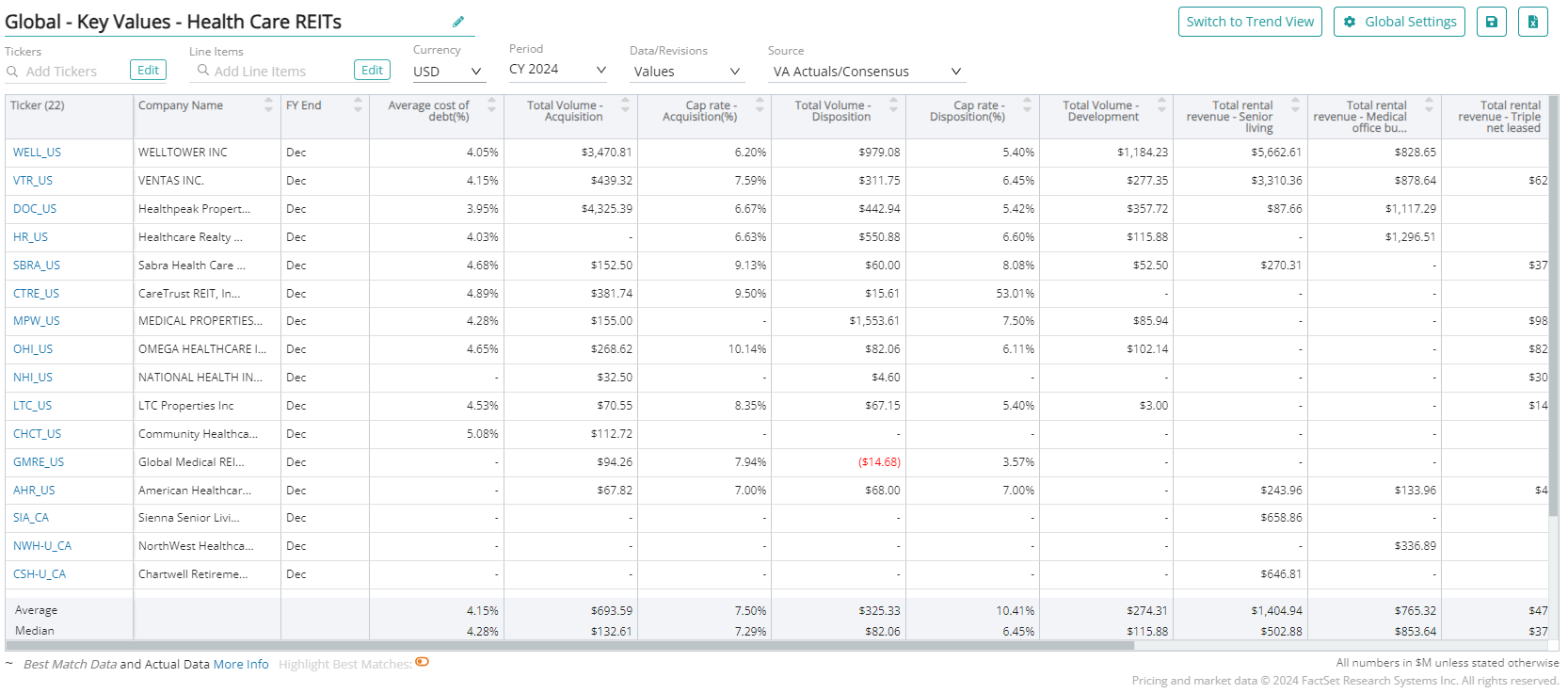

Visible Alpha offers 11 healthcare REIT industry-related comp tables, comparing forecasts for key financial and operating metrics, to make it easy to quickly conduct relative analysis, whether you are interested in looking at key values for global companies, Americas, or Europe. Every pre-built, customizable comp table is based on region, sub-industry, or key operating metrics.

This guide highlights the key performance indicators for the healthcare REIT industry and where investors should look to find an investment edge, including: