Featured Topics

Featured Products

Events

Our Services

Investment Themes

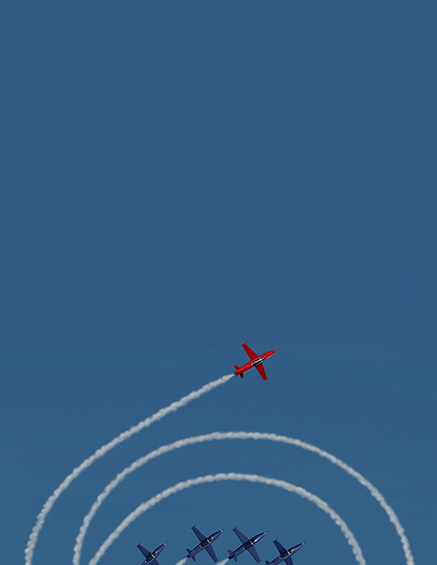

Explore new territories with greater confidence

Equity

Fixed Income

Commodities

Multi-Asset

Sustainability

Dividends & Factors

Thematics

Our Exchange Relationships

S&P DJI combines global reach with local expertise, working with exchanges around the world to build indices for both the local and international investment communities.

Education

SPIVA®

For over 20 years, our renowned SPIVA research has measured actively managed funds against their index benchmarks worldwide.

Events & Webinars

Register to attend complimentary webinars and deepen your knowledge of current trends and issues impacting the index universe today.

Governance

Methodologies

Our Services

Professional Resources

Equity

Fixed Income

Commodities

Multi-Asset

Private Markets

Sustainability

Dividends & Factors

Thematics

Digital Assets

Indicators

Other Strategies

By Region

Our Exchange Relationships

S&P DJI combines global reach with local expertise, working with exchanges around the world to build indices for both the local and international investment communities.

Research & Insights

Education

Performance Reports

SPIVA®

For over 20 years, our renowned SPIVA research has measured actively managed funds against their index benchmarks worldwide.

Events & Webinars

Register to attend complimentary webinars and deepen your knowledge of current trends and issues impacting the index universe today.

Methodologies

SPICE

Your Gateway to Index Data

S&P Global Offerings

Featured Topics

Featured Products

Events

Research & Insights

-

- Featured

- Index TV

- Feb 24, 2026

Understanding the iBoxx Tadawul SAR Indices

Understanding the iBoxx Tadawul SAR Indices

-

- Featured

- Index TV

- Feb 18, 2026

Bringing Global Credit Index Innovation to the Brazilian Market

Bringing Global Credit Index Innovation to the Brazilian Market

-

- Featured

- Commentary

- Feb 16, 2026

2025 Fixed Income Index Products Report

2025 Fixed Income Index Products Report

-

- Featured

- Index TV

- Feb 16, 2026

S&P 500 in Focus: Global Trends and Local Insights

S&P 500 in Focus: Global Trends and Local Insights

-

- Featured

- Index TV

- Feb 10, 2026

S&P 500 FC 7% Index: The Gold Standard of Indices Meet’s Today’s Technology

S&P 500 FC 7% Index: The Gold Standard of Indices Meet’s Today’s Technology

Research

Explore Research-

- Research

- Dec 12, 2025

Benchmarking the Energy Transition: Insights from S&P DJI

Benchmarking the Energy Transition: Insights from S&P DJI

-

- Research

- Dec 9, 2025

Heroes in Haystacks: Index Comparisons for Active Portfolio Performance

Heroes in Haystacks: Index Comparisons for Active Portfolio Performance

-

- Research

- Nov 21, 2025

The Carbon Efficient Blueprint: Valuable Insights for Climate-Aligned Strategies

The Carbon Efficient Blueprint: Valuable Insights for Climate-Aligned Strategies

-

-

- Research

- Nov 21, 2025

The Carbon Efficient Blueprint: Valuable Insights for Climate-Aligned Strategies

The Carbon Efficient Blueprint: Valuable Insights for Climate-Aligned Strategies

-

- Research

- Nov 20, 2025

Nature, Nurture and Numbers: Nature-Related Impacts on S&P World Index Performance

Nature, Nurture and Numbers: Nature-Related Impacts on S&P World Index Performance

Commentary

Explore Commentary-

- Commentary

- Feb 24, 2026

2025 iBoxx GBP Indices Highlights

2025 iBoxx GBP Indices Highlights

-

- Commentary

- Feb 23, 2026

2025 USD Liquid Indices Review

2025 USD Liquid Indices Review

-

- Commentary

- Feb 13, 2026

ARC Research 2025: Year in Review

ARC Research 2025: Year in Review

Education

Explore Education-

- Education

The Evolution of the Fixed Income Tradable Ecosystem

The Evolution of the Fixed Income Tradable Ecosystem

-

- Education

TalkingPoints - Introducing the S&P/IDX Indonesia Shariah High Dividend Index

TalkingPoints - Introducing the S&P/IDX Indonesia Shariah High Dividend Index

-

- Education

Orderly Fashion: Looking Inside Luxury Baskets

Orderly Fashion: Looking Inside Luxury Baskets

-

- Education

TalkingPoints - Introducing the S&P/IDX Indonesia Shariah High Dividend Index

TalkingPoints - Introducing the S&P/IDX Indonesia Shariah High Dividend Index

-

- Education

Orderly Fashion: Looking Inside Luxury Baskets

Orderly Fashion: Looking Inside Luxury Baskets

-

- Education

Exploring Dividend Opportunities in Indonesia

Exploring Dividend Opportunities in Indonesia

-

SPIVA Around the World

SPIVA Around the World

-

SPIVA Fixed Income Around the World

SPIVA Fixed Income Around the World

-

SPIVA® MENA Mid-Year 2025

SPIVA® MENA Mid-Year 2025

Dive into the active vs. passive debate in the MENA region.

-

SPIVA® Latin America Mid-Year 2025

SPIVA® Latin America Mid-Year 2025

Check out the latest SPIVA results for Latin America

-

SPIVA® Japan Mid-Year 2025

SPIVA® Japan Mid-Year 2025

Check out the latest SPIVA results for Japan.

Investment Themes

Explore key index-based investment themes relevant in today's global market.

SEE ALLNot Registered?

Access exclusive data and research, personalize your experience, and sign up to receive email updates.

RegisterNot Registered?

Access exclusive data and research, personalize your experience, and sign up to receive email updates.

Register