Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — January 30, 2026

By Sakshi Sarfare and Diksha Shetty

US real estate investment trust (REIT), Equinix Inc. (NASDAQ: EQIX) is accelerating its development pipeline to capture the surging demand for digital infrastructure as AI reshapes computing needs.

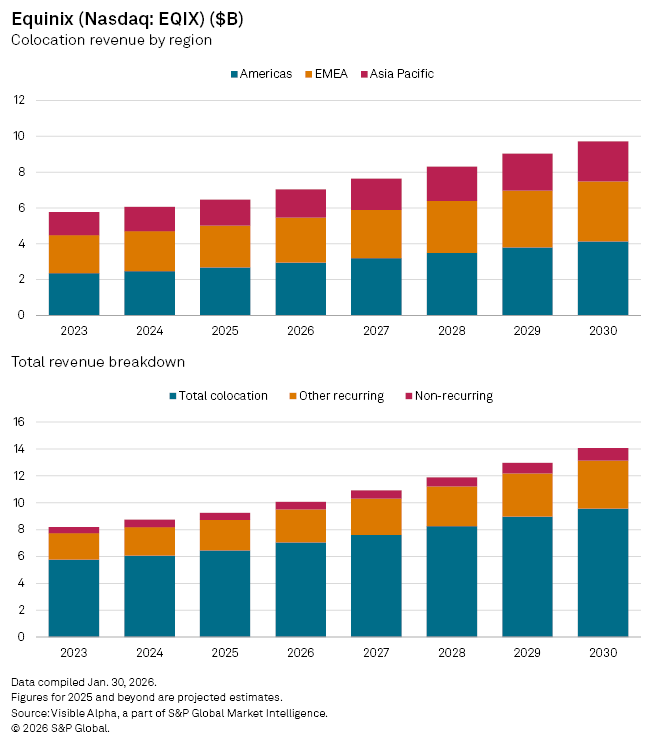

The data center REIT plans to add more than 24,000 cabinets across the Americas by 2027, a sizeable expansion of its largest regional footprint. Visible Alpha consensus estimates put cabinet capacity in the Americas at 154,745 in fiscal 2025, up 7.4% year-on-year. Analysts expect cabinet billings to rise even faster, increasing 7.8% to 125,748, putting utilization at 81% of capacity in 2025. This expansion is forecast to lift Americas colocation revenue by 8.2% to $2.7 billion in 2025. Colocation revenue is the income a company earns by renting out space and infrastructure in its facilities to customers who place their own IT equipment there. Equinix’s customer base includes Amazon’s AWS, Google Cloud, Microsoft Azure, and Oracle.

Growth elsewhere is expected to be more measured. Cabinet capacity in EMEA is forecast to rise 1.3% year-on-year to 140,004, while cabinet billing is estimated at 107,577, translating into utilization of roughly 77%. Lastly, Asia-Pacific capacity is projected to increase 2.7% to 91,482, with cabinet billing expected to increase 3.3% to 68,805, or about 75% utilization.

Colocation revenues in the two regions are nevertheless set to see healthy growth, wth EMEA up 4.5% to $2.3 billion and Asia-Pacific up 7.2% to $1.4 billion.

Taken together, colocation, which accounts for about 70% of Equinix’s total revenue, is expected to generate $6.5 billion in 2025, a 6.6% increase from the prior year. Total group revenue is projected to rise 5.8% to $9.3 billion, reflecting both new capacity coming online and steady pricing.

Equinix is due to report fourth-quarter results on Wednesday, February 11. Analysts are forecasting quarterly revenue growth of 8.6% year-on-year.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment