Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

This guide highlights the key performance indicators for the hotel REIT industry and where investors should look to find an investment edge.

A Real Estate Investment Trust (REIT) is a company that owns, operates, and/or finances income-producing real estate properties. Hotel REITs specifically focus on investing in and managing hotels and resorts, making them an essential part of the broader hospitality industry. Hotel REITs own and operate these hotels and resorts, leasing out rooms and spaces within these properties to a wide range of customers, including both business travelers and leisure tourists.

Companies within the industry are structured as publicly traded companies, allowing investors to buy shares and own a portion of the underlying real estate assets. To qualify as a REIT, these companies must distribute at least 90% of their taxable income to shareholders in the form of dividends, which makes them attractive to income-seeking investors.

Hotel REITs typically own a diverse portfolio of lodging properties, which can include luxury hotels, budget motels, all-inclusive resorts, and vacation rental properties. Some REITs focus on specific market segments, such as luxury resorts or business hotels, while others have a more diversified approach.

The performance of hotel REITs is closely tied to economic conditions, tourism trends, and travel patterns. Economic downturns, natural disasters, and health crises, such as the COVID-19 pandemic, can significantly impact their revenue and profitability.

This guide primarily covers hotel REITs, but we also offer a separate KPI guide specifically dedicated to the broader hotel industry, which delves into the key performance indicators relevant to hotels. Our coverage across the hotels, resorts, and cruise line universe includes 34 global tickers.

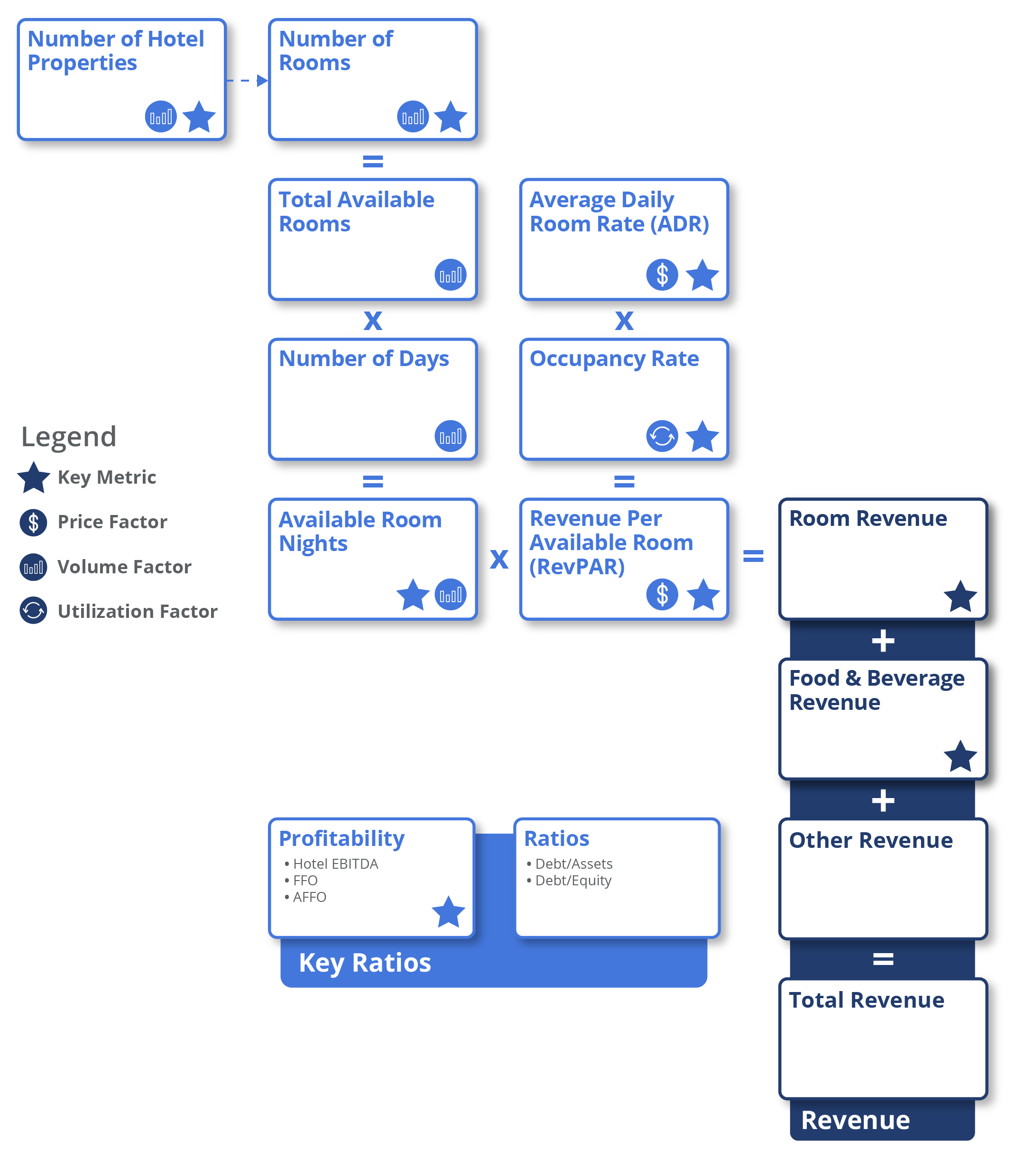

Key performance indicators (KPIs) are an industry’s most important business metrics. When understanding market expectations for the hotel REITs industry, whether at a company or industry level, some KPIs to consider include:

Hotel REITs incur various expenses in managing and operating their properties. The major expenses for these REITs typically include:

Hotel REITs derive their income primarily from renting out rooms and facilities to guests. Income streams also include food and beverage services, and other services including event hosting and various recreational amenities.

Room revenue is one of the primary sources of revenue for hotel REITs. It includes income generated from renting out guest rooms, suites, and accommodations to guests. Room revenue is typically the largest revenue segment for these REITs.

Here, available room nights refer to the total number of rooms a hotel or lodging property has available for guests to book over a specific period. It is a crucial metric for assessing a hotel’s capacity and potential occupancy. RevPAR, on the other hand, is the revenue generated per available room, whether or not they are occupied. It is calculated by multiplying a hotel’s average daily room rate (ADR) by its occupancy rate. ADR measures the average price or rate at which rooms are sold or rented over a specific period, typically on a daily basis. Occupancy rate measures the percentage of available rooms or units that are currently being rented or occupied by guests. A high occupancy rate generally indicates strong demand for the REIT’s properties, which can lead to higher rental income. Conversely, a low occupancy rate may suggest weaker demand and could impact the REIT’s revenue and profitability.

Hotels and resorts often also have on-site restaurants, bars, cafes, and room service that generate revenue from food and beverage sales. Food and beverage revenue includes income from dining and drinking establishments within the property.

Hotel REITs also generate revenue from providing several other services. This may include:

The revenue mix can vary significantly depending on the type of property, its location, and its target market. While room revenue tends to be the most substantial segment for most hotel and resort REITs, diversifying revenue sources through food and beverage services, events, and amenities helps them mitigate risks and enhance profitability.

Hotel REITs typically expand their portfolios by acquiring or developing hotel properties. Companies in this industry frequently acquire existing hotel properties and may purchase individual hotels or entire hotel chains. Such expansions allow them to diversify their holdings and gain access to properties in different markets and regions. The effects of these transactions are reflected in their financial statements, such as “cash & cash equivalents,” “property, plant and equipment, net,” and cash flow indicators like “net (acquisitions)/disposals” and “increase/(decrease) in debt, net.”

Some Hotel REITs may also engage in new hotel development projects. They invest in the construction of new hotels or the expansion of existing properties. This strategy allows them to customize the hotels to meet their specific requirements and to enter markets where they do not currently have a presence. The impact of these development projects can be seen in the cash flow category of “capital expenditures.”

Hotel REITs may enter into joint ventures with other real estate developers or hotel management companies. By pooling resources and expertise, they can jointly develop or acquire hotel properties. The overall effects of these external growth activities are reflected in metrics such as the “number of hotel properties (#)” and “number of hotel rooms (#).”

Investors assess the profitability of hotel REITs by considering various financial metrics, including Hotel EBITDA, Funds from Operations (FFO), and Adjusted Funds from Operations (AFFO).

Finally, investors monitor debt/asset and debt/equity ratios for investment efficiency and leverage.

Visible Alpha offers six hotel & resort REIT industry-related comp tables, comparing forecasts for key financial and operating metrics, to make it easy to quickly conduct relative analysis, whether you are interested in looking at key values for global companies, Americas, or Europe. Every pre-built, customizable comp table is based on region, sub-industry, or key operating metrics.

This guide highlights the key performance indicators for the hotel REIT industry and where investors should look to find an investment edge, including: