Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 4 Nov, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Banking on Climate Resilience

The series of extreme weather events in recent months, including the devastating floods in western and central Europe as well as in Pakistan, the prolonged drought and resulting famine in the greater Horn of Africa and Hurricane Ian's severe storm surge on the Florida Gulf Coast, highlights the deepening effects of climate change. If left unmanaged, climate change could present significant challenges to banks, given their exposure to virtually every sector of the global economy.

Regulators around the globe are working on initiatives to help banks assess their resilience to climate-related risks, mainly through stress tests, according to S&P Global Ratings research released Oct. 3.

There are two types of risk that banks may face from climate change. The first is physical risk caused by chronic climate hazards. Under a physical risk scenario, banks could incur losses in their mortgage and other loan portfolios due to frequent floods, droughts, storm surges and other weather hazards.

The second type of risk stems from the transition to a net-zero or low-carbon economy. To reach net-zero, the amount of greenhouse gas emissions added to the atmosphere must be equal to the amount removed. In this category, banks could face regulatory and reputational risks by financing the emissions of companies in high-carbon industries, particularly oil and gas and coal.

More than 100 eurozone banks participated in the European Central Bank’s supervisory climate stress test, while the Bank of England’s Climate Biennial Exploratory Scenario assessed seven U.K. lenders. Canada, China, Japan, Australia and a few other countries are likewise advancing their climate-risk assessments through stress tests.

In the U.S., the Federal Reserve will launch what it calls a pilot climate scenario analysis exercise, rather than a stress test, in 2023. The pilot will involve six of the nation’s top banks and will evaluate the resilience of financial institutions under hypothetical climate scenarios.

Despite the progress, challenges surrounding methodology, data availability and fragmented climate risk disclosure standards remain, the S&P Global Ratings research concluded.

The banking sector is also making headway in the low-carbon transition, with more than 100 banks worldwide committing to reach net-zero emissions by 2050 across their lending and investment portfolios. Green banks, which use public funds to spur private capital into clean energy projects, are also expanding, with over 20 operating in the U.S. and a $27 billion federal boost to potentially create a national green bank.

However, policymakers are aiming for a gradual approach to climate regulation for banks. Michael Barr, vice chair for supervision at the U.S. Federal Reserve, said the agency will focus on its “important, but narrow” supervisory mandate. "You're not going to see us tell firms: Lend to this sector or don't lend to this sector."

Chris Faint, head of climate at the Bank of England, also cautioned banks against pulling financing from high-emitting clients too fast to avoid economic shocks. "Of course, it's essential that we fund the transition and move away from more polluting sectors. But defunding certain sectors too quickly at a point where substitutes are not available could create a disorderly transition and a potential shock to the system," Faint said.

Today is Friday, November 4, 2022, and here is today’s essential intelligence.

Written by Pamela Rosacia.

Listen: The Essential Podcast, Episode 70: Emerging Market Spotlight — Sri Lanka Navigates the Contradictions

Talal Rafi, Senior Global Management Consultant at Deloitte joins the Essential Podcast to discuss the challenges of Sri Lanka as an emerging market economy and how Sri Lanka can serve as a model for understanding the debt trap for other emerging economies. The Essential Podcast from S&P Global is dedicated to sharing essential intelligence with those working in and affected by financial markets. Host Nathan Hunt focuses on those issues of immediate importance to global financial markets — macroeconomic trends, the credit cycle, climate risk, ESG, global trade and more — in interviews with subject matter experts from around the world.

—Listen and subscribe to the Essential Podcast from S&P Global

Access more insights on the global economy >

Banking Risk Monthly Outlook: November 2022

New home prices in Mainland China continue to fall despite much being done for first-home buyers, such as lowering the mortgage rates floor and raising loan-to-value ratios as well as increasing the discounts allowed to be offered by property developers. S&P Global Market Intelligence judges that lending growth for mortgages will likely remain slow until an economic recovery in Mainland China but there will likely be further cautious easing for lending to non-first-home buyers.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Listen: Surging Crude Export Volumes Confront Record Freight Rates

The U.S. Gulf Coast crude market is exporting record volumes while also seeing sky-high freight rates. This dynamic has been playing out consistently for the past few months, but how are these exports continuing to move in such great volumes despite this major headwind? In this episode of the Platts Oil Markets Podcast, S&P Global Commodity Insights crude and shipping experts Laura Huchzermeyer, Kristian Tialios and Catherine Kellogg discuss the factors that are contributing to these high freight rates and how they are impacting U.S. Gulf Coast exports.

—Listen and subscribe to Platts Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on global trade >

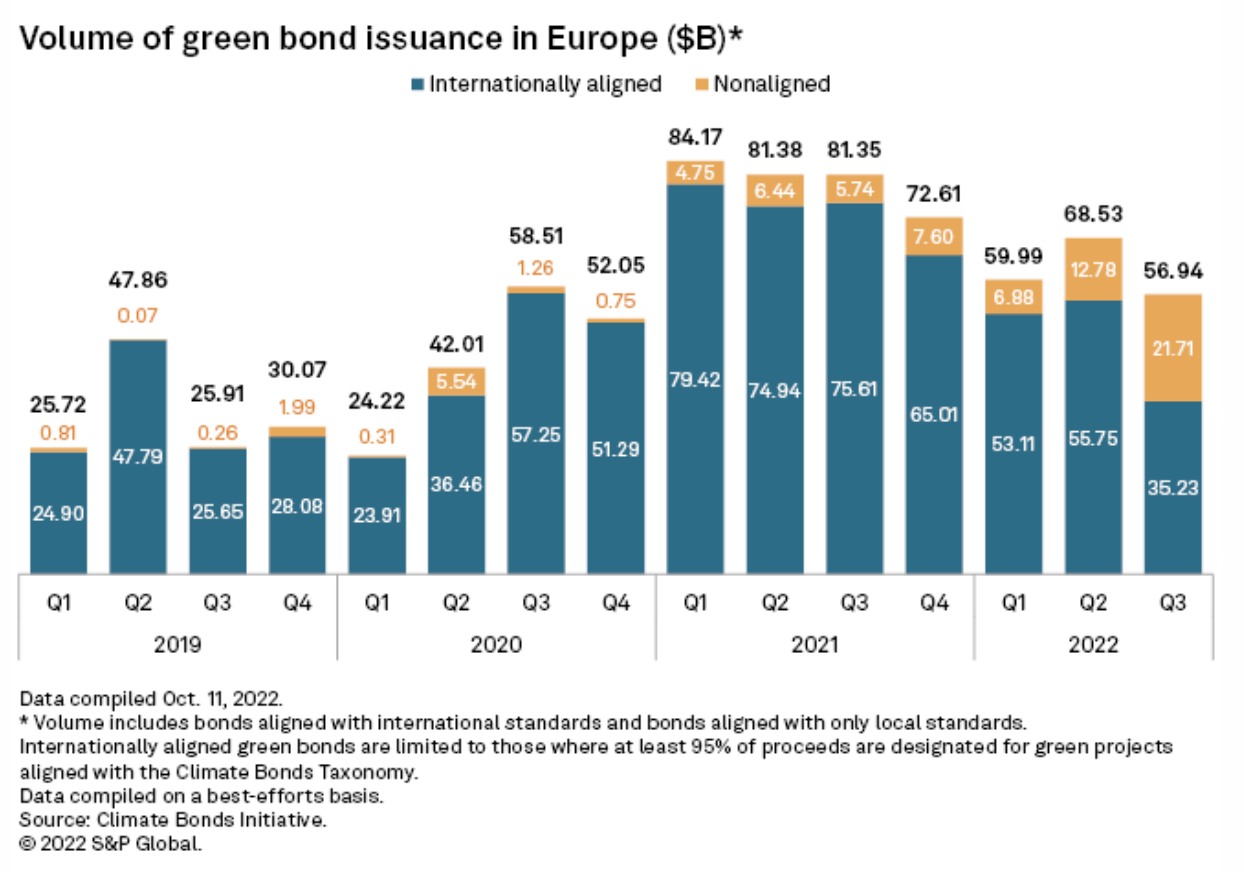

Germany, Italy Lead Q3 Green Bond Issuance In Europe

Germany and Italy emerged as Europe's top issuers of green bonds in the third quarter of 2022, with future green bond issuance commitments and targets likely to be influenced by the upcoming United Nations' COP27 climate conference. Germany led the region with $15.89 billion of internationally aligned green bond issuance, according to data from the Climate Bonds Initiative, or CBI. This is down 7.6% from $17.2 billion a year earlier but up 55% from $10.26 billion in the previous quarter.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

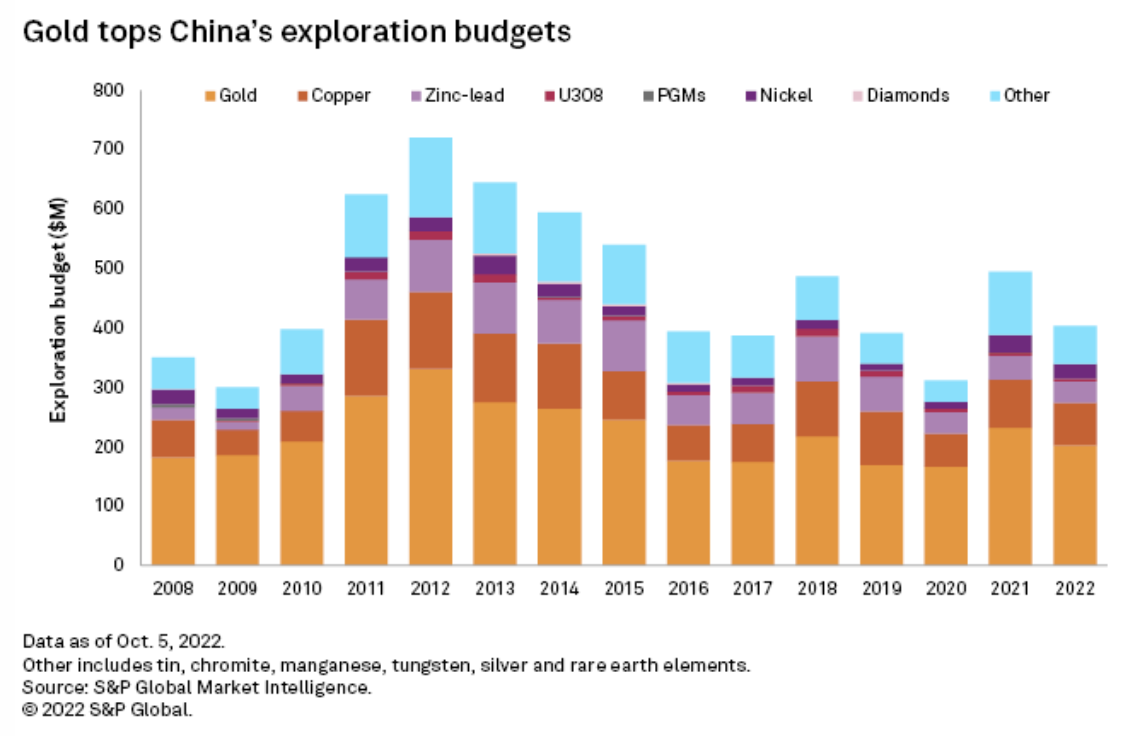

China – Mining By The Numbers, 2022

Having dominated the key mineral sectors of zinc and rare earth elements, China has shifted focus over the past five years to battery metals through developing and acquiring new lithium projects and securing supply chains for its manufacturing sector. Copper and battery metals projects have been key in China's recent mergers and acquisition activity, while internally, exploration budgets have continued to focus on gold. China remained the largest producer of mined gold in 2021, with output of 12.9 million ounces.

—Read the article from S&P Global Market Intelligence

Access more insights on energy and commodities >

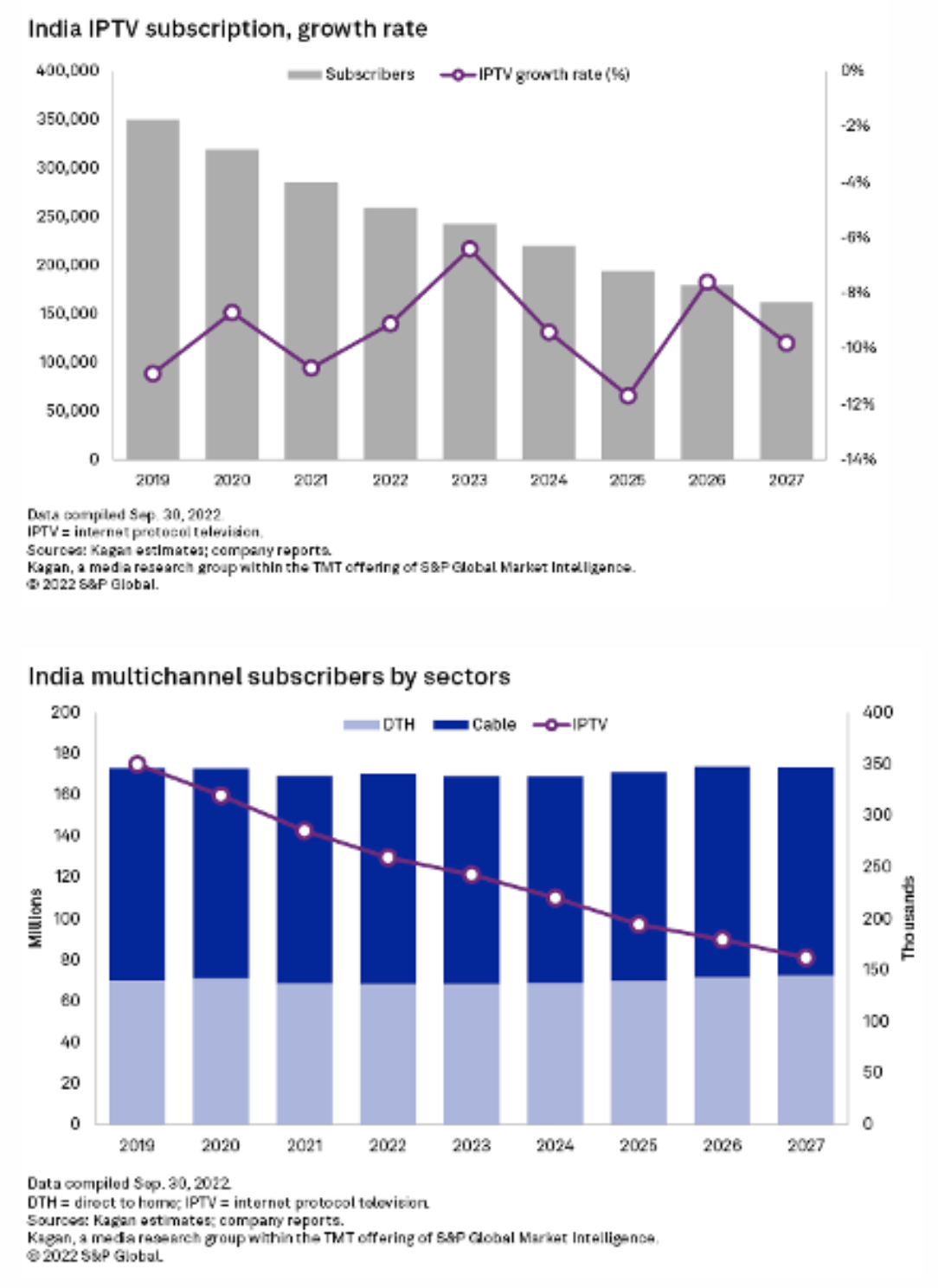

Indian IPTV Loses Users Due To Competitors' OTT Features, Affordability

IPTV operators in India ended 2021 with about 285,000 subscribers overall, down 10.7% year over year, as competing services in the market — such as cable and direct-to-home — offered more affordable and diverse over-the-top options. Kagan estimates India IPTV subscriptions will further drop to less than 162,000 by the end of 2027, representing a compound annual growth rate of negative 9% from 2022 to 2027, while multichannel subscriptions will grow at a projected 0.4% CAGR.

—Read the article from S&P Global Market Intelligence