Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — January 6, 2026

By Melissa Otto, CFA

Nvidia at CES 2026: Vera Rubin to lower costs

Speaking to a packed arena, NVIDIA Corp. (NASDAQ: NVDA) CEO, Jensen Huang, delivered his keynote. It covered a wide range of topics, highlighting the next generation of AI applications and physical AI. In addition, he described several partnerships, which seemed to cement Nvidia’s criticality in the future robotics ecosystem.

Overall, Huang’s keynote at CES emphasized that AI aims to make the world more productive to drive growth. He explained that computing is the key to the success of applications at the top of the stack, due to the current high cost to understand and process context. As a result, inferencing costs are very high and have been a blocker to broad adoption.

According to Huang, Vera Rubin, Nvidia’s next generation platform, is in production and will deliver a significant step up in performance, enabling 6% savings in data center power and 5x greater inference performance with 10x lower inference token costs. By optimizing the cost and performance of the data center, the industry may be able to improve inferencing quality and begin to more meaningfully scale new applications.

Agents: Next gen applications

Huang showcased the customization capabilities of agentic AI applications. According to Huang, these customized agents will become the next generation of applications. The agentic system will be the interface with a simpler framework, making the creation of these agents much faster. Applicatins are likely to be built as reasoning agents that may be able to interact seamlessly across the cloud and the edge.

Synthetic data: Gateway to robotics

Huang highlighted the Cosmos foundation model, which creates simulation capabilities enabling physical AI to learn from video and robotics data. He showed a simulation for an autonomous ride, incorporating driver surprises and pedestrians for the program to respond to. This type of simulation is going to enable robo-taxis and robotics to evolve and potentially scale. However, broader adoption will likely require significant levels of computing to perfect the inferencing. Given the current cost and power constraints, scaling robo-taxis and robots is likely a longer-term trend.

CES and the outlook for Q4 2026 and FY 2027

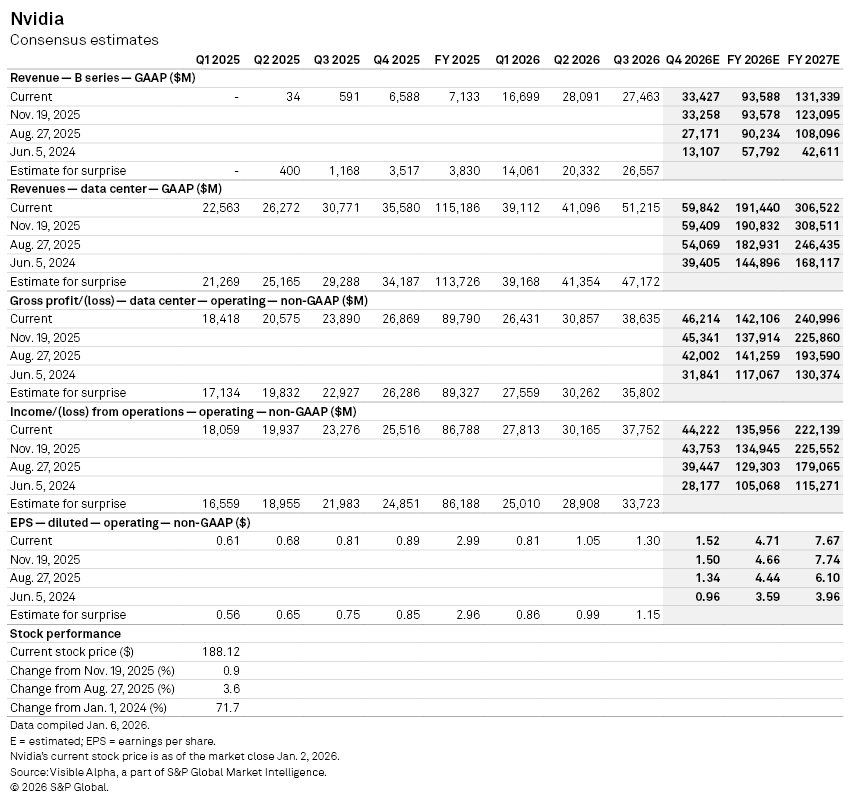

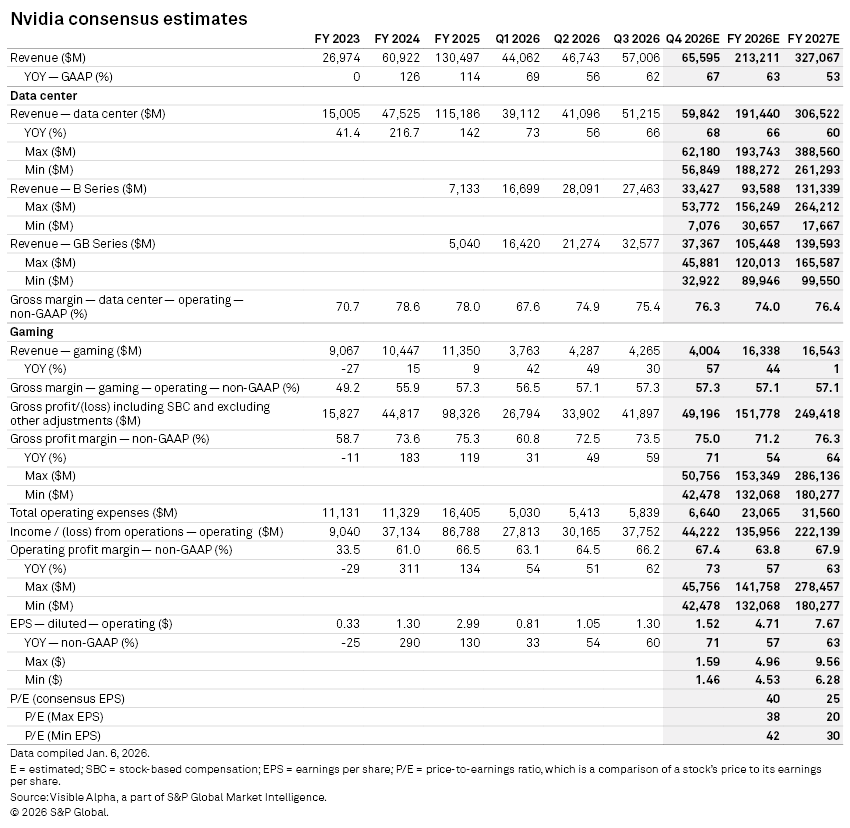

At CES, Huang emphasized the optimization of the data center. This focus was a pivot away from the surge in expected demand he noted at GTC in Washington DC in late October 2025. For fiscal Q4 2026, Nvidia guided in line with expectations of ~$65 billion in total revenue and noted that the outlook does not include any revenue from China. This outlook was in line with consensus, but slightly disappointed the market, as some analysts were expecting Q4 guidance to be higher. Analysts are projecting the Data Center segment to make up $59.8 billion, up from $54.6 billion in late August. However, as Blackwell ramps, gross margin is expected to moderate year-over-year to the mid-70s in the Q4.

Consensus expects the Data Center gross margins for FY 2026 to be 74.0% and 76.4% next year, below the 78% of FY 2024 and FY 2025. When Blackwell is fully ramped, the Company expects gross margin to be in the mid-70s in Q4, suggesting it may not tick back to the high-70s till FY 2027 or later. In addition, there continue to be questions about the timing of Blackwell’s trajectory and how that will be reflected in next year’s quarters. Sentiment has become slightly more conservative on the magnitude of the earnings impact from Blackwell this year and next year. In addition, now that Vera Rubin is in production, there are questions about the sales and profit impact to FY 2027 and FY 2028.

There continues to be debate among analysts about the B-series and GB-series ramps and how much the long-term expected growth is projected to add to revenues and earnings in FY 2027 and beyond. Given the visibility of demand, it will be important to hear how Management guides Q1 and FY 2027. For FY 2027, Blackwell expectations have more than tripled since June 2024, increasing from $42.6 billion to now $131.3 billion.

According to Visible Alpha consensus, Data Center revenues for FY 2027 are now expected to be $306.5 billion, up from $247.3 billion in August, driven by the strength of Blackwell. Consensus EPS is projected to be $7.67/share, up from $6.10/share in August, on Blackwell revenues ramping and Data Center gross margin moving up 230bps to 76.4% from this year’s 74.0%. The current consensus target price is $254/share and puts the market cap at over $5 trillion, an implied return of 35% from current levels.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment