Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

RESEARCH — Dec 17, 2025

By Adam Wilson and Tony Lenoir

A confluence of power demand-boosting factors, necessitating significant investment in the bulk power system, has led to relatively steep increases in nominal monthly retail electricity rates across the US from 2025 to 2030. To address these challenges, regulatory initiatives are emerging that vary by jurisdiction and consumer class, aiming to balance grid investment needs with energy affordability.

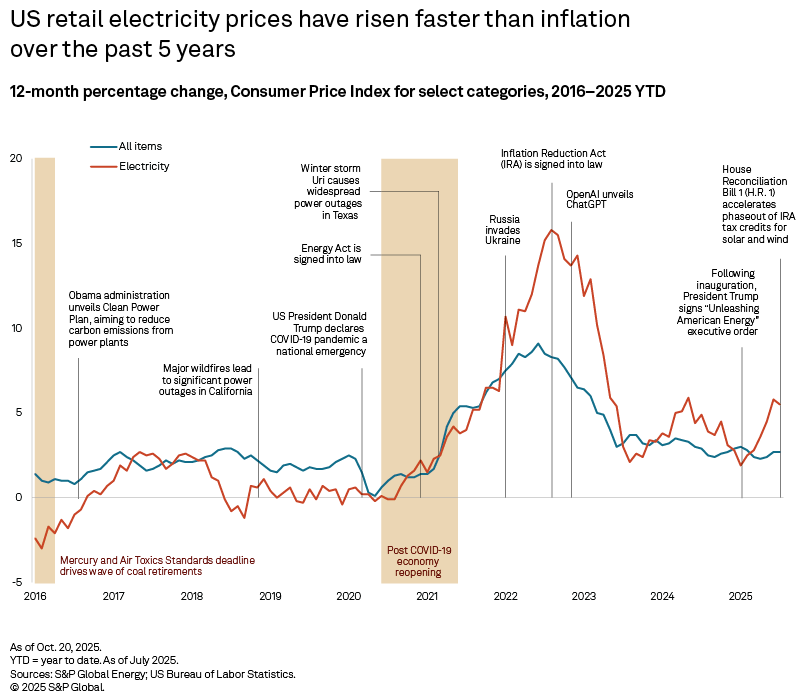

➤ Electricity prices are rising faster than inflation. Since the mid-2020s, the average residential electricity price has increased 32%, outpacing inflation and drawing scrutiny from consumers and policymakers alike.

➤ S&P Global Energy forecasts a two-thirds increase in power demand from data centers by 2030, necessitating substantial investments in infrastructure.

➤ Regulatory initiatives evolving and the landscape for data centers is characterized by diversity. The ongoing development of policies, such as minimum billing requirements and separate rate classes, reflects a concerted effort to manage the complexities of rapid data center growth while ensuring consumer protection.

Download our interactive report to explore tracked developments across select US states.

The convergence of developments pushing retail electricity rate higher includes the electrification of the automobile and building heating sectors, the reshoring of manufacturing and the build-out of data centers — a trend magnified by the emergence of generative AI, following the launch of ChatGPT in the fall of 2022.

Globally, post-COVID-19 recovery dynamics — including fiscal and monetary stimulus and supply chain bottlenecks — and the impact of Russia's invasion of Ukraine on global energy markets contributed to generationally high, persistent inflation, distorting readings of the metric. For example, when adjusted for inflation using US Bureau of Labor Statistics Consumer Price Index data, the estimated average residential electricity rate rose 5.8% between July 2020 and July 2025, compared with a nominal increase of 32.2% over the same period.

In real terms, the average residential price of electricity declined in 24 states in 2020–25. The pressure of power outlays on US household budgets is mounting, however. In the 12 months leading up to July 2025, the average real rate increased across 37 states and the District of Columbia (DC). In face value cents per kWh, this was felt in wallets across 44 states and DC, including double-digit nominal shocks in a quarter of this footprint. DC experienced the largest year-over-year jump in nominal terms, up 33.7%. That said, at an average of 39.36 cents/kWh — compared with 13.97 cents nationally — Hawaii had the highest monthly residential electricity rate in the US in July 2025.

Impacts of the AI boom and ensuing demand spike from AI-supportive data centers is yet to be seen in residential electricity bills. Capital expenditure for new energy generation and infrastructure continues to increase across the country, with many developers pointing to data center demand as the primary driver for new investment.

To date, there is no distinct correlation between data center development and electricity rate increases at the state level, but that could change as forecast data center demand over the next five years significantly outpaces growth observed since 2020. According to 451 Research projections, data center power demand grew by 194 TWhs between 2020 and 2025. Data center power demand from 2025 to 2030 is forecast to grow by 352 TWhs across the US.

Download the 2026 US data centers and energy interactive PDF.

Data visualization by Chris Allen Villanueva.

For wholesale prices and supply and demand projections, see the S&P Global Market Indicative Power Forecast .

Regulatory Research Associates is a group within S&P Global Energy.

S&P Global Energy produces content for distribution on S&P Capital IQ Pro.

Chris DeLucia and Qingyang Liu contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.