Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 30 May, 2023

By Sarah Cottle

Today is Tuesday, May 30, 2023, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

In this edition of Insight Weekly, we put the spotlight on US banks' loan-to-deposit ratios, a metric that investors often use to assess liquidity. The industry aggregate ratio was 65.2% in the first quarter, compared to 63.6% in the fourth quarter of 2022 and 57.0% in the first quarter of 2022, according to S&P Global Market Intelligence data. In the first quarter, deposits across banks fell sequentially by 2.4%, or $421.40 billion, the biggest since deposits started declining in the second quarter of 2022.

S&P 500 companies in the industrials, healthcare, information technology, utilities and consumer staples sectors all recorded lower rates of turning inventory into sales during the first quarter than prior to COVID-19, according to the latest data from Market Intelligence. The slowdown in inventory turnover would suggest a mixture of slowing demand as well as overstocking, said Chris Rogers, head of supply chain research at Market Intelligence.

Women are taking on more leadership roles in the long male-dominated metals and mining sector, a data analysis from S&P Global Commodity Insights shows. Women fill about 12.1% of the C-suite positions across a universe of more than 2,000 global publicly traded mining companies, up 1.6 percentage points since an October 2021 data analysis. While the sector has been slower on the uptake than many others, recent progress has encouraged some women.

The Big Number

Trending

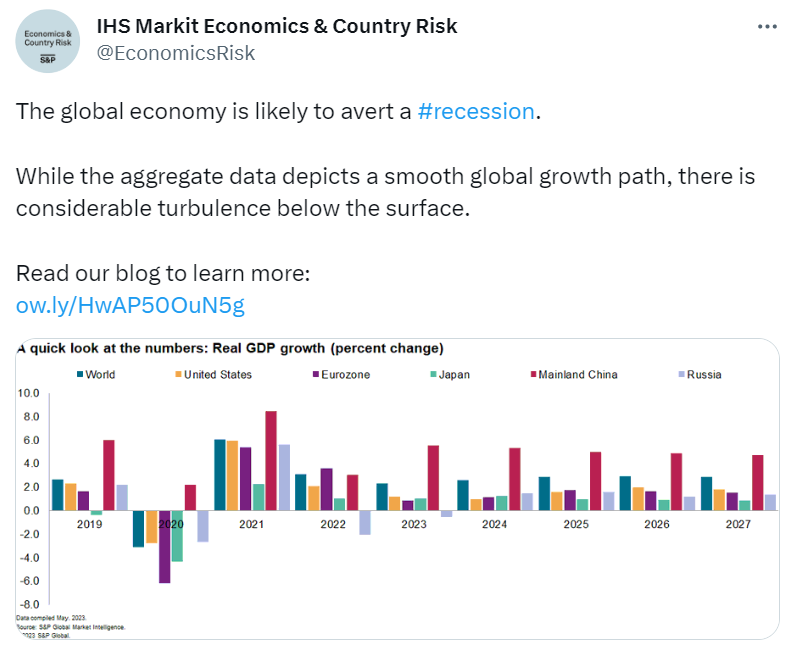

—Read more on S&P Global Market Intelligence and follow @EconomicsRisk on Twitter.

Transform Your Tomorrow

A sustainable tomorrow starts with actionable intelligence today. Advance your sustainability journey with data, analytics and workflow solutions that help you take the next step. And the step after that.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Compiled by Roma Arora

Theme