Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — January 16, 2026

By Melissa Otto, CFA

The Visible Alpha AI Monitor aggregates publicly traded US technology companies, providing a comprehensive measure of the current state and projected growth of the core AI industry. This encompasses AI-exposed revenues for companies that are building AI infrastructure and capabilities for both enterprises and consumers.

Investors may use the Visible Alpha AI Monitor to generate new ideas to capture growth emanating from the core AI industry, as well as to evaluate the potential AI exposure of technology stocks in their existing portfolios. We have identified specific line items that capture potential growth of AI-related revenues that are available in the Visible Alpha Insights platform.

(Goals, objectives, and methodology of the AI Monitor can be found towards the bottom of this page).

Key questions for 2026:

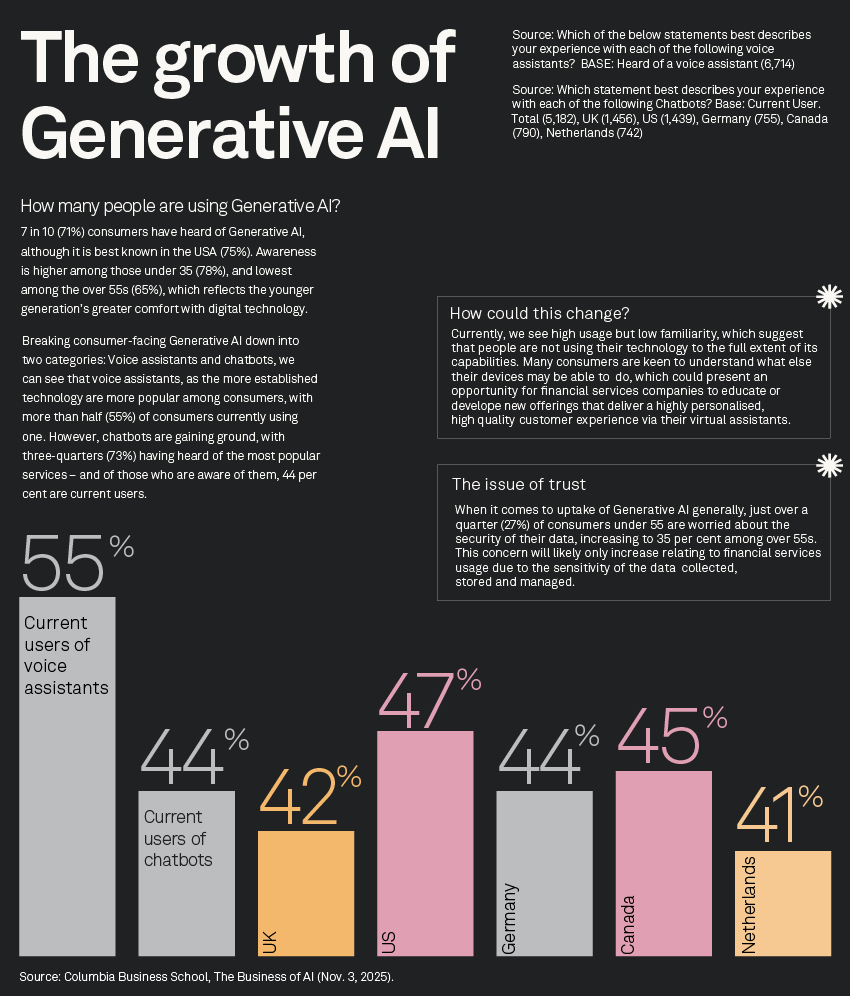

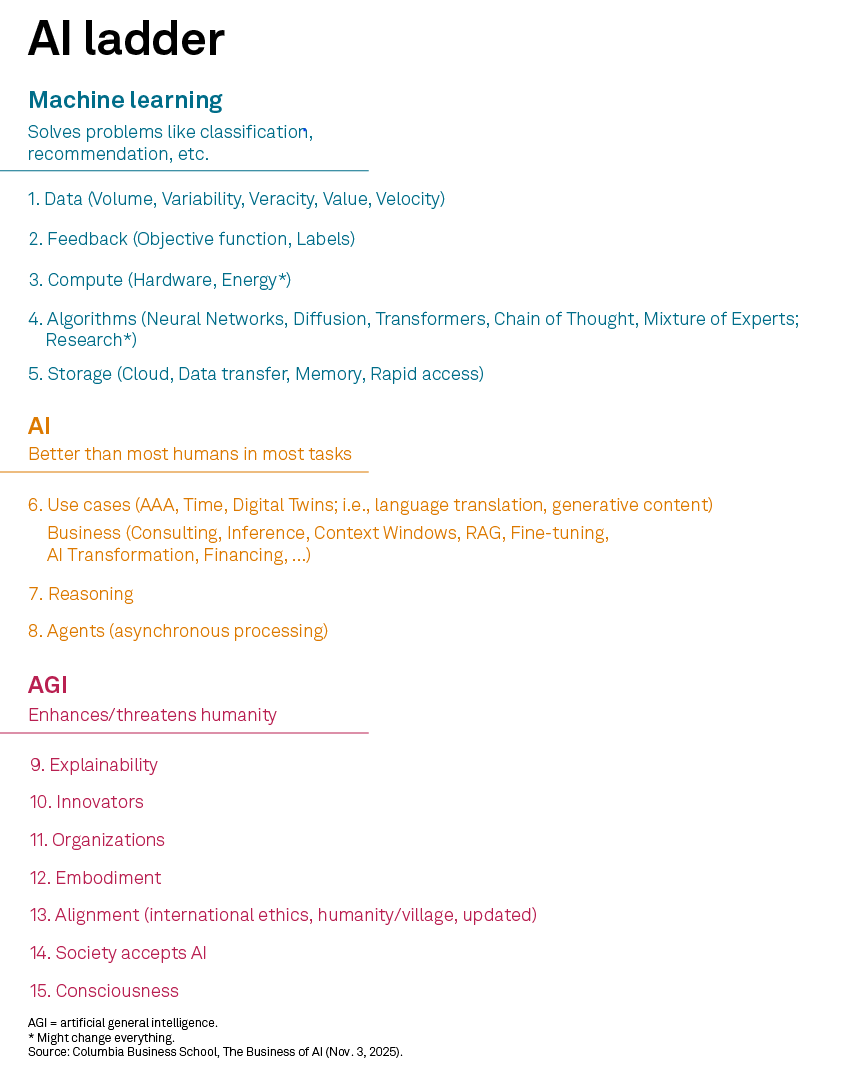

Introduction: Agents?

The generative AI (GAI) trend continued to drive AI momentum in 2025 as Cloud Service Providers continued to invest heavily in capex to transition data centers to accelerated computing. In 2025, the AI theme continued to evolve. Visible Alpha observed that companies attempted to make a greater push with AI into their organizations with the hopes of improving efficiency and enhancing the client experience. While the usage and output quality of OpenAI Inc.'s ChatGPT and its peers improved in 2025, there has been no game-changing new agentic applications leveraging AI. At the Consumer Electronics Show in Las Vegas, NVIDIA Corp. (NASDAQ: NVDA) CEO, Jensen Huang, predicted that agents will become the next generation of applications. Will we start to see these AI agents emerge in 2026?

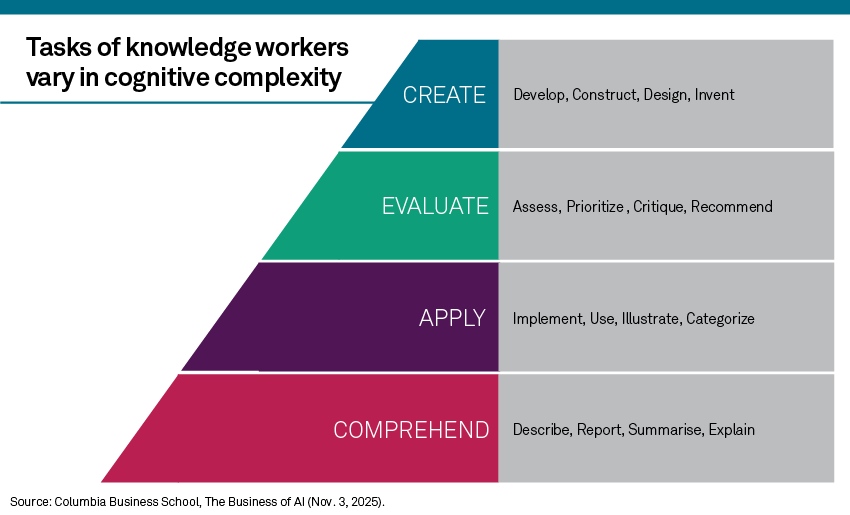

Over the past few years, we have seen a lot of innovation in the chip and model and that has benefited Nvidia. However, there has not been as much innovation at the application level to drive broader adoption of AI with end users, leading to a more competitive business model. The verdict is still out on the magnitude of the impact AI may yield for businesses and individuals. Could these AI benefits help to deliver stronger fundamentals and earnings growth, or will it be merely anecdotal due to the high costs?

In 2025, AI adoption began to happen more broadly in enterprises with the introduction of AI agents into role-specific workflows. AI agents seem to enable domain and persona-specific workflows to complement human roles in an organization. For example, a firm may have a unique AI agent for Research, Security, Analytics, Sales, and Customer Service to complement the human work done in these functions. We want to see how firms leverage these agents and what may be the direct or indirect impact on revenues and cost longer-term.

The challenge is getting the persona and the domain-specific output correct. However, complex inferencing is very expensive and remains an impediment to growth. Token and power costs likely need to decrease significantly and become optimized in the data center for results to improve and generate trust with users. For simple, generic tasks, costs and organizational requirements may make adoption easier. Incorporating unique domain and persona characteristics to basic tasks significantly increases the risk of hallucination and, ultimately, the cost to improve the results.

Based on comments at CES 2026 in early January, Huang explained that agents will be a gateway to next generation applications that can lead to broader adoption of AI overall. Applications are going to be built as “reasoning agents” that interact across the Cloud and Edge. Generative AI can enhance the testing process by augmenting environments with rare or hazardous events (e.g., a burning car), changing lighting or weather, and inserting new objects with correct shadows and reflections. This makes it possible to create endless environment variations from a single real-world capture. This domain-specific, detailed, complex testing is critical for client-facing and internal AI output to be precise and impactful within enterprises.

However, at the moment, it appears that the AI technology is ahead of the adoption. In addition to the massive cost of inferencing, orchestration, guard rails, feedback, risk management and incentives will need to evolve in organizations. According to MIT’s 2025 AI Workforce report, 12% of U.S. jobs are automatable, but few leaders know which ones or how to describe the workflow of specific roles. The study also found that over 90% of companies claim to use AI, yet 97% reported little to no measurable productivity improvement and that when early AI rollouts do not go well both cost and distrust increase. The companies that align AI to these support functions and the business strategy may have a competitive advantage in the future. Reimagining risk and incentive functions may become powerful IP for the future of organizations as AI adoption increases.

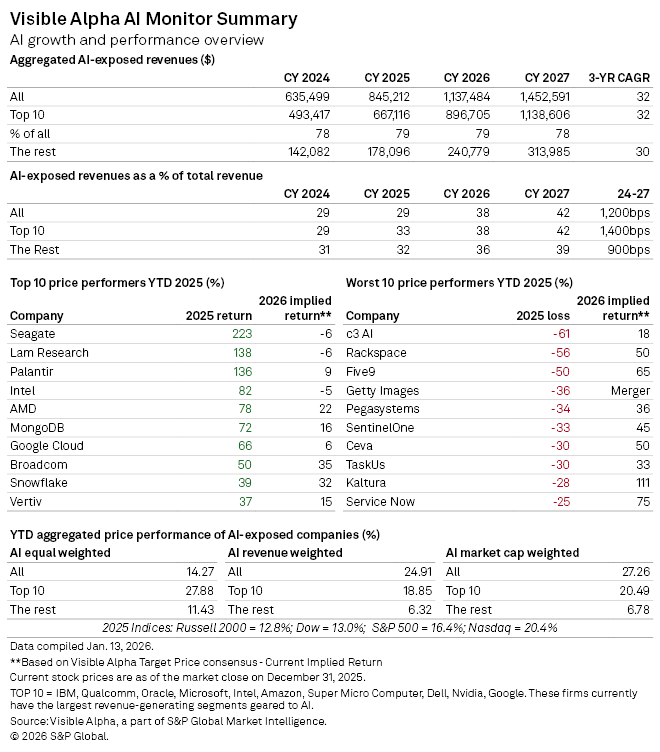

2025 performance summary

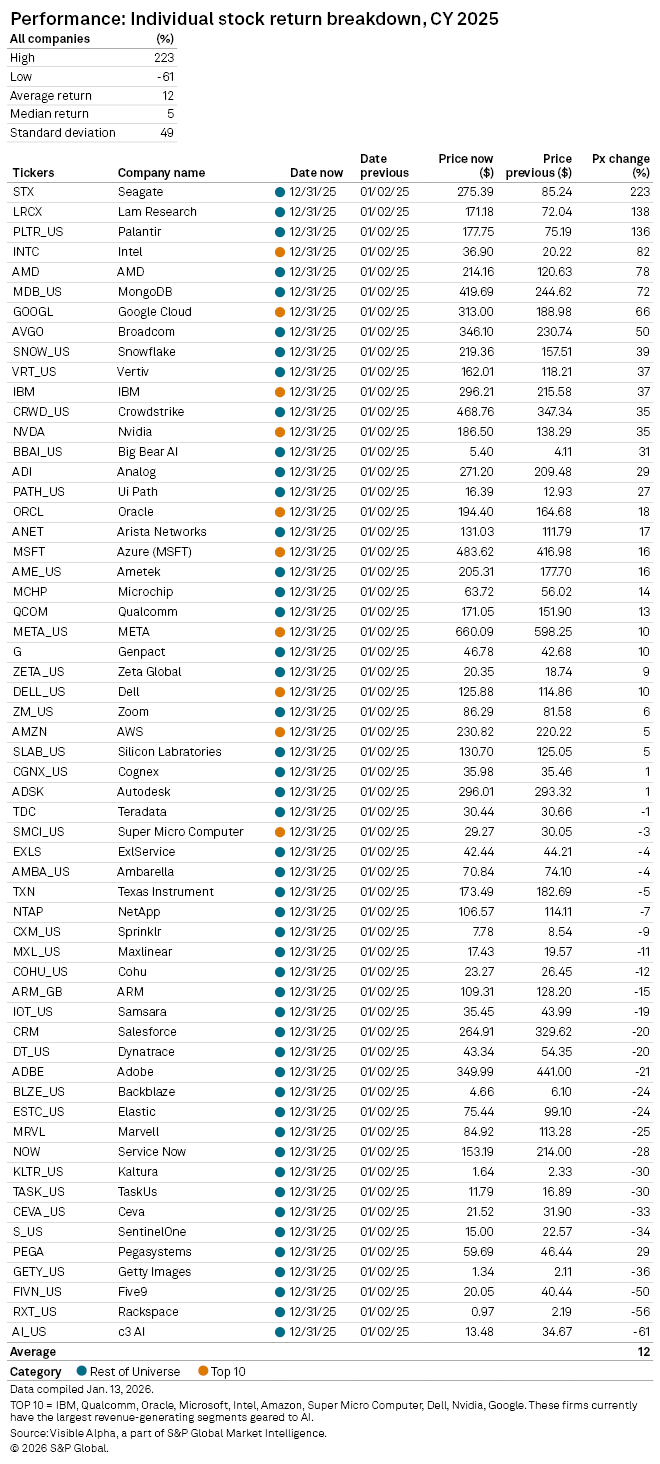

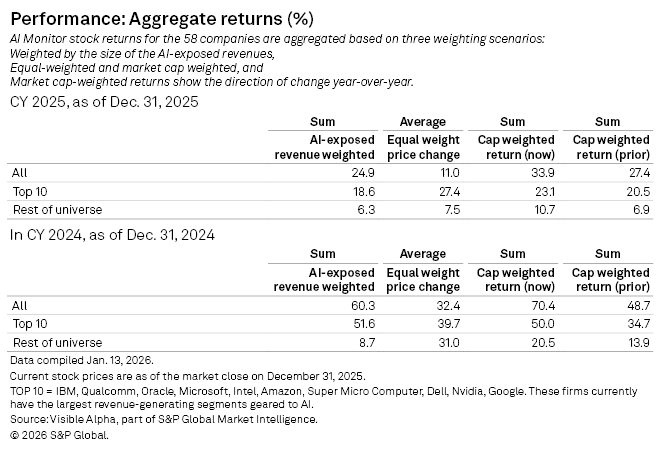

Currently, the Visible Alpha AI Monitor universe of 58 publicly traded US companies is 79% weighted to the 10 largest companies, with the remaining 21% dispersed among 48 companies. On a market-cap-weighted and AI-exposed revenue-weighted basis, the Visible Alpha AI Monitor continued to be driven by stock price outperformance (vs. the S&P 500 index) of the largest companies this year. In addition, performance in the smaller companies (vs. the S&P 500 index) lagged in 2025. In addition, even though the segment underperformed, small-caps companies generated a positive return in 2025 and gap narrowed with the mega-caps. On an equal-weighted basis, the AI Monitor generated an overall lower return when compared to the market-cap and AI-exposed revenue-weighted aggregations this year, driven by the drag of a lower return generated by the smallest names. In 2025, the larger market-cap names continued to drive outperformance, as they did in 2024. Looking out to 2026 and 2027, smaller companies may get a boost from the new administration’s policies and potentially lower interest rates.

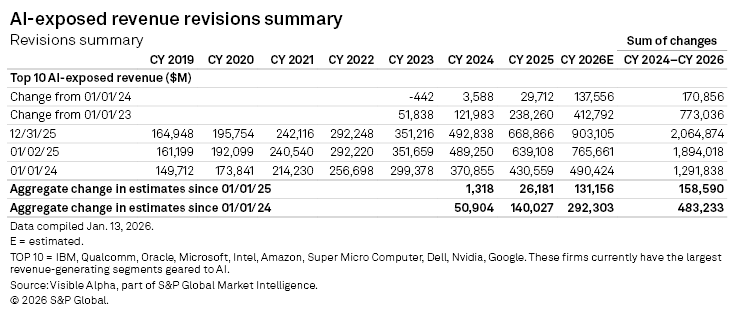

Top 10

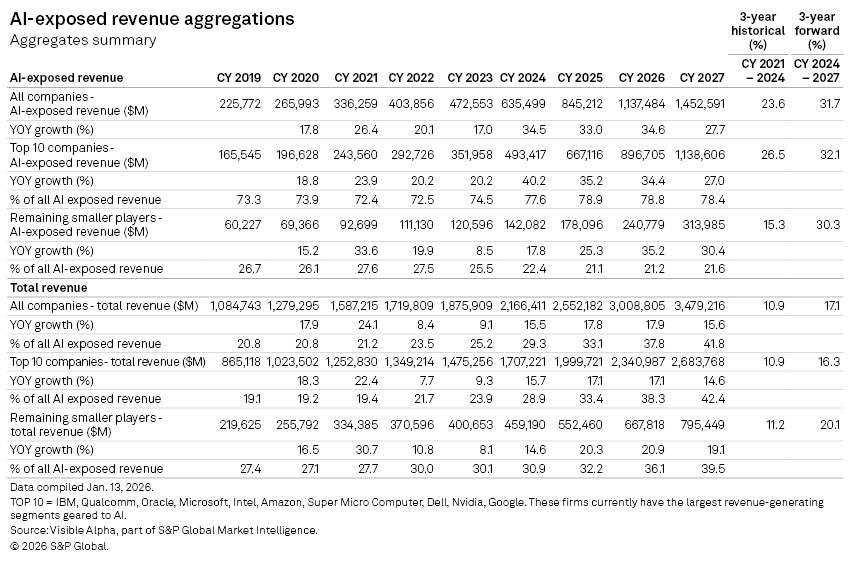

Based on an analysis of the 10 largest players, 2025 revenue forecasts for AI-exposed revenue segments increased $29.7 billion in total since January 2025. However, only $7.6 billion of the 2026 increase was from Nvidia. However, looking ahead to 2026, Nvidia’s revisions expanded $83 billion. While this number is significant, it more than doubled from last year’s upward revisions. These estimates seem to indicate that the momentum and positive sentiment are likely to continue for Nvidia and the AI trade in 2026.

Smaller contributors

The remaining list of 48 companies may serve as a good place for investors to discover new ideas by surfacing expanding new players. While smaller companies in aggregate have not performed as well as the Top 10, there have been some clear outperformers relative to the composite. Among the smaller firms, revenue growth expectations are very mixed. Strong double-digit revenue growth is expected at some firms, while others are seeing estimates decline. These dynamics may help investors identify emerging trends in the space.

For 2025, we have seen that to be true with BigBear.ai Holdings Inc. (NYSE: BBAI), Seagate Technology Holdings PLC (NASDAQ: STX), and MongoDB Inc. (NASDAQ: MDB). These companies delivered strong outperformance (vs. the Russell 2000), which helped position these firms longer term as the possible up-and-comers in the space. In sync with these outperformers, 31% of the smaller companies in the AI Monitor outperformed in 2025. This strength may imply that the fundamentals and valuations of the smaller firms may be starting to gaining traction into 2026.

What is moving the AI Monitor

In 2025, five out of the 10 largest AI-exposed revenue generators drove strong outperformance, while only 31% of the smaller-cap AI stocks outperformed the small-cap index. AI-exposed revenues are expected to grow $1 trillion, from $472 billion at the end of 2023 to $1.5 billion at the end of 2027, driven overwhelmingly by the Top 10 largest companies in the AI Monitor. Nvidia alone made up a third of the expected CY 2027 AI-exposed revenues of the Top 10 and 27% of the total.

Nvidia and the AI arms race

From the end of 2023 to the end of 2026, consensus expectations for Nvidia’s AI-exposed revenues were revised up by over $400 billion in aggregate since the beginning of 2024. These upward revisions contributed significantly to both the AI-exposed revenue concentration and the stock performance of the AI Monitor.

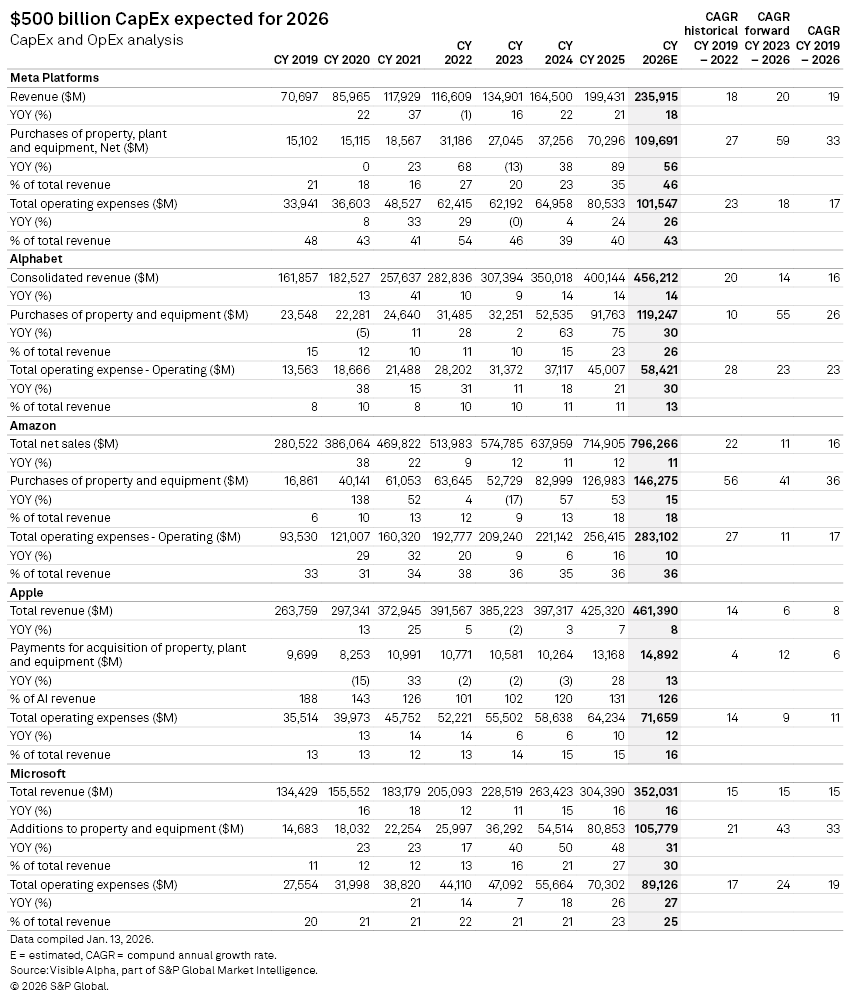

In 2024, it is worth highlighting there was an additional $200 billion in upward revisions on top of the initial $200 billion made in 2023 to Nvidia’s Data Center revenue estimates. This optimism has been driven by continued heavy capex investment by the cloud service providers to support transforming data centers to accelerated computing to support AI applications. Capex spending from Meta Platforms Inc. (NASDAQ: META), Alphabet Inc. (NASDAQ: GOOGL), Amazon.com Inc. (NASDAQ: AMZN), Apple Inc. (NASDAQ: AAPL), and Microsoft Corp. (NASDAQ: MSFT) is expected to be over $500 billion in 2026, up signifantly from $159 billion in 2023. In 2025, upward revisions for Nvidia have continued to increase further, but at a slower pace and smaller magnitude. In addition, coming into the Q4 earnings release, the pace of revisions to Data Center profitability has moderated. Questions remain about how much of the capex spending surge has already been captured by the market and if estimates may see further upward revisions. Currently, the consensus revisions seem to have plateaued, but the AI GPU total addressable market seems to continue expanding.

The massive ramp in capex fueled by the cloud service providers is likely driven by a desire stake a claim on the corpus of text and video, as AI moves into different modalities. Alphabet’s TPU is made for video and has the potential to balance Nvidia out the dominance for their GPU’s that are better for text.

What about Apple?

In addition to the Top 10, we are monitoring the potential AI revenue trends at Apple. The company released Apple Intelligence last summer and has embedded many new AI capabilities in its latest iPhone models. These product updates have not garnered much excitement with users and there are concerns that the new AI functionality has not been enough to make users want to upgrade their older phones. In the latest earnings release, the company committed to increasing investments for AI. There are questions about the strategy and whether Apple may opt for a large acquisition in the space. With over $120 billion of cash on the balance sheet, Apple could make a big move in space.

For FY 2026 iPhone units, expectations have come down from 237 million last year to now 230 million, in part due to lower growth in China. It will be interesting to see and hear what new updates Apple may reveal that could get the market excited and fuel upgrades. For now, the next iPhone upgrade cycle has been slow. However, if Apple begins to purchase TPUs aggressively, it may catapult what AI can do on an iPhone.

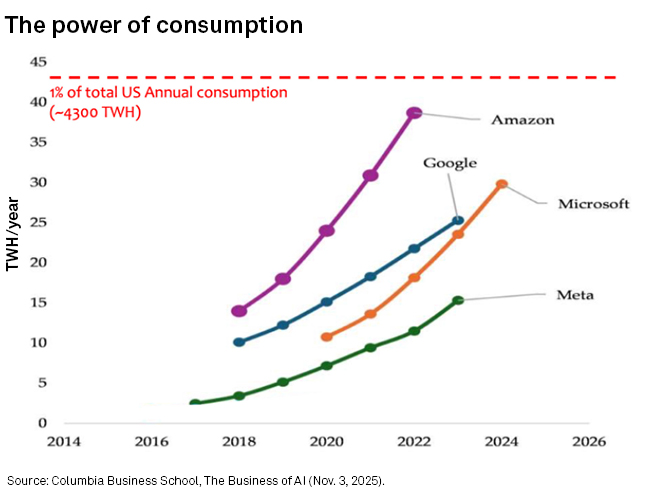

Energy: Big power consumption increases from AI investment

Under the new US administration, regulation, governance, and oversight of AI has been replaced with a focus on establishing new AI infrastructure initiatives in the US. In early 2025, Trump launched the Stargate Project, an AI infrastructure company that plans to invest $500 billion over the next four years to build out new AI infrastructure in the United States. Stargate will be initially financed by SoftBank, OpenAI (Microsoft), Oracle Corp. (NASDAQ: ORCL), and MGX. Speaking with President Trump, Oracle CTO, Larry Ellison, Softbank CEO, Masayoshi Son, and OpenAI CEO, Sam Altman, outlined the ambitious goals of Stargate and their initial commitment of $100 billion and the subsequent $400 billion of financing over the next four years.

As the government continues to focus on AI and its implications for the US, the new administration now seems to be more focused on building and securing the infrastructure, instead of trying to regulate AI. According to a study performed at Columbia University, AI currently uses 2% of US energy, but this is likely to grow to 15-20% by 2030 due to grow of AI infrastructure. Having enough power to fuel the data centers that will enable AI agents to operate is likely to be critical for the future of AI.

Source: America’s AI Action Plan, July 23, 2025.

Final thoughts

Given the new administration’s support of AI and the expansion of AI infrastructure in the US, cloud service providers (CSPs) will likely continue to remain front and center. In 2025, Seagate and Palantir led, driven by strong demand for AI solutions. We may begin to see the players shift in 2026. Commodities for AI may emerge as a key investment theme in 2026. In addition, Apple is the biggest wildcard in the space.

At the same time, debates are emerging about how best to create scalable enterprise AI agents. For many firms, it is not clear how they will participate in bringing AI to enterprises and grow the impact of AI exposure in their business models. The importance of specializing and bringing domain expertise to smaller models will likely be increasingly critical to the success of these tools. In 2026, we are watching the pace at which companies are enabling innovation with AI agents in enterprises. There is some skepticism emerging about the actual use cases, real impact, and ROI. In 2026, AI agents and AI laptops may be compelling mechanisms for fostering broader adoption and driving specialized applications in enterprises. However, the verdict on these new AI tools is still out.

We are interested to see how technology partnerships with the US government will evolve. Initiatives, like the Stargate project partnership between ARM, Nvidia, Oracle, Softbank, and OpenAI (Microsoft) could drive growth in sales and earnings in the key players. There may be a few new companies in the AI space that emerge as significant beneficiaries of the significant AI infrastructure growth in the US. While the performance of AI-related stocks was choppy in 2025, AI demand continues to be strong for the key players. This seems to be partially driven by the US government’s continued focus on AI for defense and national security.

AI Monitor goals and objectives

The objective of the Visible Alpha AI Monitor is to show the investment community which companies are likely to drive AI. As the world embraces AI and its applications to enterprise workflows and our daily lives, there are big questions about how AI’s impact on company business models will unfold over the next 3-5 years. AI can potentially free people from tedious grunt work to enable more focus on critical workflows that require human creativity and analysis.

A primary goal of the Visible Alpha AI Monitor is to show which US companies and specific line items we are watching as the embryonic AI theme emerges across company fundamentals and begins to scale broadly across the economy. We are monitoring how AI may be reflected in the numbers, and which companies may be benefiting more or less. This universe attempts to be comprehensive and to show investors the dynamics of both the large and smaller US players. Additionally, it aims to help investors identify new names that may be smaller and less covered but potentially growing and emerging more quickly.

AI Monitor methodology

Using Visible Alpha’s comprehensive database of detailed estimates pulled directly from sell-side analysts’ spreadsheet models, we have assembled an aggregation with a universe of 61 publicly traded companies that are contributing to the infrastructure and broad scaling of AI capabilities. This monitor aims to provide a current and future snapshot of where AI-related revenue is and is not growing across each of these 69 companies, particularly the 10 largest.

We have aggregated the revenue of specific business segments at firms that are driving the wider AI trend. For larger firms, we have attempted to pinpoint where in their revenue model AI is driving growth. For some smaller firms, we are simply incorporating 100% of revenue. The AI-exposed revenue lines we identify are intended to be used as a proxy for monitoring the growth of each company’s AI business. Given both the lack of discrete company disclosures and how intertwined AI and conventional technologies and services can be, these lines should not be taken as exact quantifications of AI revenues, but are, we believe, the best systematic approximation available.

The AI Monitor provides three measures of stock performance for its universe. These metrics are meant to show the returns of various weighting schemes. The returns are calculated on both an equal-weighted and market-cap-weighted basis. The universe performance of the AI Monitor is also weighted based on AI-exposed revenues and calculated in aggregate. From 2024, the return calculations were standardized, and market-cap-weighted now reflects year-over-year changes.

For Visible Alpha subscribers, details of these companies can all be found within the Visible Alpha Insights platform. Each company included in the monitor has coverage by at least four sell-side analysts. In addition, given the quickly evolving state of the AI space, these line items are subject to change and may shift significantly over time. We plan to refresh the data on an ongoing basis and provide regular updates.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment