Daily Index Insights offers a concise two-minute read on the latest news and trends in index markets. This resource includes performance data from S&P Dow Jones Indices across equities, fixed income, multi-asset, commodities, and factors. Our daily insights are designed to provide you with a comprehensive understanding of market movements, empowering you to make informed decisions based on the most current indices data and analysis.

"I saw the angel in the marble and carved until I set him free."

Michelangelo (6 March 1475 – 18 February 1564)

Today marks 157 years since the scientific world was forever altered by a single, visionary document. On this day in 1869, Dmitri Mendeleev presented his revolutionary periodic table to the Russian Chemical Society in St. Petersburg, offering the world its first coherent map of the universe's building blocks. Far more than a mere organizational chart, Mendeleev’s genius lay in his bold foresight; he famously left intentional gaps in the grid, effectively predicting the existence and specific properties of elements that had yet to be discovered. This elegant system did far more than catalogue the 63 elements known at the time; it established a predictive framework that has served as the foundational language of chemistry ever since, guiding generations of scientists from their first classroom lessons to the very frontiers of modern research. Here is your daily dashboard.

- The S&P 500® slipped 0.6% on Thursday as bond yields climbed, and oil prices jumped. Energy was the best-performing large cap segment, up 0.6%, while Staples pulled up the rear, giving up 2.4%.

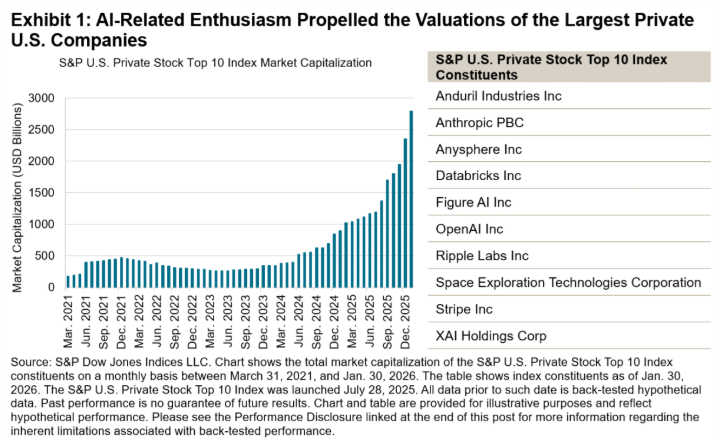

- In the past few years, there has been a meteoric rise of venture-backed AI giants like SpaceX and OpenAI, with the collective valuation of the 10 largest companies seeing a 1,500% increase since March 2021. As a number of them are preparing for an initial public offering (IPOs) later this year, you may wonder when they will join the S&P 500. To find out, read Hamish Preston’s latest blog, which also compares the S&P 500’s eligibility criteria with those of the S&P Total Market Index and the Dow Jones U.S. Total Stock Market Index.

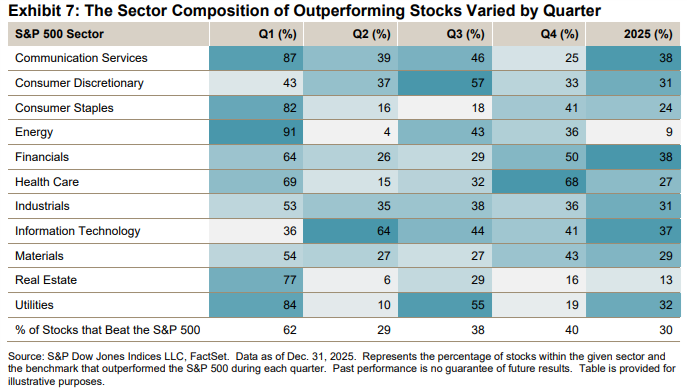

- The Year-End 2025 SPIVA® season kicked off this week with the publication of the SPIVA U.S. Scorecard. The report highlights that 79% of all active large-cap U.S. equity funds underperformed the S&P 500 as active managers faced unusual conditions; market breadth significantly narrowed during the course of the year with 62% of stocks outperforming the benchmark during Q1, but only 30% of stocks outperforming overall in 2025.

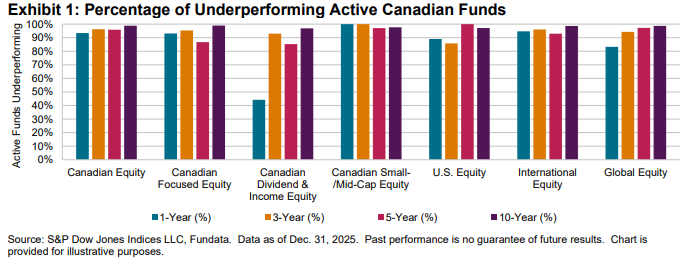

- Hot on the heels of the U.S. report, the Year-End 2025 SPIVA Canada Scorecard hit the wires yesterday. Across categories, an average of over 85.4% of active funds underperformed their benchmarks, including Canadian Equity funds at 93.4%, Canadian Focused Equity funds at 93.1% and Canadian Small-/Mid-Cap funds at 100.0%.