Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 18 Jul, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Beleaguered Business of Commercial Real Estate

Commercial real estate in the US is experiencing a confluence of challenges that could spell trouble for the nation’s banking sector. On the one hand, diminished demand for commercial real estate is causing property valuations to plummet. On the other, the Federal Reserve’s aggressive interest rate hikes in recent months are making it more expensive for borrowers in the sector to obtain new financing or refinance existing loans.

The woes of commercial real estate (CRE) — income-producing properties that range from offices, malls and hotels to apartments and warehouses — started when the COVID-19 pandemic hit in 2020. As the world went into lockdown to curb the spread of the virus, travel shut down, e-commerce accelerated and many companies transitioned to remote work. These trends depressed the demand for hotel, retail and office space, and increased the need for warehouses and last-mile logistics facilities used for fulfilling online orders. The reduced demand in key segments of the asset class pushed occupancy to record lows, weighed on net operating income growth and pressured property prices.

After the pandemic, hotel and retail properties have bounced back and warehouses have remained strong, but offices are still under intense pressure. Demand and valuations for office properties have not recovered as the shift to remote and hybrid work seemingly becomes more permanent and technology companies, which used to be the top building occupants, resort to massive layoffs and space reductions to cut costs amid a slowing economy. As of June 2023, the discount to net asset value stood at negative 59.5% for office real estate investment trusts, according to S&P Global Market Intelligence data.

The ongoing stress in the CRE and office property sector places renewed pressure on banks. It comes at a time when banks are already facing liquidity concerns due to deposit outflows and reduced share prices. Banks’ balance sheets are also under heightened scrutiny following the failures of Silicon Valley Bank and Signature Bank in March. Investors and regulators are probing banks’ balance sheets for weakness, including exposure to loans related to CRE, particularly office properties.

Given the growing scrutiny, banks started tightening CRE lending policies in 2022. As of the first quarter, BofA Securities analysts said a net 61% of banks responding to senior loan officer surveys reported implementing more stringent standards. Notwithstanding the tighter lending conditions, some US banks increased their exposure to CRE loans in recent months, driven by M&A transactions. CRE loans at US banks rose to $2.436 trillion at the end of the first quarter, from $2.423 trillion at the end of 2022, and grew 10.51% year over year as of March 31.

Among US lenders, regional banks have outsized exposure to CRE loans. According to S&P Global Market Intelligence data, roughly $1.078 trillion in US CRE loans are set to come due in 2023 and 2024, of which about 70% are held by regional banks. With refinancing costs rising sharply, regional banks run the risk of having to absorb defaults and devalued properties. At the end of the first quarter, the CRE loan delinquency rate rose to 0.77%, the highest level since the third quarter of 2021.

The spillover effects on banks have fueled fears that CRE’s troubles would trigger another financial system collapse akin to the Great Recession. However, industry observers believe that banks are well-positioned to handle losses in some segments of the CRE market and that concerns of a broader crisis are overblown.

Solita Marcelli of UBS Global Wealth Management said a repeat of the 2008 liquidity crisis is unlikely. “CRE exposure at banks is currently manageable with potential loss levels even in a hard landing scenario likely causing earnings pressure rather than capital depletion," Marcelli said.

"The average commercial lease is five years so losses will be spread over time, rather than a one-time shock like the collapse of Lehman Brothers," added Vincent Deluard, director of global macro strategy at StoneX.

Today is Tuesday, July 18, 2023, and here is today’s essential intelligence.

Written by Pam Rosacia.

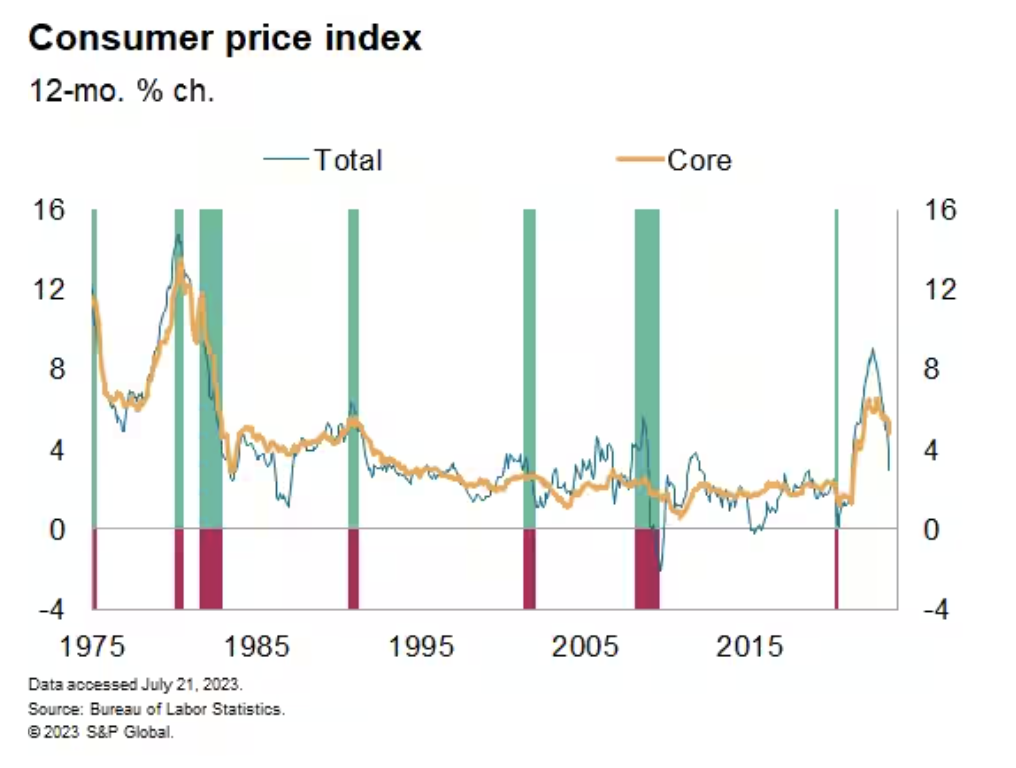

US Weekly Economic Commentary: Some Good News On Inflation

While last week was relatively light for data releases with direct implications for our GDP tracking, there were several noteworthy releases on inflation. Consumer prices continued to moderate through June, with the 12-month change in the headline consumer price index easing to 3.0%, the lowest reading since March 2021 and well below the recent peak of 9.1% last June. The recent softening in the headline index in part reflects the softening in energy prices relative to peak prices last summer (the CPI for energy is down 16.7% from last June).

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

This Week In Credit: No Defaults Amid Continued Divergence

Divergence in terms of rating performance remains a key theme with most downgrades last week concentrated among lower-rated, speculative-grade issuers. This week, several data releases will give a sense of the overall global economic picture. Chinese growth slowed in second-quarter 2023 while U.S. retail sales will be watched following a run of recent positive economic data. The yield on the U.K. 10-year gilt is currently at its highest level since early 2008, also bringing Wednesday's CPI numbers sharply into focus. All this will set the backdrop for second-quarter earnings season, which kicks off in earnest this week.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

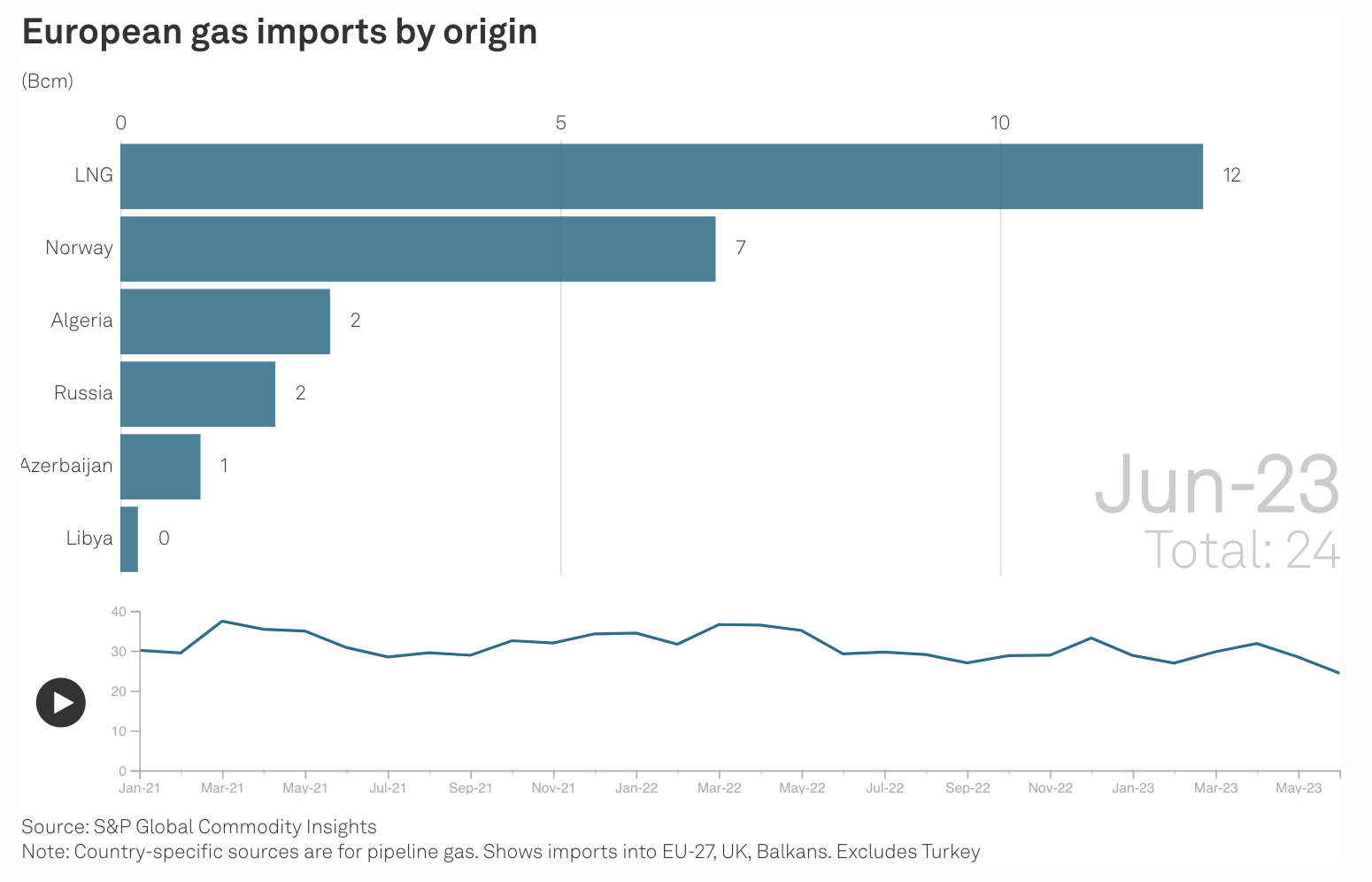

Russian Gas Market Share In Europe On The Wane As LNG, Norway Step Up

Before skyrocketing gas prices encouraged Norwegian supply and LNG imports, Russia had been the largest single source of gas supply for Europe. However, it was Russia's invasion of Ukraine — followed by Gazprom reducing and then halting deliveries to Germany via Nord Stream — that signaled a tipping point in Europe's gas supply.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

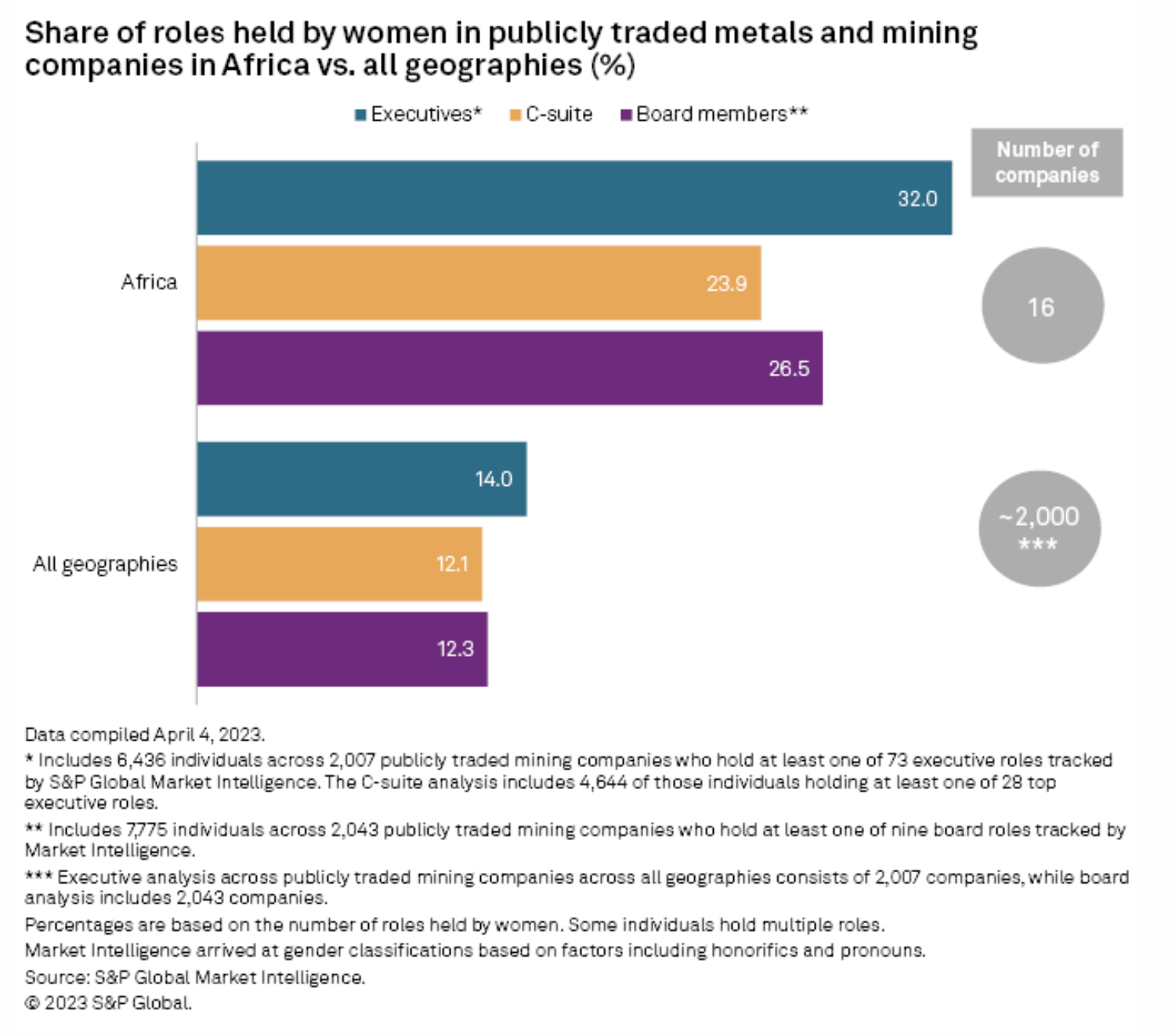

African Mining Companies Outpace Global Peers On Women In Leadership

More women sit at the top of Africa-based metals and mining companies than the global average, an analysis of S&P Global Market Intelligence data shows. The dataset for publicly traded miners in Africa is relatively small, comprising just 16 publicly traded companies headquartered in Mauritius, Morocco, South Africa, Tanzania and Zambia. The larger global dataset comprises more than 2,000 global metals and mining companies. However, among those companies in Africa, women hold 32.0% of the executive roles, 23.9% of the C-suite roles and 26.5% of the board roles.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

Listen: Wyoming Holds First Post-IRA Oil And Gas Lease Sale … And The Results Are Meh

The Bureau of Land Management held a federal oil and gas lease sale in Wyoming on June 29. It marks the second onshore lease sale for the state since President Joe Biden took office and the first to take place in the state since the Inflation Reduction Act instituted higher oil and gas royalty rates and leasing costs for development. Pete Obermueller, president of the Petroleum Association of Wyoming, joined the podcast to discuss the lease sale results. He spoke with S&P Global Commodity Insights senior editor Starr Spencer about the emerging unconventional Powder River Basin which featured prominently in the auction, the impact of the IRA and how the Biden administration's actions are affecting industry behavior and interest.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Ep38: Mary Pryshlak On Generative AI In Credit Research And How To Manage 130 Investment Professional

Mary Pryshlak, head of investment research at Wellington Management, joined Alexandra Dimitrijevic, global head of research and development at S&P Global Ratings, and host Joe Cass on this episode of Fixed Income in 15. Discussion focused on the potential role of Generative AI in credit research, leadership experiences from Alexandra and Mary and books that have fundamentally changed our guests' lives.

—Listen and subscribe to Fixed Income in 15, a podcast from S&P Global Ratings

Content Type

Location

Segment

Language