Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 23, 2021

Japan flash PMI indicates further economic slowdown in June amid COVID-19 emergency and supply disruptions

| au Jibun Bank Japan PMI | Month | Flash PMI | Prior |

| Flash Composite Output Index | June | 47.8 | 48.8 |

| Flash Services Business Activity Index | June | 47.2 | 46.5 |

| Flash Manufacturing Output Index | June | 49.1 | 53.7 |

Source: IHS Markit, au Jibun Bank

- Manufacturing output declined in June, breaking the four-month growth streak, joining the service sector in decline

- COVID-19 containment and supply constraints limited Japan's private sector performance in June

- Employment and future expectations were the bright spots as vaccination rollout gains momentum

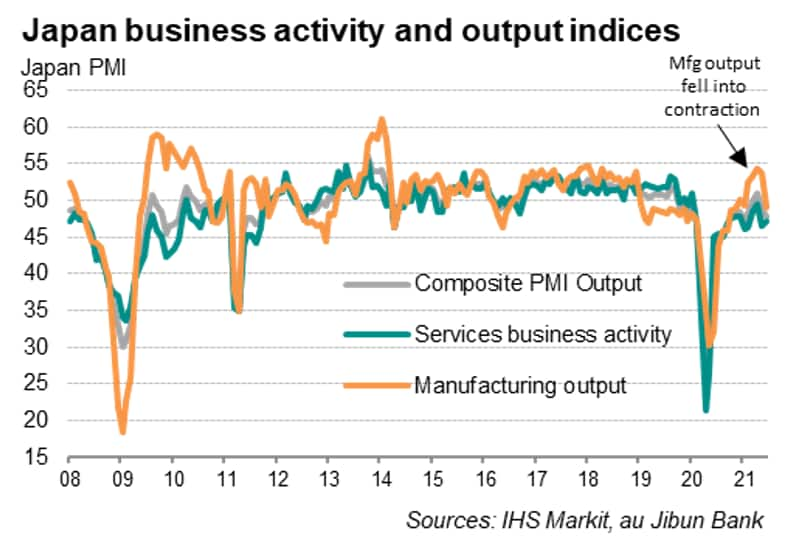

The au Jibun Bank Flash Japan Composite PMI, compiled by IHS Markit and published ahead of the final PMI results, indicated Japan's private sector shrank for a second straight month and at a faster pace in June. Manufacturing output notably slipped back into contraction after growing for four consecutive months while services output fell for the seventeenth month in a row.

The extension of the state of emergency into June contributed to the decline in output, particularly for the manufacturing sector. At the same time, anecdotal evidence also found many manufacturers suffering supply delays for parts, notably including semiconductors. As a result, even though new orders continued to improve from May, albeit marginally, manufacturing output was dragged into contraction.

Meanwhile services business activity continued to shrink, though at a slower rate in June. Demand, including foreign orders, remained lacklustre, one month ahead of the Tokyo Olympics. While overseas spectators had long been determined to miss the event, it remains to be seen what the 10,000 domestic fans per venue, announced June 21, will do for services performance.

The PMI data come on the heels of the Bank of Japan (BOJ) having left its monetary policy settings unchanged in the recent June 17-18 meeting, in line with expectations. The central bank also made an earlier than expected announcement for the extension of its pandemic relief program beyond the September deadline by six months, to March 2022. Although the extension had been widely expected, the timing of the announcement reaffirms the urgency to reassure the Japanese economy which remains weighed down by the fourth COVID-19 wave.

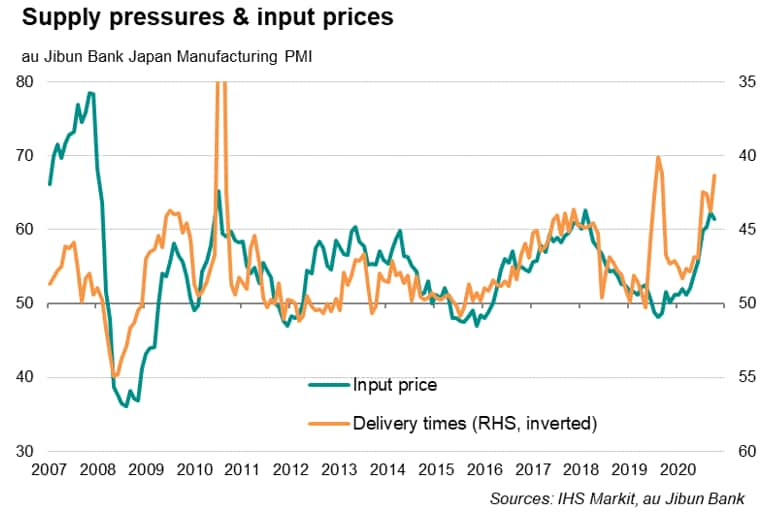

Supply disruptions remain prevalent

Zooming into the Japanese manufacturing sector performance, the flash PMI sub-indices continued to reflect the issue of supply constraints and price pressures in June. This continues to affirm our view that output for Asia economies, such as Japan, may be further hampered by these supply issues.

As shown above, the rate of industrial input price growth remained at elevated levels compared to historical data in June even as it eased marginally from May. Meanwhile lead times worsened, lengthening at the fastest rate since May 2020. IHS Markit continues to view supply-chain disruptions and higher commodity prices as key issues adversely affecting production momentum going forward, even as vaccine rollouts play their part to support the recovery.

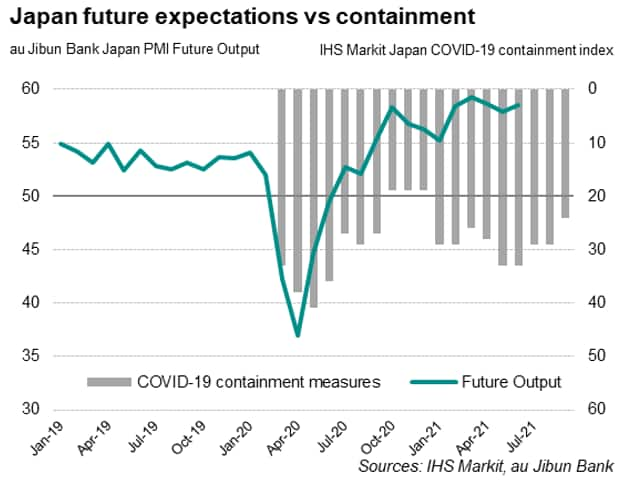

Firms remain optimistic on future output as vaccination progress picks up

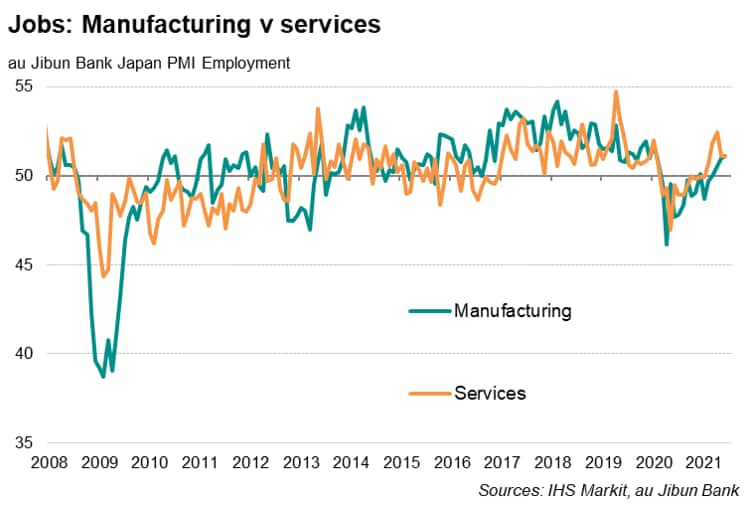

The most positive indications from the June flash PMIs meanwhile were the employment and future output sub-indices. Job creation was reported for a fifth straight month across the private sector as a whole, with manufacturing seeing the fastest increase in staffing levels since January 2020. Despite manufacturing output dipping into contraction territory in June, limited by the abovementioned issues, firms continued to expand their operating capacity in anticipation of a future pickup in demand.

At the same time, firms grew more optimistic with regards to the next 12-month output on a broad level. These are reassuring signs, despite the extension of the state of emergency through to the majority of our June survey period. Many firms cited hopes for the COVID-19 situation to take a turn for the better. Indeed, Japan's fourth COVID-19 wave was seen tapering off into June and vaccination progress had picked up noticeably, with 17.8% of the population receiving at least one dose as of June 20th. This is expected to extend to about 30% by end of July, around the Olympic commencement, according to Economy Minister Yasutoshi Nishimura.

As far as our IHS Markit Japan COVID-19 containment index suggests, things may improve into July. This is, however, barring any unexpected worsening of the COVID-19 situation with the increase in activity surrounding the Olympic event.

Jingyi Pan, Economics Associate Director, IHS Markit

jingyi.pan@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-pmi-indicates-further-economic-slowdown-June21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-pmi-indicates-further-economic-slowdown-June21.html&text=Japan+flash+PMI+indicates+further+economic+slowdown+in+June+amid+COVID-19+emergency+and+supply+disruptions+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-pmi-indicates-further-economic-slowdown-June21.html","enabled":true},{"name":"email","url":"?subject=Japan flash PMI indicates further economic slowdown in June amid COVID-19 emergency and supply disruptions | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-pmi-indicates-further-economic-slowdown-June21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+flash+PMI+indicates+further+economic+slowdown+in+June+amid+COVID-19+emergency+and+supply+disruptions+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-pmi-indicates-further-economic-slowdown-June21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}