Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — May 22, 2023

By Sara Johnson

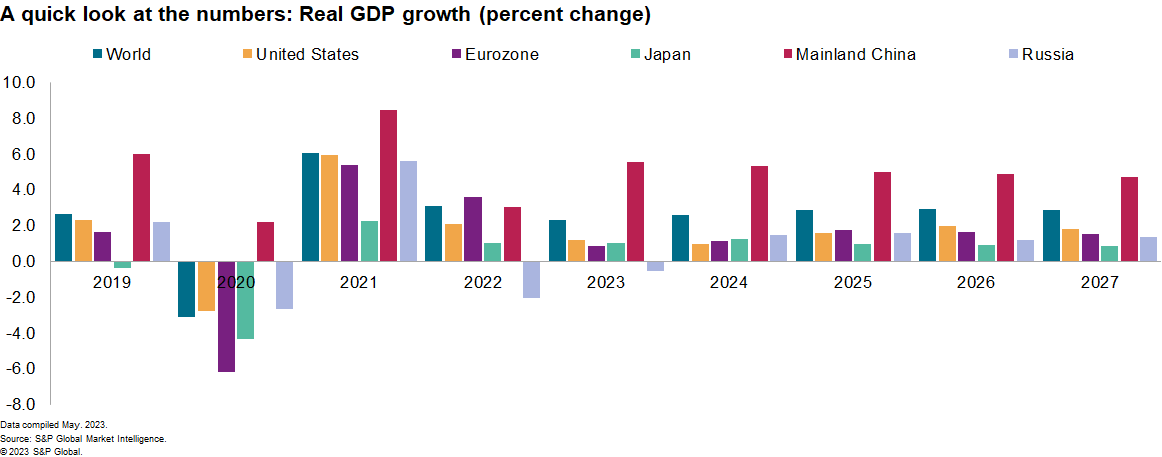

Despite the challenges of high inflation, tightening financial conditions and geopolitical conflicts, the global economy is likely to avert a recession. World real GDP growth picked up from an annual rate of 1.6% quarter over quarter in the final quarter of 2022 to 2.5% in the first quarter of 2023. Aside from a mild deceleration in the second quarter, this moderate growth pace will likely be sustained. After a 3.1% advance in 2022, the S&P Global Market Intelligence forecast calls for world real GDP to increase 2.3% in 2023, 2.6% in 2024, and 2.9% in 2025.

While the aggregate data depicts a smooth global growth path, there is considerable turbulence below the surface.

Different sectors are experiencing the ups and downs of business cycles but at different times. Economic cycles also vary across countries, reflecting the timing of COVID-19 outbreaks and policy responses or the impacts of the Russia-Ukraine war on international trade and capital flows. The result is an asynchronous global expansion. S&P Global's recent Purchasing Managers' Index™ (PMI™) surveys through April signal strong resilience in service sectors but stagnation in manufacturing.

The sharp rise in policy interest rates over the past 15 months is affecting global investment with variable lags.

The most immediate impacts have been on house sales, prices and construction in the United States, Canada, Western Europe, and parts of Asia-Pacific, with spillovers to home-related consumer spending. An emerging vulnerability is commercial real estate, which will likely drag on economic growth through 2025. The work-from-home movement has led to rising office and retail vacancy rates, sharply reduced property valuations, and a diminishing pipeline of new projects. Defaults on commercial real estate loans are a risk for banks and other lenders. Offsetting the declines in residential and commercial construction are strong gains in infrastructure and energy investments.

Global consumer spending is projected to increase in step with real GDP, supported by income gains and savings accumulated during the pandemic.

With the end of pandemic-related restrictions, the composition of consumer spending has shifted back to services. The result has been strong gains in travel, food services, recreation, healthcare and personal services. As pent-up demand is satisfied, however, spending on services will likely decelerate in the year ahead.

As shortages of semiconductors and other inputs ease, global automotive production and sales are rebounding, supporting economic growth.

S&P Global Mobility analysts project that light vehicle sales will rise from 78.9 million units in 2022 to 83.3 million in 2023 and 87.8 million in 2024. However, it will be 2028 before the 2017 peak of 94.4 million units is surpassed as high prices and tight credit conditions will restrain demand.

Inflation will diminish as commodity prices fall and wage pressures ease.

Global consumer price inflation will likely slow from 7.6% in 2022 to 5.6% in 2023 and 3.5% in 2024. Commodity prices are expected to drift downward through mid-2024 in response to improving supply chain conditions, high interest rates, and weak demand for goods. Services price inflation will be more persistent owing to labor shortages, pent-up demand, and capacity reductions during the pandemic.

Policy interest rates are at or near their peaks, although a tightening of bank lending standards will contribute to more restrictive financial conditions in the months ahead.

The European Central Bank and other central banks in Western Europe are expected to raise policy rates by 25 basis points in June. No further rate increases are expected by the US Federal Reserve and most other major central banks. In most regions of the world, monetary easing will begin in 2024 as inflation subsides.

The US economic outlook is clouded by banking stresses and massive federal budget deficits.

This month's forecast of US real GDP growth has been marked down from 1.4% to 1.2% for 2023 and from 1.5% to 0.9% for 2024. While the forecast assumes that the federal debt ceiling will be raised in time to avoid a default, the current impasse is rattling financial markets and is expected to cause a temporary drop in stock prices. With the annual federal deficit projected to exceed 6% of GDP throughout the decade, the United States is in a deep fiscal hole that will eventually need to be addressed. The downward forecast revisions also reflect a potential deterioration in the quality of commercial real estate loans that leads to a further tightening of bank credit standards and reduced investment in nonresidential structures. The US unemployment rate is projected to rise from 3.4% in April to 4.8% in 2025, contributing to a deceleration in wages and prices. As interest rates retreat, real GDP growth should pick up to 1.6% in 2025.

In Western Europe, buoyancy in service sectors is offset by weakness in manufacturing.

High inflation continues to squeeze household purchasing power while tightening financial conditions restrain investment. Banking sector turbulence, falling house prices, and rising corporate insolvencies are growing concerns. Western Europe's real GDP growth is projected to slow from 3.6% in 2022 to 0.7% in 2023. As inflation and interest rates retreat, growth will slowly improve to 1.0% in 2024 and 1.6% in 2025.

Asia-Pacific will lead all regions in economic growth.

Sparked by mainland China and India, Asia-Pacific's real GDP growth should strengthen from 3.2% in 2022 to 4.3% in 2023 and 4.5% in 2024. S&P Global's PMI™ surveys show India leading all major economies with robust growth in both services and manufacturing. While growth in Taiwan, South Korea, and Australia has slowed markedly, expansions in Vietnam, the Philippines, and Indonesia remain robust. Mainland China's economic data through April gives mixed signals: services output and retail sales have rebounded strongly since the lifting of zero-COVID policies, outpacing subdued growth in fixed investment and exports. After 3.0% growth in 2022, mainland China's real GDP is projected to increase 5.5% in 2023 before resuming a long-term deceleration.

Bottom line

The global economic expansion will proceed at a moderate pace, led by service sectors. Economic performance will vary widely across sectors and regions, with Europe and the Americas experiencing sluggish growth and parts of Asia-Pacific and Africa enjoying healthy expansions. With commodity prices on a downward path and supply constraints easing, inflation will diminish, allowing monetary policies to ease in 2024-25.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.