Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

By Cornis van der Lugt and Alexander Johnston

Highlights

As the crypto ecosystem matures, there is an opportunity to leverage the technology to further sustainability efforts.

Bringing an ESG framework and associated due diligence to crypto-related enterprises could help investors make informed decisions in a challenging sector underpinned by a variety of architectures and business models.

We proposed an exploratory framework to assess what a sustainable crypto industry enterprise would look like, taking inspiration from the S&P Global Corporate Sustainability Assessment (CSA), and used S&P Kensho New Economy Indices as well as CSA data to compare how companies involved in fintech perform on some of the criteria in the proposed framework.

As crypto moves from years of experimentation into a more mature stage in its evolution, crypto entrepreneurs are challenged to reimagine a value-adding role. With this comes a window of opportunity, recognizing the significant role that emerging digital finance technologies can play in sustainability initiatives. They can facilitate peer-to-peer transactions and alternative banking, support new markets for clean energy or trading carbon credits and collect and verify vast quantities of environmental and social data. But enabling these effectively requires rooting sustainability criteria in company operations, products and services. The time is ripe to ask how to assess sustainability in the crypto ecosystem and how to identify initiatives or enterprises that reflect such potential.

Designing an environmental, social and governance (ESG) framework to assess all projects or enterprises active in the crypto ecosystem is challenged by the diversity of activity, architectures and business models emerging in the field. Investors will be cognizant of the unique challenges that cryptocurrencies, blockchain and decentralized finance (DeFi) present to ESG assessment. In many initiatives investors will not be able to engage with a traditional operating structure, where a mediating body can both directly measure and unilaterally act on ESG considerations. While decentralization is positioned by blockchain and crypto advocates as driving more ethical and transparent business practices, it is challenging for the investor to monitor the decentralization of projects and understand its implications in areas such as data sovereignty and sustainability impact.

With this in mind, we explored a broad ESG framework to assess what a sustainable crypto industry enterprise would look like. Considering questions on ESG performance the S&P Global Corporate Sustainability Assessment (CSA) asks listed enterprises, we defined a framework (see box below) that investors could use as reference for assessing various crypto-related enterprises. We specifically considered questions included in the CSA for IT and finance sectors, questions answered by listed enterprises involved in different financial technologies and many involved in some way in the crypto ecosystem. Crypto entrepreneurs could also refer to this framework when establishing new enterprises and considering steps to become more mature, albeit “alternative” organizations. In addition to our proposed ESG framework, we outlined its structure and elaborated on what is proposed under its list of criteria. We also provide illustrative examples of ESG scores of listed companies under related CSA questions, including enterprises that are leading members of relevant S&P FinTech indices.

What are the entity’s business activities and size, and how centralized or decentralized is it?

Crypto-related enterprises that have emerged over the past decade offer diverse services and take various forms: digital asset financial services providers, infrastructure solutions providers, digital asset brokerages, blockchain infrastructure providers, crypto index platforms and developers of digital marketplaces. The application of crypto in finance includes both DeFi and centralized finance (CeFi) platforms. DeFi is underpinned by blockchain networks and smart contracts, enabling direct peer-to-peer transactions. CeFi platforms are typically exchanges that facilitate conversion between bitcoin, other crypto assets and fiat money. DeFi applications can involve multiple blockchains when providing lending and trading services within the crypto ecosystem.

The industry behind crypto involves technology infrastructure, the blockchain service market (software programs including decentralized applications) and the crypto asset financial market (including exchanges and funds). The type of organization whose ESG performance would be assessed could take various forms, come from different subindustries and have different sizes and degrees of decentralization. This means an assessment of the ESG performance of such an enterprise will face challenges of scope, boundaries and measurement. The scale and measurement of decentralization in particular is cause for much debate. There are a variety of architectural choices for blockchain network design, with networks ranging from highly distributed and open, to private chains governed by a single party. These nuances, alongside a tendency toward pseudonymity in the public blockchain ecosystem, complicate assessment. An additional complication is the lack of a traditional operating structure within many distributed ledger initiatives, without a mediating body that can directly measure and unilaterally act on ESG considerations.

Investors interested in crypto may be examining established, listed corporations from the IT or finance sector that provide foundational infrastructure or capital for the crypto ecosystem. Alternatively, they may be examining recently listed or licensed startup enterprises, initial coin offerings (ICOs) or entrepreneurial ventures in the form of some registered partnerships developing DAOs. The investees could also be a mix of traditional institutions. For example, the decentralized proof-of-stake network Hedera Hashgraph’s cryptocurrency HBAR has a list of owners and governing council including companies such as Boeing, Deutsche Telekom, Google, IBM, LG Electronics, Tata Communications and Wipro. Finally, the interested investor may be an institutional one signed up to an industry initiative such as the Principles for Responsible Investment (PRI), or a crypto venture capital investor interested in select sustainability themes including clean tech. It may be an investor active in the global impact investing market, currently estimated at US$1.164 trillion.1 Whatever the type of responsible or ESG-minded investor, the first point of interest will be the value proposition of the investee involved.

ESG considerations vary substantively as to where a provider or technology sits in the fintech value chain. The foundation of decentralized applications are distributed ledger networks: peer-to-peer architectures made up of devices running blockchain software. Much of this software is open source and these networks can be built in several ways, supporting large public ecosystems or more controlled, permissioned networks. Permissioned networks have an access control layer and are used to restrict governance to approved individuals. Above these foundations sit a range of offerings, from developer tooling to packaged applications, as well as service providers offering node hosting services or consulting practice. Figure 1 provides a simplified vision of this stack, with an example of offerings at each stage.

When exploring the upper echelons of the blockchain stack, where much of the complexity of managing blockchain infrastructure may be abstracted away for users, risk profiles become more complex. Entities may make use of a range of blockchain protocols or insert themselves as centralized intermediaries to decentralized networks, for example. However up-stack, when blockchain is an integrated component of a broader application, particularly from established technology providers, offerings tend to be easier to assess through traditional vendor risk management practices. A traditional technology provider that offers a data marketplace or supply chain mapping application, where auditability is underpinned by an otherwise invisible blockchain, offers a very different risk profile to a Web3 startup promising a means to port enterprise data on-chain to trigger automated smart contracts.

Web3 startups fit less comfortably into standard enterprise performance management frameworks or methodologies, and a distinct lens for analysis may be required. Web3 startups are businesses that have emerged within decentralized technology ecosystems, commonly incorporating aspects of decentralization or token-based economics into their business practices. Many Web3 startups building on distributed ledger foundations have very specific challenges related to areas such as user governance and distinct issues around measuring their ESG impact.

What is the value proposition of the enterprise involved? A sustainable enterprise will offer a technology with a purpose, addressing a real-world problem with a defined sustainability solution.

The past decade has shown growing expectations for blockchain and crypto innovations to deliver solutions to current social and environmental challenges. If crypto-related products and services are meant be less about speculative investments and more about tokenized utility, questions related to sustainability and purpose need to be clear in a crypto-related enterprise’s value proposition.

In 2018 the UN Inquiry and the Swiss-based Sustainable Digital Finance Alliance (SDFA, now GDFA)2 developed a framework for assessing the potential contributions of digital finance. It describes four levels of contribution, which can also be applied to crypto: systems and data that support incorporating sustainability into financial decision-making, incentivizing consumers to make more sustainable choices, mobilizing new sources of finance and boosting innovative business models in support of the Sustainable Development Goals (SDGs). This was conceived with various technologies in mind, specifically big data, machine learning and artificial intelligence (AI), mobile and web-based platforms, blockchain, crypto and the internet of things (IoT).

The UN/GDFA framework can be expanded further, with potential benefits of crypto as suggested in figure 2 below. These contributions, which can serve the goals of ESG integration and pricing sustainability risks and opportunities, range from collecting and securing data on a massive scale to rolling out new business models to support markets for alternative products and services. The benefits of any social or environmental project can be translated into rights for contributing participants, and those rights can be turned into tokens for trading in an open market.

Building on early-stage pilot schemes and developing new markets, tokenization today is reaching a broad range of real-world assets. Possibilities include the tokenization of social and natural assets such as forestry, renewable energy, water reduction, land rights and carbon offsets. Climate-related projects include possibilities for trade in carbon credits and local communities trading in renewable energy in decentralized power supply. The wealth of activity can be seen in the over 200 energy applications tracked by the Energy Web Foundation, applications using blockchain and involving major energy corporations.

Blockchain and crypto-related initiatives for sustainability goals can be focused on social or environmental impact, comparable with social and environmental bonds. Common social objectives include financial inclusion, with blockchain-based technologies positioned to broaden access to services and greater transparency. Relevant startups include Cash Cow Global LLC (doing business as Leaf Global Fintech), which aims to use blockchain to provide virtual financial services to refugees, as well as mobile-first blockchain developers Celo Foundation. Grassroots Economics, a Kenyan headquartered non-profit, is involved in voucher and inclusion currency programs designed to support regional development.

The IXO Foundation, a Swiss distributed ledger technology (DLT) platform that tracks impact and automates tokenized payments using smart contracts when the impact criteria are met, enables complete transparency and traceability for social and environmental projects where participation and payments are tokenized. The digital impact credits it validates are turned into tradeable digital assets such as carbon, biodiversity, education or health credits.

Blockchain and crypto-related enterprises often address environmental objectives and impact areas like climate and energy, water, circularity, biodiversity, reforestation and conservation. The World Economic Forum has referred to “Blockchains for a Better Planet.”3 Initiatives that facilitate trading in credits have emerged in developed and developing societies alike.4 In India, the Australian company Power Ledger established a project that enabled homeowners with solar arrays on their rooftops to sell power to others on the grid, setting prices in real time and executing transactions over blockchain. In South Africa, the Sun Exchange allows anyone with an internet connection to buy solar panels online and rent them to businesses, hospitals or schools in Africa. It uses bitcoin for cross-border payments, involving no intermediaries between the beneficiaries and investors. Identified as one of the top carbon crypto companies to watch in 2023, Brazilian company Moss has developed its own token, the MCO2, by tokenizing verified carbon credits.5 Each MCO2 token represents one tonne of carbon offset, with a particular focus on credits generated from forest preservation projects in the Amazon rainforest.

Distributed renewable energy markets and peer-to-peer token trading schemes have flourished in developed economies, with companies such as SolarCoin (USA), LO3 Energy (USA), WePower (Lithuania), Conjoule (Germany), Jouliette (Netherlands) and GREENEUM (Israel). California, which is prone to droughts, provides an example of trading in water rights: applying IoT sensors, AI and blockchain could help identify changes in water conditions, suggest contingency plans and find buyers (drought-stricken regions) and sellers (regions with good rainfall) in water management and trading schemes.6

In addition to environmental and social objectives, key governance objectives include transparency and information security. Blockchain immutability and transparency are important features in the context of ESG reporting, helping stakeholders verify the authenticity of information, for example. Information security and data privacy have implications for both governance and human rights. Data breaches and record tampering can harm organizations, customers and partnered companies. Worldwide, the number of data breaches has increased significantly since 2022, and the average cost of a corporate data breach in 2023 was some US$4.5 million.

As a decentralized network, blockchain can prove more resilient than an environment where compromising a single server puts all data at risk. As figure 3 illustrates, improving data security was the most identified driver for organizations that have invested, or are planning to invest, in blockchain. Zero-knowledge proofs, which enable the verification of information without disclosing the underlying data, and “layer 2” networks, which can conduct transactions on a separate chain before settling them as a batch on the “main” chain, are helping drive blockchain privacy and scalability. Blockchain and tokenized assets could form a foundation for more responsible data handling, allowing for greater autonomy and control over one’s personal data.

What is the composition of the leadership team and what risk mitigation policies are in place? A sustainable enterprise will have a diverse, experienced board and comprehensive policies for risk management, ethics and compliance, taxes and information security.

In the 2000s, the AA1000 standard for stakeholder-based assurance was created, defining three principles at its foundation: materiality, completeness and responsiveness. A key message of this multistakeholder initiative was that someone must be held accountable. Developed in the early days of voluntary ESG standards, its philosophy was a democratic, inclusive approach to assuring relevant content on which an organization communicates comprehensively and responsively. Similarly, distributed ledger technology and decentralized finance as a vehicle for secure and transparent processes is commonly couched in the language of empowerment, linked with initiatives around voting, data verification and decentralization. But while crypto and Defi may be promoted as a democratic ideal, where is accountability in the face of anonymity?

At their most decentralized, highly democratic entities in the form of DAOs exist with transparent and distributed decision-making processes, as well as auto-enforcement of decisions. In simple terms, a DAO is as a community-led entity with governance delegated to members and its foundational rules defined by smart contracts — programs stored on the blockchain that execute processes when certain conditions are met. These communities allow members to create and vote on proposals about future operations. DAOs are frequently unincorporated or general partnerships, without official legal status or associated protections. It is challenging to maintain their level of decentralization; fractionalized ownership complicates governance. Typically, token ownership is initially concentrated among the founders and developers. Even if that concentration declines over time, voter participation rates tend to be low and again concentrated among these core participants. This is particularly challenging in projects which are technically complex, where few community members feel knowledgeable enough to meaningfully shape decision-making. Here the ideals of broad participation are potentially countered by the expertise of a tech elite.

Key questions on corporate governance in any business partnership or enterprise relate to the composition of the leadership team, the quality of risk management applied, as well as compliance and business ethics. The shape of the leadership team may be formalized in some way, depending on the entity’s size, whether it is listed or what other form of organization it takes. The leadership team may include a formal board, which all public companies must have, or an informal advisory board that provides guidance for the senior management team. In a DAO that leadership team may simply be a handful of entrepreneurs who initiated a project, or they may have a democratic mandate and were selected by members. Their organization might have some form of registration, for example as a trust, but in some instances the entity may simply be an unincorporated partnership.

Key aspects of organization and leadership are ownership and voting rights, as well as how much independent expertise is involved. Independent members, like independent board members, are there to ensure that the best interests of shareholders and the organization as a whole are met. Furthermore, the leadership team should have relevant industry experience, diversity in terms of gender and culture, as well as knowledge of the ESG agenda.

The “Fintech indices and ESG performance of select constituents” box below shows how a collection of diversified financial and IT companies involved in fintech report on leadership-level gender diversity and other ESG topics. Governance-focused investors engaging with the leadership team would want to get a sense of leadership quality and experience. Equally relevant from an ESG perspective is whether leadership understands sustainability issues such as climate change and social development.

Leadership also needs a good grasp of the most material risks and opportunities the organization faces. The launch of a crypto enterprise can be accompanied by much excitement about prospects and opportunities — this needs to be balanced with a sound understanding of risks involved and mechanisms to ensure its policies are consistent with its shareholders’ risk tolerance. It requires clear allocation of responsibilities for risk governance, management and processes including risk monitoring and audit (see “Fintech indices and ESG performance of select constituents” below). Specialized in lending to tech companies, Silicon Valley Bank in 2023 faced the consequences of not having a chief risk officer.7 Risk management functions should be separated from business functions. Processes include sensitivity analysis, and systems need to be backed by an appropriate risk culture.

Compliance and business ethics raise a major concern for crypto organizations. Failure in this area has caused several prominent entities to collapse. The same features of decentralization, anonymity and perceived security that attract idealistic entrepreneurs also attract participants with suspect motives. For regulators, consumer protection, market conduct and anti-money-laundering rules are critical. Depending on the nature of the business, startups may need licenses to operate legally and to comply with evolving consumer protection rules. They may be faced with data protection laws where some legislation appears, on the surface, to challenge the use of blockchain. For example, the need to be able to delete personal data conflicts with blockchain’s immutability.

The ability of blockchain-based technologies to remove intermediaries, boost efficiency and counter fraud through independent verification and assurance must consider the entry point where human actors define and initiate new currencies, tokens and transactions. Within crypto-related organizations, there should be formal codes of conduct, stated ethics policies that are effectively applied and monitoring of any suspicious activities in-house and on-chain. This includes monitoring information security breaches and transparent customer relationship management. Key topics on the information security agenda are hacking attacks and the risk of theft, which underlines the importance of monitoring blockchain transactions. Blockchain and crypto tracking firms such as Chainalysis and Elliptic have reported, for example, that North Korean crypto hackers have stolen billions of US dollars from banks in cryptocurrency firms in recent years.8

Crypto startups may find themselves at fault for failing to counter fraud. For example, virtual currency mixer Tornado Cash has been sanctioned by the US Treasury, with transactions to or from the protocol prohibited for US users after federal regulators concluded that cyber criminals used it to launder money. Crypto exchanges may be expected to play a role in countering money laundering and criminal misuse of digital assets. This requires them to advance fair business practices, staying clear of conflict-of-interest situations such as those faced by Binance and Crypto.com,9 and effectively apply anti-money laundering and client identification rules backed by appropriate compliance and risk mitigation procedures. Listing requirements include having audit committees. Audits of listed enterprises can detect the risk of fraud, whereas prominent crypto company failures have involved misrepresentation, fraudulent statements and misappropriation of investors’ funds. Listed enterprises must meet their regulatory obligations, which can be challenging for businesses operating new activities in an evolving regulatory landscape. In the US, the SEC acted against several leading exchanges in 2023.

What is the enterprise’s approach to applying ESG criteria in its products and services? A sustainable enterprise offers credibly labeled products and monitors their application and compliance with stated ESG principles.

A sustainable enterprise’s value proposition points to having a unique service offering. From an ESG perspective, it raises fundamental questions about the enterprise’s sustainability approach, how it manages client relations, how it labels its products and what controls it applies to effectively integrate and continue to meet the specific sustainability principles and standards it committed to.

When asked about their approach to sustainable investment, financial institutions can point to a range of strategies, from negative or positive screening to an ESG integration approach or thematic and impact-focused investment. These can be applied to active and passive approaches, including exchange-traded funds (ETFs). This is particularly relevant for fund managers as the SEC in January approved 11 ETFs for bitcoin, paving the way for investors to invest in bitcoin without having to buy it directly. Crypto-related enterprises can publicly state their approach to “responsible fintech,” as this is inherently linked with their value proposition. If sustainability criteria are built in, how are they applied more concretely to the lending, investment, insurance or trading services they provide? As the technology is still new, it may be more likely that crypto entrepreneurs will publicly state a thematic or impact investment approach, such as issuing carbon and energy coins/tokens (climate thematic) or SDG impact coins/tokens (confirming specified developmental contributions).

Crypto may be appreciated for its anonymity or pseudonymity, but increasing the scale, organization and volumes of capital managed will inevitably raise questions about the credibility of clients as well as support for clients. The latter surrounds customer satisfaction and levels of digital finance or crypto literacy, notably for retail customers. The former is linked with business ethics and steps taken to prevent crime. While blockchain may offer a reliable guarantee of documentation in handling non-face-to-face customer due diligence, at some level basic know-your-client requirements become relevant in monitoring on-chain activity. For token initiatives built on a certain utility, the credibility of business partners and projects (for say, clean energy or development) need to be assured. Blockchain can reduce middlemen and safeguard certificates, but the entry point service or product providers require assessment.

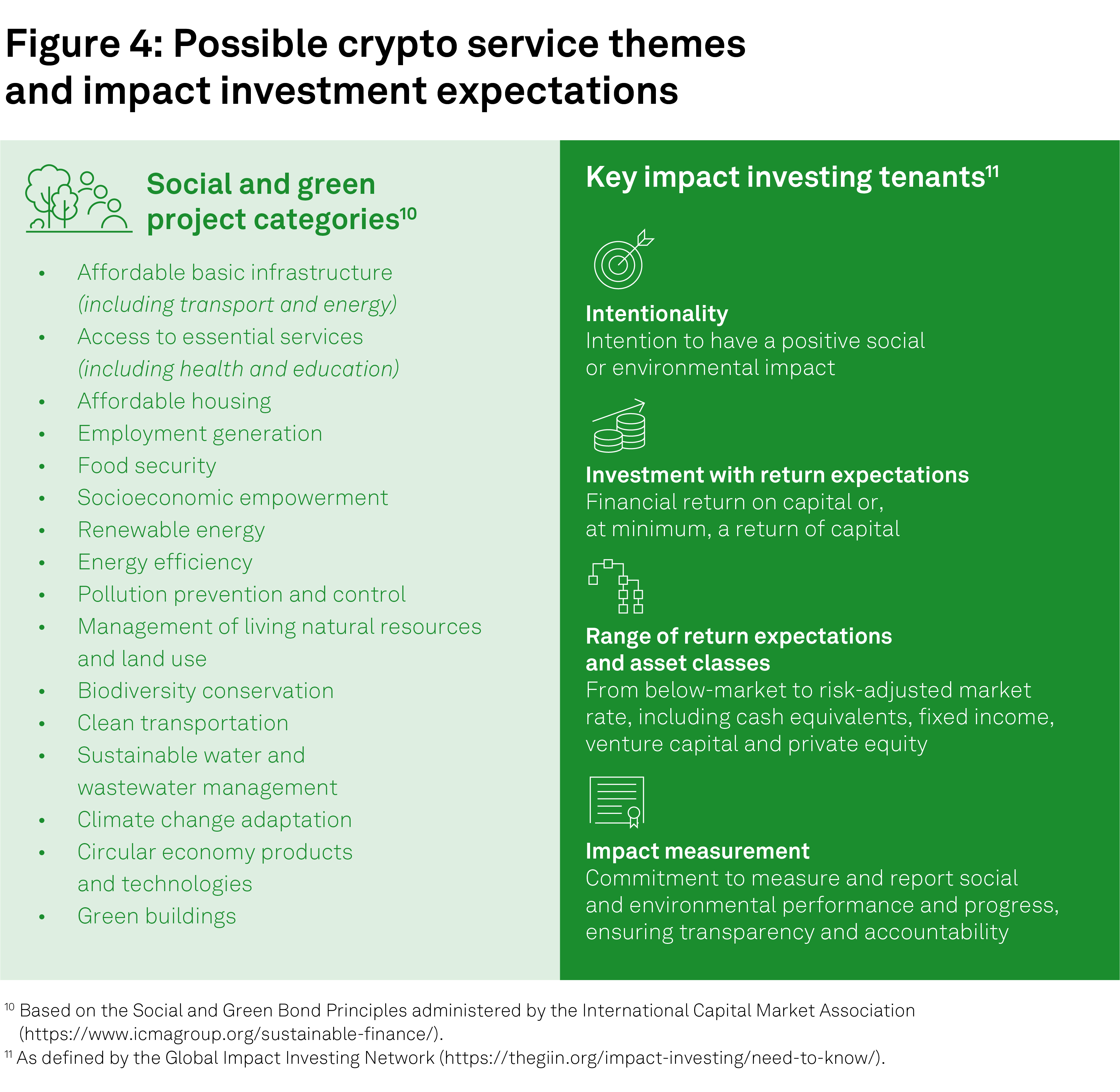

Investors would expect clear labeling of products or services that have an explicit sustainability theme. This may refer to themes such as climate, biodiversity, financial inclusion or small business development. Figure 4 below provides examples of common themes, building on the experience of green and social or impact bonds. The SDGs encompass a broader range of themes, including gender equality and sustainable consumption. The investor would want to see how E, S and/or G criteria are integrated into, for example, an investment or lending product, the transaction levels and financial volumes involved and the impact of the labeled products. It’s therefore important to have published policy and guidance that outlines the processes and progress targets to achieve the desired sustainability outcome.

Larger enterprises have some combination of formal and informal management control systems. Formal controls need to ensure basic checks on, among others, the application of ESG principles the enterprise committed to. Softer controls may involve training on ESG topics, regular staff check-ins and events to promote a certain culture. In benchmarking with peers, controls may also reference industry standards that have been developed and applied by enterprises as a voluntary undertaking and affirmation of what constitutes recognized best practices. Examples are sustainability bond standards or green project finance standards. Enterprises as a rule are expected to report publicly on their use of such standards and progress made annually.

An enterprise should have certain processes and mechanisms to ensure the application and reach of the sustainability principles and goals it is committed to. For start-ups, soft management controls may be especially important in shaping a culture of responsible business conduct. With this goes the use of appropriate rewards and incentives that reinforce the principles behind the services offered. Good practice in applying sustainable investment approaches will also benefit from referencing recognized standards developed with industry peers. For crypto exchanges, there is plenty to learn from guidance shared by the Sustainable Stock Exchanges Initiative (SSE), which published a guide for reporting ESG information to investors — a voluntary tool for exchanges to guide issuers.

Does the enterprise have recognized employment standards and principles? A sustainable enterprise should offer relevant employee education and training, long-term incentives to retain talent, and employee support programs.

One of the main challenges for crypto-related enterprises is talent management. Developers in this field need advanced knowledge and skills in areas such as programming language, coding, cryptography and data analysis, combined with an understanding of financial systems. At a socially responsible crypto enterprise, employees also need expertise in sustainability. Attracting and retaining reliable talent from these fields requires offering long-term incentives and employee support programs. CSA data from S&P Global Sustainable1 has shown that industry groups with significant intangible assets — notably human capital — also generate more revenue from product innovation. This is especially true for those running effective employee development and support programs, for example in the software and services industries where the proportion of innovation-related revenue was associated with better human capital management scores.

The COVID-19 pandemic highlighted the need for employee support programs to address employee health and wellbeing. It led to cases of “IT burn-out,” as software specialists spent long hours working remotely. Scientific research on the health implications of employees spending long hours in front of screens without taking breaks is growing. It has led some tech firms to introduce less than five-day work weeks, noting how four-day work weeks have become both healthier and more productive.12

Remote versus in-office work remains a subject of debate in the financial sector as companies experiment with hybrid approaches. Results from the Employee Experience Insight Reports 2023 found from respondents internationally that hybrid workers are happier than office-only workers.13 Crypto exchange Binance was famously “headquarterless,” with employees based in 27 countries and yet tried to enforce a certain “cultural fit” among its workforce. An unbalanced hybrid approach and work-from-anywhere bring their own risks. One of the weaknesses of Silicon Valley Bank was said to be excessive decentralization and senior managers working from dispersed locations in different countries.14 Arguably, effective risk management has critical moments where lead managers involved need to be in the same room.

The tech world is known for innovation, rapid change and dynamic competition. Sustainable finance requires this to be principles-based and focused on the long term. Employee development should enable experts from the IT, finance and ESG domains to get to know each other’s fields of work, which can be done via ongoing training and education in these areas. Leadership needs to be able to converse across these fields, and crypto gurus need education in select ESG subject areas such as climate change, financial inclusion, business ethics and human rights. Leading enterprises should report hours and spending on employee training in these fields.

Employment practices in a socially responsible enterprise respect recognized labor standards. It has a policy on nondiscrimination and anti-harassment. It promotes a healthy work environment with formal and informal controls, including regular discussions with employees that are engaging and adapted to digital and remote working environments. It also promotes diversity, including cultural and gender diversity, and tracks progress in strengthening and reaping the benefits of a diverse workforce. Employees feel they can speak up, be it through regular conversations, online surveys, helplines and other tools such as anonymous reporting.

As with many other technology startups, diversity and inclusion are important topics. Prominent industry commentators have highlighted the challenges caused by its lack of gender diversity. The problem is pronounced enough that several groups, Global Women in Blockchain (GWB) among the most prominent, have been established to drive greater diversity. The GWB among others highlight the lack of venture capital going to tech startups founded by women. A challenge with social assessments comes in the form of community and diversity, where the tendency in public blockchain ecosystems toward pseudonymity (users having a consistent identifier that is not their real name) can make assessing inclusion challenging.

Is there a policy and program for energy efficiency, renewables and reducing GHG emissions? A sustainable enterprise has a credible climate strategy.

The volume of data created, transmitted and stored in the cloud or on public blockchains continues to grow exponentially and is now measured in zetabytes. Behind them are thousands of energy-intensive data centers worldwide that use extensive power to run their servers and cooling systems. Data centers among others provide the physical nodes that blockchain networks rely on. DLT therefore drives data center demand. The proof-of-work calculations cryptocurrencies such as bitcoin require is accompanied by mining and network activity that is highly energy intensive; the annual terawatt-hours of electricity consumption are more than what many countries use annually. Massive electricity use tends to be accompanied by high levels of GHG emissions.

Estimates of bitcoin’s carbon footprint can give an idea of this intensity. The Cambridge Bitcoin Electricity Consumption Index, one of many ongoing efforts monitoring bitcoin’s energy usage, estimates that its annualized emissions are around 69 metric tons of carbon dioxide equivalent (MtCO2e).15 This could rise even further as bitcoin’s price increases from lows in late 2022 as the profitability of mining improves. Looking beyond bitcoin to blockchain, later generations of blockchains largely use different, less energy-intensive methods of arriving at consensus. These architectures are more commonly used to underpin decentralized applications. Several blockchain networks — for example Algorand, Cardano and Solana — have made well-publicized announcements around carbon neutrality and even carbon negative objectives, achieved in part by offsetting.16

In September 2022 Ethereum switched to a proof-of-stake consensus mechanism that is radically less energy intensive than its prior proof-of-work mechanism (still used by Bitcoin). A proof-of-work consensus mechanism derives its security from the computational complexity required to mine the next block on the chain. Participants are rewarded if they are the first selected to mine the next block on the chain. To do so, they must solve a complex cryptographic puzzle before other participants. They are therefore incentivized to maximize their computational power, creating an “arms race” effect of increasing energy usage. In contrast, a proof-of-stake consensus mechanism derives its security from the economic stake committed by validators participating in the network. Computational power is not necessarily a driver to participate, meaning that the overall energy usage is much lower. Short of changing its consensus mechanism, reducing bitcoin’s GHG footprint would require miners to pursue energy efficiency as well as renewable supplies that can be contracted in different jurisdictions.

The Crypto Climate Accord (CCA) of the Rocky Mountain Institute,17 World Economic Forum and others promote accounting tools for miners to measure and report on their energy use, seeking new ways to advance renewable power generation. For the allocation of GHG emissions responsibilities, the CCA framework recommends a hybrid approach in which GHG emissions are allocated to stakeholders based on the value of a user’s holdings (which drives block reward incentives) and the transaction fees the user pays (which drives transaction fee incentives). Those with operational control over an asset, such as cryptocurrency asset owners and service providers, are therefore responsible for their relative share of total GHG emissions (scope 1 - 3).18

Estimating the energy consumption of blockchain networks is challenging, requiring an understanding of the total combined computational power to process transactions and the efficiency of the devices powering the network. These estimations become more challenging when attempting to assess renewable energy use, where the decentralized nature of large public blockchain networks will commonly require geolocation mapping of the hardware underpinning the network. Many estimations will rely on grid mix data, information on sources of electricity generation on a regional or national level. A point-in-time analysis would require not only knowing where a certain percentage of the nodes currently active in a network are, but estimating the energy use of the associated hardware and then the localized breakdown of the energy sources being used to power them. Many industries have learned to conduct this type of analysis over the past two decades by applying tools such as the GHG Protocol and related International Organization for Standardization (ISO) standards.

The CCA among others believes that blockchain as open source, decentralized technology, can bring greater data transparency and trust to decarbonization efforts. Pressure to improve the industry’s energy and climate impact will continue. When a consumer site in 2023 listed the “28 most sustainable cryptocurrencies” of the year, the main criterion applied was energy use.19 To join data centers with renewables projects, owners of data centers and crypto mining operations are exploring options to help integrate renewables and balance grids in different economies.

Environmental challenges for blockchain and crypto extend beyond energy and GHG emissions. New measures developed under the EU’s new Markets in Crypto-Asset (MiCA 2023) regulation will require issuers and crypto-asset service providers to disclose adverse climate and environment-related impacts. Consultations led by the European Securities and Markets Authority (ESMA) on MiCA’s proposed technical standards suggested that those preparing crypto asset white papers and crypto asset service providers must identify the energy consumption of DLT network nodes, calculate GHG emissions associated with different locations and address water use as well as waste.20

Broader environmental concerns commonly surround the infrastructure that underpins networks. Data center and blockchain-related resource demand includes water use for cooling purposes, onsite and at power supply sites. The volumes of water used and its significance is determined by location and the energy sources used for power supplies. Millions of transactions behind bitcoin take place in for example China, Europe and North America, where the International Water Association reports that cooling thermal installations require 20 to 60 gallons of water per kilowatt-hour.21 This requires billions of cubic meters of water, and is influenced by the energy source (e.g. coal, nuclear, hydro). Whatever data center energy efficiency improvements are made may be undermined by a rebound effect as bitcoin miners pursue more profitable transactions. The challenge for second-generation crypto technologies would therefore be research and development, as well as education, to ensure market growth is decoupled from resource use. While blockchain itself may be used to improve intelligent water management and water rights trading systems, upstream the technology faces water scarcity or water stress challenges as well as possible user conflicts as data center demand competes with other sectors in the same location.

Additionally, blockchain infrastructure has an electronic waste (eWaste) problem. Bitcoin mining requires extensive usage of specialized hardware (including application-specific integrated circuit chips) with short life cycles, thus adding to eWaste volumes and associated problems involving toxic chemicals and heavy metals pollution. Research in 2021 estimated that bitcoin's e-Waste amounts to 30.7 metric kilotons annually, comparable to the total amount of small IT and telecommunications equipment waste produced by the Netherlands. The Bitcoin eWaste Monitor22 has compared the eWaste footprint of a single bitcoin transaction with common items such as mobile phones and the eWaste footprint per transaction processed by a credit card financial institution. A bitcoin transaction has an estimated eWaste footprint of over 300 grams, compared to the less than 50 grams of 10,000 credit card transactions, over 150 grams of an Apple iPhone 12 and close to 500 grams of an Apple iPad.

Mining often happens in countries where eWaste collection and/or regulation is minimal. From 2014–2019 the global generation of e-Waste grew by 9.2 Mt and in 2020 an International Telecommunication Union study projected it to grow to 74.7 Mt by 2030 — almost doubling in 16 years.23 The highest eWaste generation was in Asia, and globally the formal documented collection and recycling of eWaste was only around 17% of the total volume of e-Waste generated. The crypto industry’s operational waste problem needs to be weighed against the potential for crypto technologies and blockchain to offer service solutions by helping track waste from source to recycling or disposal sites.

The sustainable enterprise publishes clear, periodic updates and annual reports including ESG performance data.

Nonfinancial reporting on sustainability performance has progressed from a few companies publishing social or environmental reports in the 1990s to common practice among large and listed corporations. A multistakeholder process under the Global Reporting Initiative (GRI) has developed international standards for sustainability reporting over the past 20 years. The participative process itself has been seen as democratizing, accompanied by the creation of the AA1000 standard for participatory assurance of sustainability disclosures.

Following experimentation by various initiatives (such as the CDP) with disclosure approaches on different ESG themes, it has become more mainstream under the auspices of the new International Sustainability Standards Board (ISSB). The ISSB was established by the International Financial Reporting Standards Foundation in 2021, taking sustainability disclosures into the domain of financial reporting. It published its first two standards in June 2023, focused on general requirements and climate change. New topics such as human capital will be taken on in the coming two years.

The new standards ISSB developed run parallel with new regulatory requirements by the EU under its Corporate Sustainability Reporting Directive (CSRD), with mandatory disclosure requirements on a broad sustainability agenda affecting some 50,000 companies in Europe. These will also apply to small and medium-sized enterprises (SMEs) listed on regulated European markets — approximately 700 according to the European Financial Reporting Advisory Group — that also meet certain thresholds for total assets (€4 million), net turnover (€8 million) and average number of employees (over 50). SMEs will be allowed a transitional period up to 2028 to introduce sustainability reporting as required by the CSRD’s European Sustainability Reporting Standards in a simplified version for SMEs.

Reporting on ESG topics need not be excessively complex for smaller enterprises, as their smaller scale in some areas (for example number of employees) implies performance measurement and reporting is significantly less complex than large enterprises. In the case of crypto start-ups, the enterprise involved may have 25 employees based in 25 different countries. The crypto-related enterprise may be a listed, multinational SME, which brings different organizational complications in addition to the complexities of crypto finance.

Whether small in terms of employees, financially significant players will increasingly be expected to disclose and publish periodic reports on their financial and ESG performance. In response to investor expectations of audited reports on turnover and net asset value, many crypto funds already publish externally audited financial reports even if they are not legally obliged to do so. Cases of fraud have led to renewed focus on transparency, including the expectation that crypto exchanges need to provide proof of reserves. Only a third of crypto exchanges offer proof of reserves or alternatives such as regularly audited financial statements according to the data provider CCData.24

In defining the contours of the sustainable crypto-related enterprise, our proposed ESG framework can be used as a reference for crypto entrepreneurs and investors alike. The proposed framework covers basic elements of an ESG agenda, from value proposition to performance reporting, and is applicable to various levels of formalization or institutionalization and (de)centralization. At a time when the crypto industry is having to improve its reputation and faces greater regulatory scrutiny as it seeks to enter the mainstream, a sustainability agenda offers a prime opportunity for crypto visionaries to engrain ESG factors into their value propositions, operations, products and services.

The pressure for greater sustainability and social responsibility may come from both regulators and investors. This includes self-regulation and promotion by stock exchanges of relevant best practice standards. While interest from retail investors may be associated with plenty of noise, institutional investors can process larger volumes of information including new information sets related to ESG performance. This means that institutional investor attention can have a more a constructive impact on both idiosyncratic risk and liquidity in crypto markets.25

Support for sustainable crypto innovation may come from high-net-worth individuals, in particular the 41% who, according to a World Wealth Report by Capgemini, stated that they view investing for ESG impact as a top priority.26 It may also come from venture capital investors with interest in ESG themes such as decarbonization and clean energy. While venture capital flows into financial technology companies had plunged 36% globally year over year to $6 billion by late 2023, investment in fintech has shown some signs of optimism. The banking technology and payments segments have been winning back some investor support. VCs displayed continued interest in fintechs that reduce friction in cross-border transactions, a domain for which blockchain and crypto are clear champions. Valuations of listed fintechs including those on the S&P Kensho indices, have continued to recover in 2023 (see Appendix).

As the crypto industry matures, both retail and institutional investors including venture capital funds are paying closer attention to cryptocurrency businesses. And while fundraising through ICOs may simply require a website and white paper, VC funds do more due diligence, including a review of the soundness of projects and their market prospects. Startups can also decide to opt for doing initial exchange (or DEX) offerings, where the backup of an exchange adds legitimacy.27 Crypto VC Firms support the growth of the crypto ecosystem by providing market validation. They also help to improve risk management by assessing market, regulatory and technology risks for more informed investment decision-making.

Development of the technology is shifting toward a more environmentally responsible direction, and evolving away from, for example, the energy-intensive consensus mechanisms that underpin many cryptocurrencies. Social and governance concerns will also mount, as cases of illicit trade, fraud and leadership failure make the headlines. ESG concerns around consumer protection have become increasingly elevated. Fraud, scams and security vulnerabilities represent significant concerns. Conversely, the growing number of projects targeting “social good” and developmental objectives provide a more positive ESG lens that can be extended in the crypto ecosystem.

To compare how established companies perform on some of the ESG criteria featured in our proposed framework, we selected a group of listed companies and looked at their feedback to the annual S&P Global Corporate Sustainability Assessment. We examined companies that were reclassified under the GICS classification from TSV IT Services industry to FBN Diversified Financial Services in 2023 and the top 20 constituents of four of the S&P Kensho New Economies Indices (all equities) covering alternative finance, democratized banking, future of payments and blockchain. The list of 96 companies identified showed the results presented below on the topics board diversity, risk management, information security and GHG emissions.

To compare how established companies perform on some of the ESG criteria featured in our proposed framework, we selected a group of listed companies and looked at their feedback to the annual S&P Global Corporate Sustainability Assessment. We examined companies that were reclassified under the GICS classification from TSV IT Services industry to FBN Diversified Financial Services in 2023 and the top 20 constituents of four of the S&P Kensho New Economies Indices (all equities) covering alternative finance, democratized banking, future of payments and blockchain. The list of 96 companies identified showed the results presented below on the topics board diversity, risk management, information security and GHG emissions.

Designed to capture the depth and breadth of companies driving the Fourth Industrial Revolution, the S&P Kensho New Economy Indices were launched in 2021 to represent groundbreaking innovations and transformative technologies that are driving economic growth and may, in turn, present investors with significant opportunities. The indices not only identify the leading companies in each industry, they also capture the entire ecosystems supporting them — which is essential for fully understanding where the economic impact and benefits lie, including sustainability. They include sector and subsector indices that can be used individually or as building blocks, ranging from clean power to advanced manufacturing and democratized banking.

The sector and subsector indices referenced within the S&P Kensho New Economy Index series include the following:

S&P Kensho Democratized Banking Index (Sector): Measures the performance of companies focused on innovations within financial services, including direct lending, crowdfunding, automated wealth management, usage/on-demand insurance services and digital currencies and related capabilities. It draws its constituents list from the S&P Kensho Alternative Finance Index, the S&P Kensho Future Payments Index and the S&P Kensho Distributed Ledger Index.

S&P Kensho Distributed Ledger Index (Subsector): Measures the performance of companies involved in the advancement of distributed ledger technology and those enabling services, such as miners.

S&P Kensho Future Payments Index (Subsector): Measures the performance of companies involved in providing products or services related to general-purpose platforms that allow consumers to transact using a digital balance. These companies are focused on building the next generation of payment capabilities, such as digital wallets; platforms that allow merchants to manage multichannel payments in one system, real-time payments and transfers across consumer and merchant accounts; transaction security (e.g., tokenization, end-to-end encryption); and biometrically enabled payments.

S&P Kensho Alternative Finance Index (Subsector): Measures the performance of companies focused on providing alternative financing and wealth management capabilities, and building out next-generation capabilities within financial services, including direct lending, crowdfunding, automated wealth management, usage or on-demand insurance services and digital currencies and related capabilities.

Andrew O’Neill, CFA

Managing Director,

Methodologies,

S&P Global Ratings

Alexandre Birry

Chief Analytical Officer,

Financial Institutions,

S&P Global Ratings

Jordan McKee

Director,

Fintech Research & Advisory Practice,

S&P Global Market Intelligence

Maria Jaramillo

ESG Specialist,

Research & Development,

S&P Global Sustainable1

Special thanks to Natasha Barrientos for her contributions to this research.

Andrew O’Neill, CFA

Managing Director,

Methodologies,

S&P Global Ratings

Alexandre Birry

Chief Analytical Officer,

Financial Institutions,

S&P Global Ratings

Jordan McKee

Director,

Fintech Research & Advisory Practice,

S&P Global Market Intelligence

Maria Jaramillo

ESG Specialist,

Research & Development,

S&P Global Sustainable1

Special thanks to Natasha Barrientos for her contributions to this research.

1. GIINsight: Sizing the Impact Investing Market 2022, Oct. 12, 2022.

2. Digital Technologies for Mobilizing Sustainable Finance (unepinquiry.org), October 2018.

3. Building Block(chain)s for a Better Planet, World Economic Forum, September 2018.

4. See climate and energy examples from developing economies in: Blockchain for sustainable energy and climate in the Global South, UN Environmental Programme and the Social Alpha Foundation.

5. Top 5 Carbon Crypto Companies to Watch in 2023 (carboncredits.com).

6. Thirsty California May Be Wary of Blockchain Water Rights (cointelegraph.com), March 12, 2019.

7. Silicon Valley Bank’s governance red flags (ft.com), March 13, 2023.

8. How North Korea’s Hacker Army Stole $3 Billion in Crypto, Funding Nuclear Program - WSJ, June 11, 2023, and Inside the international sting operation to catch North Korean crypto hackers | CNN Politics, April 11, 2023.

9. Trading teams at Crypto.com exchange raise conflict questions (ft.com), June 28, 2023.

12. The Pandemic Changed Us. Now Companies Have to Change Too. (hbr.org), July 1, 2022.

13. Hybrid workers named happiest in the world - HRreview, July 25, 2023.

14. ‘It is not cut-throat like Goldman Sachs’: SVB’s culture in focus (ft.com), March 15, 2023.

15. The Cambridge Bitcoin Electricity Consumption Index is updated every 24 hours; accessed on Aug. 11, 2023.

16. Solana Foundation announces blockchain carbon neutral, December 2021; How Green can the Cardano community make Cardano’s blockchain?, September 2021; Algorand Pledges to be the Greenest Blockchain, April 2021.

17. Cryptocurrency’s Energy Consumption Problem - RMI, Jan. 30, 2023.

18. See South Pole and Crypto Carbon Ratings Institute (CCRI). 2022. Accounting for Cryptocurrency Climate Impacts, written in consultation with PayPal, at https://carbon-ratings.com/.

19. The 28 Most Sustainable Cryptocurrencies for 2023 - LeafScore , Jan. 5, 2024.

20. Markets in Crypto-Assets Regulation (MiCA) (europa.eu).

21. How Bitcoin’s hidden footprint is impacting water use (thesourcemagazine.org), Sept. 3, 2018.

22. Bitcoin Electronic Waste Monitor – Digiconomist, and Bitcoin’s growing e-waste problem (ScienceDirect), Sept. 13, 2021.

23. The Global E-waste Monitor 2020.

24. Rebuild or retreat? Crypto faces tough choices after FTX, Financial Times, Nov. 12, 2023.

25. Retail vs institutional investor attention in the cryptocurrency market, November 2022.

26. World Wealth Report 2023 | Research & insight | Capgemini

27. Venture capital financing: A beginner’s guide to VC funding in the crypto space (cointelegraph).